State Tax Utah Rates

Utah's state tax system is designed to fund public services and infrastructure while maintaining a balanced approach to taxation. The state levies various taxes, including income tax, sales tax, and property tax, each with its own rates and regulations. Understanding these tax rates is crucial for individuals and businesses operating within Utah, as it allows for better financial planning and compliance with state tax laws.

Income Tax Rates in Utah

Utah’s income tax is progressive, meaning the tax rate increases as income levels rise. As of 2023, the state has five income tax brackets, each with its own tax rate. Here is a breakdown of these brackets:

| Income Bracket | Tax Rate |

|---|---|

| First $2,400 of taxable income | 4.65% |

| $2,400.01 - $6,000 | 4.85% |

| $6,000.01 - $10,000 | 5.15% |

| $10,000.01 - $16,000 | 5.45% |

| Over $16,000 | 5.75% |

It's important to note that these rates are subject to change, and residents are advised to refer to the latest tax guidelines issued by the Utah State Tax Commission for the most accurate and up-to-date information.

Tax Credits and Deductions

Utah offers various tax credits and deductions that can reduce the overall tax liability for individuals and businesses. Some common deductions include the standard deduction, personal exemptions, and deductions for business expenses. Additionally, Utah residents may be eligible for tax credits such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit.

Filing and Payment Options

Utah residents have multiple options for filing their income tax returns. The Utah State Tax Commission provides an online filing system, UtahTaxes.utah.gov, which is user-friendly and secure. Taxpayers can also choose to file their returns by mail or seek assistance from tax professionals. Payment options include direct debit, credit/debit cards, and electronic funds transfer.

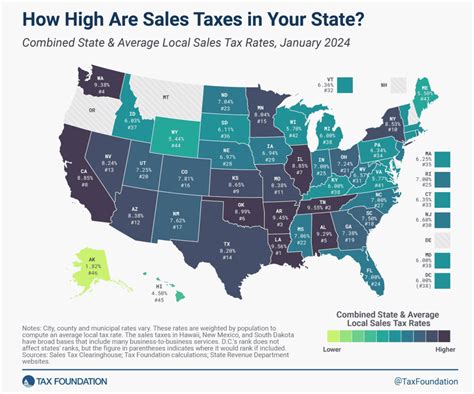

Sales and Use Tax Rates

Utah imposes a state sales and use tax on the sale of tangible personal property and certain services. The base state sales tax rate is 4.70%, and local municipalities may also levy additional sales taxes, creating a combined rate that varies across the state.

Sales Tax Exemptions and Special Rates

Certain items and services are exempt from Utah’s sales tax. These include most food items for home consumption, prescription drugs, and select medical devices. Additionally, Utah has special sales tax rates for specific products like alcohol (16.46%) and gasoline (46 cents per gallon). It’s crucial for businesses to understand these exemptions and special rates to ensure compliance and avoid overcharging customers.

Use Tax

Utah’s use tax applies to goods and services purchased from out-of-state vendors if those items would have been subject to Utah’s sales tax had they been purchased within the state. This tax ensures fairness and equal treatment for local businesses and prevents tax evasion. The use tax rate mirrors the sales tax rate, and it is the responsibility of the purchaser to remit this tax to the Utah State Tax Commission.

Property Tax in Utah

Property tax is an essential revenue source for local governments in Utah, as it funds vital services such as education, public safety, and infrastructure. The property tax rate in Utah varies across different counties and municipalities.

Assessment and Taxation Process

Property in Utah is assessed and taxed based on its fair market value. The assessment is conducted by the Utah State Tax Commission, and the resulting value is then used to calculate the property tax. The tax rate is determined by the local taxing entities, which include counties, cities, and special service districts. These entities set their tax rates based on the budget they need to operate and provide services to their constituents.

Tax Relief Programs

Utah offers several tax relief programs to assist homeowners, especially those who may be struggling financially. These programs include the Property Tax Deferral Program, which allows eligible homeowners aged 65 and older to defer a portion of their property taxes until they sell their home or no longer occupy it as their primary residence. Additionally, the Utah State Tax Commission provides information on other tax relief options, such as the Disabled Veteran Property Tax Exemption and the Disabled Civilian Property Tax Exemption.

Other Utah Taxes

In addition to the taxes mentioned above, Utah levies several other taxes to support specific industries and services. These include:

- Lodging Tax: Imposed on the rental of accommodations for short-term stays.

- Tobacco Tax: Levied on the sale of tobacco products.

- Mining Tax: Applied to the extraction of certain minerals.

- Severance Tax: Imposed on the extraction and production of natural resources.

Each of these taxes has its own specific rates and regulations, and it's essential for businesses and individuals engaged in these activities to understand their tax obligations.

When is the tax filing deadline in Utah?

+

For most individuals, the tax filing deadline in Utah is aligned with the federal deadline, which is typically April 15th of each year. However, this can be extended to October 15th for those who file for an extension. It’s always best to refer to the official guidelines provided by the Utah State Tax Commission for the most accurate and up-to-date information.

Are there any special tax considerations for remote workers in Utah?

+

Yes, Utah has specific guidelines for remote workers, particularly those working for out-of-state companies. In general, remote workers are required to pay taxes based on where they live, not where their employer is located. This means that Utah residents working for out-of-state companies would typically pay Utah state taxes, while non-residents working remotely for Utah companies may not be subject to Utah taxes. It’s essential for remote workers to understand these nuances and consult with tax professionals if needed.

How often do Utah’s tax rates change?

+

Utah’s tax rates can change periodically, typically as a result of legislative action or to address budget needs. While major tax rate changes are relatively infrequent, it’s important for taxpayers to stay informed and aware of any potential changes. The Utah State Tax Commission usually provides updates and notifications regarding any significant tax rate adjustments.