Sales Tax In Riverside Ca

Sales tax in California, including Riverside, plays a significant role in the state's economy and financial landscape. Understanding the sales tax system is crucial for both businesses and consumers alike. This comprehensive guide will delve into the intricacies of sales tax in Riverside, California, providing an in-depth analysis of its structure, rates, exemptions, and implications.

The Sales Tax System in Riverside, California

Riverside, a vibrant city located in Southern California, is part of the expansive sales tax system that governs the entire state. California’s sales tax is a key revenue generator for the state government and is utilized to fund various public services and infrastructure projects.

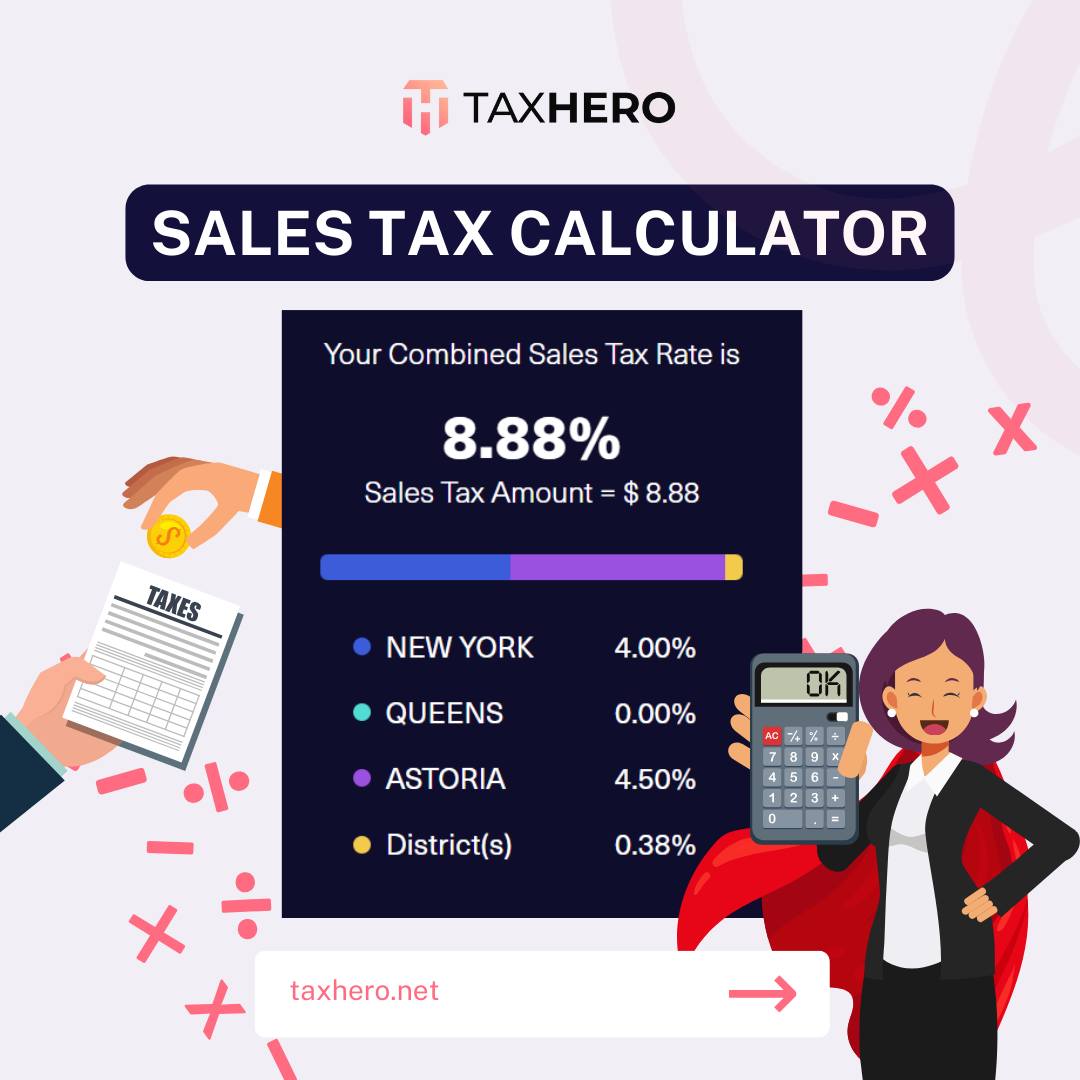

Sales Tax Rates in Riverside

The sales tax rate in Riverside, like many other cities in California, is determined by a combination of state, county, and city tax rates. As of the latest available information, the total sales tax rate in Riverside is 7.25%, which includes:

- A 6% state sales tax rate.

- A 0.25% county transportation tax.

- A 1% city of Riverside sales tax.

It’s important to note that these rates may be subject to change, and it is the responsibility of businesses and consumers to stay updated with the latest tax regulations.

Sales Tax Exemptions and Special Cases

California, and consequently Riverside, offers a range of sales tax exemptions and special cases that can significantly impact the overall tax liability of businesses and consumers. Some of the notable exemptions include:

- Food and Drugs: Certain unprepared food items, such as fresh produce, meat, and dairy products, are exempt from sales tax. Additionally, non-prescription drugs and medical supplies are also tax-exempt.

- Clothing and Shoes: In a move to support lower-income individuals, California exempts clothing and footwear items priced under $100 from sales tax.

- Grocery Stores: Certain grocery stores that meet specific criteria are eligible for a reduced sales tax rate of 1% on taxable items.

- Manufacturers and Resellers: Manufacturers and resellers often have different tax obligations, with some items being subject to a vendor’s use tax instead of sales tax.

| Sales Tax Exemptions | Applicable Rates |

|---|---|

| Unprepared Food | 0% |

| Clothing and Shoes under $100 | 0% |

| Grocery Stores (Specific Criteria) | 1% |

| Manufacturers and Resellers (Vendor's Use Tax) | Varies |

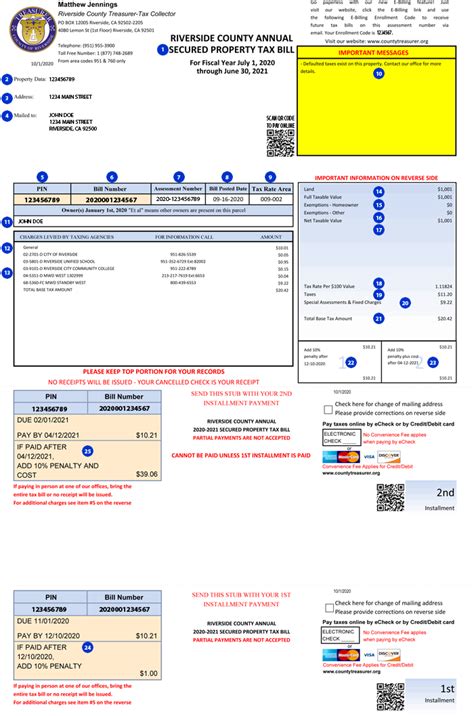

Sales Tax Collection and Remittance

Sales tax collection and remittance are critical processes that businesses operating in Riverside must navigate meticulously. Here’s an overview of the key steps involved:

Step 1: Registering for a Seller’s Permit

Any business selling taxable goods or services in Riverside is required to obtain a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state.

Step 2: Collecting Sales Tax

Once registered, businesses must collect sales tax from customers at the point of sale. The tax is calculated based on the total taxable amount of the transaction, including any applicable surcharges or fees.

Step 3: Calculating and Remitting Sales Tax

Businesses are responsible for calculating the total sales tax liability based on their sales during a specified period, typically monthly or quarterly. This calculation involves multiplying the total taxable sales by the applicable sales tax rate. The calculated tax amount must then be remitted to the CDTFA by the due date.

Step 4: Filing Sales Tax Returns

In addition to remitting the tax, businesses must also file sales tax returns with the CDTFA. These returns provide a detailed breakdown of taxable sales, exempt sales, and any applicable deductions or credits. Filing deadlines vary based on the business’s filing frequency, which is determined during the registration process.

Compliance and Audits

Ensuring compliance with sales tax regulations is paramount for businesses in Riverside. The CDTFA conducts audits to verify that businesses are accurately collecting and remitting sales tax. During an audit, businesses may be required to provide documentation, including sales records, invoices, and tax returns.

Common Audit Findings

- Under-reporting of Sales: Auditors often scrutinize sales records to ensure that all taxable sales are reported accurately.

- Misclassification of Taxable Items: Auditors may review transactions to ensure that items are correctly classified as taxable or exempt.

- Late Filing or Non-Filing of Returns: Audits may focus on businesses that have failed to file returns or have consistently filed late.

Future Implications and Changes

The sales tax landscape in California, including Riverside, is subject to potential changes and developments. Here are some key considerations for the future:

Potential Rate Increases

With the state’s ongoing financial challenges and the need to fund various public initiatives, there is a possibility of future sales tax rate increases. Businesses and consumers should stay vigilant for any proposed changes and plan their financial strategies accordingly.

Technological Advancements in Tax Collection

As technology advances, the CDTFA may explore new methods for sales tax collection and compliance. This could include the adoption of digital tax collection systems or the implementation of real-time sales tax reporting.

Expanding Exemptions

There is ongoing debate surrounding the expansion of sales tax exemptions. Advocates argue that certain items, such as menstrual products or diapers, should be exempt to reduce the financial burden on specific demographics. Businesses should stay informed about any proposed changes to exemptions.

Conclusion

Understanding the sales tax system in Riverside, California, is essential for businesses and consumers alike. With its complex structure, varying rates, and exemptions, sales tax can significantly impact financial planning and decision-making. By staying informed and compliant, businesses can navigate the sales tax landscape effectively, ensuring they remain competitive and financially stable.

What is the current sales tax rate in Riverside, California?

+

As of the latest information, the total sales tax rate in Riverside, California is 7.25%, which includes a state sales tax rate of 6%, a county transportation tax of 0.25%, and a city of Riverside sales tax of 1%.

Are there any sales tax exemptions in Riverside?

+

Yes, Riverside, like the rest of California, offers several sales tax exemptions. These include exemptions for unprepared food items, clothing and shoes under $100, certain grocery stores, and manufacturers and resellers, who may be subject to a vendor’s use tax instead of sales tax.

How often do businesses need to remit sales tax in Riverside?

+

The frequency of sales tax remittance in Riverside depends on the business’s sales volume and registration status. Typically, businesses must remit sales tax on a monthly or quarterly basis. However, certain high-volume businesses may be required to remit sales tax more frequently.

What happens if a business fails to collect or remit sales tax in Riverside?

+

Failing to collect or remit sales tax in Riverside can result in significant penalties and interest charges. The California Department of Tax and Fee Administration (CDTFA) may conduct audits and impose fines for non-compliance. Businesses should ensure they are aware of their tax obligations and stay up-to-date with tax regulations.

Are there any resources available for businesses to learn more about sales tax in Riverside?

+

Yes, the California Department of Tax and Fee Administration (CDTFA) provides extensive resources and guidance for businesses on their website. This includes information on registration, tax rates, exemptions, and compliance. Businesses can also consult tax professionals or seek guidance from industry associations for specific inquiries.