Dupage Property Taxes

In the heart of Illinois, DuPage County stands out not just for its vibrant communities and diverse offerings but also for its unique approach to property taxation. Understanding the ins and outs of DuPage property taxes is crucial for both residents and prospective homeowners alike. This article aims to demystify the process, providing a comprehensive guide to navigating the assessment and payment of property taxes in this county.

Unraveling the Complexities of DuPage Property Taxes

DuPage County’s property tax system is a nuanced one, influenced by various factors including the property’s location, size, and usage. It’s a vital component of the county’s financial ecosystem, contributing significantly to the maintenance and development of local infrastructure, schools, and public services.

For property owners, comprehending the assessment process is key to ensuring fairness and accuracy. This process typically involves evaluating the property's value based on market conditions, recent sales of similar properties, and other relevant factors. It's a critical step that determines the tax liability for the ensuing year.

The Assessment Process in Detail

The DuPage County Assessor’s office is responsible for the annual assessment of all properties within the county. This assessment cycle begins with a physical inspection of the property, followed by a detailed analysis of its features and characteristics. The assessor takes into account factors such as the property’s age, condition, and any recent improvements or additions.

Once the initial assessment is complete, property owners receive a notice of assessment, detailing the estimated value of their property and the associated taxes. This notice serves as a crucial document, providing transparency and allowing for potential appeals should the owner believe the assessment is inaccurate.

To facilitate the appeal process, the Assessor's office provides a comprehensive guide, outlining the necessary steps and timelines. This ensures that property owners have a clear understanding of their rights and the procedures involved in challenging an assessment.

| Assessment Category | Key Metrics |

|---|---|

| Residential Properties | Assessed at 33.33% of fair market value |

| Commercial Properties | Evaluated based on income and expense factors |

| Agricultural Lands | Assessed using a combination of productivity and soil quality |

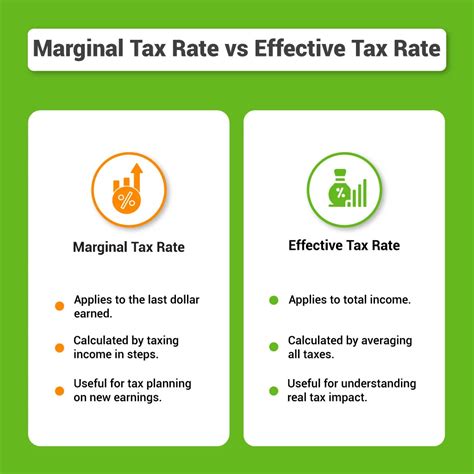

Understanding Tax Rates and Levies

The tax rate in DuPage County is determined by a combination of factors, including the county’s overall tax levy and the specific tax rates set by various taxing bodies within the county. These taxing bodies can include municipalities, school districts, and special taxing districts.

Each year, these entities determine their budgetary needs and set tax rates accordingly. The resulting tax levy is then divided among all taxable properties within the county, with the rate applied based on the assessed value of each property. This means that the actual tax amount varies depending on the property's value and the specific tax rates in the area.

For instance, consider a residential property with an assessed value of $200,000. If the tax rate is 6%, the annual property tax would amount to $12,000. However, this is just a simplified example, and in reality, the tax rate can vary significantly across different areas of the county, influenced by the specific taxing bodies and their budgetary requirements.

| Taxing Body | Tax Rate (per $100 of Assessed Value) |

|---|---|

| DuPage County | 1.8 |

| Local School District | 4.2 |

| Municipality | 1.5 |

| Special District (e.g., Park District) | 0.5 |

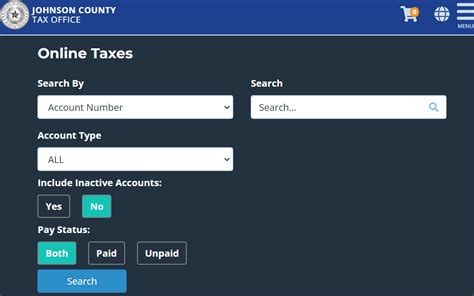

Payment Options and Due Dates

DuPage County offers several convenient methods for property tax payment. Property owners can choose to pay online through the county’s official website, by mail, or in person at the Treasurer’s office. The payment due dates are typically set for two installments, with the first due in March and the second in September.

It's important for property owners to note that failure to pay property taxes on time can result in penalties and interest. The county provides a grace period of several weeks after the due date, but beyond that, late fees and additional charges may apply. To avoid these penalties, it's advisable to stay informed about the payment due dates and take advantage of the various payment options offered by the county.

Conclusion: Navigating DuPage Property Taxes with Confidence

Understanding the intricacies of DuPage property taxes is essential for both current and prospective property owners. By familiarizing themselves with the assessment process, tax rates, and payment options, they can ensure they’re prepared for their financial obligations and can contribute effectively to the county’s growth and development.

For more detailed information and resources, the DuPage County website offers a wealth of knowledge, including interactive tax maps, tax rate databases, and contact information for relevant departments. Additionally, the Assessor's office and Treasurer's office are available to provide further assistance and guidance.

How often are properties assessed for tax purposes in DuPage County?

+Properties in DuPage County are assessed every four years. However, if significant changes or improvements are made to a property, the Assessor’s office may conduct an assessment outside of this regular cycle.

What happens if I disagree with my property assessment?

+If you believe your property assessment is inaccurate, you have the right to file an appeal. The DuPage County Assessor’s office provides detailed instructions and timelines for the appeal process. It’s important to act promptly as there are specific deadlines for filing an appeal.

Are there any tax exemptions or discounts available for certain property owners in DuPage County?

+Yes, DuPage County offers various tax exemptions and discounts to eligible property owners. These can include senior citizen exemptions, homeowner exemptions, and exemptions for disabled veterans. It’s worth exploring these options to potentially reduce your tax liability.

Can I pay my property taxes in installments, and if so, what are the terms?

+Yes, DuPage County allows property owners to pay their taxes in two installments. The first installment is typically due in March, and the second in September. Failure to pay by the due date may result in additional charges and penalties.