Is Margin Interest Tax Deductible

Understanding the tax implications of margin interest is crucial for investors, as it can significantly impact their financial strategies and overall tax liability. Margin interest, a key component of margin trading, is the cost incurred when borrowing funds from a brokerage firm to purchase securities. This article aims to provide a comprehensive analysis of whether margin interest is tax-deductible and explore the associated tax benefits and considerations.

Tax Deductibility of Margin Interest

The deductibility of margin interest depends on how the investor uses the borrowed funds and the specific tax regulations in their jurisdiction. In the United States, for instance, the tax treatment of margin interest varies based on the investor’s tax status and the purpose of the margin loan.

Investment-Related Margin Interest

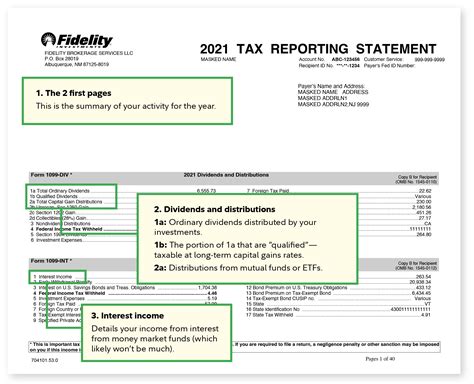

When margin interest is directly related to investment activities, it can be considered a legitimate business expense and thus tax-deductible. This is particularly relevant for active traders and investors who use margin to leverage their positions. The Internal Revenue Service (IRS) allows investors to deduct margin interest expenses incurred for investment purposes on their tax returns.

For example, consider an investor who borrows funds at a margin rate of 5% to purchase stocks with the expectation of earning capital gains. If the investor meets the requirements for a trader or dealer in securities, the margin interest paid on this loan would be tax-deductible as a business expense. This deduction is crucial for investors as it reduces their taxable income, potentially lowering their overall tax liability.

| Margin Interest Rate | Borrowed Amount | Interest Expense |

|---|---|---|

| 5% | $100,000 | $5,000 |

Personal Margin Loans

Margin interest on personal loans, however, typically does not qualify for tax deductions. When an investor uses a margin loan for personal purposes or to purchase non-investment assets, the interest incurred is generally treated as consumer debt interest, which is not tax-deductible in most cases.

For instance, if an investor borrows funds at a margin rate to purchase a personal residence or fund their child's education, the interest paid would not be tax-deductible. This distinction is essential as it separates investment-related expenses from personal expenses for tax purposes.

Tax Benefits and Considerations

The tax benefits of deducting margin interest are significant for investors, as they can offset taxable income and reduce the overall tax burden. However, it is crucial to consider certain factors when leveraging margin for tax advantages.

Margin Interest Deduction Limits

While margin interest is tax-deductible, there are limitations to this deduction. The IRS imposes a floor on miscellaneous itemized deductions, including margin interest. This means that an investor can only deduct the portion of margin interest that exceeds 2% of their adjusted gross income (AGI). For example, if an investor’s AGI is 100,000 and they pay 10,000 in margin interest, they can only deduct 8,000 (10,000 - 2% of $100,000) from their taxable income.

Risk and Tax Strategy

Using margin to enhance investment returns and potentially reduce taxes can be a double-edged sword. While it offers tax benefits, margin trading also carries a higher level of risk. Investors must carefully consider their risk tolerance and ensure they have a comprehensive understanding of the potential consequences, both financial and tax-related.

Additionally, investors should be mindful of the impact of margin interest deductions on their tax brackets. Deductions can reduce taxable income, potentially moving an investor into a lower tax bracket and lowering their overall tax liability. However, it is crucial to balance this strategy with other tax considerations to ensure optimal tax planning.

Real-World Examples and Strategies

To illustrate the practical application of margin interest deductions, consider the following scenarios:

Scenario 1: Active Trader

John, an active trader, borrows 50,000 at a margin rate of 6% to trade stocks and options. He generates a total of 15,000 in capital gains from his trading activities during the year. John can deduct the full 3,000 in margin interest (6% of 50,000) from his trading income, reducing his taxable capital gains to $12,000.

Scenario 2: Conservative Investor

Emily, a conservative investor, borrows 20,000 at a margin rate of 4% to purchase dividend-paying stocks. She earns 4,000 in dividend income and pays 800 in margin interest. As Emily is not an active trader, her margin interest is not fully deductible. However, she can deduct 600 (80% of the interest) as it exceeds 2% of her AGI.

Conclusion

Understanding the tax implications of margin interest is a critical aspect of investment planning. While margin interest can be tax-deductible for investment-related activities, investors must navigate specific regulations and limitations. The deductibility of margin interest provides a valuable tool for investors to manage their tax liability, but it should be approached with caution and a thorough understanding of the potential risks and benefits.

Frequently Asked Questions

Can I deduct margin interest on my tax return if I’m not a professional trader?

+The deductibility of margin interest depends on how you use the borrowed funds. If you’re not a professional trader, margin interest on personal loans is generally not tax-deductible. However, if you use margin to invest in securities and meet certain criteria, you may be able to deduct a portion of the interest as a business expense.

Are there any limitations to deducting margin interest on my tax return?

+Yes, there are limitations. The IRS imposes a floor on miscellaneous itemized deductions, including margin interest. This means you can only deduct the portion of margin interest that exceeds 2% of your adjusted gross income (AGI). It’s important to consider this limitation when calculating your tax deductions.

What happens if I use margin for both investment and personal purposes?

+If you use margin for both investment and personal purposes, you need to allocate the interest expense accordingly. The portion of the interest related to investment activities may be deductible, while the personal portion is typically not. Proper record-keeping and allocation are crucial in these situations.