Loudoun Property Tax

Understanding Loudoun County's property tax system is crucial for homeowners and investors alike. With a diverse range of property types and a dynamic real estate market, Loudoun County, Virginia, offers unique challenges and opportunities when it comes to property taxation. This comprehensive guide aims to shed light on the intricacies of Loudoun's property tax, providing an in-depth analysis of the assessment process, tax rates, exemptions, and more.

The Complex World of Loudoun Property Taxes

Loudoun County’s property tax landscape is a complex web of assessments, rates, and exemptions, tailored to the diverse real estate market in the region. The assessment process, a critical component of the system, ensures that property values are accurately reflected in the tax calculations. This process, however, is not without its complexities, as it involves a detailed analysis of each property’s characteristics and market trends.

The assessment, conducted by the Loudoun County Department of Assessment and Taxation, takes into account a myriad of factors. These include the property's location, size, age, condition, and recent sales data of comparable properties. This comprehensive approach ensures that the assessed value is an accurate representation of the property's true market value.

Once the assessment is complete, the property tax rate comes into play. This rate, set annually by the Loudoun County Board of Supervisors, is applied to the assessed value to determine the property tax liability. The tax rate can vary based on the property's classification, with different rates for residential, commercial, and agricultural properties. This differentiation is crucial, as it allows for a fair and equitable taxation system tailored to the unique characteristics of each property type.

Understanding the Assessment Process

The assessment process in Loudoun County is a meticulous and detailed procedure. Assessors consider a wide range of factors to determine the property’s value, including its physical attributes, such as square footage, number of rooms, and the condition of the structure. They also analyze recent sales data of similar properties in the area to ensure that the assessed value is in line with the current market trends.

For instance, a recently renovated property with modern amenities is likely to have a higher assessed value compared to an older property with similar square footage but fewer updates. This consideration of physical attributes and market trends ensures that the assessment process is fair and up-to-date.

| Property Type | Assessment Factors |

|---|---|

| Residential | Size, number of bedrooms/bathrooms, garage, condition, recent sales data |

| Commercial | Square footage, location, type of business, income potential, comparable leases |

| Agricultural | Land size, soil quality, irrigation availability, nearby development, historical data |

Tax Rates and Classifications

Loudoun County’s property tax rates are not a one-size-fits-all affair. Instead, the county employs a classification system that recognizes the unique characteristics of different property types. This system ensures that properties are taxed equitably, taking into consideration their specific uses and values.

The tax rate for residential properties, for instance, might differ from that of commercial properties. This differentiation is crucial as it reflects the varying contributions of different property types to the local economy and infrastructure needs. Similarly, agricultural properties might have a separate rate, recognizing the specific challenges and benefits associated with agricultural land use.

Here's a simplified breakdown of the tax rates as of the last assessment year:

| Property Type | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential | $0.998 |

| Commercial | $1.18 |

| Agricultural | $0.705 |

These rates are subject to change annually, based on budgetary needs and other factors. It's important for property owners to stay updated with the latest tax rates to accurately calculate their property tax liabilities.

Exemptions and Reliefs

Loudoun County offers a range of exemptions and relief programs to ease the tax burden on certain property owners. These exemptions are designed to support specific groups, such as seniors, veterans, and those with disabilities, as well as promote certain types of land use, such as agricultural preservation.

For instance, the County provides a homestead exemption, which reduces the assessed value of a primary residence by a certain amount. This exemption is particularly beneficial for homeowners, as it directly lowers their property tax liability. Similarly, the County offers a Land Use Assessment Program, which provides a reduced tax rate for landowners who maintain their property for agricultural or horticultural use.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Reduces the assessed value of a primary residence by $25,000. |

| Land Use Assessment Program | Offers a reduced tax rate for land used for agricultural or horticultural purposes. |

| Senior Citizen Tax Relief | Provides a credit against real estate taxes for eligible seniors. |

| Veteran's Exemption | Reduces the assessed value of a primary residence for qualified veterans. |

The Impact of Property Taxes on Loudoun’s Real Estate Market

Property taxes play a significant role in shaping Loudoun County’s real estate market. The tax burden can influence investment decisions, property values, and the overall health of the market. Understanding how property taxes interact with the market can provide valuable insights for investors, homeowners, and policymakers alike.

Property Tax Burden and Its Effects

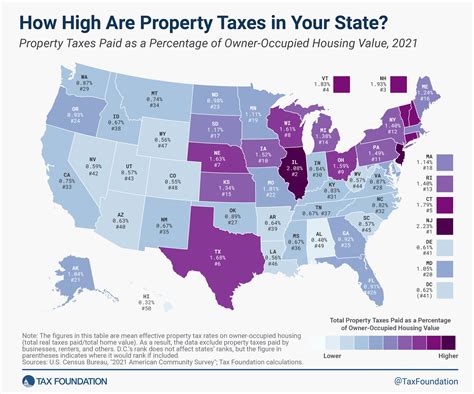

The property tax burden, which is the total tax liability as a percentage of a property’s value, is a key factor in the real estate market. A high tax burden can deter potential buyers, as it increases the overall cost of homeownership. This, in turn, can lead to a decrease in property values and a slowdown in the real estate market.

Conversely, a well-managed tax system with reasonable rates and equitable assessments can encourage investment and promote market growth. It can attract buyers and investors, leading to increased property values and a vibrant real estate market.

Here's a hypothetical scenario to illustrate the impact of property taxes on the market: Let's consider two similar properties in Loudoun County. Property A has a high tax burden due to an inaccurate assessment or a high tax rate. This results in a higher monthly mortgage payment, making the property less attractive to buyers. Property B, on the other hand, has a lower tax burden due to accurate assessments and reasonable tax rates. This makes the property more affordable and attractive to buyers, potentially leading to a higher sales price and a faster sale.

Property Tax and Investment Decisions

Property taxes are a significant consideration for investors when making real estate investment decisions. A high tax burden can reduce the profitability of an investment, as it decreases the net income from the property. On the other hand, a well-managed tax system can make an investment more attractive, as it lowers the overall cost of ownership and increases the potential for profit.

For instance, an investor considering a commercial property in Loudoun County would carefully analyze the tax implications. They would factor in the tax rate, any applicable exemptions, and the overall tax burden to determine the potential return on investment. A lower tax burden could make the investment more appealing, potentially leading to increased investment in the county's real estate market.

Future Outlook and Policy Implications

Looking ahead, Loudoun County’s property tax system is expected to continue evolving to meet the changing needs of the community and the real estate market. As the county’s population grows and the real estate market evolves, the tax system will need to adapt to ensure fairness and sustainability.

One potential area of focus could be further refinement of the assessment process to ensure accuracy and transparency. This could involve implementing advanced technologies for data analysis and property valuation, as well as regular reviews and updates to the assessment methodology. By improving the accuracy of assessments, the county can ensure that property taxes are fairly distributed among residents.

Another area of interest could be the exploration of new tax relief programs or the expansion of existing ones. For instance, the county could consider implementing or expanding programs that offer tax incentives for energy-efficient or environmentally friendly properties. Such initiatives not only promote sustainability but also provide financial benefits to property owners, making the county's real estate market more attractive to environmentally conscious buyers and investors.

Furthermore, the county might also look into ways to streamline the tax payment process, making it more convenient and efficient for taxpayers. This could involve the introduction of online payment options, automated billing systems, or even the integration of blockchain technology for secure and transparent tax transactions. Such innovations could enhance taxpayer satisfaction and reduce administrative costs for the county.

How often are properties reassessed in Loudoun County?

+Properties in Loudoun County are typically reassessed every year. However, significant changes to a property, such as additions or renovations, may trigger a reassessment outside of the regular cycle.

Can property owners appeal their assessments?

+Absolutely. Property owners who believe their assessment is incorrect have the right to appeal. The appeal process involves submitting documentation and evidence to support the claim, and may lead to a reduction in the assessed value.

Are there any online resources to help understand Loudoun’s property tax system better?

+Yes, the Loudoun County government website offers a wealth of information, including detailed explanations of the assessment process, tax rates, and exemption programs. There are also online calculators and resources to help estimate property tax liabilities.

What happens if property taxes are not paid on time in Loudoun County?

+Late payment of property taxes can result in interest and penalties. In severe cases, the county may initiate tax lien proceedings, which could lead to the sale of the property to satisfy the tax debt.

Are there any upcoming changes to Loudoun County’s property tax system that residents should be aware of?

+The Loudoun County Board of Supervisors regularly reviews and makes changes to the tax system. Residents are advised to stay updated with local news and government announcements to stay informed about any changes that may impact their property taxes.