Mn Property Tax Refund 2025

Minnesota residents are well aware of the state's unique property tax system, which offers a potential property tax refund to homeowners and renters. The Minnesota Property Tax Refund program is designed to provide relief to eligible individuals who meet certain income and property tax criteria. As we approach the year 2025, it's crucial to understand the program's mechanisms, eligibility requirements, and how to maximize your potential refund.

Understanding the Minnesota Property Tax Refund Program

The Property Tax Refund program in Minnesota is an essential initiative aimed at assisting residents in managing their property tax obligations. It is administered by the Minnesota Department of Revenue and offers a potential refund to homeowners and renters based on their income and the property taxes they pay.

The program's primary objective is to ensure that property taxes remain affordable for all Minnesotans, especially those with limited incomes. By providing a refund mechanism, the state aims to promote fairness and maintain a balanced tax system.

How the Property Tax Refund Works

Eligible homeowners and renters can apply for a property tax refund, which is calculated based on their income and the taxes they’ve paid. The refund is designed to offset a portion of the property taxes, helping individuals manage their financial obligations.

The refund amount is determined by the Department of Revenue using a formula that considers various factors, including the applicant's income, property value, and the total amount of property taxes paid. This ensures that those who need it the most receive a significant portion of their taxes back.

It's important to note that the refund is not automatic. Applicants must actively file for the refund, typically through their income tax return or a separate application form. This process ensures that the state accurately assesses each individual's eligibility and refund amount.

| Refund Categories | Description |

|---|---|

| Regular Refund | Basic refund for homeowners and renters based on income and property taxes paid. |

| Special Refund | Additional refund for homeowners over 65 or disabled, and renters over 65, disabled, or with dependent children. |

| Homestead Credit Refund | Refund for homeowners who have lived in their homes for at least two years and meet income criteria. |

Eligibility Criteria for the Property Tax Refund

To be eligible for the Minnesota Property Tax Refund, applicants must meet specific income and property tax criteria. These criteria are subject to change annually, so it’s essential to refer to the most recent guidelines provided by the Department of Revenue.

Generally, eligibility is determined by the applicant's gross income, which includes all sources of income before deductions. The income limit for the regular refund is typically set at a certain amount, and applicants must fall below this threshold to qualify. For the special refund, there are often separate income limits for homeowners and renters.

In addition to income, applicants must also have paid property taxes. For homeowners, this includes taxes on their primary residence. Renters must provide proof of rent payments, which can be challenging for those with informal rental arrangements.

Furthermore, the property must be the applicant's primary residence. Vacation homes or investment properties do not qualify for the refund. The property must also be located within Minnesota to be eligible.

Maximizing Your Property Tax Refund in 2025

As we look ahead to 2025, it’s crucial for Minnesota residents to understand the strategies they can employ to maximize their potential property tax refund. By staying informed and taking proactive steps, individuals can ensure they receive the maximum benefit from this important program.

Stay Informed About Income Limits and Property Tax Requirements

The income limits and property tax requirements for the Minnesota Property Tax Refund program can vary from year to year. It’s essential to stay up-to-date with the latest guidelines released by the Department of Revenue. These guidelines will outline the specific income thresholds and property tax criteria for the upcoming year.

By being aware of these changes, individuals can assess their eligibility and take steps to ensure they meet the requirements. This may involve adjusting their income or property tax payments to fall within the eligible ranges.

Additionally, it's crucial to understand the different refund categories and their respective criteria. As mentioned earlier, there are regular, special, and homestead credit refunds, each with its own set of requirements. Being knowledgeable about these categories can help individuals determine which refund they are most likely to qualify for and maximize their potential benefits.

File Your Taxes Early and Accurately

Filing your taxes accurately and on time is crucial for maximizing your property tax refund. The refund is often calculated as part of your income tax return, so it’s essential to ensure all information is correct and complete.

Consider seeking professional tax preparation services or using reputable tax software to minimize errors and maximize your refund. These tools can help you navigate the complex tax landscape and ensure you receive all the deductions and credits you're entitled to, including the property tax refund.

Furthermore, filing early can be advantageous. By submitting your tax return promptly, you may receive your refund sooner, providing you with additional financial flexibility.

Utilize Property Tax Credits and Deductions

In addition to the property tax refund, Minnesota offers various tax credits and deductions that can further reduce your property tax burden. These credits and deductions can be applied to your tax liability, potentially increasing your refund or reducing the amount of taxes you owe.

For instance, the Homestead Credit is a valuable tool for homeowners. This credit provides a direct reduction in property taxes for eligible homeowners, making it easier to manage their tax obligations. By understanding and utilizing these credits and deductions, individuals can further maximize their savings and potentially increase their property tax refund.

Real-Life Success Stories: Maximizing Property Tax Refunds

To illustrate the impact of the Minnesota Property Tax Refund program, let’s explore a few real-life success stories of individuals who have maximized their refunds and benefited from the program’s provisions.

John’s Story: A Senior Homeowner’s Journey

John, a retired senior living in a modest home in rural Minnesota, has been a beneficiary of the property tax refund program for several years. With a fixed income, John carefully manages his finances and understands the importance of every dollar.

By staying informed about the program's guidelines, John ensured he met the income criteria for the special refund for seniors. He also took advantage of the Homestead Credit, which provided him with an additional reduction in his property taxes. As a result, John received a substantial refund each year, allowing him to maintain his comfortable lifestyle without worrying about the financial burden of property taxes.

Sarah’s Story: A Young Family’s Journey to Homeownership

Sarah and her husband, recent homeowners in the Twin Cities, were unsure if they qualified for the property tax refund program. With a growing family and a tight budget, they were eager to maximize any potential savings.

After researching the program's requirements, they discovered that, as first-time homeowners, they were eligible for the Homestead Credit Refund. This credit, combined with their regular property tax refund, provided them with a significant financial boost. With the refund, they were able to set aside money for their children's education fund and save for future home improvements, ensuring their new home remained a source of joy and financial stability.

Mark’s Story: Navigating the Complexities of Rental Agreements

Mark, a renter in a bustling Minneapolis neighborhood, faced a unique challenge when it came to claiming the property tax refund. With an informal rental agreement, he struggled to provide proof of rent payments.

However, with the help of a local tax preparation service, Mark was able to gather the necessary documentation. By carefully tracking his rent payments and maintaining a detailed record, he successfully applied for the refund. This refund provided Mark with much-needed financial relief, allowing him to continue living in his desired neighborhood without compromising his financial goals.

Future Outlook: The Evolution of Minnesota’s Property Tax System

As we look to the future, it’s evident that the Minnesota Property Tax Refund program will continue to play a crucial role in supporting residents’ financial well-being. However, the state’s property tax system is not without its complexities and potential areas for improvement.

Addressing Property Tax Inequities

One of the ongoing challenges in Minnesota’s property tax system is the issue of inequities. Property taxes can vary significantly across different regions and municipalities, leading to disparities in the burden placed on homeowners and renters.

Efforts are being made to address these inequities through legislative initiatives and local government reforms. By standardizing assessment practices and implementing fairer tax structures, the state aims to ensure that property taxes are more evenly distributed and aligned with the ability to pay.

Enhancing Transparency and Accountability

Transparency and accountability are key principles in any tax system. Minnesota is committed to enhancing these aspects by providing clear and accessible information to residents. This includes improving communication channels, ensuring that tax guidelines and eligibility criteria are easily understandable, and offering support to individuals navigating the refund process.

Additionally, the state is exploring ways to streamline the application process, making it more efficient and less burdensome for applicants. This may involve digitalizing forms and utilizing technology to simplify the submission of necessary documentation.

Exploring Alternative Tax Structures

While the Property Tax Refund program has been a successful initiative, Minnesota is also considering alternative tax structures to further enhance fairness and efficiency.

One potential option is the implementation of a Land Value Tax, which would tax the value of the land itself rather than the improvements made to it. This approach could lead to a more equitable distribution of tax burdens, as it would not penalize homeowners for making improvements to their properties. It would also encourage efficient land use and discourage land speculation.

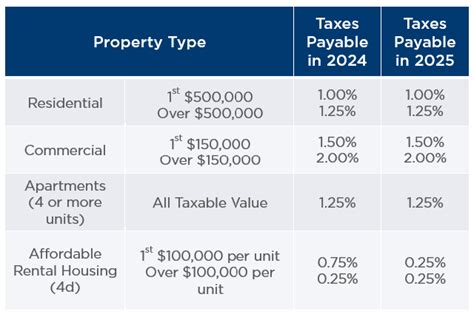

Another possibility is the adoption of a Progressive Property Tax system, where tax rates vary based on property value. This system could ensure that those with higher-value properties contribute a larger share of taxes, providing additional revenue for public services and infrastructure.

Conclusion: Navigating Minnesota’s Property Tax Landscape

Minnesota’s Property Tax Refund program is a vital component of the state’s commitment to providing financial relief to its residents. By understanding the program’s mechanisms, staying informed about eligibility criteria, and taking proactive steps, individuals can maximize their potential refunds and manage their property tax obligations effectively.

As the state continues to refine its property tax system, residents can look forward to a more equitable and transparent process. The future of Minnesota's property taxes holds promise, with ongoing efforts to address inequities, enhance transparency, and explore innovative tax structures. By staying engaged and informed, residents can actively participate in shaping a tax system that works for all Minnesotans.

How often can I apply for the Minnesota Property Tax Refund?

+You can apply for the refund annually, typically as part of your income tax return or through a separate application process. It’s important to stay updated with the specific deadlines and requirements each year.

What if I miss the application deadline for the property tax refund?

+Missing the deadline may result in a delayed refund or a reduced refund amount. It’s crucial to mark your calendar with important dates and submit your application promptly to avoid any penalties or disadvantages.

Can I receive the property tax refund if I don’t file my income taxes?

+No, the property tax refund is often calculated as part of your income tax return. Filing your income taxes is a necessary step to receive the refund. However, if you have extenuating circumstances, it’s advisable to consult with a tax professional for guidance.