Property Tax Santa Clara County

Property taxes are a crucial aspect of local government funding, and understanding the specifics of your area's tax structure can be invaluable for homeowners and investors alike. Santa Clara County, located in the heart of Silicon Valley, boasts a thriving real estate market and a diverse range of property types, making a thorough exploration of its property tax system essential.

Unraveling the Property Tax Landscape in Santa Clara County

The property tax system in Santa Clara County operates under the principles outlined in the California Constitution and various state laws. These regulations provide the framework for assessing property values, calculating tax rates, and ensuring a fair and transparent taxation process.

Property Assessment and Valuation

The process of determining property value, a critical step in property taxation, is undertaken by the Santa Clara County Assessor’s Office. This office is responsible for assessing the value of all taxable properties within the county, ensuring accuracy and fairness in the valuation process.

The assessment process involves evaluating factors such as the property's location, size, improvements, and market conditions. This data is then used to calculate the Assessed Value (AV), which serves as the basis for property tax calculations. Santa Clara County employs a declining assessment ratio, meaning that the AV of a property generally decreases over time, except in cases of new construction or significant improvements.

| Assessment Ratio | Description |

|---|---|

| 100% | Initial assessment ratio for new properties or properties with significant changes. |

| 80% | Ratio applied to most properties after the first year. |

| 75% | Ratio for properties with certain characteristics, such as those in areas with high property value fluctuations. |

Tax Rate Calculation and Breakdown

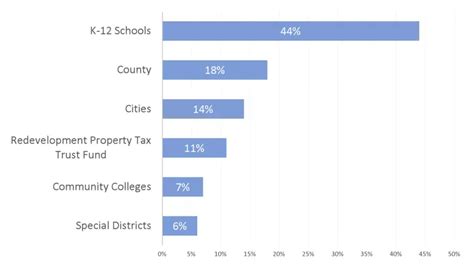

The tax rate in Santa Clara County is determined by a combination of the county’s general tax rate, special assessments, and voter-approved initiatives. The general tax rate is set annually by the county’s Board of Supervisors and is applied uniformly across all taxable properties.

In addition to the general tax rate, properties in Santa Clara County may be subject to special assessments, which are additional charges levied by local agencies for specific purposes such as infrastructure improvements or maintenance. These assessments are typically tied to a specific property or neighborhood and can vary significantly.

Voter-approved initiatives, such as school bonds or infrastructure projects, can also result in additional property tax rates. These rates are typically approved through ballot measures and are dedicated to specific projects or services.

Tax Bill Components

A typical property tax bill in Santa Clara County consists of several components, including:

- General Tax: This is the base tax rate set by the county and applies to all taxable properties.

- Special Assessments: Additional charges for specific purposes, as outlined above.

- Voter-Approved Measures: Rates associated with specific initiatives or projects approved by voters.

- Penalty and Interest: Late payment penalties and interest charges may apply if taxes are not paid by the due date.

Property Tax Relief Programs

Santa Clara County offers various property tax relief programs to assist homeowners, particularly those on fixed incomes or with financial hardships. These programs include:

- Homeowner's Property Tax Exemption: Provides a partial exemption from property taxes for qualifying homeowners.

- Senior Citizen's Property Tax Postponement: Allows eligible seniors to defer property tax payments until their property is sold or they pass away.

- Disabled Veterans' Property Tax Exemption: Offers a full or partial exemption for qualifying disabled veterans.

Property Tax Payment Options and Due Dates

Property taxes in Santa Clara County are typically due in two installments, with the first installment due on December 10th and the second on April 10th of the following year. However, if these dates fall on a weekend or holiday, the due date is extended to the next business day.

Homeowners have several payment options, including online payment, payment by phone, and traditional methods such as mail or in-person at the County Treasurer-Tax Collector's office.

Analyzing Property Tax Trends and Impact

Understanding the historical and projected trends in property taxes is crucial for both homeowners and investors. Let’s delve into some data and analysis to provide a clearer picture of the property tax landscape in Santa Clara County.

Historical Property Tax Rates

Over the past decade, Santa Clara County has experienced a generally stable property tax rate, with only minor fluctuations. The average annual general tax rate has hovered around 1.05% of the assessed value, with a slight increase observed in the past few years.

| Year | General Tax Rate |

|---|---|

| 2013 | 1.03% |

| 2014 | 1.04% |

| 2015 | 1.03% |

| 2016 | 1.05% |

| 2017 | 1.04% |

| 2018 | 1.06% |

| 2019 | 1.05% |

| 2020 | 1.06% |

| 2021 | 1.07% |

| 2022 | 1.08% |

Impact of Property Tax on Homeownership

Property taxes play a significant role in the affordability of homeownership. In Santa Clara County, the average annual property tax bill for a median-value home can range from 4,000 to 6,000, depending on the specific location and any applicable special assessments.

For first-time homebuyers, the property tax can represent a substantial portion of their monthly housing costs. It's essential for prospective buyers to factor these expenses into their financial planning to ensure sustainable homeownership.

Future Projections and Considerations

Looking ahead, several factors may influence property tax rates in Santa Clara County. These include:

- Population Growth: The county's population is expected to continue growing, which may lead to increased demand for services and potentially higher tax rates.

- Infrastructure Development: Proposed infrastructure projects, such as road improvements or public transportation initiatives, could result in additional special assessments.

- Economic Fluctuations: Economic downturns can impact property values and, subsequently, property tax revenue. The county may need to adjust tax rates to maintain service levels during such periods.

Conclusion

Navigating the property tax landscape in Santa Clara County requires a thorough understanding of the assessment process, tax rate calculation, and various relief programs. By staying informed and proactive, homeowners and investors can effectively manage their property tax obligations and plan for the future.

Frequently Asked Questions

How often are property values reassessed in Santa Clara County?

+

Property values are reassessed every year to ensure that the assessed value accurately reflects the current market conditions. This annual reassessment is a key aspect of the county’s property tax system.

Are there any exemptions or reductions available for property taxes in Santa Clara County?

+

Yes, Santa Clara County offers several tax relief programs, including the Homeowner’s Property Tax Exemption, Senior Citizen’s Property Tax Postponement, and Disabled Veterans’ Property Tax Exemption. These programs provide financial relief to eligible homeowners.

How can I appeal my property’s assessed value in Santa Clara County?

+

If you believe your property’s assessed value is inaccurate, you can file an appeal with the Santa Clara County Assessor’s Office. The process typically involves submitting documentation to support your claim, and a hearing may be scheduled to review your appeal.

What happens if I miss the property tax payment deadline in Santa Clara County?

+

If you miss the payment deadline, a penalty and interest charge will be added to your tax bill. It’s important to note that late payments can impact your credit score and may result in additional fees. Contact the County Treasurer-Tax Collector’s office for more information on late payment options.

How can I stay updated on property tax-related news and changes in Santa Clara County?

+

Staying informed is crucial. You can subscribe to notifications from the Santa Clara County Assessor’s Office and the County Treasurer-Tax Collector’s office. Additionally, local news outlets often cover relevant property tax news and updates.