What Is Sales Tax New York

Sales tax in New York is a critical aspect of the state's tax system, impacting both residents and businesses. With a unique structure and varying rates, understanding sales tax in New York is essential for anyone navigating the state's economy. This comprehensive guide aims to provide an in-depth analysis of New York's sales tax, covering its history, current rates, exemptions, and the impact it has on the state's revenue and economic landscape.

A Historical Overview of Sales Tax in New York

The journey of sales tax in New York began in the mid-20th century, specifically in 1965, when the state first introduced the sales and use tax system. This marked a significant shift in New York’s revenue generation strategy, providing a more stable and predictable source of income compared to income taxes, which can fluctuate with economic cycles.

Over the decades, New York's sales tax has undergone several revisions and amendments, each tailored to the state's economic needs and societal changes. These adjustments have not only impacted the rates but have also expanded the scope of taxable items and services, ensuring the tax remains relevant and capable of supporting the state's growing infrastructure and social welfare programs.

A notable example of such an amendment was the Tax Reform and Fairness Act of 2009, which aimed to simplify the tax system and make it more equitable. This act streamlined various tax rates and exemptions, bringing clarity and consistency to the sales tax structure.

Understanding the Sales Tax Rates in New York

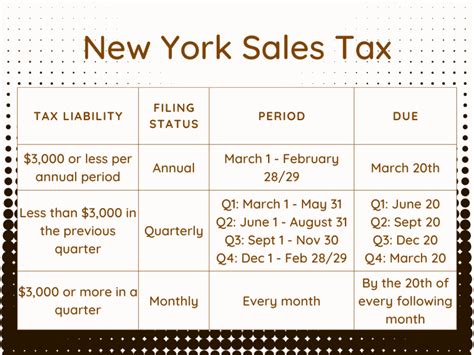

New York operates with a complex yet structured sales tax system, employing both state and local sales taxes. The state sales tax rate is currently set at 4%, a rate that has remained consistent for over a decade, providing a stable revenue stream for the state.

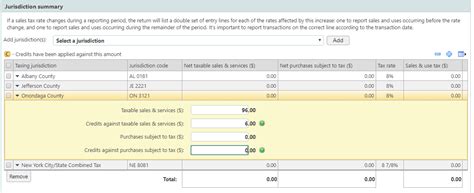

However, the story doesn't end there. New York is also known for its local sales taxes, with each of the 62 counties in the state having the authority to impose additional sales taxes. These local rates can vary significantly, with some counties charging as low as 0% and others up to 4.75%, making the total sales tax rate a dynamic figure across the state.

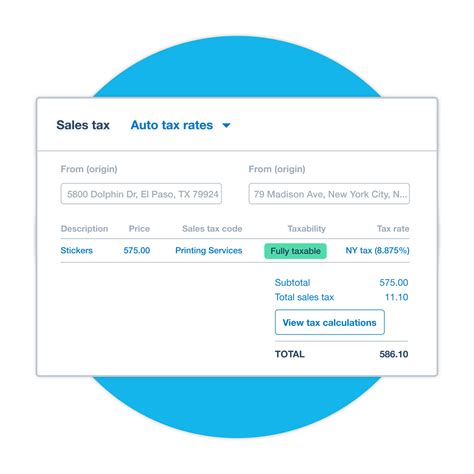

For instance, in New York City, the combined sales tax rate is 8.875%, comprising the state's 4%, a local rate of 4.5%, and a 0.375% Metropolitan Commuter Transportation District (MCTD) tax. This makes New York City one of the highest sales tax areas in the state.

In contrast, certain areas like the Catskill Resort Area have a special sales tax rate of 3%, offering a reduced tax burden to promote tourism and economic activity in these regions.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| New York City | 4.5% | 8.875% |

| Albany County | 3.75% | 7.75% |

| Nassau County | 4.0% | 8.0% |

| Erie County | 3.0% | 7.0% |

| Rockland County | 3.0% | 7.0% |

Exemptions and Special Considerations in New York Sales Tax

New York’s sales tax, like many other states, is not a universal tax. It exempts certain goods and services, ensuring that essential items remain accessible to all income levels. Here are some key exemptions and special considerations:

- Groceries and Food Products: Most food items intended for consumption at home are exempt from sales tax. This includes non-prepared food products from grocery stores and farmers' markets.

- Prescription Medications: Sales tax does not apply to prescription drugs and certain medical devices.

- Clothing and Footwear: New York exempts clothing and footwear items under $110 from sales tax, providing a significant benefit to families and individuals on a budget.

- Educational and Cultural Services: Admission fees to museums, theaters, and similar cultural institutions are exempt, encouraging access to these enriching experiences.

- Residential Utilities: Sales tax does not apply to the supply of electricity, gas, and other essential residential utilities.

The Impact of Sales Tax on New York’s Economy

Sales tax is a significant contributor to New York’s overall revenue, funding various public services and infrastructure projects. In the 2022-2023 fiscal year, sales tax generated an estimated $22.7 billion in revenue, accounting for approximately 21.5% of the state’s total tax collections.

This revenue stream supports critical public services, including education, healthcare, transportation, and public safety. It also plays a pivotal role in funding social welfare programs, ensuring the state's commitment to its most vulnerable residents.

Furthermore, sales tax has an indirect economic impact by influencing consumer behavior and business operations. Businesses must navigate the complex sales tax system, ensuring compliance and efficient tax management. For consumers, the tax rate can influence purchasing decisions and overall spending habits, impacting the state's retail and service industries.

Navigating the Future: Potential Changes and Challenges

As New York’s economy continues to evolve, the sales tax system is likely to face new challenges and opportunities. Here are some potential developments on the horizon:

- E-commerce and Online Sales: With the rise of online shopping, ensuring fair and effective taxation of e-commerce sales will be crucial. New York is already exploring ways to tax online sales, ensuring that brick-and-mortar stores are not at a disadvantage.

- Tax Reform and Simplification: There are ongoing discussions about simplifying the sales tax structure, potentially harmonizing local rates to create a more uniform tax environment.

- Revenue Needs and Budgetary Considerations: As the state's needs evolve, the sales tax may need to adapt to meet these demands, whether through rate adjustments or expanded tax bases.

- Tax Evasion and Compliance: With a complex tax system, ensuring compliance and addressing tax evasion will remain a key challenge. New technologies and data analytics may play a role in enhancing tax enforcement.

Frequently Asked Questions

How often are sales tax rates updated in New York?

+Sales tax rates are typically updated annually or semi-annually to account for inflation and changing economic conditions. These updates are announced by the New York State Department of Taxation and Finance.

Are there any plans to simplify the sales tax structure in New York?

+Yes, there have been discussions about simplifying the sales tax structure, particularly harmonizing local rates. This could lead to a more uniform tax system, making it easier for businesses and consumers to understand and comply with sales tax regulations.

How does New York handle sales tax for online purchases?

+New York has implemented laws requiring online retailers to collect and remit sales tax for purchases made by New York residents. This ensures that online retailers contribute to the state’s revenue stream, just like brick-and-mortar stores.

Stay informed and keep up with the latest developments in New York’s sales tax landscape to ensure compliance and take advantage of any potential benefits. Understanding the nuances of sales tax is key to navigating the state’s economy successfully.