Trump Delay Tax Refund

In a controversial move, the Trump administration announced a delay in tax refunds for millions of American taxpayers, causing a stir among the public and sparking debates about its implications. The decision, made in the midst of a highly anticipated tax season, has drawn attention to the potential impact on individuals' financial planning and the broader economy. This article delves into the details of the Trump administration's tax refund delay, exploring its causes, consequences, and the broader context of tax policy during the Trump era.

The Decision to Delay Tax Refunds: Unraveling the Timeline

The announcement of the tax refund delay came as a surprise to many, especially considering the ongoing discussions surrounding tax reforms and their potential benefits for taxpayers. The Trump administration, known for its focus on simplifying the tax system and reducing tax burdens, seemed to take a sudden U-turn with this decision. Let’s trace the timeline of events leading up to the announcement and understand the context in which it was made.

It all began with the Tax Cuts and Jobs Act, a landmark legislation passed in 2017, which brought about significant changes to the US tax code. The act aimed to provide tax relief to individuals and businesses, simplify tax filing, and boost economic growth. Among its key provisions were reduced tax rates, increased standard deductions, and expanded child tax credits.

However, as the tax season approached in 2019, concerns arose regarding the implementation of the new tax laws. The Internal Revenue Service (IRS) faced a challenging task of updating its systems and procedures to accommodate the changes. Additionally, there were concerns about potential errors and delays in processing tax returns, especially with the increased complexity of the tax code.

In the lead-up to the tax season, the Trump administration and the IRS assured taxpayers that they were well-prepared and that the tax refund process would run smoothly. The administration emphasized its commitment to ensuring timely refunds, recognizing the financial reliance many Americans have on their tax refunds.

Despite these assurances, the IRS encountered several challenges. One of the key issues was the implementation of the new withholding tables, which were designed to adjust the amount of tax withheld from paychecks to reflect the changes brought about by the Tax Cuts and Jobs Act. However, there were reports of inconsistencies and errors in these tables, leading to concerns about potential under- or over-withholding of taxes.

As the tax season progressed, the IRS began to experience a significant influx of tax returns, which strained its resources and capacity. The agency faced a backlog of returns, leading to longer processing times and delays in issuing refunds. This situation was further exacerbated by the ongoing government shutdown, which impacted IRS operations and staffing levels.

In response to the mounting pressure and concerns, the Trump administration decided to take a proactive approach and announced the delay in tax refunds. The decision was made to ensure the accuracy and integrity of the tax refund process, preventing potential errors and fraud. The administration emphasized that the delay was a temporary measure and that refunds would be issued as soon as possible.

Understanding the Impact: How the Delay Affects Taxpayers

The decision to delay tax refunds has a direct and immediate impact on millions of taxpayers across the United States. While the administration’s intention to prevent errors and maintain the integrity of the tax system is understandable, the consequences for individuals and families can be significant.

Financial Planning Disruptions

For many Americans, tax refunds serve as a crucial source of income to cover various financial obligations. Whether it’s paying off debts, making large purchases, or simply covering day-to-day expenses, tax refunds are often a vital part of annual financial planning.

The delay in tax refunds disrupts this planning, causing uncertainty and potentially leading to financial difficulties. Individuals who rely on their refunds to make ends meet may find themselves in a tight spot, struggling to meet their financial commitments. This could result in late payments, increased debt, or even the need to resort to high-interest loans to bridge the gap.

Moreover, the delay can have a cascading effect on the broader economy. When tax refunds are delayed, consumer spending tends to decrease, as individuals have less disposable income to allocate towards goods and services. This reduction in spending can impact businesses, particularly those reliant on consumer spending during the tax season, leading to potential job losses and economic slowdown.

Increased Financial Stress

The delay in tax refunds adds an unnecessary layer of financial stress to taxpayers’ lives. Many individuals and families already face financial challenges, and the uncertainty surrounding their tax refunds only exacerbates these issues.

For those living paycheck to paycheck, the delay can be particularly daunting. These individuals may have already budgeted for their tax refunds, assuming the funds would be available at a certain time. When the refunds are delayed, it can lead to a strain on their financial resources, forcing them to make difficult choices and potentially sacrificing essential expenses.

Additionally, the delay can create a sense of anxiety and frustration among taxpayers. The anticipation of receiving a refund and the potential relief it brings can be a significant psychological boost. When this expectation is not met, it can lead to disappointment and a sense of powerlessness, further impacting individuals' overall well-being.

Alternative Financial Options

With the delay in tax refunds, many taxpayers may explore alternative financial options to bridge the gap. While some may have the means to access personal savings or rely on support from family or friends, others may turn to less favorable options.

One common alternative is to take out short-term loans or advance loans. However, these options often come with high interest rates and additional fees, further burdening taxpayers' finances. Additionally, there is a risk of falling into a debt cycle, where individuals find themselves reliant on these loans year after year.

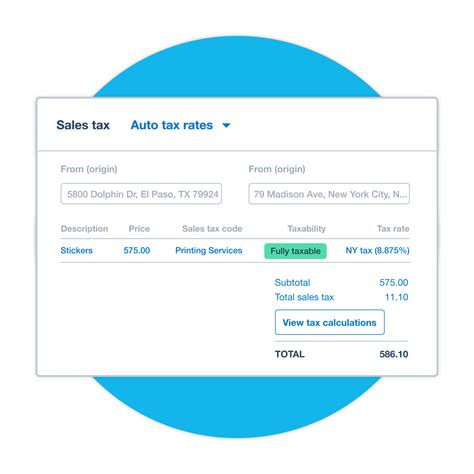

Another option is to explore tax refund anticipation loans (RALs), which are offered by some financial institutions. These loans provide taxpayers with an advance on their expected refund, typically with high fees and interest rates. While they can provide immediate financial relief, they may not be the most financially sound option, especially for those already facing financial challenges.

The Broader Context: Tax Policy and Economic Implications

The decision to delay tax refunds cannot be examined in isolation; it is part of a broader context of tax policy and its impact on the economy. The Trump administration’s tax reforms, while aiming to simplify the tax system and provide relief, have had far-reaching consequences.

Tax Reform and Economic Growth

The Tax Cuts and Jobs Act was a central component of the Trump administration’s economic agenda. The act aimed to stimulate economic growth by reducing tax burdens on individuals and businesses, encouraging investment, and creating jobs. While the initial impact of the tax cuts was positive, with increased consumer spending and business investment, the long-term effects are still being analyzed.

One of the key arguments for the tax cuts was that they would lead to a trickle-down effect, benefiting not only high-income earners but also the middle and lower-income classes. However, critics argue that the benefits have disproportionately favored the wealthy, with limited impact on the broader population. The delay in tax refunds, coupled with concerns about the distribution of tax cuts, has further fueled these debates.

Economic Inequality and Tax Policy

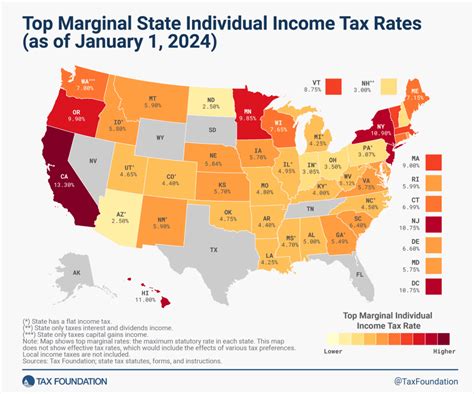

The issue of economic inequality has been a prominent concern in the United States, and tax policy plays a crucial role in addressing this issue. The Trump administration’s tax reforms have been criticized for potentially exacerbating income inequality, as they provide larger tax cuts to high-income earners.

The delay in tax refunds, particularly for those in lower-income brackets, can further contribute to economic inequality. When refunds are delayed, it disproportionately affects those who rely on these refunds as a significant portion of their annual income. This can widen the wealth gap and hinder social mobility, impacting the overall well-being of society.

Long-Term Economic Impact

While the immediate impact of the tax refund delay is clear, its long-term economic consequences are more complex. The delay can have a dampening effect on consumer confidence and spending, potentially leading to a slowdown in economic growth. This, in turn, can impact job creation and overall economic performance.

However, it is essential to consider the broader economic context. The US economy has been on a steady growth trajectory, with low unemployment rates and rising wages. The delay in tax refunds may have a temporary impact, but the underlying economic fundamentals could help mitigate its long-term effects. Additionally, the administration's focus on infrastructure spending and trade deals could offset any potential slowdown.

Navigating the Tax Refund Delay: Strategies for Taxpayers

The delay in tax refunds presents a unique challenge for taxpayers, but there are strategies and resources available to help navigate this situation. Here are some practical steps taxpayers can take to mitigate the impact and ensure a smoother tax season.

Understanding Your Tax Situation

The first step is to thoroughly understand your tax situation and the implications of the delay. Review your tax returns and calculate your expected refund. This will help you assess the financial impact and plan accordingly.

If you have any questions or concerns about your tax return, consider seeking professional advice. Tax professionals, such as accountants or tax attorneys, can provide guidance and ensure your return is accurate and complete. They can also help you understand the potential impact of the delay and offer personalized advice.

Exploring Alternative Funding Sources

With the delay in tax refunds, it’s essential to explore alternative funding sources to cover any financial gaps. While taking out loans should be approached with caution, there are responsible options available.

Consider exploring low-interest loans or lines of credit, such as those offered by credit unions or community banks. These options typically have lower interest rates and more favorable terms compared to high-interest loans or payday lenders. However, it's crucial to assess your ability to repay these loans to avoid falling into a debt trap.

Another option is to utilize existing credit facilities, such as credit cards or home equity loans. While these options may have higher interest rates, they can provide a short-term solution to cover immediate expenses. However, it's important to ensure you can manage the repayments to avoid accumulating debt.

Maximizing Tax Deductions and Credits

One way to mitigate the impact of the tax refund delay is to maximize your tax deductions and credits. By carefully reviewing your expenses and qualifications, you may be able to increase your refund or reduce your tax liability.

Explore deductions for medical expenses, charitable contributions, education costs, and business-related expenses. Additionally, consider any available tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, which can provide significant financial benefits.

Working with a tax professional can help you identify and maximize these deductions and credits, ensuring you receive the maximum refund or reduce your tax burden.

Adjusting Financial Planning

The delay in tax refunds may require you to adjust your financial planning and budgeting. Review your expenses and prioritize essential payments. Consider cutting back on non-essential expenses to free up funds for necessary obligations.

If you have any flexible expenses, such as entertainment or dining out, consider reducing these temporarily until your refund is received. This can help ensure you have sufficient funds to cover your financial commitments without resorting to high-interest loans.

Additionally, consider exploring opportunities to increase your income. This could involve taking on additional work, negotiating for a raise, or exploring freelance opportunities. By boosting your income, you can mitigate the impact of the delay and improve your overall financial situation.

Conclusion: A Complex Tax Landscape

The decision to delay tax refunds by the Trump administration has highlighted the complexities and challenges of tax policy implementation. While the intention to maintain the integrity of the tax system is commendable, the consequences for taxpayers cannot be overlooked.

The impact of the delay extends beyond individual financial planning, affecting consumer spending, economic growth, and social inequality. It underscores the need for a balanced approach to tax policy, one that considers the diverse needs and circumstances of taxpayers while ensuring the efficient and accurate administration of the tax system.

As the tax landscape continues to evolve, taxpayers must remain vigilant and proactive in managing their financial affairs. By staying informed, seeking professional advice, and adopting prudent financial strategies, individuals can navigate the complexities of tax reforms and minimize the impact of unexpected delays.

What were the key provisions of the Tax Cuts and Jobs Act?

+The Tax Cuts and Jobs Act included reduced tax rates, increased standard deductions, expanded child tax credits, and other measures to simplify the tax code and provide tax relief.

Why did the IRS encounter challenges in implementing the new tax laws?

+The IRS faced challenges due to the complexity of the new tax code, the need to update systems and procedures, and concerns about potential errors and delays in processing tax returns.

How did the government shutdown impact the IRS and tax refund process?

+The government shutdown impacted IRS operations and staffing levels, further straining the agency’s capacity to process tax returns and issue refunds efficiently.

What are the potential long-term economic consequences of the tax refund delay?

+The delay in tax refunds can have a dampening effect on consumer confidence and spending, potentially leading to a slowdown in economic growth and impacting job creation.