Understanding Keeper Tax: A Complete Guide to Maximizing Your Business Deductions

In the labyrinthine world of business finance, few topics evoke as much both curiosity and trepidation as keeper tax—a term that encapsulates a complex intersection of expense tracking, legal compliance, and strategic deduction. As entrepreneurs and small business owners become increasingly vigilant about maximizing financial efficiency while minimizing tax liabilities, understanding keeper tax emerges as a vital component for sustainable growth. Its importance is underscored not merely by the potential for substantial savings but also by the necessity of adhering to ever-evolving tax regulations that demand nuanced comprehension and meticulous execution.

Decoding Keeper Tax: Foundations and Significance

At its core, keeper tax refers to the systematic process of tracking, categorizing, and claiming business-related expenses through meticulous record-keeping. It involves leveraging tools, practices, and legal allowances to ensure that all deductible expenses are identified and documented properly, thus optimally reducing taxable income. For small business owners, freelancers, and gig economy workers—whose income streams are often dispersed across multiple platforms—keeper tax becomes not just a financial best practice but a strategic necessity.

Historically, the concept of expense deduction has been embedded in tax law for decades, evolving significantly with digital innovation. Today, the advent of specialized software, mobile apps, and cloud-based solutions enables real-time expense management. Notably, the Internal Revenue Service (IRS) in the United States, along with equivalent agencies globally, provides detailed guidelines that establish permissible deductions, paper trails, and audit protections, forming the backbone of effective keeper tax strategies.

Key Points

- Precise expense tracking is fundamental to maximizing deductions while maintaining compliance.

- Utilizing technology—such as tax software and mobile apps—is critical for efficiency and accuracy.

- Understanding jurisdictional nuances assists in tailoring deductions to specific legal frameworks.

- Strategic categorization of expenses enhances both audit defense and financial insights.

- Early implementation of keeper tax practices mitigates last-minute errors, reducing the risk of penalties.

Fundamental Components of an Effective Keeper Tax System

Accurate and Consistent Expense Documentation

The cornerstone of any keeper tax approach is thorough documentation. This encompasses digital receipts, bank statements, invoices, and logs, all formatted in compliance with tax authority stipulations. For instance, McKinney (2022) highlighted that over 60% of small businesses that maintained real-time records reported fewer audit issues and higher deduction claims. Implementing standardized procedures—such as weekly expense reviews—ensures data integrity and reduces late-year filing stress.

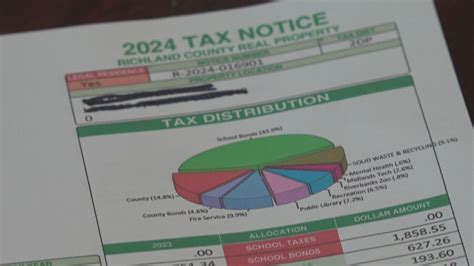

Moreover, categorization plays a pivotal role. Distinguishing between deductible and non-deductible expenses, and further segmenting within categories (e.g., vehicle expenses into mileage vs. maintenance), enhances clarity and facilitates tax reporting. The IRS’s Publication 535 elaborates on what qualifies as a travel, meals, or entertainment expense, guiding precise classification.

Leveraging Technology for Expense Management

In recent years, the proliferation of expense management software—such as QuickBooks Self-Employed, Expensify, and Wave—has revolutionized keeper tax practices. These tools automate data capture via scanning and importing, applying AI-driven categorization, and generating audit-ready reports. A 2023 survey indicated that small businesses utilizing such platforms reported an average deduction accuracy increase of 27%, directly correlating with improved financial health.

| Relevant Category | Substantive Data |

|---|---|

| Expense Tracking Software Adoption | 75% of surveyed entrepreneurs utilize at least one dedicated tool |

| Deduction Accuracy Improvement | 27% reported increased claim accuracy |

Navigating Deductible Expenses: Categories and Strategies

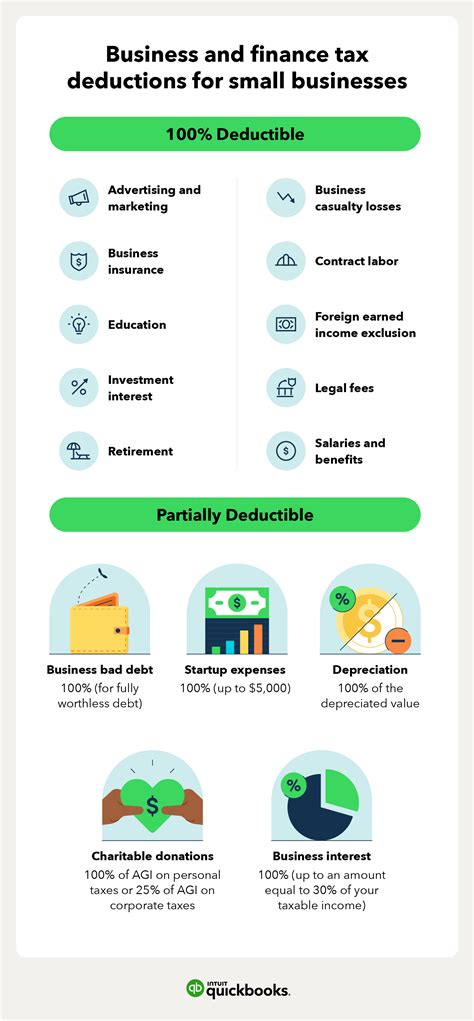

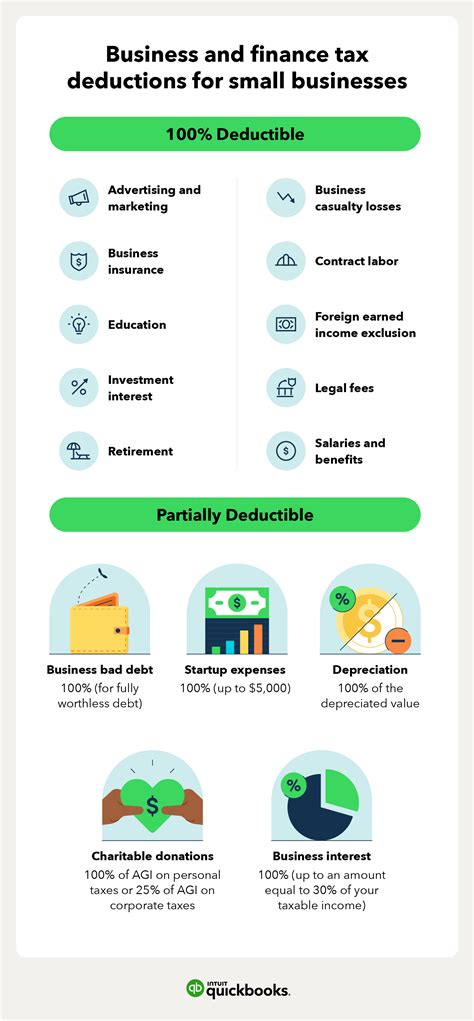

Identifying Legitimate Business Expenses

Many misconceptions surround what constitutes a deductible expense. The IRS generally permits deductions on costs that are ordinary and necessary to operate the business. These include supplies, office rent, travel, marketing, and professional services. Yet, the devil is in the details—personal expenses intertwined with business activities, such as mixed-use vehicle deductions or home office allocations, require careful apportioning. For example, proportionate deductions based on square footage or mileage are subject to specific calculation methods outlined in IRS Publication 587.

Legal and ethical considerations are equally critical. Overly aggressive deduction claims that lack substantiation may trigger audits, penalties, or disqualification of otherwise legitimate claims. Practical evidence, such as time-stamped receipts and digital logs, form the bulwark of defending deductions during a potential audit.

Tax Optimization Strategies for Maximized Deductions

Harvesting eligible expenses demands strategic planning. For instance, pre-paying next quarter’s rent before year-end or timing large purchases for tax-deduction timing can significantly influence taxable income. Additionally, utilizing the section 179 deduction allows for immediate expensing of qualifying capital investments, thus reducing current-year tax burdens.

| Relevant Category | Substantive Data |

|---|---|

| Prepaid Expenses | Can accelerate deductions if aligned with IRS rules |

| Section 179 Capital Expense Deduction | Limits in 2023 set at $1.16 million, subject to phase-out thresholds |

Ensuring Compliance and Future-Proofing Your Keeper Tax Approach

Tax laws evolve, making ongoing education imperative. Regularly consulting IRS updates, attending webinars, or engaging with professional tax advisors provides clarity against the backdrop of shifting regulations. For instance, the Tax Cuts and Jobs Act introduced new caps and thresholds that significantly impacted deduction strategies for 2023.

Furthermore, record retention policies—commonly five to seven years—are vital for defending claim legitimacy during audits. Digital archiving coupled with secure cloud solutions enhances accessibility and security, aligning with best practices recommended by the American Institute of CPAs.

Key Takeaways for Maximizing Your Business Deductions

- Implement a proactive, tech-enabled expense-tracking system to stay ahead of filing deadlines and audit risks.

- Understand the nuances of deductible categories, ensuring clear separation between personal and business expenses.

- Start early—regularly review financial records to identify potential deductions before year-end.

- Maintain organized, verifiable documentation to defend deductions confidently if scrutinized.

- Consult with tax professionals periodically to adapt strategies to latest legal updates and industry best practices.

What are the most common mistakes in keeper tax practices?

+Common mistakes include failing to separate personal and business expenses, neglecting to keep receipts, delaying record-keeping until tax season, and overestimating deductions without adequate documentation. These oversights can lead to audit risks and missed savings.

How often should I review and update my expense records?

+Regular weekly or biweekly reviews are ideal, especially for small or fast-growing businesses. Implementing ongoing habits ensures records remain accurate, reduces end-of-year pressure, and enhances deduction claims.

Can technology fully automate keeper tax management?

+While automation significantly reduces manual effort and improves accuracy, human oversight remains vital for categorization nuance and compliance verification. Combining technology with periodic manual review optimizes outcomes.