Futa Tax Rate

Welcome to this comprehensive exploration of the Futa Tax Rate, a critical component of payroll and tax management for employers across the United States. The Federal Unemployment Tax Act (FUTA) is a fundamental part of the nation's unemployment insurance system, providing a safety net for millions of workers and a complex regulatory framework for businesses to navigate. In this expert guide, we will delve into the intricacies of the Futa Tax Rate, offering a detailed analysis of its structure, calculation, and implications for businesses and employees alike.

Understanding the Futa Tax Rate

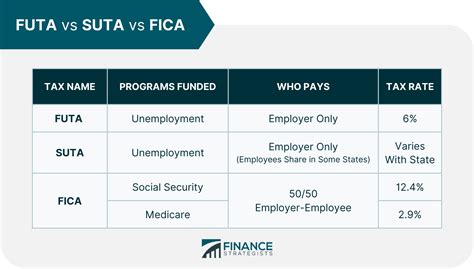

The Futa Tax Rate, a cornerstone of the American tax system, serves as the primary funding mechanism for federal unemployment benefits. This tax is distinct from state unemployment taxes and is levied on employers to support the federal-state unemployment insurance partnership. The rate is subject to regular review and adjustment to ensure the solvency of the unemployment trust fund, with a focus on maintaining a delicate balance between providing adequate benefits and sustaining the stability of the fund.

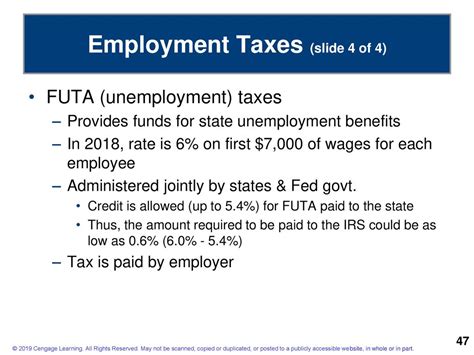

The current Futa Tax Rate is set at 6.0% for the first $7,000 of an employee's wages annually. However, this rate is not uniformly applied, as employers are eligible for a 5.4% credit against their FUTA tax liability if they have paid their state unemployment taxes on time and in full. This effectively reduces the net Futa Tax Rate to 0.6% for most employers, a critical detail in understanding the actual tax burden.

For instance, consider a small business with 10 employees, each earning an annual salary of $50,000. Without the credit, the Futa Tax liability for this business would be $2,100 per employee, totaling $21,000. However, with the credit, the net Futa Tax liability reduces to $300 per employee, a total of $3,000 for the business. This example highlights the significant impact of the credit on an employer's tax burden.

Key Factors Influencing the Futa Tax Rate

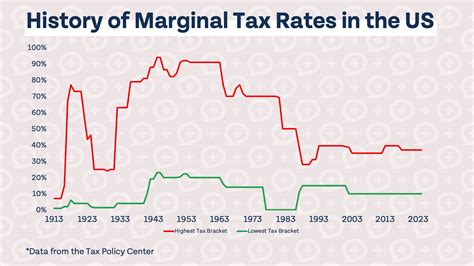

- Economic Conditions: The Futa Tax Rate is often adjusted to respond to economic fluctuations. During recessions, the rate may be increased to bolster the unemployment trust fund, while in robust economic periods, it can be reduced to ease the tax burden on businesses.

- State Unemployment Tax Compliance: The 5.4% credit is a significant incentive for employers to remain compliant with state unemployment tax laws. Non-compliance with state laws can result in the loss of this credit, significantly increasing the Futa Tax liability.

- Federal Reserve Actions: The Federal Reserve’s monetary policies can indirectly influence the Futa Tax Rate. For instance, during periods of inflation, the government may consider adjusting the rate to maintain the purchasing power of the unemployment trust fund.

| Factor | Impact on Futa Tax Rate |

|---|---|

| Economic Downturn | Increased rate to bolster unemployment funds. |

| Economic Boom | Reduced rate to ease tax burden on businesses. |

| State Unemployment Tax Compliance | Eligible for a 5.4% credit, reducing net rate to 0.6%. |

| Federal Reserve Policies | Indirect impact through economic conditions. |

Calculating Futa Tax Liability

Understanding how to calculate Futa Tax liability is essential for businesses to ensure accurate tax reporting and compliance. The calculation involves several steps, each influenced by specific criteria and considerations.

Step-by-Step Guide to Calculating Futa Tax

- Identify Taxable Wages: Start by determining the taxable wages for each employee. This is the total wages paid to an employee during the calendar year up to $7,000. Any wages above this threshold are not subject to Futa Tax.

- Calculate Preliminary Futa Tax: Multiply the taxable wages by the preliminary Futa Tax Rate, which is currently set at 6.0%. This calculation provides the initial tax liability before any credits are applied.

- Apply State Unemployment Tax Credit: If an employer has paid their state unemployment taxes timely and in full, they are eligible for a 5.4% credit. This credit is subtracted from the preliminary Futa Tax, reducing the net Futa Tax liability.

- Consider Additional Credits: In some cases, employers may be eligible for additional credits, such as the Work Opportunity Tax Credit (WOTC). These credits can further reduce the Futa Tax liability, but they are subject to specific eligibility criteria and must be claimed separately.

For example, let's consider a business with 5 employees, each earning an annual salary of $45,000. The taxable wages for each employee would be $7,000, as this is the Futa Tax threshold. The preliminary Futa Tax for each employee would be $420 (6.0% of $7,000). With the 5.4% credit, the net Futa Tax liability reduces to $36.72 per employee ($420 - 5.4% of $420). The total Futa Tax liability for the business would be $183.60 for the year ($36.72 x 5 employees). This calculation highlights the importance of understanding the credit system in reducing the Futa Tax burden.

Compliance and Reporting

Ensuring compliance with Futa Tax regulations is a critical aspect of payroll management for businesses. Non-compliance can lead to significant penalties, interest charges, and negative impacts on the business’s creditworthiness.

Key Compliance Considerations

- Timely Reporting: Futa Tax returns must be filed quarterly on Form 940. Late filings can result in penalties and interest charges, so it’s essential to maintain a rigorous reporting schedule.

- Accurate Calculation: The accuracy of Futa Tax calculations is crucial. Errors in identifying taxable wages or applying credits can lead to underpayment or overpayment, both of which can result in penalties.

- Employee Classification: Properly classifying employees as exempt or non-exempt is vital. Misclassification can lead to Futa Tax liabilities for wages that were not originally considered taxable.

- Record Keeping: Maintaining detailed records of payroll, tax payments, and filings is essential for compliance and audit purposes. These records should be retained for at least 4 years to comply with IRS regulations.

To ensure compliance, businesses should consider implementing robust payroll and tax management systems. These systems can automate Futa Tax calculations, ensure timely reporting, and maintain accurate records, reducing the risk of errors and penalties.

Implications for Businesses and Employees

The Futa Tax Rate has significant implications for both businesses and employees, impacting financial planning, employment decisions, and the overall economy.

Impact on Businesses

- Financial Planning: The Futa Tax liability is a critical consideration in a business’s financial planning. It directly affects the bottom line and must be factored into budget projections and cash flow management.

- Employment Decisions: The Futa Tax Rate can influence employment decisions, particularly in the context of hiring and retention strategies. Businesses may need to adjust their staffing plans based on the tax implications.

- Competitive Advantage: Businesses that effectively manage their Futa Tax liabilities can gain a competitive advantage. By minimizing their tax burden through compliance and strategic planning, they can allocate more resources to growth and innovation.

Impact on Employees

- Unemployment Benefits: The Futa Tax Rate directly funds unemployment benefits, which provide a critical safety net for employees during periods of unemployment. A well-funded unemployment trust fund ensures that employees can access these benefits when needed.

- Employment Security: The existence of the Futa Tax and the resulting unemployment insurance program can enhance employment security for workers. It provides a level of financial support during job loss, potentially reducing the impact of unemployment on individuals and families.

Future Outlook and Potential Changes

The Futa Tax Rate is subject to ongoing review and potential adjustments, driven by economic conditions, legislative changes, and the evolving needs of the unemployment insurance system.

Potential Future Scenarios

- Economic Recession: In the event of a recession, the Futa Tax Rate may be increased to bolster the unemployment trust fund, ensuring it can support a larger number of unemployed individuals. This would likely be a temporary measure to address the increased demand for unemployment benefits.

- Economic Recovery: Conversely, during periods of economic recovery, the Futa Tax Rate may be reduced to provide relief to businesses and encourage hiring. A lower tax rate can stimulate economic growth and job creation.

- Legislative Changes: Changes in tax laws or unemployment insurance regulations can also impact the Futa Tax Rate. For instance, the introduction of new credits or adjustments to existing credits can alter the net Futa Tax liability for employers.

Staying informed about potential changes to the Futa Tax Rate is essential for businesses to adapt their financial planning and payroll strategies accordingly. Regular reviews of tax regulations and consulting with tax professionals can help businesses navigate these changes effectively.

Conclusion

The Futa Tax Rate is a dynamic and critical component of the American tax system, playing a vital role in funding unemployment benefits and supporting the economic well-being of the nation. Understanding its structure, calculation, and implications is essential for businesses and employees alike. By staying informed and proactive in tax management, businesses can ensure compliance, minimize their tax burden, and contribute to the stability of the unemployment insurance system.

How often is the Futa Tax Rate adjusted, and what triggers these adjustments?

+The Futa Tax Rate is typically adjusted annually, with the IRS announcing any changes by the end of the calendar year. These adjustments are triggered by economic conditions, legislative changes, and the solvency of the unemployment trust fund. The rate can increase during recessions to bolster the fund and decrease during economic booms to provide relief to businesses.

Are there any exemptions or special considerations for certain businesses regarding the Futa Tax Rate?

+Certain types of organizations, such as governmental entities, certain non-profit organizations, and agricultural workers, may be exempt from Futa Tax or have different tax rates. It’s important to consult with a tax professional to determine if your business qualifies for any exemptions or special considerations.

What happens if a business fails to pay or underpays their Futa Tax liability?

+Failure to pay or underpayment of Futa Tax can result in significant penalties and interest charges. The IRS may also levy a penalty of up to 15% of the unpaid tax for each month the tax remains unpaid, up to a maximum of 75%. In addition, non-compliance can impact the business’s creditworthiness and ability to obtain financing.