Nebraska State Sales Tax

Nebraska's state sales tax is an essential component of the state's revenue system, impacting both residents and businesses. This tax, a percentage added to the price of goods and services, is a key source of income for state and local governments, funding vital public services and infrastructure. Understanding the intricacies of Nebraska's sales tax is crucial for individuals and businesses operating within the state, as it directly influences their financial obligations and planning.

The Nebraska State Sales Tax: An In-Depth Exploration

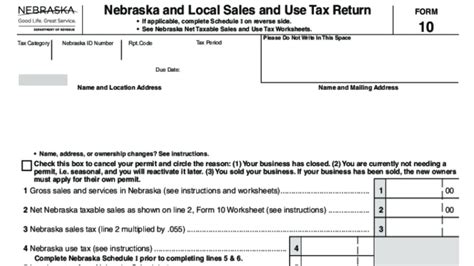

The state of Nebraska imposes a 5.5% sales and use tax on the purchase of tangible personal property and certain services. This tax, effective from January 1, 2023, represents a 0.25% increase from the previous rate. The additional revenue generated by this increase is earmarked for specific projects, including road repairs and improvements to the state’s transportation infrastructure.

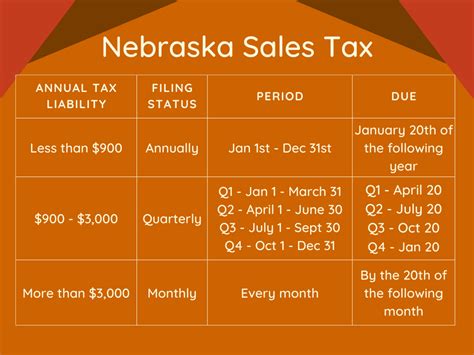

Nebraska's sales tax is administered by the Nebraska Department of Revenue, which provides detailed guidelines and resources for taxpayers. The tax applies to a broad range of transactions, including retail sales, leases, rentals, and certain services. However, it's important to note that Nebraska also allows local jurisdictions to levy their own sales taxes, creating a unique tax landscape across the state.

Local Sales Tax Variations

Nebraska’s local sales taxes vary significantly, with rates ranging from 0% to 2.5% in different counties and municipalities. For instance, the city of Lincoln imposes an additional 1.5% sales tax, bringing the total sales tax rate to 7% within city limits. On the other hand, counties like Arthur, Banner, Blaine, and others have no additional local sales tax, maintaining the state’s base rate.

| County | Additional Local Sales Tax Rate |

|---|---|

| Arthur | 0% |

| Banner | 0% |

| Lincoln | 1.5% |

| Cheyenne | 2.5% |

| ... (and more) | ... |

These local variations in sales tax rates can have a significant impact on businesses operating in multiple locations or consumers shopping across county lines. It's crucial for businesses to stay informed about these local tax rates to ensure compliance and for consumers to understand the total tax they may incur on their purchases.

Sales Tax Exemptions and Special Considerations

Nebraska provides certain exemptions from sales tax to promote specific economic or social objectives. For instance, the state exempts sales of agricultural equipment, most food items, and prescription drugs from sales tax. These exemptions are designed to support local agriculture, encourage healthy eating, and reduce the financial burden on those with medical needs.

Additionally, Nebraska offers a sales tax holiday each year, typically in August. During this period, certain items, such as school supplies, clothing, and shoes, are exempt from sales tax, providing a significant savings opportunity for families preparing for the new school year.

However, it's important to note that these exemptions and special considerations can be complex and subject to change. Businesses and individuals should refer to the Nebraska Sales Tax Guide published by the Department of Revenue for the most up-to-date information.

Compliance and Enforcement: Ensuring Fair Taxation

The Nebraska Department of Revenue employs a range of strategies to ensure compliance with sales tax laws. This includes regular audits of businesses, particularly those in high-risk industries or with large sales volumes. The department also leverages technology to identify potential tax evasion, such as through data analytics and electronic filing systems.

For businesses, the department provides resources and guidance to ensure proper tax collection and reporting. This includes detailed instructions on tax registration, filing requirements, and tax rate determination. The Department of Revenue also offers a Taxpayer Assistance Division to provide personalized support and answer specific questions about sales tax obligations.

Penalties and Appeals

Non-compliance with Nebraska’s sales tax laws can result in significant penalties. These may include fines, interest on late payments, and even criminal charges for deliberate tax evasion. The severity of the penalty often depends on the nature and extent of the violation.

Businesses and individuals who receive a sales tax assessment or penalty notice have the right to appeal. The appeals process is outlined in the Nebraska Sales and Use Tax Act, and the Department of Revenue provides guidance on how to navigate this process. It's important to note that timely action is crucial, as appeals must be filed within a specific timeframe.

Future Trends and Potential Changes

As with any tax system, Nebraska’s sales tax is subject to ongoing review and potential changes. The recent increase in the state sales tax rate, for instance, demonstrates the dynamic nature of this revenue source. Future changes could include further rate adjustments, the introduction of new tax categories, or the removal of existing exemptions.

The trend towards online sales and the growth of e-commerce present unique challenges and opportunities for sales tax administration. Nebraska, like many other states, is navigating these changes, considering how best to tax remote sellers and online transactions while ensuring fairness and compliance.

Additionally, the state is exploring the potential of sales tax incentives to encourage economic development and investment in specific industries or regions. These incentives could take the form of tax holidays, tax credits, or reduced tax rates for certain businesses or transactions.

What is the current Nebraska state sales tax rate?

+

The current Nebraska state sales tax rate is 5.5% as of January 1, 2023.

Are there any local sales taxes in Nebraska?

+

Yes, many counties and municipalities in Nebraska levy additional local sales taxes, which can range from 0% to 2.5%.

What items are exempt from Nebraska sales tax?

+

Exemptions include agricultural equipment, most food items, prescription drugs, and certain other goods and services.

How often are sales tax rates reviewed and adjusted in Nebraska?

+

Sales tax rates are subject to legislative review and can be adjusted at any time, although significant changes typically occur less frequently.

What is the role of the Nebraska Department of Revenue in sales tax administration?

+

The Nebraska Department of Revenue is responsible for enforcing sales tax laws, providing guidance to taxpayers, conducting audits, and ensuring compliance with sales tax regulations.