Taxes Two Step

Welcome to a comprehensive exploration of the fascinating world of taxes, where we delve into the intricacies of the "Taxes Two Step," a crucial dance every business and individual must master. In this intricate routine, every move is calculated, every step has a purpose, and the music is the ever-changing rhythm of tax regulations. This guide will break down the complex choreography, offering an insightful and detailed perspective for those seeking to navigate the tax landscape with precision and grace.

The Rhythm of Taxation: Understanding the Basics

Taxation, at its core, is a fundamental mechanism through which governments raise revenue to fund public expenditures and uphold societal welfare. It’s a delicate balance between revenue collection and economic growth, requiring a deep understanding of tax laws and regulations to ensure compliance and optimize financial strategies.

The "Taxes Two Step" is a metaphorical dance that represents the dual nature of taxation: the careful compliance with legal obligations and the strategic optimization of financial positions. It's a dynamic process, requiring constant adaptation to the ever-shifting landscape of tax laws and regulations.

The First Step: Compliance

Compliance is the bedrock of taxation. It involves understanding and adhering to the complex web of tax laws and regulations. This step ensures that businesses and individuals fulfill their legal obligations, avoiding penalties and legal issues.

Key considerations in this step include:

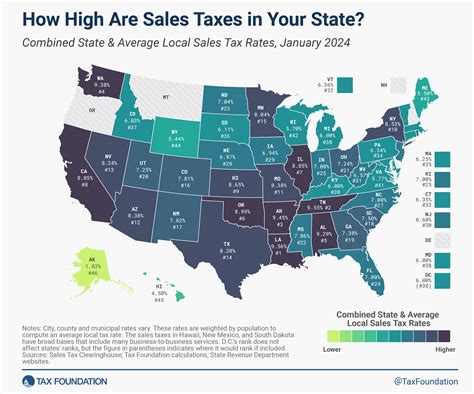

- Understanding tax laws and regulations: Staying updated with the latest tax legislation is crucial. This includes monitoring changes in tax rates, deadlines, and reporting requirements.

- Accurate record-keeping: Maintaining detailed and organized financial records is essential for compliance. This ensures that all relevant transactions are documented and readily accessible for tax purposes.

- Timely filing and payment: Meeting tax deadlines is critical. Late filings can result in penalties and interest charges, impacting financial health.

- Proper tax identification and registration: Ensuring that all necessary tax identification numbers are obtained and registrations are up-to-date is vital for compliance.

For instance, consider the case of a small business owner who meticulously maintains financial records, ensuring that every transaction is properly documented. This not only facilitates compliance with tax laws but also provides valuable insights for strategic financial planning.

The Second Step: Optimization

While compliance forms the foundation, optimization is the creative and strategic aspect of taxation. It involves leveraging tax laws and regulations to minimize tax liabilities and maximize financial benefits.

Key strategies for optimization include:

- Tax planning: This involves analyzing financial situations and developing strategies to reduce tax burdens. It may include exploring tax-efficient investment options, taking advantage of tax credits and deductions, or structuring transactions to minimize tax implications.

- Tax-efficient investments: Investing in tax-efficient assets or instruments can significantly impact overall financial health. This might include utilizing tax-advantaged retirement accounts, investing in tax-free municipal bonds, or taking advantage of tax-loss harvesting strategies.

- Strategic business structuring: The way a business is structured can have significant tax implications. Optimizing business structures can involve considering factors like entity type, ownership structure, and location to minimize tax liabilities.

- International tax considerations: For businesses operating globally, understanding and navigating international tax laws is crucial. This includes considerations like transfer pricing, foreign tax credits, and double taxation agreements.

Take, for example, a multinational corporation that carefully navigates the complex landscape of international tax laws. By strategically structuring its operations and leveraging tax treaties, the corporation is able to optimize its global tax position, reducing its overall tax burden and enhancing its financial competitiveness.

The Dynamics of the Dance: Practical Applications

The “Taxes Two Step” is not merely a theoretical concept but a practical framework that guides real-world tax strategies. It’s a dynamic process that requires constant adaptation and a deep understanding of the tax landscape.

Case Study: Small Business Tax Strategies

For small businesses, the “Taxes Two Step” is a critical dance that can significantly impact their financial health and growth prospects. Let’s consider a hypothetical scenario involving a small retail business.

Step 1: Compliance

The business owner ensures compliance by:

- Maintaining detailed records of sales, purchases, and expenses.

- Regularly updating their understanding of sales tax laws, ensuring they charge and remit the correct taxes.

- Timely filing of tax returns and payments to avoid penalties.

Step 2: Optimization

To optimize their tax position, the business owner might:

- Explore tax-efficient purchasing strategies, such as bulk buying to qualify for tax breaks.

- Consider investing in tax-advantaged retirement plans for employees, which can reduce taxable income.

- Strategically time purchases and sales to take advantage of year-end tax benefits.

Case Study: Individual Tax Planning

For individuals, the "Taxes Two Step" is a personal journey that requires a tailored approach. Let's consider the case of a high-income professional.

Step 1: Compliance

The professional ensures compliance by:

- Maintaining detailed records of income, expenses, and deductions.

- Understanding the latest tax laws, especially those pertaining to high-income earners, and ensuring compliance.

- Engaging in regular tax planning sessions with a tax advisor to stay updated and compliant.

Step 2: Optimization

To optimize their tax position, the professional might:

- Invest in tax-efficient savings accounts and retirement plans.

- Explore tax-deductible investments, such as real estate or education expenses.

- Strategically time income and deductions to optimize tax brackets and reduce overall tax liability.

The Future of Taxation: Navigating Uncertainty

The world of taxation is in a constant state of flux, with tax laws and regulations evolving in response to economic, social, and political dynamics. This dynamic landscape presents both challenges and opportunities for businesses and individuals.

Challenges and Opportunities

The ever-changing tax landscape presents a host of challenges, including:

- Keeping up with frequent changes in tax laws and regulations.

- Navigating complex international tax environments for global businesses.

- Managing the impact of economic policies and tax reforms on financial strategies.

However, these challenges also present opportunities:

- Staying agile and adapting financial strategies to optimize tax positions.

- Exploring new tax-efficient investment options and business models.

- Leveraging tax incentives and credits to support business growth and innovation.

Staying Informed and Adaptable

In an uncertain tax landscape, the key to success lies in staying informed and adaptable. This involves:

- Regularly monitoring tax law changes and understanding their implications.

- Engaging with tax professionals and advisors to stay updated and ensure compliance.

- Developing flexible financial strategies that can adapt to changing tax environments.

For example, a forward-thinking business might invest in tax technology solutions that automate compliance processes and provide real-time updates on tax law changes. This enables the business to stay compliant while also identifying opportunities for tax optimization.

Conclusion: Mastering the “Taxes Two Step”

The “Taxes Two Step” is a complex dance, but with the right knowledge and strategies, it can be mastered. By understanding the fundamentals of taxation, staying updated with tax laws, and developing flexible financial strategies, businesses and individuals can navigate the tax landscape with confidence and optimize their financial positions.

Remember, taxation is a dynamic field, and staying informed is key. Keep an eye on the latest tax news, engage with tax professionals, and don't be afraid to adapt your financial strategies. The world of taxes may be complex, but with the right steps, you can dance through it with grace and success.

What are some common challenges individuals face when navigating the tax landscape?

+

Individuals often face challenges such as understanding complex tax laws, keeping up with frequent changes, and ensuring accurate record-keeping. Additionally, optimizing tax strategies while balancing other financial goals can be a complex task.

How can businesses stay updated with tax law changes and their implications?

+

Businesses can stay informed by subscribing to tax law updates, engaging with tax professionals, and participating in industry-specific tax webinars or workshops. Regular reviews of tax strategies are also crucial to adapt to changing regulations.

What are some tax-efficient investment options for individuals looking to optimize their tax position?

+

Individuals can explore tax-efficient investments such as retirement accounts (e.g., IRAs, 401(k)s), tax-free municipal bonds, and tax-advantaged health savings accounts. These options can help reduce taxable income and optimize long-term financial planning.