Arizona Sales Tax On Automobiles

In the state of Arizona, sales tax is a significant aspect of purchasing a vehicle, impacting both new and used car buyers. Understanding the sales tax on automobiles in Arizona is crucial for buyers and sellers alike, as it directly affects the overall cost of a vehicle and the financial planning required for a successful transaction. This comprehensive guide aims to delve into the intricacies of Arizona's sales tax laws, offering a detailed breakdown of how these taxes are calculated, who is responsible for paying them, and the potential exemptions that may apply.

Understanding Arizona Sales Tax on Automobiles

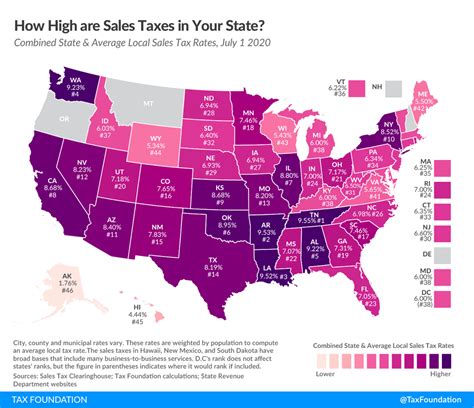

The Arizona Department of Revenue is responsible for overseeing the state’s sales tax regulations, including those applicable to vehicle purchases. Arizona imposes a state sales tax rate of 5.6%, which applies to most retail purchases, including vehicles. However, it is essential to note that local municipalities and counties may also levy additional sales taxes, resulting in a higher overall tax rate for vehicle purchases.

For instance, in Phoenix, the largest city in Arizona, the total sales tax rate on vehicles is 8.1%, consisting of the state tax rate and an additional 2.5% local tax. This local tax rate can vary significantly across the state, so it is crucial to check the specific tax rate applicable to the location where the vehicle is purchased.

Calculating Sales Tax on Automobiles

Calculating the sales tax on a vehicle purchase in Arizona involves multiplying the purchase price by the applicable tax rate. For instance, if a vehicle is purchased for 30,000</strong> in an area with a total sales tax rate of <strong>8.1%</strong>, the sales tax due would be <strong>2,430 ($30,000 x 0.081).

| Purchase Price | Sales Tax Rate | Sales Tax Due |

|---|---|---|

| $20,000 | 8.1% | $1,620 |

| $35,000 | 8.1% | $2,835 |

| $50,000 | 8.1% | $4,050 |

It is important to note that sales tax is calculated based on the total purchase price, which includes any additional costs, such as dealer fees, documentation fees, and optional add-ons like extended warranties or accessories.

Responsibility for Paying Sales Tax

In most cases, the responsibility for paying sales tax on a vehicle purchase falls on the buyer. This means that when a buyer purchases a vehicle from a dealership or a private seller, they are typically required to pay the applicable sales tax at the time of purchase or registration.

However, there are certain situations where the seller may be responsible for paying sales tax. For example, if a business sells a vehicle as part of its inventory or if an individual sells multiple vehicles within a short period, they may be considered a "dealer" and be responsible for collecting and remitting sales tax on the transactions.

Exemptions and Special Considerations

While the majority of vehicle purchases in Arizona are subject to sales tax, there are certain exemptions and special considerations that may apply in specific circumstances.

Trade-Ins and Rebates

When trading in a vehicle as part of a purchase, the sales tax due is typically calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This means that the sales tax is applied to the net amount, which can result in a reduced tax liability for the buyer.

Additionally, if a buyer qualifies for a rebate or incentive program offered by the manufacturer or dealership, the sales tax may be calculated based on the net purchase price after the rebate has been applied. This can further reduce the sales tax obligation for the buyer.

Leases and Rentals

Sales tax on leased or rented vehicles in Arizona is calculated based on the periodic rental or lease payments. The tax is typically due at the time of each payment, and the total tax liability is spread across the duration of the lease or rental agreement.

It is important to note that the sales tax rate for leases and rentals may differ from the rate applicable to outright purchases. Therefore, it is advisable to consult with the leasing or rental company to understand the specific tax obligations associated with the agreement.

Vehicle Exchanges and Gifts

When a vehicle is exchanged between individuals without a monetary transaction, such as in a gift or inheritance scenario, the sales tax implications can be complex. In these cases, it is crucial to consult with a tax professional to determine the tax obligations, if any, associated with the exchange.

Military Personnel and Veterans

Arizona offers certain tax exemptions and benefits to military personnel and veterans. For example, active-duty military personnel stationed in Arizona may be exempt from paying sales tax on vehicle purchases if they are not residents of the state. Similarly, veterans may qualify for reduced or waived sales tax rates depending on their disability status and other factors.

Registration and Titling

In Arizona, the process of registering and titling a vehicle is closely tied to the sales tax obligations. When a vehicle is purchased, the buyer is typically required to pay the applicable sales tax at the time of registration. This payment is made to the Arizona Motor Vehicle Division (MVD) along with the registration fees and any other applicable taxes or charges.

The MVD will then issue a registration certificate and license plates for the vehicle, which must be displayed and maintained according to state regulations. Failure to pay the sales tax and register the vehicle can result in penalties and legal consequences.

Online Registration and Sales Tax Payment

Arizona offers an online registration and titling service through the MVD website. This service allows buyers to complete the registration process and pay the sales tax online, providing a convenient and efficient option for vehicle owners.

To utilize the online service, buyers will need to provide information about the vehicle, including the make, model, year, and Vehicle Identification Number (VIN). They will also need to have their driver's license and proof of insurance readily available. The MVD website provides a step-by-step guide to help users navigate the online registration process.

Future Implications and Tax Reform

The sales tax landscape in Arizona, like in many other states, is subject to ongoing discussions and potential reforms. While the current sales tax rate on vehicles is relatively stable, there are ongoing debates and proposals for changes that could impact the tax obligations of vehicle buyers and sellers.

Potential Tax Reforms

One of the key discussions surrounding Arizona’s sales tax on vehicles is the idea of implementing a flat tax rate or a sales tax holiday. A flat tax rate would simplify the tax calculation process by applying a uniform tax rate across the state, eliminating the need to consider local tax rates. A sales tax holiday, on the other hand, would involve a temporary waiver of sales tax on specific types of purchases, such as vehicles, during a designated period.

While these proposals have gained traction in the past, there is no clear timeline for their implementation. However, staying informed about potential tax reforms is essential for both buyers and sellers to understand the evolving tax landscape in Arizona.

Impact on the Automotive Industry

Changes to the sales tax structure can have significant implications for the automotive industry in Arizona. A flat tax rate, for instance, could simplify the tax calculation process for dealerships and reduce administrative burdens. On the other hand, a sales tax holiday could stimulate vehicle sales during the designated period, providing a boost to the industry.

However, it is important to consider the potential long-term effects of such reforms. A sales tax holiday, while beneficial in the short term, may lead to a decrease in overall tax revenue for the state. This could impact funding for essential services and infrastructure, potentially affecting the overall economic health of the state.

Advocacy and Public Opinion

As discussions around sales tax reforms continue, it is crucial for stakeholders in the automotive industry, as well as the general public, to engage in the conversation. Expressing opinions and advocating for specific tax policies can influence the decision-making process and help shape the future of sales tax laws in Arizona.

Conclusion

Understanding the sales tax on automobiles in Arizona is a critical aspect of vehicle ownership and financial planning. From calculating the applicable tax rate to navigating exemptions and special considerations, buyers and sellers must stay informed to ensure compliance with Arizona’s sales tax laws.

As the sales tax landscape continues to evolve, staying updated on potential reforms and their implications is essential. By actively engaging in the discussion and advocating for tax policies that benefit the automotive industry and consumers, stakeholders can contribute to shaping a fair and sustainable tax environment in Arizona.

FAQ

How often do sales tax rates change in Arizona?

+

Sales tax rates in Arizona can change periodically, typically as a result of legislative actions or local government decisions. While the state sales tax rate has remained stable at 5.6%, local tax rates can vary and are subject to change. It is advisable to check the current tax rates applicable to the specific location where a vehicle is being purchased.

Are there any online tools available to calculate sales tax on vehicle purchases in Arizona?

+

Yes, there are several online sales tax calculators available that can help estimate the sales tax due on a vehicle purchase in Arizona. These calculators typically consider the purchase price, the applicable tax rates (state and local), and any additional fees or charges. However, it is important to note that these calculators provide estimates and may not account for all variables.

What happens if I fail to pay the sales tax on my vehicle purchase in Arizona?

+

Failing to pay the sales tax on a vehicle purchase in Arizona can result in penalties and legal consequences. The Arizona Department of Revenue may impose fines and interest on the unpaid tax, and the vehicle registration may be delayed or denied until the tax obligation is fulfilled. It is crucial to pay the sales tax at the time of purchase or registration to avoid these issues.

Can I deduct sales tax on my vehicle purchase from my federal or state income taxes in Arizona?

+

The deductibility of sales tax on vehicle purchases depends on various factors, including your tax filing status, income level, and the specific tax laws in Arizona. It is advisable to consult with a tax professional or refer to the guidelines provided by the Internal Revenue Service (IRS) and the Arizona Department of Revenue to determine if you are eligible for any tax deductions related to vehicle purchases.

Are there any sales tax exemptions for electric or hybrid vehicles in Arizona?

+

Yes, Arizona offers certain tax incentives and exemptions for the purchase of electric and hybrid vehicles. These incentives may include reduced or waived sales tax rates, tax credits, or other benefits. The specific exemptions and qualifications can vary, so it is recommended to check with the Arizona Department of Revenue or consult a tax professional for up-to-date information on these incentives.