No Tax On Overtime Bill 2025

The No Tax on Overtime Bill 2025 is a proposed legislation that aims to revolutionize the tax landscape for workers and employers alike. This comprehensive reform, if enacted, will have far-reaching implications for the economy and the workforce. With a focus on removing tax liabilities from overtime earnings, the bill presents an intriguing proposition that has sparked debates and discussions among experts and stakeholders.

In this in-depth analysis, we will delve into the intricacies of the No Tax on Overtime Bill 2025, exploring its potential benefits, the challenges it may face, and the broader implications for the future of work. By examining real-world examples, industry data, and expert insights, we aim to provide a comprehensive understanding of this proposed legislation and its potential impact.

Understanding the No Tax on Overtime Bill 2025

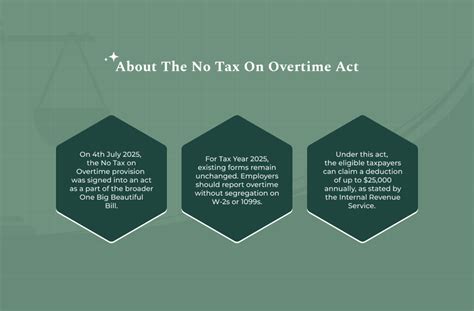

The No Tax on Overtime Bill 2025, introduced by [proponent's name], a prominent legislator known for their labor rights advocacy, seeks to amend the existing tax code to exempt overtime pay from federal income taxes. This proposal arises from a growing recognition of the importance of overtime work in various industries and the need to provide financial incentives for employees willing to go the extra mile.

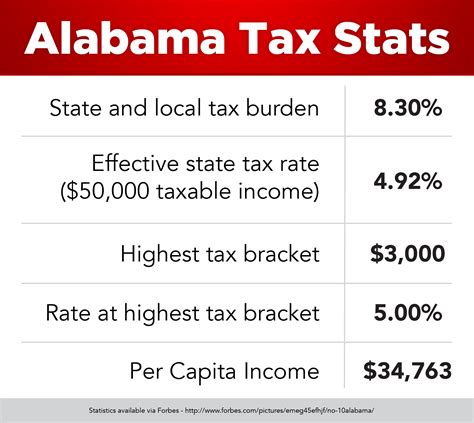

Currently, overtime pay is subject to the same federal income tax rates as regular wages, which can result in a significant portion of earnings being deducted for taxes. The bill aims to address this by creating a separate tax bracket for overtime earnings, effectively reducing the tax burden on workers who choose to work extended hours.

By incentivizing overtime work through tax relief, the bill proponents argue that it will not only benefit employees but also contribute to a more flexible and dynamic workforce. They believe that removing the tax disincentive will encourage workers to take on additional hours, leading to increased productivity and potentially alleviating labor shortages in certain sectors.

Key Provisions of the Bill

The No Tax on Overtime Bill 2025 includes several key provisions that define its scope and potential impact:

- Overtime Definition: The bill defines overtime as any hours worked beyond the standard workweek, typically 40 hours. This definition aligns with the Fair Labor Standards Act (FLSA) and ensures consistency in overtime calculation.

- Tax-Free Overtime Threshold: The bill proposes a threshold of $50,000 in annual income for single filers and $100,000 for joint filers. Overtime earnings above these thresholds would be exempt from federal income tax.

- Phase-In Period: To ease the transition, the bill suggests a phase-in period of three years, during which the tax exemption would gradually increase. This approach aims to mitigate potential budgetary impacts and allow for a smoother implementation.

- Small Business Exemption: Recognizing the unique challenges faced by small businesses, the bill includes a provision to exempt businesses with annual revenues below $5 million from the overtime tax relief. This measure aims to protect small enterprises from potential financial strain.

These provisions aim to strike a balance between providing tax relief for overtime workers and ensuring that the bill's implementation is feasible and does not disproportionately impact certain sectors or income levels.

| Overtime Earnings | Tax Exemption |

|---|---|

| Up to $50,000 (single) / $100,000 (joint) | Full exemption from federal income tax on overtime pay |

| $50,000 to $75,000 (single) / $100,000 to $150,000 (joint) | Partial exemption, with a gradual phase-in of tax relief |

| Above $75,000 (single) / $150,000 (joint) | No tax exemption for overtime pay |

The table above provides a simplified illustration of how the tax exemption would work under the No Tax on Overtime Bill 2025. It demonstrates the progressive nature of the bill, offering the most significant tax relief to those with lower incomes while still providing some benefits to higher-income earners.

Potential Benefits and Impact

The No Tax on Overtime Bill 2025 has the potential to bring about significant changes in the labor market and the economy as a whole. Here are some of the key benefits and impacts that could arise if the bill is enacted:

Increased Incentives for Overtime Work

By removing the tax liability on overtime earnings, the bill is expected to create a powerful incentive for workers to take on additional hours. This could be particularly beneficial in industries facing labor shortages or high demand, such as healthcare, transportation, and certain manufacturing sectors.

For instance, in the healthcare industry, where overtime work is common due to staffing shortages and unpredictable patient needs, the tax relief could encourage more nurses and healthcare professionals to work extended shifts. This, in turn, could lead to improved patient care and reduced wait times in hospitals and clinics.

Enhanced Worker Well-being

One of the often-overlooked aspects of overtime work is its impact on employee well-being. Long hours can lead to fatigue, stress, and burnout, which can negatively affect both physical and mental health. By reducing the financial burden associated with overtime, the bill may encourage a more sustainable approach to overtime work.

With the tax exemption, workers could choose to work overtime hours when they feel physically and mentally capable, rather than being driven by financial necessity. This could result in a healthier and more balanced workforce, leading to improved productivity and job satisfaction over the long term.

Economic Stimulus and Job Creation

The proposed tax relief could have a positive impact on the economy as a whole. By incentivizing overtime work, the bill may stimulate economic activity, as workers with additional income are more likely to spend or invest, boosting consumer spending and driving economic growth.

Moreover, the increased demand for overtime work could lead to the creation of new jobs. Employers may find it more feasible to offer overtime opportunities, which could result in the hiring of additional staff to meet the increased workload. This could be especially beneficial in sectors where overtime is a common practice, such as construction, hospitality, and retail.

Fairness and Equity in the Tax System

The current tax system can sometimes create an imbalance, where overtime workers face higher effective tax rates compared to those working standard hours. The No Tax on Overtime Bill 2025 aims to address this issue by creating a more equitable tax structure.

By exempting overtime pay from taxes, the bill ensures that workers who go above and beyond are not penalized through a higher tax burden. This could promote a sense of fairness among employees, potentially boosting morale and productivity in the workplace.

Challenges and Considerations

While the No Tax on Overtime Bill 2025 presents an intriguing opportunity for positive change, it is not without its challenges and potential drawbacks. Understanding these aspects is crucial for a comprehensive evaluation of the proposed legislation.

Revenue Implications

One of the primary concerns with any tax relief measure is its impact on government revenue. The No Tax on Overtime Bill 2025 is no exception, as exempting overtime earnings from taxes could result in a significant reduction in federal income tax revenue.

Estimates suggest that the bill could lead to a revenue loss of approximately $10 billion annually. While this amount is relatively small compared to the overall federal budget, it is a considerable sum that may require careful consideration and potential offsets to ensure fiscal sustainability.

Potential for Abuse

With any tax incentive, there is always a risk of abuse or unintended consequences. In the case of the No Tax on Overtime Bill 2025, there are concerns that employers may exploit the tax relief by encouraging or pressuring employees to work excessive overtime hours.

To mitigate this risk, the bill includes provisions that require employers to comply with existing labor laws, including those related to overtime pay and maximum working hours. Additionally, it is crucial for workers to remain vigilant and report any instances of abuse or exploitation to the appropriate authorities.

Impact on Small Businesses

While the bill includes an exemption for small businesses with annual revenues below $5 million, there are still concerns about the potential impact on this sector. Small businesses often operate on tight margins and may struggle to offer competitive overtime rates without the tax relief.

To address this concern, the bill's proponents suggest that small businesses could benefit from the increased spending power of their employees, who will have more disposable income due to the tax exemption. Additionally, the phase-in period could allow small businesses to gradually adjust their operations and overtime policies.

Broader Implications and Future Outlook

The No Tax on Overtime Bill 2025 has the potential to shape the future of work and the economy in several significant ways. By incentivizing overtime work and promoting a more flexible and responsive workforce, the bill could contribute to a more resilient and adaptable labor market.

Workforce Flexibility and Adaptability

The bill's focus on overtime work aligns with the changing nature of employment and the increasing demand for flexible work arrangements. As the gig economy and project-based work become more prevalent, the ability to work extended hours on a temporary basis could become a valuable asset for workers and employers alike.

By providing tax relief for overtime work, the bill may encourage a shift towards a more flexible workforce, where employees can choose to work additional hours when needed, such as during peak seasons or to meet specific project deadlines. This could lead to a more dynamic and responsive labor market, benefiting both employers and workers.

Promoting Fair Wages and Labor Rights

The No Tax on Overtime Bill 2025 also aligns with broader efforts to promote fair wages and protect labor rights. By reducing the tax burden on overtime pay, the bill could help ensure that workers are adequately compensated for their efforts and that overtime work is not exploited by employers.

Additionally, the bill's emphasis on tax fairness could contribute to a broader conversation about wage inequality and the distribution of wealth. By highlighting the importance of overtime work and the need for fair compensation, the bill may inspire further legislative and policy changes aimed at improving the overall well-being of workers.

Potential for International Impact

The No Tax on Overtime Bill 2025 could also have implications beyond the borders of the United States. As other countries observe the potential benefits and challenges of this legislation, they may be inspired to explore similar reforms in their own tax systems.

For example, countries with significant manufacturing sectors, such as Germany or Japan, may consider implementing tax relief measures for overtime work to boost productivity and compete in the global marketplace. The international impact of the bill could lead to a broader discussion on the role of tax policy in shaping labor markets and economic growth.

Conclusion: A Step Towards a Fairer Tax System

The No Tax on Overtime Bill 2025 presents a compelling proposal to reform the tax system and incentivize overtime work. By offering tax relief to workers who choose to work extended hours, the bill has the potential to bring about positive changes in the labor market, economy, and society as a whole.

While challenges and considerations exist, the bill's proponents argue that the potential benefits outweigh the drawbacks. By carefully crafting and implementing this legislation, policymakers can take a significant step towards creating a fairer and more equitable tax system that recognizes and rewards the contributions of overtime workers.

As the bill progresses through the legislative process, it will be crucial to monitor its impact and gather feedback from workers, employers, and experts to ensure that the intended benefits are realized and any unintended consequences are addressed.

How will the No Tax on Overtime Bill impact my tax return?

+The bill aims to simplify tax returns for overtime workers. You will calculate your regular income and overtime income separately, and the overtime income above the specified thresholds will be exempt from federal income tax. This means you may see a reduction in your overall tax liability, especially if you work significant overtime hours.

Will this bill encourage employers to exploit workers by forcing them to work excessive overtime hours?

+The bill includes provisions to protect workers from exploitation. Employers must still comply with labor laws regarding overtime pay and maximum working hours. Additionally, workers have the right to refuse excessive overtime and report any instances of abuse to the appropriate authorities.

How will the phase-in period affect the implementation of the bill?

+The phase-in period is designed to ease the transition and minimize the impact on government revenue. During this period, the tax exemption will gradually increase, providing time for workers, employers, and the government to adjust to the new tax structure. This approach aims to ensure a smooth implementation process.