San Mateo Tax Collector

The San Mateo County Tax Collector's Office plays a crucial role in the local government's operations, responsible for collecting various taxes, fees, and assessments to fund essential public services and infrastructure. In this comprehensive guide, we will delve into the services, responsibilities, and impact of the San Mateo Tax Collector, offering valuable insights for residents and businesses alike.

Understanding the Role of the San Mateo Tax Collector

The San Mateo Tax Collector’s Office is a key financial pillar of the county, ensuring the smooth collection and management of taxes to support the community’s growth and development. This office, headed by an elected Tax Collector, oversees a wide range of tax-related processes, from property tax assessments to business tax administration and more.

For residents and business owners, understanding the functions and services of the Tax Collector's Office is vital. It ensures compliance with tax regulations, facilitates efficient financial management, and promotes transparency in local governance. Let's explore the specific services and responsibilities of this essential county department.

Property Tax Administration

One of the primary responsibilities of the San Mateo Tax Collector is the assessment and collection of property taxes. This involves evaluating real estate properties within the county, determining their taxable value, and issuing property tax bills to owners.

The Tax Collector's Office maintains a comprehensive database of property information, including ownership details, assessed values, and tax histories. This data is crucial for accurate tax assessment and efficient collection processes. Residents can access this information through the office's online portal, which provides a transparent view of their property's tax status.

| Property Tax Statistics | San Mateo County |

|---|---|

| Total Property Tax Revenue | $1.2 billion (2022) |

| Average Property Tax Rate | 1.10% (2022) |

| Number of Property Tax Accounts | Over 180,000 (2022) |

Business Tax Services

The Tax Collector’s Office is also responsible for administering business taxes within the county. This includes collecting taxes on various business activities, such as sales, use, and room occupancy taxes.

Businesses operating in San Mateo County are required to register with the Tax Collector's Office and obtain the necessary permits and licenses. The office provides a streamlined registration process, ensuring that businesses can easily comply with tax regulations and avoid penalties.

Additionally, the Tax Collector's Office offers resources and guidance to help businesses understand their tax obligations. This includes educational materials, workshops, and one-on-one assistance to ensure businesses are equipped with the knowledge to manage their tax responsibilities effectively.

Other Tax Collections and Assessments

Beyond property and business taxes, the San Mateo Tax Collector’s Office is responsible for collecting and administering a range of other taxes and assessments. These include:

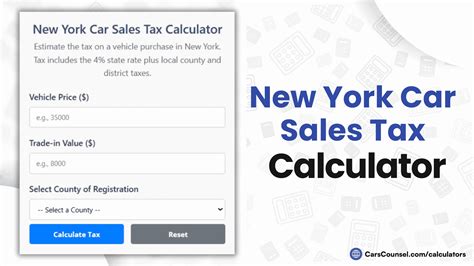

- Vehicle License Fees

- Hotel and Transient Occupancy Taxes

- Special Assessments for County Services

- Tax Collection for Special Districts within the County

The office ensures that these taxes and assessments are accurately calculated, billed, and collected, contributing to the funding of vital county services and infrastructure projects.

Online Services and Resources

The San Mateo Tax Collector’s Office has embraced digital transformation to enhance its services and provide greater convenience to taxpayers. The official website offers a range of online tools and resources, allowing residents and businesses to manage their tax obligations efficiently.

Online Tax Payment Portal

One of the most significant advancements is the online tax payment portal. This secure platform enables taxpayers to view their tax bills, make payments, and manage their tax accounts anytime, anywhere. It accepts various payment methods, including credit cards, e-checks, and electronic fund transfers.

The portal also provides real-time updates on tax payments, ensuring transparency and helping taxpayers track their financial obligations easily. This digital service has significantly improved the efficiency of tax payments, reducing the need for in-person visits and wait times.

Tax Lookup and Research Tools

The Tax Collector’s Office website offers powerful lookup and research tools. These tools allow taxpayers to access detailed information about their tax accounts, including property tax assessments, business tax obligations, and payment histories.

For property owners, the website provides a property tax lookup tool, enabling them to quickly retrieve tax information based on their property address or Assessor's Parcel Number (APN). This tool is especially useful for understanding tax assessments, tracking payment due dates, and managing property-related financial obligations.

Tax Calendar and Notifications

To help taxpayers stay informed and compliant, the San Mateo Tax Collector’s Office maintains a tax calendar on its website. This calendar highlights important tax-related deadlines, such as payment due dates, registration deadlines, and tax filing periods.

Additionally, the office offers subscription services for tax notifications. Taxpayers can sign up to receive email or text alerts about upcoming deadlines, changes in tax regulations, and other relevant updates. This proactive approach helps taxpayers avoid late fees and ensures they remain current with their tax obligations.

Community Engagement and Outreach

The San Mateo Tax Collector’s Office is committed to fostering a culture of transparency and taxpayer engagement. It actively engages with the community through various outreach initiatives, educational programs, and public events.

Community Forums and Workshops

The office regularly hosts community forums and workshops to educate residents and businesses about tax regulations, processes, and best practices. These events provide a platform for taxpayers to ask questions, clarify doubts, and receive personalized guidance from tax experts.

Topics covered in these forums range from property tax assessments to business tax compliance, helping attendees better understand their tax obligations and responsibilities. These interactive sessions foster a sense of community, promote transparency, and build trust between taxpayers and the Tax Collector's Office.

Taxpayer Assistance Programs

Recognizing that tax obligations can be complex and challenging for some taxpayers, the San Mateo Tax Collector’s Office offers assistance programs. These programs aim to provide support and guidance to taxpayers facing financial difficulties or needing extra help with their tax obligations.

For instance, the office may offer extended payment plans for taxpayers who cannot afford to pay their taxes in full. It also provides resources and referrals to taxpayers seeking financial counseling or assistance with tax-related matters. These programs ensure that all taxpayers, regardless of their financial situation, have the support they need to fulfill their tax obligations.

Partnerships with Local Organizations

The Tax Collector’s Office collaborates with local community organizations, non-profits, and advocacy groups to enhance its outreach efforts. These partnerships help the office reach a wider audience and provide tailored support to specific taxpayer groups.

For example, the office may work with senior citizen centers to offer tax assistance programs targeted at older adults. It may also collaborate with small business associations to provide specialized tax workshops and resources for small business owners. These partnerships strengthen the Tax Collector's Office's ability to serve the diverse needs of the San Mateo County community.

Future Trends and Innovations

As technology continues to advance and taxpayer expectations evolve, the San Mateo Tax Collector’s Office is committed to staying at the forefront of innovation. Here are some potential future trends and developments we can expect to see:

Enhanced Digital Services

The office will likely continue to invest in digital transformation, further enhancing its online services and resources. This could include integrating artificial intelligence and machine learning technologies to streamline tax processes, improve data analytics, and offer more personalized taxpayer experiences.

For instance, the Tax Collector's Office might develop intelligent chatbots or virtual assistants to provide instant answers to common tax queries. These digital tools can offer 24/7 assistance, reducing the need for taxpayers to wait for assistance during peak periods.

Blockchain and Cryptocurrency Integration

With the growing adoption of blockchain technology and cryptocurrencies, the San Mateo Tax Collector’s Office may explore ways to integrate these innovations into its tax collection processes. Blockchain’s secure and transparent nature could enhance tax recordkeeping, payment processing, and data sharing, reducing the risk of fraud and errors.

The office might consider accepting cryptocurrency payments for taxes, offering taxpayers an additional payment option that aligns with modern financial trends.

Smart Data Analytics

By leveraging advanced data analytics, the Tax Collector’s Office can gain deeper insights into tax trends, patterns, and behaviors. This can help the office make more informed decisions, optimize tax collection processes, and identify potential areas of improvement.

For instance, data analytics can help the office pinpoint areas with high tax delinquency rates, enabling targeted outreach and assistance programs to address the root causes of non-compliance.

Sustainable and Green Initiatives

In line with San Mateo County’s commitment to sustainability, the Tax Collector’s Office may explore ways to reduce its environmental footprint and promote green practices. This could include initiatives such as paperless billing, digital document storage, and energy-efficient office operations.

The office might also collaborate with local environmental organizations to develop programs that encourage taxpayers to adopt sustainable practices, such as offering tax incentives for energy-efficient home improvements or renewable energy installations.

Conclusion

The San Mateo Tax Collector’s Office is an integral part of the county’s governance, ensuring the efficient and transparent collection of taxes to fund vital public services. By understanding the office’s services, responsibilities, and the resources it provides, residents and businesses can better manage their tax obligations and contribute to the county’s prosperity.

As the office continues to innovate and adapt to changing technologies and taxpayer needs, it remains dedicated to its core mission: serving the community with integrity, transparency, and efficiency. The future of tax collection in San Mateo County looks bright, with a focus on digital transformation, sustainability, and enhanced taxpayer engagement.

What are the property tax due dates in San Mateo County?

+Property taxes in San Mateo County are typically due in two installments. The first installment is due on December 10th and the second installment is due on April 10th. However, if these dates fall on a weekend or holiday, the due date is extended to the next business day.

How can I pay my property taxes online?

+You can pay your property taxes online through the San Mateo County Tax Collector’s official website. Visit the website, navigate to the online payment portal, and follow the instructions to make your payment. The portal accepts credit cards, e-checks, and electronic fund transfers.

Are there any tax relief programs available for senior citizens or low-income residents?

+Yes, San Mateo County offers several tax relief programs for eligible residents. These programs include the Senior Citizens’ Property Tax Postponement Program and the Homeowner and Renter Property Tax Assistance Program. To learn more about these programs and eligibility requirements, you can visit the Tax Collector’s website or contact their office for assistance.

How can I register my business for tax purposes in San Mateo County?

+To register your business for tax purposes, you can visit the San Mateo County Tax Collector’s website and navigate to the business tax registration section. The website provides a step-by-step guide and all the necessary forms to complete the registration process. You can also contact the Tax Collector’s office for assistance if needed.

What happens if I don’t pay my property taxes on time?

+If you fail to pay your property taxes on time, the Tax Collector’s Office may charge a late penalty fee. Additionally, your property may be subject to a tax default process, which could lead to a tax sale if the taxes remain unpaid. It’s important to stay informed about your tax obligations and payment deadlines to avoid penalties and potential legal consequences.