Salt Lake Sales Tax

Salt Lake City, located in the heart of Utah, is a vibrant metropolis with a thriving business community. As a bustling hub for commerce, understanding the sales tax landscape is essential for both local businesses and consumers alike. This comprehensive guide will delve into the intricacies of the Salt Lake City sales tax, providing an in-depth analysis of its rates, exemptions, and practical implications.

Understanding the Salt Lake City Sales Tax Structure

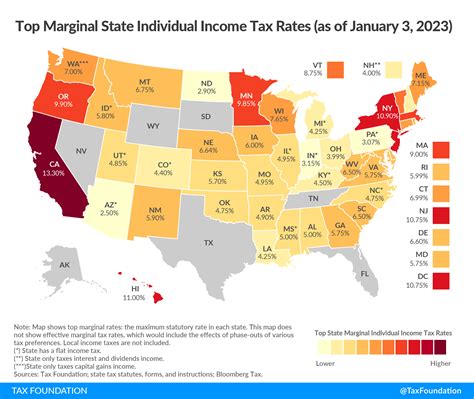

The sales tax in Salt Lake City is a combination of state, county, and municipal taxes, each contributing to the overall rate. Currently, the state of Utah imposes a sales tax rate of 4.70%, which serves as the foundation for the city’s tax structure. However, it is the additional local taxes that can make a significant difference in the total sales tax rate.

County and City Sales Taxes

Salt Lake County adds a sales tax rate of 1.25%, bringing the total up to 5.95% so far. But the city itself also imposes a sales tax, which currently stands at 1.75%, resulting in a combined sales tax rate of 7.70%. This means that every purchase made within Salt Lake City is subject to this tax, with the revenue collected being allocated for various public services and infrastructure development.

Special Tax Districts and Exemptions

It is important to note that Salt Lake City, like many other municipalities, may have special tax districts with unique tax rates. These districts are typically created to fund specific projects or initiatives, such as transportation improvements or tourism development. While the exact boundaries and rates of these districts can vary, they often add an additional percentage point or two to the total sales tax.

Furthermore, certain items are exempt from sales tax in Salt Lake City. These exemptions can vary depending on the nature of the item and the purpose of the purchase. For instance, most groceries are exempt from sales tax, providing some relief for households' daily expenses. Additionally, some clothing items, prescription medications, and educational materials may also be exempt, depending on the specific criteria outlined by the state and local governments.

| Tax Type | Rate (%) |

|---|---|

| State Sales Tax | 4.70 |

| Salt Lake County Sales Tax | 1.25 |

| Salt Lake City Sales Tax | 1.75 |

| Total Combined Sales Tax | 7.70 |

Impact on Local Businesses and Consumers

The sales tax in Salt Lake City has a notable impact on both businesses and consumers. For businesses, especially those in the retail sector, the sales tax rate directly affects their pricing strategies and profitability. With a combined rate of 7.70%, businesses must carefully calculate their pricing to remain competitive while still generating sufficient revenue to cover their costs and turn a profit.

Competitiveness and Pricing Strategies

Businesses operating in Salt Lake City may need to adjust their pricing models to remain competitive with online retailers or businesses in neighboring cities with lower sales tax rates. This can be particularly challenging for small businesses, as they often have limited resources for advertising and marketing to offset the higher tax burden.

To mitigate the impact of sales tax, some businesses may opt for dynamic pricing strategies, adjusting their prices based on the location of the customer. For instance, offering discounted prices to customers outside of Salt Lake City to compensate for the higher tax rate within the city limits. This strategy, however, requires sophisticated sales and inventory management systems and may not be feasible for all businesses.

Consumer Spending and Perception

From the consumer perspective, the sales tax rate in Salt Lake City can influence spending habits and perceptions of value. Consumers may be more inclined to shop online or in neighboring cities with lower tax rates, especially for larger purchases where the tax difference becomes significant. This can have a negative impact on local businesses, leading to reduced foot traffic and sales.

To counteract this, local businesses may need to emphasize the benefits of shopping locally, such as personalized service, community support, and the unique shopping experience that only a physical store can provide. Additionally, businesses can leverage loyalty programs, promotions, and special events to encourage consumer spending and build brand loyalty.

Future Outlook and Potential Changes

The sales tax landscape in Salt Lake City, like any other city, is subject to change. As economic conditions evolve and new initiatives arise, the city and county governments may propose adjustments to the sales tax rate or create new tax districts. These changes can have a significant impact on businesses and consumers, so staying informed is crucial.

Potential Tax Reform and Economic Impact

In recent years, there has been a growing discussion around tax reform in Utah, with some advocating for a simplified tax structure. While the specifics are yet to be determined, potential reforms could include a reduction in the state sales tax rate, which would subsequently impact the total sales tax rate in Salt Lake City. Such a change could provide relief for businesses and consumers, making the city more competitive in the regional market.

However, it is important to note that tax reform is a complex process that requires careful consideration of various economic factors. The impact of any changes would need to be analyzed thoroughly to ensure they benefit the local economy without compromising essential public services.

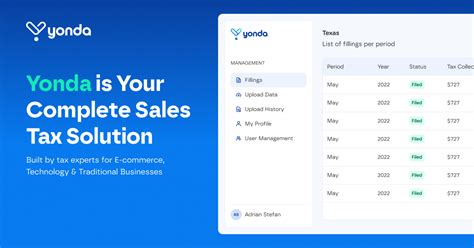

Technology’s Role in Sales Tax Management

As technology continues to advance, businesses in Salt Lake City can leverage innovative solutions to streamline their sales tax management processes. Tax calculation and compliance software, for instance, can automate much of the tax calculation and reporting process, reducing the risk of errors and saving businesses valuable time and resources.

Furthermore, e-commerce platforms and online retailers can take advantage of technology to offer personalized pricing and tax rates to customers based on their location. This dynamic pricing approach can help businesses in Salt Lake City remain competitive, even with the higher sales tax rate.

Conclusion: Navigating the Salt Lake City Sales Tax Landscape

Understanding and navigating the sales tax structure in Salt Lake City is crucial for businesses and consumers alike. With a combined sales tax rate of 7.70%, businesses must carefully consider their pricing strategies, while consumers may need to adjust their spending habits to support local businesses and take advantage of tax-exempt items.

As the city and state continue to evaluate their tax structures and consider potential reforms, staying informed and adapting to changes will be essential for both businesses and consumers. By leveraging technology and staying engaged with local tax initiatives, the business community in Salt Lake City can continue to thrive and contribute to the city's vibrant economy.

How often are sales tax rates updated in Salt Lake City?

+Sales tax rates in Salt Lake City are typically updated annually, often in line with the new fiscal year. However, it’s important to note that special tax districts may have different timelines for rate adjustments.

Are there any upcoming changes to the sales tax rate in Salt Lake City?

+As of the latest information, there are no immediate plans for changes to the sales tax rate in Salt Lake City. However, it’s always advisable to stay updated with local news and government announcements, as any proposed changes would likely be publicly discussed before implementation.

How can businesses stay compliant with sales tax regulations in Salt Lake City?

+Businesses can stay compliant by registering for a sales tax permit with the Utah State Tax Commission and staying informed about any changes to tax rates or regulations. Utilizing sales tax software can also help automate tax calculation and filing processes, reducing the risk of errors and non-compliance.