Detroit Property Taxes

Understanding Detroit property taxes is crucial for homeowners and investors alike. The city of Detroit, Michigan, has a unique tax landscape that influences real estate decisions and community development. This article delves into the intricacies of Detroit property taxes, providing a comprehensive guide for anyone navigating the city's real estate market.

The Basics of Detroit Property Taxes

Detroit, like many cities in the United States, relies on property taxes as a significant source of revenue for local government operations and services. These taxes are levied on both residential and commercial properties and are calculated based on the assessed value of the property.

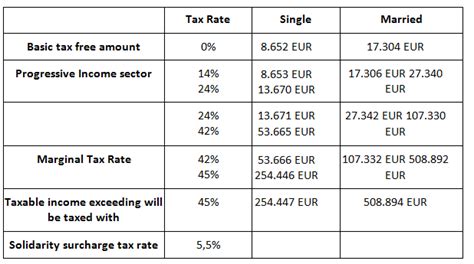

The property tax rate in Detroit is typically expressed as a millage rate, which represents the number of dollars owed per $1,000 of assessed value. For instance, a millage rate of 30 mills would mean $30 is owed for every $1,000 of assessed value. These millage rates are often set annually by the local government and can vary depending on the type of property and its location within the city.

The assessment process is a key component of property taxation. In Detroit, property assessments are conducted by the Wayne County Equalization Department, which determines the taxable value of each property. This value takes into account factors such as the property's size, condition, and recent sales of similar properties in the area.

Once the assessed value is determined, it is multiplied by the applicable millage rate to calculate the property tax owed. For example, if a residential property has an assessed value of $150,000 and the millage rate is 30 mills, the annual property tax would be $4,500 ($150,000 x 0.030 = $4,500). It's important to note that the assessed value may not always reflect the market value of the property.

Factors Influencing Detroit Property Taxes

Property Type and Location

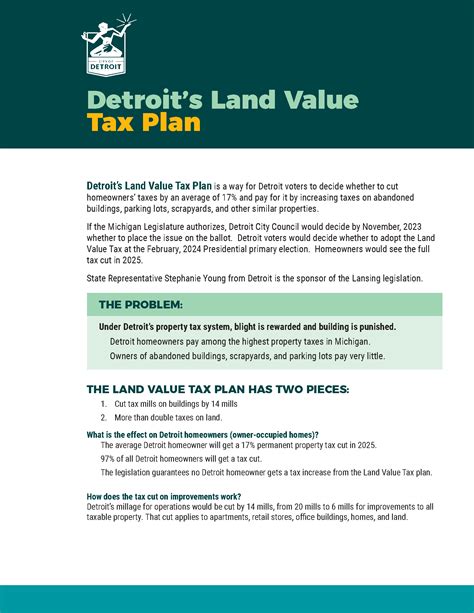

Detroit property taxes can vary significantly based on the type of property and its location within the city. Residential properties, commercial buildings, and vacant land may all have different tax rates and assessment methods. Additionally, properties located in different neighborhoods or districts may be subject to unique tax incentives or penalties, such as those aimed at promoting urban renewal or community development.

For instance, the Detroit Economic Growth Corporation offers tax incentives to encourage commercial development in certain areas, while other neighborhoods may have higher tax rates to support specific community initiatives.

Assessments and Appeals

Property owners in Detroit have the right to appeal their property assessments if they believe the assessed value is inaccurate or unfair. This process, known as a tax assessment appeal, allows homeowners and businesses to present evidence and arguments to support a lower assessed value, which could lead to reduced property taxes.

The assessment appeal process typically involves submitting an appeal to the Wayne County Tax Tribunal, providing supporting documentation, and potentially attending a hearing. Successful appeals can result in substantial savings for property owners, making this an important aspect of managing Detroit property taxes.

Tax Incentives and Exemptions

Detroit offers various tax incentives and exemptions to promote economic development, encourage homeownership, and support community initiatives. These incentives can significantly reduce the property tax burden for eligible homeowners and businesses.

For example, the Homestead Property Tax Credit provides a partial refund of property taxes for principal residences in Michigan. Additionally, the Industrial Facilities Exemption program offers tax breaks for certain types of industrial properties, aiming to attract new businesses and create jobs.

The Impact of Detroit Property Taxes

Homeownership and Investment

Property taxes in Detroit play a pivotal role in shaping the local real estate market. For prospective homeowners, understanding the tax implications can be critical in making informed buying decisions. The tax burden can significantly affect a property’s affordability and overall cost of ownership.

Similarly, investors considering real estate opportunities in Detroit must carefully assess the impact of property taxes on their potential returns. Strategies such as purchasing properties in areas with lower tax rates or taking advantage of tax incentives can be crucial for maximizing investment outcomes.

Community Development and Revitalization

Detroit’s property tax structure is intricately tied to the city’s efforts for community development and revitalization. Tax revenues fund essential public services, infrastructure improvements, and initiatives aimed at enhancing the quality of life for residents.

For instance, the Detroit Future City initiative, a comprehensive plan for the city's long-term development, relies on property tax revenues to implement various projects, including blight removal, green space development, and neighborhood stabilization efforts.

Tax Foreclosures and Property Ownership

While property taxes are essential for local government operations, they can also lead to challenges for property owners who struggle to meet their tax obligations. In Detroit, like many other cities, failure to pay property taxes can result in tax foreclosures, where the local government seizes the property and sells it to recoup the unpaid taxes.

This process can have significant implications for homeowners and the overall housing market. It's crucial for property owners to stay informed about their tax obligations and explore options for assistance or payment plans to avoid potential foreclosure.

Navigating Detroit Property Taxes: Expert Tips

Understanding and managing Detroit property taxes can be complex, but there are strategies and resources available to help:

- Stay Informed: Keep up-to-date with local tax policies, rates, and incentives. The City of Detroit and Wayne County websites are excellent resources for official information.

- Assessment Accuracy: Ensure your property's assessed value is accurate. Regularly review your assessment notices and consider appealing if you believe the value is incorrect.

- Tax Incentives: Explore tax incentives and exemptions that may apply to your property. These can significantly reduce your tax burden and should be factored into your financial planning.

- Payment Plans: If you're struggling to meet your tax obligations, consider payment plans offered by the city. These plans can help manage your debt and avoid foreclosure.

- Community Engagement: Get involved in your community's tax-related initiatives and discussions. Your input can influence tax policies and ensure they align with the needs of residents.

Navigating Detroit's property tax landscape requires a thorough understanding of the local market, tax policies, and available resources. By staying informed and proactive, homeowners and investors can make the most of their real estate opportunities while contributing to the vibrant future of the city.

Detroit Property Taxes FAQ

How are property taxes calculated in Detroit?

+Property taxes in Detroit are calculated by multiplying the assessed value of the property by the applicable millage rate. The assessed value is determined by the Wayne County Equalization Department, while the millage rate is set by the local government.

Can I appeal my property assessment in Detroit?

+Yes, property owners in Detroit have the right to appeal their property assessments if they believe the assessed value is inaccurate. Appeals are submitted to the Wayne County Tax Tribunal, and successful appeals can lead to reduced property taxes.

What tax incentives are available in Detroit for homeowners and investors?

+Detroit offers a range of tax incentives, including the Homestead Property Tax Credit for primary residences and the Industrial Facilities Exemption for certain industrial properties. These incentives aim to encourage homeownership and attract new businesses.

How do Detroit property taxes impact the real estate market and community development?

+Property taxes in Detroit play a crucial role in shaping the real estate market and community development. They influence homeownership affordability, investment opportunities, and the funding of essential public services and initiatives aimed at revitalizing the city.

What should I do if I’m struggling to pay my Detroit property taxes?

+If you’re facing difficulties paying your property taxes, consider exploring payment plans offered by the city. These plans can help manage your debt and avoid tax foreclosure. Additionally, seek advice from financial professionals or community resources to find the best solution for your situation.