State Tax Rate For Pennsylvania

When discussing the state tax rates, it is important to understand the complexities and variations that exist across different jurisdictions. The state tax landscape in the United States is a diverse and ever-evolving one, and Pennsylvania is no exception. This article aims to provide an in-depth analysis of the state tax rate in Pennsylvania, shedding light on its structure, implications, and future prospects.

Unraveling the Pennsylvania State Tax Rate

The Keystone State, Pennsylvania, boasts a rich history and a unique approach to taxation. Its state tax rate stands as a crucial component of the state’s financial framework, influencing the lives of both residents and businesses. As of my last update in January 2023, Pennsylvania operates with a flat income tax rate, offering a straightforward and predictable system for its taxpayers.

Pennsylvania's state income tax rate currently stands at 3.07%, which is applied to all taxable income earned by individuals, trusts, and estates. This flat rate ensures uniformity and simplicity in tax calculations, making it relatively easier for taxpayers to comprehend and plan their financial obligations.

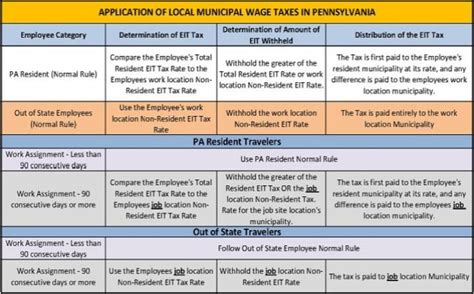

However, it is essential to note that Pennsylvania's tax landscape extends beyond the income tax. The state also imposes various other taxes, including a sales and use tax, a personal property tax, and a corporate net income tax, among others. These additional taxes contribute to the overall revenue generation for the state and influence the financial decisions of its residents and businesses.

Pennsylvania’s Income Tax: A Flat-Rate System

The flat-rate income tax system in Pennsylvania offers a unique advantage in terms of simplicity and consistency. Unlike some other states that employ a progressive tax structure with varying rates for different income brackets, Pennsylvania’s approach ensures that all taxpayers, regardless of their income level, contribute at the same rate. This system has its advantages and disadvantages, which we will explore further.

The flat tax rate can provide a sense of fairness, as it treats all taxpayers equally. It simplifies tax calculations and reduces the complexity often associated with progressive tax systems. However, it also means that high-income earners pay the same rate as those with lower incomes, which may result in a less progressive tax structure overall.

Additionally, Pennsylvania's flat tax rate can impact the state's revenue generation. While it provides a stable and predictable income stream, it may not generate the same level of revenue as a progressive tax system, especially in times of economic prosperity when higher-income earners contribute significantly to tax revenue.

Sales and Use Tax: Impact on Consumers

Pennsylvania also imposes a sales and use tax, which is applied to the retail sale, lease, or rental of tangible personal property and certain services. As of my last update, the state’s sales tax rate is 6%, which is added to the purchase price of taxable goods and services. This tax directly affects consumers, impacting their purchasing power and overall financial planning.

The sales tax can vary depending on the type of item purchased and the local municipality. Some items, such as groceries and certain medical devices, may be exempt from the sales tax, while others, like luxury goods or specific services, may be subject to additional taxes. Understanding these variations is crucial for consumers to make informed financial decisions.

Furthermore, the sales tax can have a cascading effect on the economy. It can influence consumer behavior, impact business operations, and affect the overall economic growth of the state. As such, it is a critical component of Pennsylvania's tax structure and requires careful consideration and management.

Corporate Taxes: Attracting Businesses

Pennsylvania’s corporate tax structure plays a vital role in attracting and retaining businesses within the state. The corporate net income tax, which is imposed on the income of corporations, is set at 9.99% as of my last update. This rate is competitive compared to other states, making Pennsylvania an attractive destination for businesses looking to minimize their tax obligations.

The corporate tax rate can significantly impact a business's decision to operate in Pennsylvania. A lower corporate tax rate can reduce the financial burden on businesses, allowing them to allocate more resources towards growth, innovation, and job creation. It can also enhance the state's competitiveness in attracting new investments and fostering economic development.

However, it is essential to consider the trade-offs associated with a lower corporate tax rate. While it may attract businesses, it can also lead to reduced revenue for the state, impacting its ability to fund essential services and infrastructure projects. Finding the right balance between attracting businesses and generating sufficient revenue is a delicate task for state policymakers.

The Impact of State Taxes on Pennsylvania’s Economy

The state tax rate in Pennsylvania has a profound impact on the state’s economy, influencing the financial decisions of residents, businesses, and investors. It shapes the cost of living, impacts business operations, and affects the overall economic growth and development of the region.

For residents, the state tax rate directly affects their disposable income and purchasing power. A higher tax rate can reduce the amount of money available for personal spending, saving, and investing, potentially impacting their overall financial well-being. On the other hand, a lower tax rate can provide residents with more financial freedom and opportunities for growth.

Businesses, too, are influenced by the state tax rate. A competitive tax structure can attract new businesses and encourage existing ones to expand. It can reduce their financial burden, allowing them to invest in research and development, create jobs, and contribute to the overall economic vitality of the state. Conversely, a less favorable tax environment may drive businesses away, impacting employment opportunities and economic growth.

Investors also consider the state tax rate when making investment decisions. A low tax rate can make Pennsylvania an attractive destination for investment, leading to the growth of industries, the creation of jobs, and the overall improvement of the state's economy. Conversely, a high tax rate may deter investors, resulting in a potential slowdown in economic development.

Comparative Analysis: Pennsylvania’s Tax Landscape

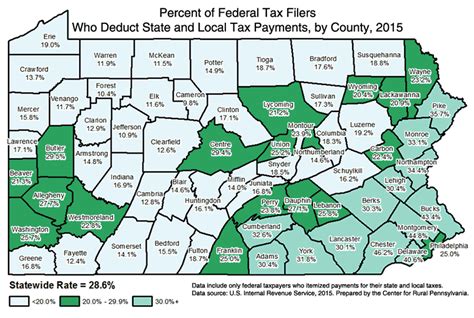

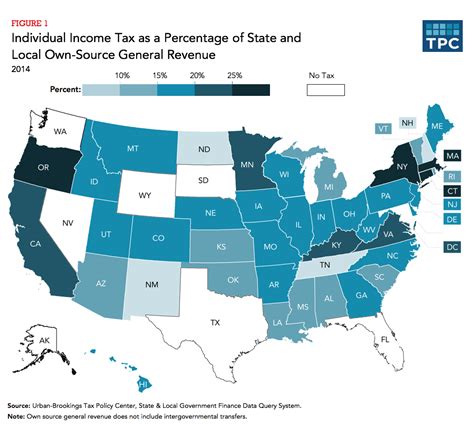

To gain a comprehensive understanding of Pennsylvania’s tax rate, it is essential to compare it with other states. While each state has its unique tax structure, comparing tax rates can provide valuable insights into the competitiveness and attractiveness of Pennsylvania’s tax environment.

As of my last update, Pennsylvania's state income tax rate of 3.07% is relatively low compared to some neighboring states. For instance, New York has a progressive income tax rate ranging from 4% to 8.82%, while New Jersey's income tax rate varies from 1.4% to 10.75%. This comparison highlights Pennsylvania's competitive advantage in terms of income tax rates, which can be a significant factor in attracting residents and businesses.

However, it is important to consider the overall tax burden when comparing states. While Pennsylvania's income tax rate may be lower, other taxes, such as property taxes or sales taxes, can vary significantly across states. A holistic analysis of the tax landscape is crucial to understanding the true impact of state taxes on residents and businesses.

The Future of State Taxes in Pennsylvania

The state tax rate in Pennsylvania is subject to change and evolution, influenced by various factors such as economic conditions, political decisions, and societal needs. As such, it is essential to consider the potential future implications and scenarios that may arise.

One potential scenario involves a shift towards a more progressive income tax structure. This could mean implementing different tax rates for different income brackets, ensuring that higher-income earners contribute a larger proportion of their income to the state's revenue. Such a move could generate additional revenue for the state, especially during economic downturns when lower-income earners may require more support.

Alternatively, there may be a push for tax reforms aimed at simplifying the tax system and reducing the overall tax burden. This could involve consolidating or eliminating certain taxes, such as the sales tax or personal property tax, to provide relief to taxpayers and enhance the state's competitiveness. These reforms could also attract businesses and investors, contributing to economic growth.

The future of state taxes in Pennsylvania is intertwined with the state's economic and social development. Policymakers will need to carefully navigate these complex issues, considering the needs of residents, businesses, and the overall well-being of the state. Finding the right balance between revenue generation and economic competitiveness will be crucial for Pennsylvania's long-term prosperity.

| Tax Category | Tax Rate |

|---|---|

| State Income Tax | 3.07% |

| Sales and Use Tax | 6% |

| Corporate Net Income Tax | 9.99% |

How does Pennsylvania’s flat-rate income tax system impact its revenue generation compared to progressive tax systems?

+Pennsylvania’s flat-rate income tax system provides a stable and predictable revenue stream, but it may not generate the same level of revenue as a progressive tax system during times of economic prosperity when higher-income earners contribute significantly. A progressive tax system can capture more revenue from high-income individuals, potentially increasing state funds.

What are the advantages and disadvantages of Pennsylvania’s sales and use tax for consumers and businesses?

+The sales and use tax directly impacts consumers by increasing the cost of goods and services. For businesses, it can impact pricing strategies and affect their competitive position in the market. However, it also provides a stable revenue source for the state, supporting essential services and infrastructure development.

How does Pennsylvania’s corporate tax rate compare to other states, and what impact does it have on business decisions?

+Pennsylvania’s corporate tax rate of 9.99% is relatively competitive compared to other states. A lower corporate tax rate can attract businesses by reducing their financial burden, allowing for more investment and job creation. Conversely, a higher rate may deter businesses, impacting economic growth and development.