No Inheritance Tax States

In the realm of estate planning and financial management, the topic of inheritance tax is a significant consideration for individuals and families. While some states in the United States impose inheritance taxes on assets received by beneficiaries, there are a number of states that have abolished or never implemented such taxes, offering a more favorable environment for estate planning and wealth transfer. This article aims to delve into the landscape of states without inheritance taxes, exploring the benefits they provide and offering a comprehensive guide for those seeking to navigate this aspect of financial planning.

Understanding Inheritance Taxes and Their Impact

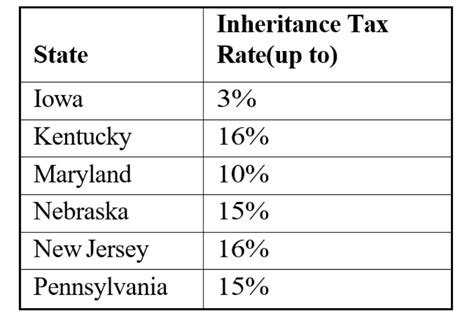

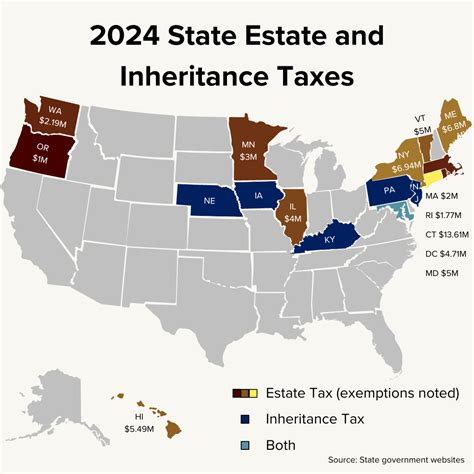

Inheritance taxes, also known as estate taxes or death taxes, are levied on the transfer of assets from a deceased individual to their beneficiaries. These taxes are typically assessed based on the value of the estate and can significantly impact the financial legacy left behind. While federal estate taxes are applicable nationwide, states have the autonomy to decide whether to implement their own inheritance tax laws, leading to a varied landscape across the country.

States that impose inheritance taxes often do so to generate revenue and redistribute wealth. These taxes can be a substantial burden on heirs, especially when combined with federal estate taxes. However, it's important to note that not all states follow this approach, and there are several that have recognized the potential negative impact of inheritance taxes on families and the economy.

The States Leading the Way: No Inheritance Tax

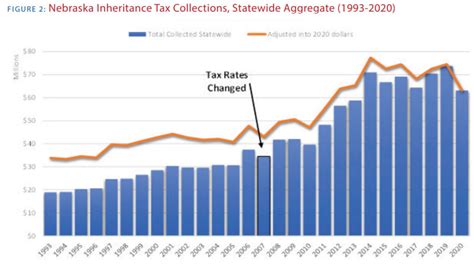

As of the latest data available, a significant number of states have taken a progressive stance by either never introducing inheritance taxes or abolishing them over time. These states understand the importance of promoting financial stability and growth by eliminating potential obstacles to wealth transfer.

Abolished Inheritance Taxes

Several states have taken the proactive step of repealing their inheritance tax laws, recognizing the benefits of a more tax-friendly environment. Among these states are Delaware, New Jersey, and Maryland, which have recently repealed their inheritance taxes, making them more attractive destinations for individuals seeking to minimize tax burdens on their estates.

In Delaware, the state's decision to abolish inheritance taxes in 2018 was a significant move, considering its reputation as a corporate haven. This change not only benefits businesses but also individuals and families, providing an incentive for wealthier individuals to consider Delaware as a state of residence or a location for their trusts and estates.

Similarly, New Jersey and Maryland have joined the ranks of states without inheritance taxes, providing relief to their residents and attracting individuals seeking to minimize tax liabilities. These states have recognized the importance of promoting economic growth and family financial stability by eliminating this tax burden.

States Never Implementing Inheritance Taxes

Additionally, there are states that have never implemented inheritance taxes, showcasing a forward-thinking approach to financial planning and wealth management. These states include Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. By avoiding inheritance taxes, these states offer a more favorable environment for individuals looking to pass on their assets without the added complication of state-level taxes.

For example, Florida has long been a popular destination for retirees and individuals seeking a tax-friendly environment. The state's absence of inheritance taxes, combined with its favorable income tax laws, makes it an attractive choice for those looking to plan their estates and ensure a smooth transfer of assets to their loved ones.

Similarly, Texas and Washington have also never imposed inheritance taxes, providing a stable and predictable tax environment for individuals and families. This consistency in tax policy can be a significant advantage for those seeking to establish long-term financial plans and protect their assets.

The Benefits of No Inheritance Tax States

The decision to reside in or establish an estate in a state without inheritance taxes can offer a multitude of benefits. Firstly, it provides individuals with the opportunity to preserve more of their wealth for their beneficiaries, as the absence of this tax means more assets can be transferred without being subjected to state-level taxation.

Additionally, states without inheritance taxes often attract businesses and high-net-worth individuals, creating a vibrant and growing economy. This can lead to a wider range of investment opportunities and a more robust job market, benefiting the state's residents and contributing to overall economic prosperity.

Furthermore, the absence of inheritance taxes can simplify the estate planning process, allowing individuals to focus on other aspects of their financial strategy, such as asset protection, charitable giving, and legacy planning. It provides a more straightforward and predictable framework for individuals to navigate, ensuring a smoother transfer of wealth.

Estate Planning Strategies

When considering a state without inheritance taxes for estate planning purposes, it’s essential to consult with experienced professionals. They can guide individuals through the process of establishing trusts, utilizing gifting strategies, and optimizing their financial plans to take full advantage of the state’s tax-friendly environment.

Trusts, in particular, can be powerful tools in these states, as they provide a means to control and manage assets while potentially minimizing tax liabilities. Experienced estate planners can help individuals establish the right type of trust, whether it's a revocable living trust, an irrevocable trust, or a charitable trust, to meet their specific goals and needs.

A Comparison of Tax Structures

While the absence of inheritance taxes is a significant advantage in certain states, it’s important to consider the overall tax landscape. Some states may have other taxes, such as income taxes or property taxes, that could impact an individual’s financial planning. Understanding the complete tax picture is crucial for making informed decisions about residence or estate planning.

For instance, while Florida has no inheritance taxes, it does have a high sales tax rate, which could impact an individual's overall tax burden. On the other hand, Texas has no state income tax, making it an attractive choice for those seeking to minimize their tax obligations. Each state has its own unique tax structure, and it's essential to weigh these factors when making financial decisions.

| State | Inheritance Tax | Income Tax | Sales Tax |

|---|---|---|---|

| Delaware | Abolished | 5.95% | 0.00% |

| New Jersey | Abolished | 10.75% | 6.625% |

| Maryland | Abolished | 2.7% | 6.00% |

| Alaska | Never Implemented | 0.00% | 1.76% |

| Florida | Never Implemented | 0.00% | 6.00% |

| Nevada | Never Implemented | 0.00% | 6.85% |

| South Dakota | Never Implemented | 4.50% | 4.50% |

| Texas | Never Implemented | 0.00% | 6.25% |

| Washington | Never Implemented | 0.00% | 6.50% |

| Wyoming | Never Implemented | 0.00% | 4.00% |

Conclusion: Navigating the No Inheritance Tax Landscape

The decision to reside in or plan an estate in a state without inheritance taxes is a strategic financial move. It offers individuals the opportunity to preserve their wealth, simplify their estate planning, and contribute to a growing economy. While the absence of inheritance taxes is a significant advantage, it’s crucial to consider the overall tax landscape and consult with professionals to ensure a comprehensive financial strategy.

By understanding the benefits and implications of living in a state without inheritance taxes, individuals can make informed choices that align with their financial goals and ensure a secure future for themselves and their loved ones. Whether it's through establishing trusts, optimizing gifting strategies, or exploring other tax-friendly options, the absence of inheritance taxes provides a unique opportunity for individuals to maximize the value of their estates.

Frequently Asked Questions

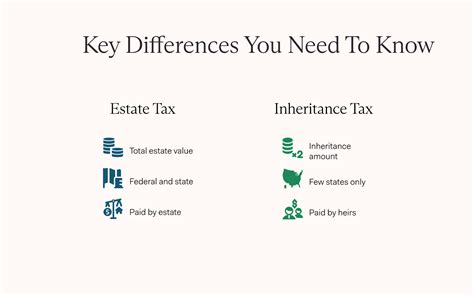

What is the difference between inheritance tax and estate tax?

+

Inheritance tax and estate tax are similar concepts, but they have some key differences. Inheritance tax is a tax imposed on the beneficiaries who receive assets from a deceased individual’s estate, whereas estate tax is levied on the estate itself before it is distributed to beneficiaries. Inheritance tax is typically a state-level tax, while estate tax is a federal tax. Not all states have inheritance taxes, but all estates over a certain value are subject to federal estate tax.

Are there any states with both inheritance and estate taxes?

+

Yes, some states have both inheritance and estate taxes. For example, Maryland and New Jersey had both taxes until recently when they repealed their inheritance taxes. It’s important to research the specific tax laws of each state to understand the potential impact on your estate planning.

Can I choose to reside in a state without inheritance tax for estate planning purposes?

+

Absolutely! Many individuals and families consider tax implications when deciding on a state of residence. By choosing to live in a state without inheritance tax, you can potentially minimize the tax burden on your estate and ensure more of your assets are passed on to your beneficiaries.

What are some strategies for minimizing inheritance taxes in states that have them?

+

If you reside in a state with inheritance taxes, there are strategies you can employ to minimize the impact. These may include establishing trusts, utilizing gifting strategies, and carefully structuring your estate plan. Consulting with an experienced estate planning attorney or financial advisor is crucial to ensure you take advantage of all available options.

Are there any potential drawbacks to residing in a state without inheritance tax?

+

While states without inheritance taxes offer significant benefits, it’s important to consider the overall tax landscape. Some states may have other taxes, such as high income or property taxes, that could impact your financial planning. It’s crucial to weigh these factors and consult with professionals to make an informed decision.