Is Life Insurance Money Taxed

When it comes to life insurance, one common question that arises is whether the proceeds from a life insurance policy are taxed. In this comprehensive guide, we will delve into the world of life insurance taxation, exploring the regulations, exceptions, and considerations surrounding this topic. By understanding the tax implications, individuals can make informed decisions about their life insurance policies and plan their financial future effectively.

The Taxation Landscape of Life Insurance

Life insurance policies are financial instruments designed to provide financial protection and security to beneficiaries upon the policyholder’s death. However, the tax treatment of these proceeds varies depending on several factors, including the type of policy, the purpose of the payout, and the jurisdiction in which the policyholder resides.

In general, life insurance proceeds are considered a form of income and are subject to taxation in many countries. The tax authorities view these proceeds as a taxable event, similar to other forms of income such as salaries or investments. However, the specific tax regulations can differ significantly from one country to another, and even within different states or provinces.

Understanding the Tax Treatment

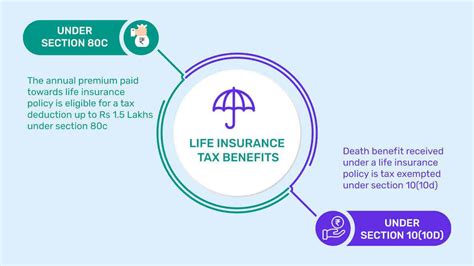

The taxation of life insurance proceeds is governed by a set of rules and regulations that vary by jurisdiction. These rules dictate whether the proceeds are taxable, the applicable tax rates, and any potential exemptions or deductions available. It is crucial for policyholders to understand these regulations to navigate the tax landscape effectively.

In some cases, life insurance proceeds may be partially or fully exempt from taxation. For instance, certain countries offer tax-free status to life insurance policies if the proceeds are used for specific purposes, such as covering funeral expenses or providing financial support to dependents. Additionally, some policies may have tax-exempt status if they are held within certain types of retirement accounts or if the proceeds are paid out in a lump sum.

| Country/Jurisdiction | Tax Treatment of Life Insurance Proceeds |

|---|---|

| United States | Generally taxable as income, with exceptions for certain life events or specific policy types. |

| Canada | Proceeds are typically tax-free for beneficiaries, but policyholders may face tax implications on policy gains. |

| United Kingdom | Most life insurance proceeds are tax-free, but certain policies may be subject to inheritance tax. |

| Australia | Tax treatment depends on the policy type and purpose. Some proceeds are tax-free, while others may be taxable. |

| Singapore | Life insurance proceeds are generally tax-free, but certain investment-linked policies may have tax implications. |

Key Considerations for Life Insurance Taxation

When exploring the tax implications of life insurance, there are several key considerations that policyholders should keep in mind:

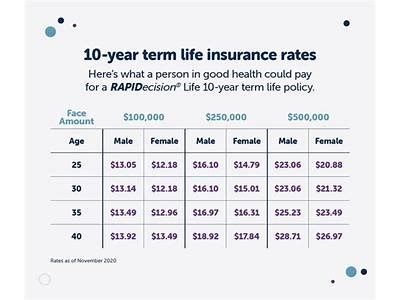

Policy Type and Purpose

The tax treatment of life insurance proceeds can vary based on the type of policy and its intended purpose. For instance, term life insurance policies, which provide coverage for a specified period, may have different tax implications compared to whole life or permanent insurance policies, which offer lifelong coverage and often have a savings or investment component.

Policies that are primarily for investment purposes, such as universal life insurance or variable life insurance, may be subject to different tax rules than traditional life insurance policies. Understanding the purpose and features of your policy is crucial in determining its tax status.

Beneficiary Designation

The tax treatment of life insurance proceeds can also be influenced by the beneficiary designation. In some cases, naming a specific individual or entity as the beneficiary may impact the tax status of the proceeds. For example, designating a charity as the beneficiary may result in different tax considerations compared to naming a family member.

Policy Cash Value

Some life insurance policies, such as whole life or permanent policies, accumulate cash value over time. This cash value can be accessed through policy loans or withdrawals. The tax treatment of these transactions can be complex and may depend on factors such as the policy’s surrender value, the length of time the policy has been in force, and the policyholder’s age.

Tax-Advantaged Accounts

Life insurance policies can be held within tax-advantaged accounts, such as retirement plans or tax-sheltered annuities. When life insurance proceeds are paid out from these accounts, the tax treatment can vary. For instance, proceeds from a life insurance policy held within a retirement account may be subject to ordinary income tax rates, while proceeds from a tax-sheltered annuity may have different tax implications.

Maximizing Tax Efficiency with Life Insurance

While life insurance proceeds may be taxable in many cases, there are strategies and considerations that policyholders can employ to maximize tax efficiency and minimize their tax burden. These strategies often involve careful planning and consultation with tax professionals.

Tax-Free Growth

Certain life insurance policies, particularly those with a savings or investment component, can offer tax-free growth on the cash value within the policy. This means that the earnings on the policy’s cash value are not subject to annual taxation, providing a tax-efficient way to grow funds over time.

Utilizing Policy Loans

Policyholders can borrow against the cash value of their life insurance policy without incurring immediate tax consequences. These policy loans can be a tax-efficient way to access funds for various purposes, such as funding education expenses or covering short-term financial needs. However, it is essential to understand the tax implications of policy loans and the potential impact on the policy’s death benefit.

Flexible Premium Payments

Some life insurance policies allow policyholders to make flexible premium payments, which can be adjusted based on financial circumstances. By optimizing premium payments, policyholders can potentially reduce their taxable income and take advantage of tax deductions or credits related to life insurance premiums.

Policy Ownership and Transfer

The ownership structure of a life insurance policy can impact its tax treatment. Policyholders should consider the tax implications of transferring policy ownership, such as to a trust or a business entity. This can have advantages in terms of estate planning and tax efficiency, especially when combined with proper legal and tax advice.

Future Implications and Industry Insights

The taxation landscape surrounding life insurance is subject to change and evolution, driven by legislative updates and shifts in economic conditions. As tax regulations are constantly reviewed and updated, policyholders must stay informed about any changes that may impact their life insurance policies.

Industry Trends and Innovations

The life insurance industry is continuously evolving, with new products and innovations being introduced to meet the changing needs of policyholders. These innovations can have tax implications, as new policies may offer different tax advantages or considerations compared to traditional life insurance products.

For instance, the rise of indexed universal life insurance policies, which offer a combination of fixed and variable rates, has introduced new tax considerations. These policies may have different tax treatment compared to traditional universal life insurance policies, and policyholders should be aware of these nuances when making decisions.

Estate Planning and Wealth Transfer

Life insurance plays a crucial role in estate planning and wealth transfer strategies. Policyholders can use life insurance policies to minimize estate taxes, provide liquidity for beneficiaries, and ensure the smooth transfer of assets. Understanding the tax implications of different estate planning strategies is essential to maximize the benefits of life insurance in this context.

Impact of Economic Conditions

Economic conditions, such as changes in interest rates or market fluctuations, can influence the tax treatment of life insurance policies. For instance, low-interest-rate environments may impact the tax efficiency of certain policy types, while market volatility can affect the tax implications of policy loans or withdrawals.

Government Initiatives and Tax Reforms

Governments often introduce tax reforms and initiatives that can impact the taxation of life insurance. These reforms may aim to simplify tax regulations, address specific concerns, or promote certain financial products. Policyholders should stay informed about these initiatives and their potential impact on life insurance taxation.

Conclusion

Understanding the tax implications of life insurance is a critical aspect of financial planning. By exploring the regulations, exceptions, and considerations surrounding life insurance taxation, policyholders can make informed decisions to maximize the benefits of their policies while minimizing their tax burden.

Whether it's navigating the complex world of policy types, beneficiary designations, or tax-advantaged strategies, consulting with qualified professionals is essential. With the right guidance and understanding, individuals can ensure that their life insurance policies provide the desired financial protection and security while aligning with their tax planning goals.

Are life insurance proceeds always taxable?

+No, life insurance proceeds are not always taxable. The tax treatment varies depending on factors such as policy type, jurisdiction, and purpose. Some life insurance policies may have tax-free status, especially if the proceeds are used for specific purposes or held within certain accounts.

Can I reduce my tax burden on life insurance proceeds?

+Yes, there are strategies to minimize the tax burden on life insurance proceeds. These include utilizing tax-advantaged accounts, understanding policy loans and withdrawals, and optimizing premium payments. Consulting with a tax professional can help you explore these options.

What is the impact of beneficiary designation on tax treatment?

+The beneficiary designation can influence the tax treatment of life insurance proceeds. Different beneficiaries, such as family members or charities, may have varying tax implications. It’s important to consider the tax status of the beneficiary when planning your life insurance policy.

Are there any tax advantages to holding life insurance within a retirement account?

+Holding life insurance within a retirement account, such as an IRA or 401(k), can provide tax advantages. The tax treatment of proceeds depends on the type of retirement account and the specific rules governing it. Consulting with a financial advisor can help you understand these advantages.

How do economic conditions impact the taxation of life insurance policies?

+Economic conditions, such as interest rates and market fluctuations, can influence the tax treatment of life insurance policies. Low-interest-rate environments may impact the tax efficiency of certain policy types, while market volatility can affect policy loans and withdrawals. Staying informed about economic trends is essential for tax planning.