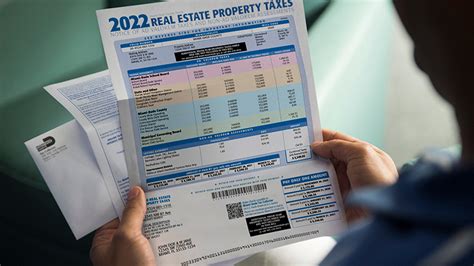

Property Tax Miami

Welcome to the comprehensive guide on understanding and managing property taxes in the vibrant city of Miami. This article will delve into the intricacies of property tax assessments, payments, and strategies to optimize your financial obligations as a property owner in this sunny metropolis. With its thriving real estate market and diverse neighborhoods, Miami presents unique considerations when it comes to property taxes. We'll explore the factors influencing tax rates, the assessment process, and provide practical tips to ensure a smooth and cost-effective experience.

Unraveling Miami’s Property Tax Landscape

Miami’s property tax system, much like any other city, is a complex interplay of local laws, property values, and municipal budgets. Understanding this landscape is crucial for property owners to navigate their financial responsibilities effectively. Let’s break down the key components and shed light on the specificities of Miami’s property tax scene.

Factors Influencing Property Tax Rates

Several factors contribute to the determination of property tax rates in Miami. Firstly, the assessed value of a property plays a pivotal role. This value is derived through a meticulous process, considering market trends, property features, and recent sales data. The higher the assessed value, the higher the potential tax liability. Additionally, Miami’s millage rate, which is set annually by local governing bodies, significantly impacts tax calculations. This rate is applied to the assessed value to determine the final tax amount.

Another crucial factor is the property's location. Miami, with its diverse neighborhoods and districts, often exhibits varying tax rates. For instance, properties situated in prime waterfront locations or within sought-after school districts may face higher tax obligations. Understanding these location-specific nuances is essential for property owners to anticipate and plan their financial strategies.

| Factor | Impact on Property Taxes |

|---|---|

| Assessed Property Value | Directly proportional to tax liability. |

| Millage Rate | Applied as a percentage to the assessed value. |

| Property Location | Varying tax rates based on neighborhood and amenities. |

The Property Assessment Process

The assessment process in Miami is a meticulous undertaking, ensuring fair and accurate valuation of properties. It typically involves the following steps:

- Data Collection: Assessing authorities gather information on properties, including recent sales, improvements, and market trends.

- Physical Inspection: In some cases, assessors may conduct on-site visits to verify property details and ensure accuracy.

- Valuation Calculation: Utilizing the collected data, assessors employ various valuation methods to determine the property's fair market value.

- Notice of Assessment: Property owners receive a detailed notice outlining the assessed value, any changes, and the appeal process.

- Appeal and Review: If property owners disagree with the assessment, they have the right to appeal and present their case to the assessment board.

Understanding this process empowers property owners to participate actively and ensure fairness in the valuation of their assets.

Navigating Property Tax Payments in Miami

Once property taxes are assessed, it’s time to delve into the payment process. Miami offers a range of options to facilitate timely and convenient tax settlements. Here’s a breakdown of the payment landscape:

Online Payment Portals

Miami recognizes the digital age and has embraced online payment systems. Property owners can conveniently access dedicated online portals, such as the Miami-Dade County Tax Collector’s website, to make payments. These portals offer secure transactions, real-time updates, and the ability to manage payment schedules.

By leveraging these online platforms, property owners can streamline their tax obligations, receive instant confirmation, and avoid the hassle of traditional in-person transactions.

Traditional Payment Methods

For those who prefer traditional methods, Miami provides a range of options. Property owners can opt to pay their taxes by:

- Mail: Sending a check or money order to the designated tax office, ensuring timely postage to avoid late fees.

- In-Person: Visiting the local tax office and making payments in cash, check, or money order. This method offers immediate confirmation but may require longer wait times.

- Bank Drafts: Arranging for bank drafts or electronic fund transfers to the tax office's account. This method ensures accuracy and avoids potential errors associated with manual payments.

Regardless of the chosen method, it's crucial to adhere to the payment deadlines to avoid penalties and maintain a positive standing with the local authorities.

Payment Schedules and Due Dates

Miami operates on a biennial tax cycle, with taxes typically due in November of odd-numbered years. Property owners receive detailed tax notices outlining the due dates, amounts, and payment options. It’s imperative to familiarize oneself with these deadlines to ensure timely payments and avoid unnecessary complications.

For those who opt for installment plans, Miami offers flexible options to spread out the tax burden. This allows property owners to manage their finances more effectively, especially for those with larger tax liabilities.

| Payment Option | Details |

|---|---|

| Online Payment | Secure, real-time, and convenient. Offers instant confirmation. |

| Traditional method, ensure timely postage to avoid delays. | |

| In-Person | Immediate confirmation but may require longer wait times. |

| Bank Drafts | Accurate and error-free method, ideal for larger payments. |

Strategies for Optimizing Property Tax Obligations

Navigating the property tax landscape in Miami doesn’t have to be a daunting task. By implementing strategic approaches, property owners can optimize their tax obligations and potentially reduce their financial burden. Here are some expert insights and practical strategies to consider:

Understanding Exemptions and Credits

Miami, like many other jurisdictions, offers a range of property tax exemptions and credits to eligible property owners. These incentives can significantly reduce tax liabilities and provide much-needed relief. Some common exemptions include:

- Homestead Exemption: Available to primary homeowners, this exemption reduces the assessed value of the property, resulting in lower taxes.

- Senior Citizen Exemption: Designed to support Miami's senior population, this exemption provides tax relief to eligible homeowners aged 65 and above.

- Veteran's Exemption: A token of appreciation for Miami's veterans, this exemption offers tax benefits to those who have served in the military.

Understanding the eligibility criteria and applying for these exemptions can be a strategic move to optimize tax obligations.

Appealing Property Assessments

If a property owner believes their assessed value is inaccurate or unfair, they have the right to appeal the assessment. This process involves presenting evidence and arguments to support a lower valuation. Common grounds for appeals include:

- Recent sales data indicating a lower market value.

- Errors in the property's physical description or improvements.

- Unfair assessment practices compared to similar properties.

Successfully appealing an assessment can lead to a reduced tax liability, making it a crucial strategy for property owners.

Property Improvements and Maintenance

Investing in property improvements can have a dual benefit: enhancing the property’s value and potentially reducing tax obligations. When improvements are made, property owners can request a reassessment, which may result in a lower tax liability. Common improvements include:

- Energy-efficient upgrades (solar panels, insulation, etc.)

- Renovations to improve functionality and aesthetics

- Landscaping enhancements

However, it's essential to note that not all improvements lead to tax savings. Consulting with tax professionals or local authorities can provide clarity on which improvements offer the most tax benefits.

Utilizing Tax Advisors and Professionals

Navigating the complexities of property taxes can be challenging, especially for those new to the process or with unique property circumstances. Engaging the services of tax advisors or professionals can be a wise investment. These experts can provide tailored advice, ensure compliance with local regulations, and identify opportunities for tax savings.

By leveraging their expertise, property owners can optimize their tax strategies, avoid potential pitfalls, and ensure a smooth and efficient tax experience.

| Strategy | Benefits |

|---|---|

| Understanding Exemptions | Potential tax relief for eligible property owners. |

| Appealing Assessments | Reduced tax liability for inaccurate or unfair assessments. |

| Property Improvements | Enhanced property value and potential tax savings. |

| Tax Advisors | Tailored advice, compliance, and tax-saving opportunities. |

Conclusion: Empowering Property Owners in Miami

Understanding and managing property taxes in Miami is a crucial aspect of property ownership. By delving into the factors influencing tax rates, the assessment process, and the various payment options, property owners can navigate their financial obligations with confidence. The strategies outlined above provide a roadmap to optimizing tax liabilities and ensuring a positive financial experience in this vibrant city.

As Miami's real estate market continues to thrive, staying informed and proactive is key. Property owners who embrace these insights and strategies are better equipped to make informed decisions, optimize their tax positions, and ultimately contribute to the vibrant fabric of this sun-soaked metropolis.

What is the current millage rate in Miami for property taxes?

+The millage rate in Miami can vary depending on the specific property and location. On average, the millage rate for residential properties is around 1.18% of the assessed value. However, it’s essential to check with the local tax authorities for the most accurate and up-to-date information specific to your property.

Are there any penalties for late property tax payments in Miami?

+Yes, late payment of property taxes in Miami can incur penalties. The specific penalty structure may vary, but generally, a late fee of 3% is applied for the first month, with an additional 1.5% added for each subsequent month until the tax is paid in full. It’s crucial to stay on top of payment deadlines to avoid these penalties.

How often are property assessments conducted in Miami?

+Property assessments in Miami are typically conducted every two years. However, certain circumstances, such as significant improvements or changes to the property, may trigger an interim assessment. It’s advisable to stay informed about the assessment schedule to ensure you are prepared for any potential changes in tax liability.