How Is Overtime Taxed

Understanding how overtime pay is taxed is crucial for both employers and employees. Overtime work can significantly impact an individual's earnings and, consequently, their tax obligations. In this comprehensive guide, we will delve into the intricacies of overtime taxation, providing you with a clear understanding of how it works and what factors influence the taxation of overtime pay.

The Basics of Overtime Taxation

Overtime pay is subject to various tax regulations that can vary depending on the jurisdiction and the specific employment laws in place. In most cases, overtime earnings are treated similarly to regular earnings for tax purposes, but there are some key differences to consider.

Tax Withholding on Overtime Pay

When an employee works overtime, their employer is typically responsible for withholding taxes from the overtime pay. The tax withholding process for overtime pay follows a similar procedure to that of regular wages.

Employers use the employee’s Form W-4 to determine the appropriate tax withholding amount. This form provides information about the employee’s filing status, allowances, and any additional withholding instructions. The employer calculates the taxes due on the overtime pay using the employee’s regular pay rate and the number of hours worked in excess of the standard workweek.

It’s important to note that the tax withholding on overtime pay is often done at a higher rate than regular earnings due to the potential for a higher tax bracket. This is because overtime pay is often calculated at a higher rate than the regular hourly rate, resulting in a higher income for that pay period.

Overtime Pay and Tax Brackets

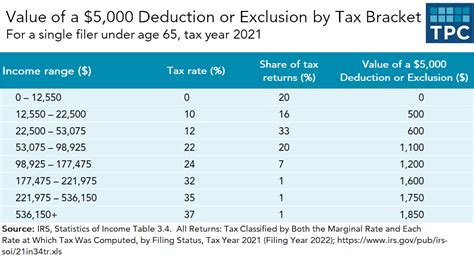

One of the critical aspects of overtime taxation is the impact on an employee’s tax bracket. Overtime pay can push an individual into a higher tax bracket, which means a higher tax rate will be applied to their earnings.

For instance, let’s consider an employee earning a regular hourly rate of 20 per hour. If they work 40 hours a week, their weekly income would be 800. However, if they work 10 hours of overtime at 30 per hour, their weekly income increases to 1,100. This additional $300 of income could potentially place them in a higher tax bracket, resulting in a higher tax liability.

Overtime Taxation Rules and Regulations

The taxation of overtime pay is governed by a set of rules and regulations that employers must adhere to. These rules ensure fair taxation and compliance with tax laws.

Federal Overtime Tax Rules

In the United States, the Internal Revenue Service (IRS) sets the guidelines for overtime tax withholding. According to the IRS, overtime pay is subject to the same federal income tax rules as regular earnings. This means that the Federal Insurance Contributions Act (FICA) taxes, which include Social Security and Medicare taxes, and federal income tax withholding, are applicable to overtime pay.

The FICA tax rate for 2023 is 7.65%, consisting of a 6.2% Social Security tax and a 1.45% Medicare tax. These taxes are applicable to all income, including overtime pay.

Additionally, the Federal Unemployment Tax Act (FUTA) tax may also apply to overtime earnings. FUTA tax is typically paid by the employer and is used to fund unemployment benefits. The FUTA tax rate is generally 6%, but employers can claim a credit of up to 5.4%, resulting in an effective rate of 0.6%.

State and Local Overtime Tax Rules

Overtime taxation can also vary at the state and local levels. Each state has its own tax laws and regulations, which may include additional taxes or variations in tax rates. For instance, some states have income taxes, while others do not. It’s crucial for employers and employees to be aware of the specific tax laws in their state regarding overtime pay.

Moreover, certain localities may have their own income tax regulations, further complicating the taxation of overtime earnings. Employers should consult with tax professionals or refer to the official tax guidelines in their respective jurisdictions to ensure compliance.

Overtime Pay Calculation and Taxation

The calculation of overtime pay and its subsequent taxation can be complex, especially when dealing with various pay rates and work schedules. Here’s a step-by-step guide to understanding how overtime pay is calculated and taxed.

Overtime Pay Calculation

Overtime pay is typically calculated using the time-and-a-half or double-time methods, depending on the applicable laws and the employee’s agreement with the employer.

- Time-and-a-half: For hours worked beyond the standard workweek, employees are paid at a rate of 1.5 times their regular hourly rate. For example, if an employee’s regular hourly rate is 20, their overtime pay rate would be 30 per hour.

- Double-time: In some cases, especially on holidays or certain designated days, employees may be entitled to double their regular rate for overtime work. So, if the regular rate is 20, the overtime pay rate would be 40 per hour.

Taxation of Overtime Pay

Once the overtime pay rate is determined, the employer calculates the taxes due on the overtime earnings. This involves the following steps:

- Calculate Overtime Earnings: Determine the total overtime hours worked and multiply them by the overtime pay rate. This gives you the gross overtime earnings.

- Calculate Total Earnings: Add the gross overtime earnings to the regular earnings for the pay period. This represents the employee’s total income for that period.

- Apply Tax Rates: Use the employee’s Form W-4 and tax bracket to determine the appropriate tax rates for the total earnings. This includes federal income tax, state income tax (if applicable), and FICA taxes.

- Calculate Tax Withholding: Subtract the total tax liability from the total earnings to determine the net pay for the pay period. The employer then withholds the appropriate amount of taxes from the employee’s pay.

Examples of Overtime Taxation Scenarios

Let’s explore some real-world examples to better understand how overtime taxation works in practice.

Example 1: Basic Overtime Taxation

Suppose an employee, Jane, has a regular hourly rate of 25 per hour and works a standard 40-hour workweek. In a given week, Jane works 10 hours of overtime at the time-and-a-half rate.</p> <table> <tr> <th>Regular Earnings</th> <td>25/hour Overtime Rate 37.50/hour (1.5 times regular rate)</td> </tr> <tr> <th>Overtime Hours</th> <td>10 hours</td> </tr> <tr> <th>Gross Overtime Earnings</th> <td>375 (10 hours x 37.50/hour)</td> </tr> <tr> <th>Total Earnings</th> <td>1,125 (40 hours x 25/hour + 375 overtime)

Assuming Jane’s total earnings for the year do not exceed the threshold for a higher tax bracket, her overtime earnings will be taxed at her regular tax rate. However, if her total earnings, including overtime, push her into a higher tax bracket, the overtime earnings will be taxed accordingly.

Example 2: Impact of Overtime on Tax Bracket

Consider a scenario where an employee, John, has a regular hourly rate of 30 per hour and a standard workweek of 40 hours. If John works 20 hours of overtime at the time-and-a-half rate, his earnings could potentially place him in a higher tax bracket.</p> <table> <tr> <th>Regular Earnings</th> <td>30/hour Overtime Rate 45/hour (1.5 times regular rate)</td> </tr> <tr> <th>Overtime Hours</th> <td>20 hours</td> </tr> <tr> <th>Gross Overtime Earnings</th> <td>900 (20 hours x 45/hour)</td> </tr> <tr> <th>Total Earnings</th> <td>2,700 (40 hours x 30/hour + 900 overtime)

In this case, John’s total earnings, including overtime, may exceed the threshold for a higher tax bracket. As a result, his overtime earnings will be taxed at a higher rate, increasing his overall tax liability.

Overtime Taxation and Tax Planning

Overtime taxation can have a significant impact on an individual’s tax obligations. Here are some tips for effective tax planning when dealing with overtime earnings.

Maximize Pre-Tax Contributions

Employees can consider maximizing their contributions to pre-tax retirement accounts, such as 401(k) plans or similar employer-sponsored retirement savings programs. By contributing a portion of their earnings, including overtime pay, to these accounts, employees can reduce their taxable income and potentially lower their tax liability.

Review Tax Withholding

Employees should regularly review their Form W-4 and adjust their withholding allowances to ensure that the correct amount of taxes is being withheld from their pay. This is especially important when overtime work is involved, as it can significantly impact tax obligations.

Employers should also encourage employees to review their tax withholding regularly and provide resources to help them make informed decisions about their withholding allowances.

Consider Tax-Efficient Investment Strategies

Employees with significant overtime earnings may want to explore tax-efficient investment strategies. This could include investing in tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which offer tax benefits and can help reduce the overall tax burden.

Future Implications and Conclusion

Overtime taxation is an essential aspect of employment and tax compliance. As labor laws and tax regulations continue to evolve, it’s crucial for employers and employees to stay informed about the latest developments. Understanding how overtime pay is taxed can help individuals make informed financial decisions and plan their finances effectively.

By staying updated on tax laws, employers can ensure fair and accurate tax withholding for overtime pay, while employees can optimize their tax strategies to minimize their tax obligations. With a comprehensive understanding of overtime taxation, individuals can make the most of their hard-earned overtime earnings.

How often should I review my tax withholding allowances?

+It’s recommended to review your tax withholding allowances annually or whenever there are significant changes in your financial situation, such as marriage, having a child, or a substantial increase in income.

Are there any tax benefits for overtime work?

+Overtime work itself does not provide specific tax benefits. However, by strategically planning your tax obligations and maximizing pre-tax contributions, you can reduce your overall tax liability.

Can I choose not to pay taxes on my overtime earnings?

+No, as an employee, you are legally obligated to pay taxes on all earnings, including overtime pay. Tax evasion carries severe penalties and legal consequences.