Property Tax In Pg County Maryland

Property taxes are an essential aspect of local governance and play a significant role in funding various public services and infrastructure projects. In Prince George's County, Maryland, property taxes are a crucial source of revenue for the county government, impacting both residents and businesses. This comprehensive guide aims to delve into the intricacies of property tax assessments, rates, and their implications in PG County, shedding light on the process and its impact on the community.

Understanding Property Tax Assessments in PG County

The property tax assessment process in Prince George’s County is a meticulous undertaking, ensuring that each property’s value is accurately determined for fair taxation. The Office of Finance, overseen by the Chief Assessment Officer, is responsible for this critical task. Assessors employ a range of methods, including market analysis, property inspections, and consideration of unique characteristics, to assign a fair market value to each property.

In PG County, the assessment process is not merely a one-time event. Instead, it is an ongoing endeavor, with properties reassessed at regular intervals. This approach ensures that property values remain up-to-date and reflective of the dynamic real estate market. The county utilizes a triennial assessment cycle, meaning that assessments are conducted every three years, with the most recent assessment year being 2023. During this process, assessors review recent sales data, construction costs, and other market factors to determine the new assessed values.

For instance, consider the case of the Smith Residence, a single-family home located in the vibrant neighborhood of Riverdale. During the 2023 assessment, the Office of Finance carefully evaluated the property's features, recent sales of comparable homes in the area, and prevailing market trends. As a result, the Smith Residence was assigned an assessed value of $420,000, reflecting the property's fair market value at that time.

Appealing Property Assessments

Recognizing that assessments are subjective and may not always align with a property owner’s perspective, PG County provides a comprehensive appeals process. Property owners who believe their assessment is inaccurate or unfair can initiate an appeal, ensuring transparency and accountability in the system. The appeals process is handled by the Maryland Department of Assessments and Taxation, which offers a two-tiered review system to address grievances.

At the first level, property owners can request a review by the Department's staff, who will carefully examine the assessment and any supporting evidence provided by the owner. If the owner remains dissatisfied, they can proceed to the second level, which involves an independent hearing before the Property Tax Assessment Appeal Board. This board, consisting of local residents, reviews the case impartially, taking into account all available information to make a final determination.

| Assessment Year | Assessment Value |

|---|---|

| 2023 | $420,000 |

| 2020 | $385,000 |

| 2017 | $350,000 |

Property Tax Rates and Calculations

Once assessments are finalized, the Office of Finance in PG County employs a standardized formula to calculate property tax bills. This process involves multiplying the assessed value of the property by the applicable tax rate, taking into account any applicable exemptions or credits. The resulting amount represents the annual property tax obligation for the property owner.

In PG County, the tax rate is expressed in dollars per hundred dollars of assessed value, a common practice across many jurisdictions. For the current tax year, the residential tax rate stands at $0.988 per hundred dollars, while the commercial tax rate is set at $1.32 per hundred dollars. These rates are established by the Prince George's County Council, reflecting the budget needs of the county and the desired balance between residential and commercial tax contributions.

To illustrate, let's consider the tax calculation for the aforementioned Smith Residence, with its assessed value of $420,000. Applying the residential tax rate, the annual tax obligation would be:

Tax Amount = ($420,000 / 100) x $0.988

Resulting in a total property tax bill of $4,155.60 for the year.

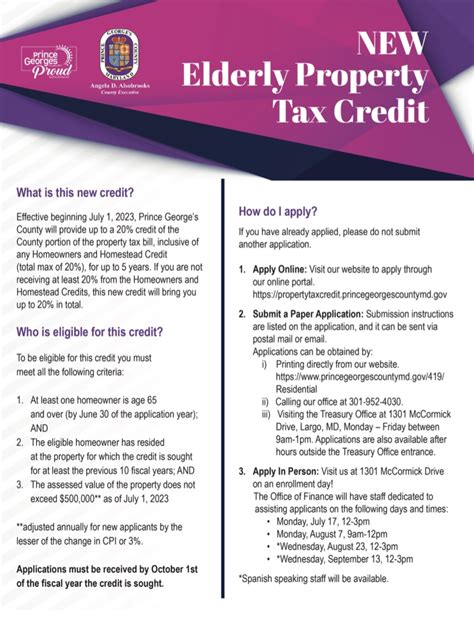

Exemptions and Credits

PG County offers a range of exemptions and credits to alleviate the tax burden on certain properties and individuals. These incentives aim to promote homeownership, support veterans, and assist senior citizens. Some notable exemptions and credits include:

- Homestead Tax Credit: Provides a credit of up to $3,750 for qualifying homeowners, reducing their taxable assessment.

- Veterans' Property Tax Credit: Offers a credit of up to $1,500 for eligible veterans, lowering their tax liability.

- Senior Citizens' Property Tax Credit: Provides a credit of up to $1,500 for senior citizens, easing the tax burden on fixed incomes.

- Circuit Breaker Tax Credit: Assists low-income homeowners and renters by providing a credit based on income and property taxes paid.

These exemptions and credits can significantly reduce the property tax obligations for eligible individuals, making homeownership more affordable and accessible.

Property Tax Payment Options and Deadlines

PG County offers several convenient payment options for property owners to settle their tax obligations. These options include online payment through the PG County Treasury Office website, which accepts major credit cards and electronic checks. Property owners can also pay by mail or in person at the Treasury Office located in the County Administration Building. For those who prefer traditional methods, payments can be made by check, money order, or cash.

It is essential for property owners to be aware of the tax payment deadlines to avoid penalties and interest. In PG County, property taxes are typically due in two installments. The first installment is due on July 1st of each year, while the second installment is due on November 1st. Property owners who miss these deadlines may incur late fees and interest charges, which can accumulate over time.

Online Payment and Bill Reminders

To enhance convenience and ensure timely payments, PG County provides an online billing and payment system. Property owners can register for an account on the PG County Treasury Office website, where they can view their current tax bills, past payment history, and due dates. The system also offers the option to receive email or text reminders for upcoming payment deadlines, helping owners stay on top of their obligations.

Additionally, the online system provides a secure platform for making payments, accepting major credit cards and electronic checks. This feature not only offers convenience but also ensures that payments are processed quickly and securely, providing peace of mind to property owners.

| Payment Option | Description |

|---|---|

| Online Payment | Convenient and secure payment through the PG County Treasury Office website. |

| Mail or In-Person | Payments can be made by check, money order, or cash at the Treasury Office. |

| Bill Reminders | Owners can register for email or text reminders for upcoming payment deadlines. |

Impact of Property Taxes on the Community

Property taxes are a vital source of revenue for PG County, funding a wide range of essential services and infrastructure projects that benefit the entire community. The revenue generated from property taxes supports critical areas such as:

- Education: Property taxes are a primary funding source for Prince George's County Public Schools, ensuring that students receive quality education and necessary resources.

- Public Safety: These taxes contribute to maintaining a robust police force, fire department, and emergency response services, enhancing community safety.

- Transportation: Property tax revenue helps maintain and improve the county's road network, public transportation systems, and infrastructure projects.

- Health and Human Services: Funding from property taxes supports healthcare facilities, social services, and initiatives aimed at improving the well-being of county residents.

- Recreation and Cultural Programs: Property taxes contribute to the development and maintenance of parks, recreational facilities, and cultural programs, enriching the community's quality of life.

Furthermore, property taxes play a crucial role in economic development and job creation. The revenue generated is often invested in initiatives that attract businesses and stimulate economic growth, creating employment opportunities and enhancing the overall prosperity of PG County.

How often are properties reassessed in PG County?

+Properties in PG County are reassessed every three years as part of the triennial assessment cycle. This ensures that property values remain current and reflective of the dynamic real estate market.

What is the appeals process for property assessments in PG County?

+The appeals process is a two-tiered system handled by the Maryland Department of Assessments and Taxation. Property owners can request a review by the Department’s staff and, if still dissatisfied, can proceed to an independent hearing before the Property Tax Assessment Appeal Board.

How are property tax rates determined in PG County?

+The Prince George’s County Council sets the tax rates based on the budget needs of the county. The rates are expressed in dollars per hundred dollars of assessed value and may vary for residential and commercial properties.

What payment options are available for property taxes in PG County?

+PG County offers various payment options, including online payment through the Treasury Office website, payment by mail or in person, and acceptance of major credit cards and electronic checks.

What are the benefits of exemptions and credits offered in PG County?

+Exemptions and credits, such as the Homestead Tax Credit and Veterans’ Property Tax Credit, reduce the tax burden on homeowners, making homeownership more affordable and accessible. They also provide support to veterans and senior citizens.