Lee County Property Tax Search

Property taxes are a crucial aspect of owning real estate, and understanding the assessment and payment process is essential for homeowners and investors alike. In Lee County, Florida, the property tax system is designed to ensure fair and accurate taxation. This article will delve into the details of the Lee County Property Tax Search, providing an in-depth analysis of the process, rates, and key considerations.

Understanding Lee County Property Tax Rates

Lee County, known for its beautiful beaches and vibrant communities, has a property tax system that is governed by the Florida Department of Revenue and local authorities. The tax rates in Lee County are determined by a combination of factors, including the millage rate and the assessed value of the property.

The millage rate is a crucial component, representing the tax rate per thousand dollars of assessed value. In Lee County, the millage rate is set annually by the Board of County Commissioners, taking into account the budget requirements for various county services. This rate can vary across different areas within the county, impacting the overall property tax burden.

| Area | Millage Rate |

|---|---|

| Unincorporated Lee County | 8.5629 mills |

| City of Cape Coral | 8.9397 mills |

| City of Fort Myers | 7.5263 mills |

| Town of Fort Myers Beach | 6.7637 mills |

It's important to note that the millage rate is subject to change annually, so it's essential to stay updated with the latest information. Property owners can refer to the official Lee County Property Appraiser's website for the most accurate and up-to-date millage rates.

Assessed Value and Property Tax Calculation

The assessed value of a property is another critical factor in determining the property tax. In Lee County, properties are appraised by the Lee County Property Appraiser’s Office, which assigns a fair market value to each property based on various factors such as location, size, improvements, and recent sales data.

The assessed value is then used to calculate the property tax liability. The formula for calculating property tax is as follows:

Property Tax = Assessed Value x Millage Rate

For example, if a property in Cape Coral has an assessed value of $250,000 and the millage rate is 8.9397 mills, the property tax calculation would be:

Property Tax = $250,000 x 0.0089397 = $2,234.93

This illustrates how the assessed value and millage rate combine to determine the property tax liability for a given property.

Lee County Property Tax Search: A Comprehensive Guide

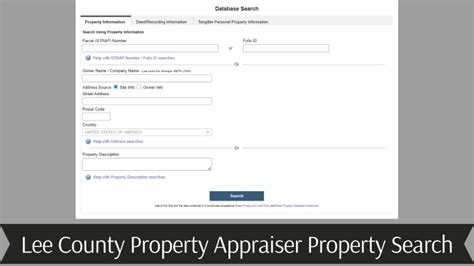

Accessing and understanding your property tax information in Lee County is made easier through the official Lee County Property Tax Search platform. This online tool provides a wealth of information to property owners and prospective buyers.

Accessing the Property Tax Search Portal

To begin your property tax search, you can visit the Lee County Property Search Portal. This user-friendly platform allows you to input your property’s address or parcel number to retrieve detailed tax information.

Once you've accessed the portal, you'll be able to view various details about your property, including:

- Property Address and Location

- Parcel Number and Legal Description

- Assessed Value and Taxable Value

- Current Millage Rate and Tax Amount

- Payment Due Dates and Payment History

The portal provides a comprehensive overview of your property's tax situation, allowing you to stay informed and plan your finances effectively.

Understanding the Property Tax Bill

The property tax bill is a critical document that outlines the amount due and the payment deadline. In Lee County, the tax bill is typically mailed to property owners in November, with the payment deadline usually set for March 31st of the following year.

The tax bill includes important details such as the property's legal description, the assessed value, and the calculated tax amount. It also provides information on any applicable exemptions or discounts, such as the Homestead Exemption or Senior Citizen Discount. Understanding these exemptions can significantly reduce your tax liability.

It's essential to review your tax bill carefully and ensure its accuracy. Any discrepancies or concerns should be addressed with the Lee County Property Appraiser's Office promptly.

Payment Options and Due Dates

Lee County offers various payment options to accommodate different preferences and needs. Property owners can choose from the following methods:

- Online Payment: A convenient and secure option, allowing you to pay your tax bill through the Lee County Property Search Portal. This method is fast and efficient, providing real-time confirmation of your payment.

- Mail-in Payment: You can mail your tax bill along with a check or money order to the Lee County Tax Collector's Office. Ensure that the payment is postmarked by the due date to avoid late fees.

- In-Person Payment: Visit one of the designated Tax Collector's Office locations to make your payment in person. This option provides immediate confirmation and allows for any necessary adjustments.

It's important to note that late payments may incur penalties and interest, so staying informed about the due dates and utilizing the available payment options is crucial.

Exemptions and Discounts: Maximizing Your Savings

Lee County offers various exemptions and discounts to eligible property owners, helping to reduce their tax liability. Understanding these benefits and applying for them can result in significant savings.

Homestead Exemption

The Homestead Exemption is one of the most widely utilized exemptions in Florida. It provides a reduction in the assessed value of a property for homeowners who reside in the property as their primary residence. This exemption can result in substantial tax savings, especially for long-term residents.

To qualify for the Homestead Exemption, property owners must meet certain criteria, including:

- Legal residence in Florida

- Ownership of the property as of January 1st of the tax year

- Permanent residence in the property

The application process for the Homestead Exemption is straightforward, and it can be completed online or in person at the Lee County Property Appraiser's Office. Once approved, the exemption is renewable annually, providing ongoing tax benefits.

Senior Citizen Discount

Lee County also offers a Senior Citizen Discount, providing a reduction in property taxes for eligible senior citizens. To qualify, homeowners must be:

- 65 years of age or older

- Permanent residents of Florida

- Have a household income that does not exceed certain limits (varies annually)

The Senior Citizen Discount can provide a significant reduction in property taxes, making it a valuable benefit for eligible seniors. The application process is similar to that of the Homestead Exemption, and it can be completed online or in person.

Other Exemptions and Discounts

In addition to the Homestead Exemption and Senior Citizen Discount, Lee County offers various other exemptions and discounts, including:

- Disabled Veteran's Exemption: Provides a reduction in assessed value for qualifying disabled veterans.

- Widow/Widower Exemption: Offers a tax benefit to surviving spouses of deceased homeowners.

- Agricultural Exemption: Reduces the assessed value of agricultural lands, promoting the preservation of farmland.

- Greenbelt Exemption: Provides tax benefits for environmentally sensitive lands.

It's important to research and understand the eligibility criteria for these exemptions and apply accordingly to maximize your savings.

Appealing Your Property Tax Assessment

In some cases, property owners may feel that their property’s assessed value is inaccurate or unfair. In such situations, Lee County provides a process for appealing the assessment.

Steps to Appeal Your Assessment

If you believe your property’s assessed value is incorrect, you can follow these steps to initiate an appeal:

- Review your property's tax information, including the assessed value and comparable sales data.

- Gather evidence and documentation to support your claim, such as recent appraisals, market data, or any relevant information.

- Contact the Lee County Property Appraiser's Office to discuss your concerns and request a review.

- If the review does not resolve your concerns, you can file a formal petition for an administrative hearing.

- Attend the administrative hearing, where you can present your case and supporting evidence to a hearing officer.

- The hearing officer will make a determination, and you will receive a written decision outlining the outcome.

It's important to note that the appeal process can be complex and time-consuming, so it's advisable to seek professional guidance if needed.

Considerations for a Successful Appeal

To increase your chances of a successful appeal, consider the following:

- Ensure you have a strong case with supporting evidence.

- Familiarize yourself with the assessment process and criteria used by the Property Appraiser's Office.

- Understand the market value of your property and how it compares to similar properties in the area.

- Seek assistance from a professional appraiser or tax consultant if needed.

By taking a proactive and informed approach, you can navigate the appeal process effectively and potentially reduce your property tax liability.

Future Implications and Key Considerations

As property values and market conditions fluctuate, it’s essential to stay informed about potential changes in Lee County’s property tax landscape. Here are some key considerations for the future:

Market Fluctuations and Property Values

The real estate market in Lee County, like any other, is subject to economic cycles and external factors. Property values can rise or fall, impacting the assessed value and, consequently, the property tax liability. Staying updated on market trends and property values in your area is crucial for accurate tax planning.

Legislative Changes and Tax Reform

The property tax system in Florida, including Lee County, is subject to legislative changes and potential reforms. Keeping an eye on proposed bills and amendments that may impact property taxes is essential. These changes can influence the millage rate, assessment processes, and available exemptions, so staying informed is vital.

Long-Term Planning and Budgeting

Property taxes are a recurring expense for homeowners and investors. To ensure financial stability and planning, it’s beneficial to consider property taxes as a long-term commitment. Incorporating tax payments into your annual budget and exploring strategies to optimize your tax liability can provide peace of mind and financial security.

Conclusion

Understanding the Lee County Property Tax Search process and its various components is crucial for property owners and prospective buyers. By staying informed about tax rates, assessment processes, and available exemptions, you can effectively manage your property tax liability. The official Lee County Property Search Portal provides a convenient and accessible way to access your property’s tax information, making it easier to plan and budget accordingly.

As you navigate the world of property taxes in Lee County, remember to stay updated on market trends, legislative changes, and potential exemptions. By doing so, you can make informed decisions and optimize your financial strategy, ensuring a stable and prosperous future for your real estate investments.

Frequently Asked Questions

When is the property tax due in Lee County, Florida?

+

Property taxes in Lee County are due by March 31st of each year. However, you can pay your taxes in two installments if you prefer. The first installment is due by March 31st, and the second installment is due by November 30th.

How can I pay my property taxes in Lee County?

+

Lee County offers various payment options, including online payment through the official website, mail-in payment with a check or money order, and in-person payment at designated Tax Collector’s Office locations. You can choose the method that suits your preferences and convenience.

Are there any exemptions or discounts available for property taxes in Lee County?

+

Yes, Lee County offers several exemptions and discounts to eligible property owners. These include the Homestead Exemption, Senior Citizen Discount, Disabled Veteran’s Exemption, Widow/Widower Exemption, Agricultural Exemption, and Greenbelt Exemption. Each exemption has specific eligibility criteria, so it’s important to research and apply for the ones that may benefit you.

How can I appeal my property tax assessment in Lee County?

+

If you believe your property’s assessed value is inaccurate or unfair, you can appeal the assessment. The process involves reviewing your property’s tax information, gathering supporting evidence, contacting the Property Appraiser’s Office, and potentially attending an administrative hearing. It’s advisable to seek professional guidance for a successful appeal.

Where can I find more information about Lee County’s property tax system and rates?

+

For detailed information about Lee County’s property tax system, rates, and assessment processes, you can visit the official websites of the Lee County Property Appraiser’s Office and the Lee County Tax Collector’s Office. These websites provide comprehensive resources and tools to help you understand and manage your property taxes effectively.