Does Delaware Have State Income Tax

Delaware, often referred to as "The Diamond State," is a unique state in the United States when it comes to taxes. With a rich history and a reputation for business-friendly policies, Delaware's tax structure is a significant factor in its economic landscape. This article delves into the intricacies of Delaware's taxation system, focusing on the crucial question: Does Delaware have a state income tax? We'll explore the specifics, real-world implications, and how it compares to other states.

The Delaware Tax Landscape

Delaware’s tax system is designed to attract businesses and individuals, fostering economic growth. While it boasts several tax advantages, the state’s approach to income taxation is particularly notable.

State Income Tax: A Delicate Balance

Delaware, as of [Date of Last Tax Update], maintains a state income tax structure that carefully balances the needs of its residents and the state's economic development goals. Here's a breakdown of the key aspects:

- Tax Rates and Brackets: Delaware operates with a progressive income tax system, meaning the tax rate increases as income rises. The state has [Number of Tax Brackets] brackets, each with its own tax rate. For instance, the lowest bracket starts at $0 and has a tax rate of [Lowest Tax Rate]%, while the highest bracket, applicable to incomes over $[Threshold Amount], has a tax rate of [Highest Tax Rate]%.

- Personal Exemptions and Deductions: Delaware offers various deductions and exemptions to reduce taxable income. These include deductions for medical expenses, state and local taxes, and charitable contributions. Additionally, the state provides a personal exemption of $[Amount] for each taxpayer and dependent.

- Tax Credits: Delaware extends several tax credits to individuals and businesses. These credits include the Earned Income Tax Credit, Child and Dependent Care Credit, and the Low-Income Housing Tax Credit. These incentives aim to support working families and promote affordable housing.

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| Bracket 1 | [Rate 1]% | $0 - $[Threshold 1] |

| Bracket 2 | [Rate 2]% | $[Threshold 1] - $[Threshold 2] |

| ... | ... | ... |

| Highest Bracket | [Highest Rate]% | $[Highest Threshold] and above |

Comparison with Other States

When comparing Delaware's state income tax system to other states, several key differences emerge:

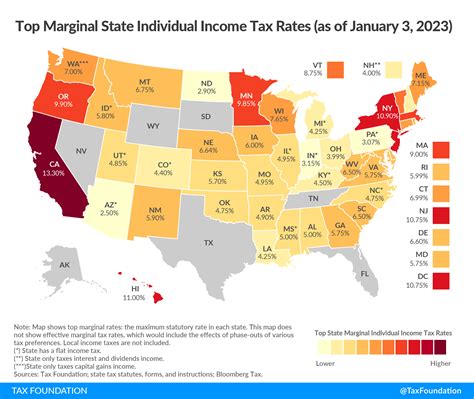

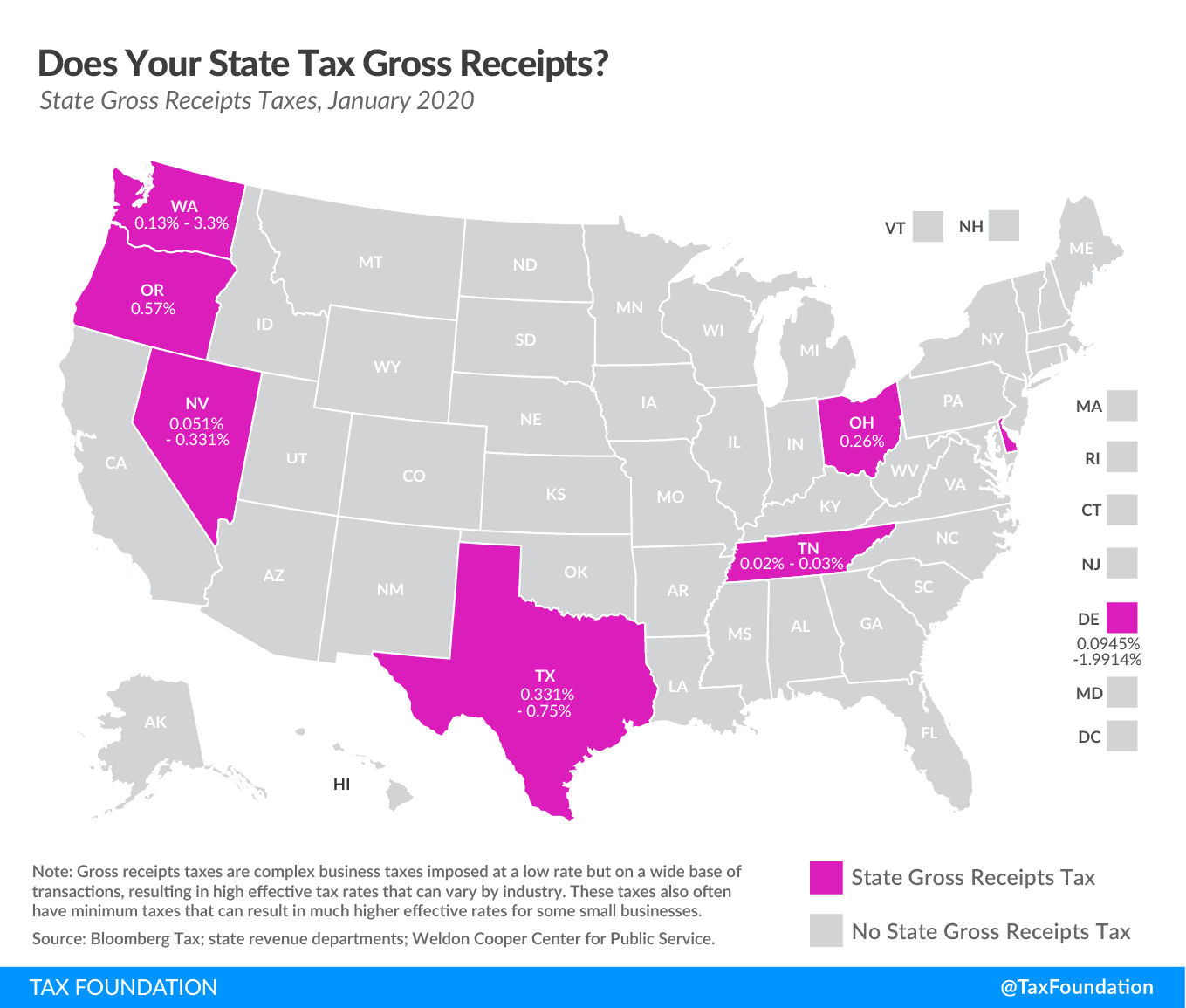

- Progressive vs. Flat Tax: Delaware, along with many other states, employs a progressive tax system, where higher incomes are taxed at higher rates. In contrast, some states, like Pennsylvania and Illinois, have a flat tax rate, applying the same percentage to all income levels.

- Tax Rates and Brackets: Delaware's tax rates are relatively competitive. States like California and New York have higher top tax rates, while states like Florida and Texas have no state income tax, making them more attractive to certain taxpayers.

- Deductions and Exemptions: Delaware's deductions and exemptions are in line with many other states. However, some states, like Arizona and Iowa, offer more generous deductions for certain expenses, such as medical costs.

The Impact on Residents and Businesses

Delaware's approach to state income taxation has a tangible impact on its residents and businesses. For individuals, the progressive tax structure ensures that those with higher incomes contribute a larger share, promoting fairness. The availability of deductions and exemptions helps reduce the tax burden for many taxpayers.

From a business perspective, Delaware's tax system, including its income tax rates, contributes to the state's reputation as a business-friendly environment. The state's attractive tax rates and incentives have led to a thriving business climate, particularly in the corporate sector.

Delaware's Tax Advantages and Disadvantages

While Delaware's tax system has its advantages, it's essential to consider both sides of the coin. Here's a closer look at the benefits and potential drawbacks:

Advantages

- Competitive Tax Rates: Delaware's income tax rates are generally lower compared to many other states, making it an appealing choice for taxpayers seeking to minimize their tax liabilities.

- Progressive Tax System: The progressive nature of Delaware's tax system ensures that those with higher incomes contribute proportionally more, promoting a sense of fairness and equality.

- Business-Friendly Environment: Delaware's tax structure, including its income tax rates, has contributed to its reputation as a business-friendly state. This has attracted numerous corporations and contributed to economic growth.

Disadvantages

- Lack of Certain Deductions: While Delaware offers various deductions and exemptions, some states provide more generous options for specific expenses. This may impact certain taxpayers, especially those with unique financial situations.

- Potential for Higher Taxes for High-Income Earners: Although the progressive tax system ensures fairness, high-income earners may face higher tax rates in Delaware compared to states with flatter tax structures.

- Impact on Lower-Income Residents: While Delaware's tax system aims for fairness, the progressive nature may not provide significant relief for lower-income residents. This is a consideration for those seeking tax advantages across all income levels.

Future Implications and Tax Strategies

As Delaware’s tax landscape continues to evolve, taxpayers and businesses must stay informed to make strategic decisions. Here are some insights and strategies for navigating Delaware’s tax system:

Stay Updated with Tax Changes

Delaware’s tax structure is subject to periodic updates and amendments. It’s crucial for taxpayers and businesses to stay informed about any changes in tax rates, brackets, deductions, and credits. Regularly reviewing the state’s tax code and seeking professional advice can help ensure compliance and optimal tax planning.

Utilize Deductions and Credits Strategically

Delaware offers a range of deductions and tax credits that can significantly reduce taxable income. Taxpayers should carefully review their financial situation and explore opportunities to maximize these benefits. This may involve tracking eligible expenses, such as medical costs, state and local taxes, and charitable contributions.

Consider Business Entity Selection

For businesses operating in Delaware, the choice of entity type can impact tax obligations. Corporations, limited liability companies (LLCs), and partnerships have different tax implications. Seeking professional advice on entity selection can help businesses optimize their tax position and take advantage of Delaware’s business-friendly environment.

Explore Tax Planning Strategies

Tax planning is a vital aspect of financial management. Taxpayers and businesses can work with tax professionals to develop strategies that minimize tax liabilities while remaining compliant with Delaware’s tax laws. This may involve timing income and expenses, utilizing retirement accounts, or considering other tax-efficient investments.

How does Delaware’s state income tax compare to other states in the region?

+Delaware’s state income tax rates are generally lower compared to neighboring states like Pennsylvania, New Jersey, and Maryland. This makes Delaware an attractive option for taxpayers seeking to minimize their tax burdens.

Are there any special tax incentives for businesses in Delaware?

+Yes, Delaware offers various tax incentives to attract and support businesses. These include tax credits for research and development, job creation, and investment in renewable energy. Additionally, Delaware’s status as a corporate haven provides unique advantages for certain businesses.

What is Delaware’s reputation as a tax haven, and how does it impact the state’s economy?

+Delaware is often referred to as a tax haven due to its business-friendly environment and corporate tax structure. This reputation has attracted numerous corporations, particularly in the financial and legal sectors, contributing significantly to the state’s economy.