How To Amend A Tax Return

Filing taxes is a complex process, and mistakes or changes are not uncommon. If you find yourself in a situation where you need to amend a tax return, whether due to an error or new information, it's essential to understand the proper procedures and implications. In this comprehensive guide, we'll delve into the world of tax return amendments, providing you with expert insights and step-by-step instructions to navigate this process smoothly.

Understanding the Need for Amendments

Amending a tax return involves making changes to previously filed tax documents. This could be due to various reasons, such as:

- Discovering mathematical errors or incorrect calculations.

- Realizing you forgot to include certain income or deductions.

- Receiving updated tax forms or documents after filing.

- Experiencing a life event that affects your tax liability (e.g., marriage, divorce, or the birth of a child).

- Correcting mistakes made by tax preparers or software.

It's crucial to address these issues promptly to ensure your tax obligations are met accurately. In some cases, amendments may even result in a refund or reduced tax liability.

The Amendment Process: A Step-by-Step Guide

Amending your tax return is a straightforward process, but it requires attention to detail. Follow these steps to ensure a smooth amendment:

1. Gather Necessary Documents

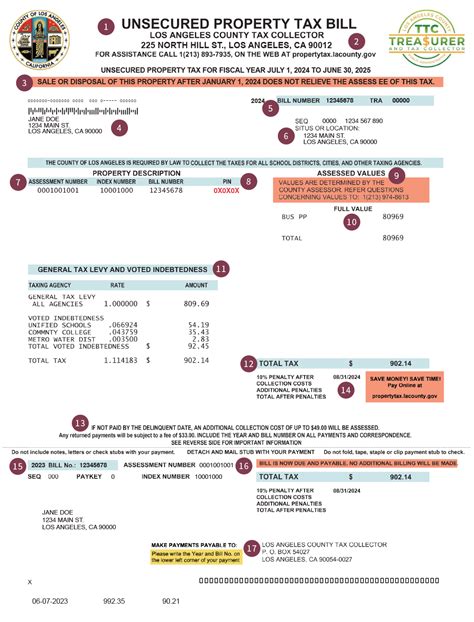

Before you begin, collect all relevant documents and information. This includes your original tax return, any supporting documents (e.g., W-2s, 1099s, receipts), and the specific details of the changes you need to make.

2. Determine the Type of Amendment

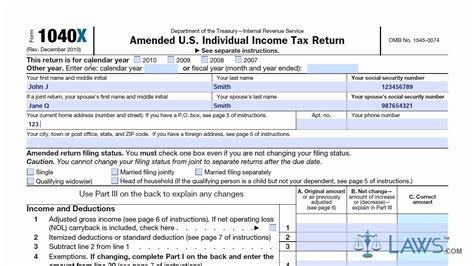

Amendments can be made using different forms, depending on the nature of the changes. The most common form is the IRS Form 1040X, used for amending individual income tax returns. However, other forms may be required for specific scenarios, such as amending business tax returns or estate tax returns.

3. Complete the Amendment Form

Fill out the appropriate amendment form carefully. You’ll need to provide details about the changes you’re making, including the original amount and the corrected amount. Ensure you follow the instructions on the form precisely.

4. Attach Supporting Documents

Attach all relevant supporting documents to your amendment form. This may include additional tax forms, statements, or any other evidence to substantiate the changes you’re making. Make sure these documents are clearly labeled and easily accessible.

5. Calculate and Pay Any Additional Taxes

If your amendment results in increased tax liability, you’ll need to calculate and pay the additional amount. Follow the instructions on the amendment form to determine the correct amount. You can pay using various methods, including direct debit, credit card, or check.

6. File Your Amendment

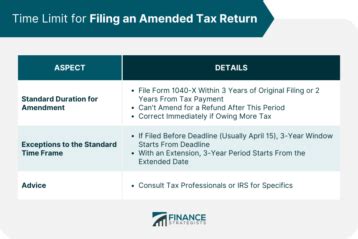

Once your amendment form is complete and all supporting documents are attached, it’s time to file. You can file electronically or by mail, depending on your preference and the complexity of your amendment. Ensure you meet the filing deadlines to avoid penalties.

7. Await Processing and Notification

After filing, the IRS will process your amendment. This process can take several weeks or months, depending on the complexity of your case. You’ll receive a notification from the IRS once your amendment has been processed, informing you of any changes to your tax liability or refund.

Common Scenarios and Considerations

When amending your tax return, several scenarios and considerations may arise:

1. Refund Amendments

If your amendment results in a refund, the IRS will issue it to you. The timing of the refund can vary, but it’s typically issued within 8–12 weeks of filing your amendment. You can track the status of your refund using the Where’s My Refund tool on the IRS website.

2. Reducing Tax Liability

Amending your return can reduce your tax liability if you discover additional deductions or credits. This can result in a refund or a smaller tax bill for the current year. It’s important to review your deductions and credits carefully to ensure you’re claiming all eligible benefits.

3. Errors by Tax Preparers

If you used a tax preparer and they made an error, they are responsible for rectifying the mistake. They should file an amended return on your behalf and provide any necessary support. However, it’s important to review the amended return carefully to ensure accuracy.

4. Life Events and Changes

Life events such as marriage, divorce, or having a child can significantly impact your tax obligations. It’s crucial to inform the IRS of these changes promptly to ensure your tax return reflects your new status. Amendments related to life events may involve changes to your filing status, deductions, or credits.

5. Audits and Amendments

In some cases, the IRS may audit your tax return, and you may need to amend it during the audit process. If you receive a notice of audit, it’s important to respond promptly and provide the requested information. An amendment may be necessary to resolve any discrepancies found during the audit.

Future Implications and Preventative Measures

Amending your tax return can have implications for future tax filings. It’s important to learn from your experience and take steps to prevent future errors or omissions:

1. Review and Double-Check

Before filing your tax return, take the time to review it carefully. Double-check all calculations, income amounts, and deductions. Consider using tax preparation software or engaging a tax professional to ensure accuracy.

2. Keep Organized Records

Maintain organized records of all your financial transactions, income documents, and tax-related information. This will make it easier to identify errors or changes that need to be addressed and provide supporting documentation for amendments.

3. Stay Informed

Stay updated on tax laws and regulations. Changes in tax codes can impact your filing requirements and potential deductions. Staying informed can help you make the most of your tax benefits and avoid errors.

4. Seek Professional Help

If you’re unsure about any aspect of your tax return or have complex financial situations, consider seeking professional tax advice. Tax professionals can provide guidance, ensure compliance, and help you maximize your tax benefits.

5. Plan for Life Changes

Life events such as marriage, divorce, or starting a business can have significant tax implications. Plan ahead and consult with tax professionals to understand how these changes will affect your tax obligations and make necessary adjustments.

Conclusion: A Smooth Tax Amendment Journey

Amending a tax return doesn’t have to be a daunting task. By following the steps outlined in this guide and staying organized, you can navigate the amendment process with confidence. Remember, accuracy and compliance are key when dealing with tax matters. With the right approach, you can ensure your tax obligations are met, and any amendments are handled smoothly.

Can I amend my tax return electronically?

+Yes, you can amend your tax return electronically using the IRS’s e-file system. However, not all tax software supports amendments. Check with your tax software provider to see if they offer this feature. Alternatively, you can file your amendment by mail using the appropriate form.

How long does it take for the IRS to process an amended return?

+The processing time for amended returns can vary, but it typically takes 8–12 weeks. However, complex amendments or those involving audits may take longer. You can track the status of your amended return using the IRS’s online tool.

What if I discover an error after amending my return?

+If you find another error after amending your return, you can submit a second amendment using the same process. Ensure you carefully review your calculations and supporting documents to avoid further errors.

Can I amend my tax return if I’ve already received a refund?

+Yes, you can amend your tax return even if you’ve already received a refund. If your amendment results in a reduced refund or an additional tax liability, you’ll need to pay the difference. The IRS will provide instructions on how to handle this situation.

Are there any penalties for amending a tax return?

+Generally, there are no penalties for amending a tax return if you’re making corrections to your benefit. However, if your amendment results in a substantial increase in tax liability, you may be subject to interest and penalties. It’s important to review the IRS guidelines on penalties to understand your specific situation.