What Is The Sales Tax In Washington

Welcome to our comprehensive guide exploring the sales tax landscape in Washington, a state renowned for its diverse economy and unique tax structure. In this article, we will delve into the intricacies of sales tax regulations in Washington, providing an in-depth analysis of the rates, applicability, and implications for businesses and consumers alike. As we navigate through the complex world of taxation, we aim to offer valuable insights and practical information to ensure a clear understanding of this critical aspect of commerce in the Evergreen State.

Understanding Washington’s Sales Tax: An Overview

Sales tax in Washington is a consumption tax levied on the sale of tangible personal property and certain services. It is a crucial revenue source for the state, funding various public services and infrastructure projects. Washington’s sales tax system is characterized by its multi-level tax structure, with rates varying based on the type of transaction and the location where the sale occurs.

The Washington State Department of Revenue is responsible for administering and enforcing sales tax regulations. Their role encompasses collecting, distributing, and managing the tax revenue, as well as providing guidance and resources to help businesses comply with the complex tax laws.

For businesses operating in Washington, understanding and adhering to sales tax obligations is vital. Accurate tax collection and remittance not only ensure compliance with the law but also contribute to the state's economic stability and development. Let's explore the key aspects of Washington's sales tax to provide a comprehensive understanding of this essential tax component.

Sales Tax Rates: A Comprehensive Breakdown

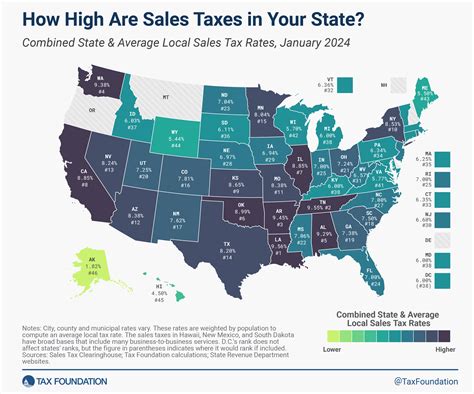

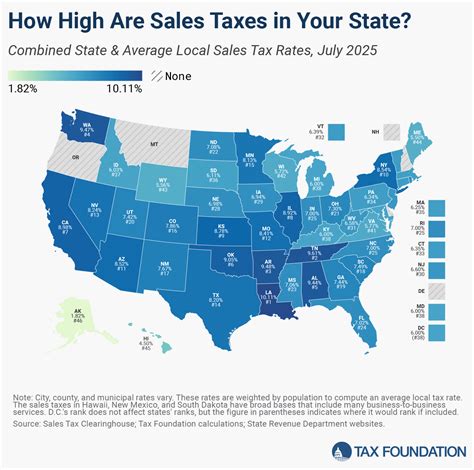

Washington’s sales tax rates are determined by a combination of state, county, and municipal taxes, resulting in a unique tax structure across the state. The state sales tax rate is a uniform 6.5%, applicable to most retail transactions. However, the total sales tax rate can vary significantly depending on the specific location of the sale.

To illustrate the variation in sales tax rates, let's consider the following table showcasing the combined sales tax rates for some of Washington's major cities:

| City | Combined Sales Tax Rate |

|---|---|

| Seattle | 10.1% |

| Tacoma | 9.8% |

| Spokane | 8.9% |

| Everett | 9.6% |

| Vancouver | 8.8% |

As evident from the table, the total sales tax rate can vary significantly, even within the same state. This is due to the additional local and municipal taxes that are often added to the state sales tax rate. These local taxes are implemented to fund specific projects or initiatives within the respective jurisdictions.

It is essential for businesses operating in Washington to be aware of the specific sales tax rates applicable to their locations. This knowledge ensures accurate tax collection and helps maintain a competitive edge in the market. For consumers, understanding the sales tax rates provides transparency and aids in budgeting and financial planning.

Sales Tax Exemptions: Unraveling the Complexities

While sales tax is applicable to a wide range of transactions, Washington does provide certain exemptions to promote economic growth and support specific industries. Understanding these exemptions is crucial for both businesses and consumers to ensure compliance and take advantage of potential tax savings.

Food and Grocery Exemptions

One notable exemption in Washington’s sales tax structure is the exemption on food and groceries. This exemption applies to the sale of unprepared food items, including produce, meat, dairy products, and non-alcoholic beverages. However, it’s important to note that this exemption does not extend to restaurant meals, prepared foods, or certain luxury food items.

For example, if you purchase a loaf of bread, a gallon of milk, and some fresh fruits from a grocery store, you will not be charged sales tax on these items. However, if you order a pizza from a restaurant or buy a pre-made sandwich from a deli, the sales tax will apply.

Manufacturing and Resale Exemptions

Washington also offers exemptions for manufacturing and resale transactions. Businesses engaged in manufacturing processes are exempt from sales tax on certain raw materials and equipment used in the production process. Similarly, businesses involved in the resale of goods are exempt from sales tax on their purchases, as long as they provide the necessary resale certificates.

These exemptions aim to encourage economic activity and support the growth of manufacturing and retail sectors in the state. By reducing the tax burden on these businesses, Washington promotes job creation and enhances its competitive position in the global market.

Other Exemptions

In addition to the exemptions mentioned above, Washington provides various other exemptions for specific goods and services. These include exemptions for:

- Prescription medications

- Agricultural equipment and supplies

- Certain types of machinery and equipment

- Books, magazines, and newspapers

- Certain medical devices and services

It is crucial for businesses and consumers to stay informed about these exemptions to ensure they are not overpaying sales tax. The Washington State Department of Revenue provides detailed guidelines and resources to help navigate these exemptions and ensure compliance with the law.

Sales Tax Compliance: Strategies and Best Practices

Adhering to sales tax regulations is a critical aspect of doing business in Washington. Non-compliance can result in significant penalties, legal consequences, and damage to a business’s reputation. To ensure sales tax compliance, businesses should consider the following strategies and best practices:

Register for a Business License and Sales Tax Permit

All businesses operating in Washington, whether online or brick-and-mortar, must obtain a business license and a sales tax permit. These licenses and permits are essential for legal operation and tax compliance. The Washington State Department of Revenue provides a streamlined online process for obtaining these documents, making it convenient for businesses to get started.

Implement Robust Sales Tax Software

Utilizing sales tax software can significantly streamline the tax compliance process. These tools automate sales tax calculations, ensuring accuracy and reducing the risk of errors. Additionally, sales tax software can help businesses stay updated with the latest tax rates and regulations, providing peace of mind and saving valuable time and resources.

Train Staff on Sales Tax Regulations

It is crucial to ensure that all staff members involved in sales and customer interactions are well-versed in sales tax regulations. Providing comprehensive training on tax rates, exemptions, and collection procedures ensures a consistent and accurate approach to sales tax compliance across the organization.

Stay Informed About Tax Rate Changes

Sales tax rates can change periodically, and it is essential for businesses to stay updated with these changes. Regularly monitoring the Washington State Department of Revenue’s website and subscribing to their newsletters can provide valuable insights into any upcoming rate changes or new regulations that may impact tax obligations.

Keep Detailed Records

Maintaining detailed records of all sales transactions is vital for sales tax compliance. These records should include the date, location, and nature of the transaction, as well as the applicable tax rate and any exemptions applied. Having accurate and organized records simplifies the tax filing process and helps in the event of an audit.

The Future of Sales Tax in Washington: Trends and Predictions

As we look ahead, it is essential to consider the future landscape of sales tax in Washington. Several trends and potential developments could shape the tax system and impact businesses and consumers alike.

Increasing Online Sales Tax Collection

With the rise of e-commerce, Washington, like many other states, is focusing on improving online sales tax collection. The state has implemented measures to ensure that out-of-state retailers with significant in-state sales collect and remit sales tax. This trend is expected to continue, with potential changes in regulations to enhance online tax compliance.

Expansion of Sales Tax Base

Washington may explore expanding its sales tax base to include additional goods and services. This could involve reevaluating existing exemptions or introducing new taxes on certain products or activities. Such changes aim to generate additional revenue for the state while ensuring a fair and equitable tax system.

Potential Sales Tax Rate Changes

While the state sales tax rate has remained relatively stable, there is always the possibility of rate changes. Economic conditions, budgetary requirements, and political factors can influence tax rate adjustments. Businesses and consumers should stay vigilant and monitor any proposed changes to ensure they are prepared for potential impacts.

Advancements in Tax Technology

The continuous development of tax technology is expected to play a significant role in Washington’s sales tax landscape. Improved tax software, automated systems, and data analytics will enhance tax compliance and efficiency. These advancements will not only benefit businesses but also contribute to the overall effectiveness of the state’s tax collection system.

Conclusion: Navigating Washington’s Sales Tax Landscape

Washington’s sales tax system, with its varying rates and exemptions, presents a unique challenge for businesses and consumers alike. By understanding the intricacies of sales tax regulations, businesses can ensure compliance and take advantage of potential tax savings. Consumers, on the other hand, can make informed purchasing decisions and plan their finances effectively.

As we've explored in this comprehensive guide, Washington's sales tax landscape is dynamic and ever-evolving. By staying informed, utilizing technology, and implementing best practices, businesses can navigate this complex tax system with confidence. The information provided here serves as a valuable resource, offering a deep understanding of Washington's sales tax regulations and their implications.

For further insights and updates on sales tax regulations, we encourage you to visit the official website of the Washington State Department of Revenue. Their comprehensive resources and guidance will ensure you stay up-to-date with the latest developments and maintain compliance with Washington's tax laws.

How often do sales tax rates change in Washington?

+Sales tax rates in Washington can change periodically, usually as a result of legislative actions or local ballot measures. It is important to stay updated with any changes, as they can impact your business’s tax obligations.

Are there any upcoming changes to Washington’s sales tax regulations?

+While we cannot predict future changes, it is always advisable to monitor the Washington State Department of Revenue’s website for any updates or proposed amendments to the sales tax regulations. Staying informed ensures you are prepared for any potential changes.

What happens if I fail to collect and remit sales tax in Washington?

+Failure to collect and remit sales tax can result in significant penalties, interest charges, and potential legal consequences. It is crucial to understand your sales tax obligations and ensure compliance to avoid these penalties.

Are there any resources available to help me understand and comply with Washington’s sales tax regulations?

+Absolutely! The Washington State Department of Revenue provides a wealth of resources, including guides, webinars, and support materials. These resources are designed to help businesses understand their sales tax obligations and comply with the regulations effectively.