Tennessee State Sales Tax Rate

The Tennessee State Sales Tax is a crucial aspect of the state's revenue generation and economic policy, impacting both residents and businesses. Understanding the intricacies of this tax is essential for anyone living, working, or doing business in Tennessee.

Unraveling the Tennessee State Sales Tax Rate

Tennessee, known as the Volunteer State, boasts a vibrant economy and a diverse tax landscape. The state’s sales tax structure is a key component of its fiscal strategy, influencing consumer behavior and business operations.

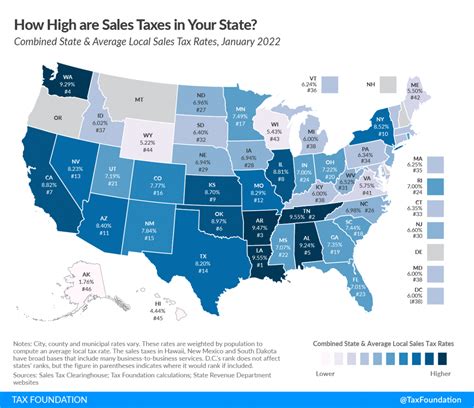

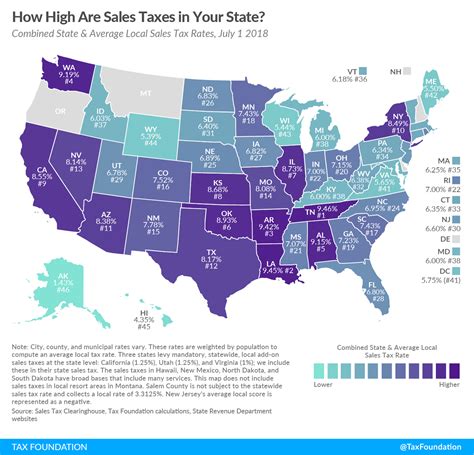

As of [insert date], the statewide sales tax rate in Tennessee stands at 7%. This base rate is applied uniformly across the state, making it a consistent factor for businesses and consumers alike. However, the story doesn't end there, as Tennessee also allows for local sales tax additions, which can significantly impact the total sales tax rate depending on the specific location.

The Complexity of Local Sales Taxes

While the statewide sales tax rate provides a uniform foundation, the introduction of local sales taxes adds a layer of complexity. These local taxes, imposed by counties and municipalities, can vary significantly, resulting in a wide range of effective sales tax rates across the state.

| County/Municipality | Local Sales Tax Rate |

|---|---|

| Davidson County (Nashville) | 2.275% |

| Shelby County (Memphis) | 2.5% |

| Knox County (Knoxville) | 2.75% |

| Hamilton County (Chattanooga) | 2.25% |

| Rutherford County (Murfreesboro) | 2.25% |

As illustrated in the table above, the local sales tax rates can vary significantly, even among major cities. This means that the total sales tax rate a consumer or business encounters can range from 9.275% in Nashville to 9.75% in Knoxville, a notable difference.

Understanding the Impact on Businesses and Consumers

For businesses, especially those with a physical presence in multiple counties, the varying sales tax rates can pose logistical and financial challenges. They must ensure compliance with different tax rates, which can be complex and time-consuming. Additionally, businesses may need to adjust their pricing strategies to account for these variations, especially if they operate in areas with higher local sales taxes.

Consumers, on the other hand, may find themselves paying different sales taxes depending on where they shop. This can influence their purchasing decisions, potentially driving them to seek out lower-taxed areas for certain purchases. Understanding these variations is crucial for both savvy consumers and businesses aiming to attract and retain customers.

The Future of Tennessee’s Sales Tax Landscape

As Tennessee’s economy continues to evolve, the state’s sales tax structure is likely to remain a dynamic and influential factor. The interplay between the statewide and local sales tax rates will continue to shape the state’s fiscal policy and economic landscape.

While the statewide rate provides a stable foundation, the flexibility of local governments to impose additional taxes allows for a certain degree of fiscal autonomy. This, in turn, can lead to unique economic strategies and incentives at the local level, further diversifying Tennessee's business environment.

In conclusion, the Tennessee State Sales Tax Rate is a complex yet critical component of the state's economic ecosystem. Its uniform statewide rate and variable local additions create a dynamic and challenging environment for businesses and consumers alike. As Tennessee's economy grows and adapts, so too will its sales tax landscape, continuing to shape the state's fiscal and economic future.

How does Tennessee’s sales tax rate compare to other states?

+Tennessee’s statewide sales tax rate of 7% is relatively average compared to other states. However, when combined with local sales taxes, the effective rate can exceed the rates of many other states, making Tennessee’s overall sales tax burden higher.

Are there any products or services exempt from sales tax in Tennessee?

+Yes, Tennessee has a list of exemptions that include items like prescription drugs, certain medical devices, and some agricultural products. It’s important to consult the state’s tax guidelines for a comprehensive list of exempt items.

How often are sales tax rates reviewed and updated in Tennessee?

+The statewide sales tax rate is set by the Tennessee General Assembly and is not subject to frequent changes. Local sales tax rates, however, can be adjusted by local governments, typically through public hearings and legislative processes.