Illegal Immigrants Pay Taxes

The topic of illegal immigrants and their tax contributions is a complex and often misunderstood issue. While it may seem counterintuitive, the reality is that undocumented immigrants in the United States do pay taxes, contributing billions of dollars annually to federal, state, and local economies. This article aims to shed light on this matter, providing an in-depth analysis and addressing common misconceptions.

Understanding the Tax Contributions of Undocumented Immigrants

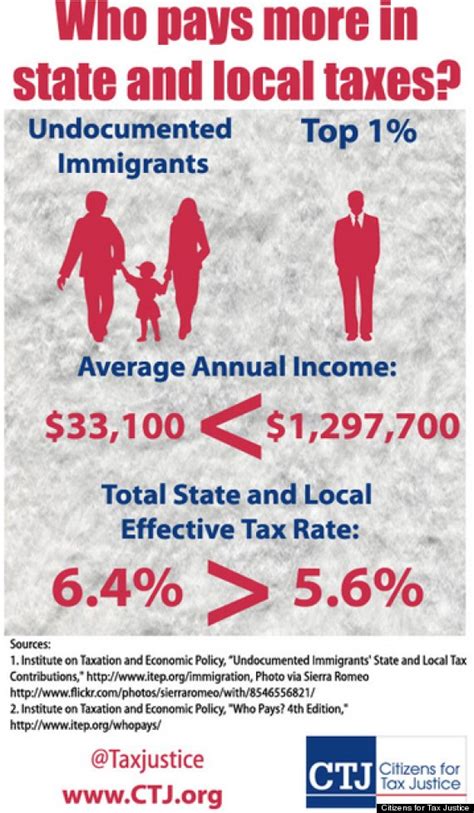

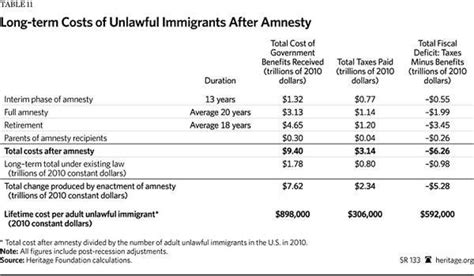

Contrary to popular belief, illegal immigrants are not exempt from paying taxes. In fact, many undocumented individuals contribute to the tax system through various mechanisms, including income taxes, sales taxes, and property taxes. While their status may limit their access to certain tax benefits and programs, they still have tax obligations and often fulfill them.

Income Tax Payments

Undocumented immigrants who work in the United States, regardless of their legal status, are required to pay federal income taxes. Many use Individual Taxpayer Identification Numbers (ITINs) to file their tax returns and pay the necessary taxes. According to the Internal Revenue Service (IRS), ITINs are used by individuals who are not eligible for a Social Security Number but still need to file tax returns, verify their identity, or claim benefits.

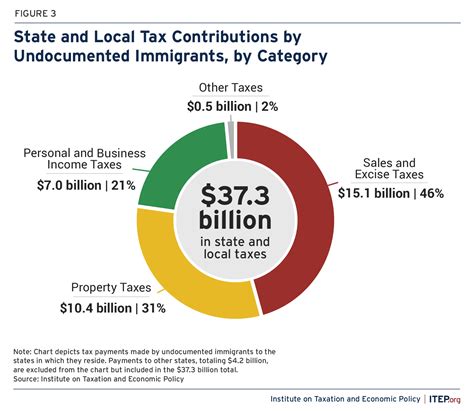

A study by the Institute on Taxation and Economic Policy (ITEP) reveals that in 2019, undocumented immigrants and their households paid an estimated $25.6 billion in state and local taxes, including income taxes. This figure is a significant contribution to the overall tax revenue of the United States.

Sales and Consumption Taxes

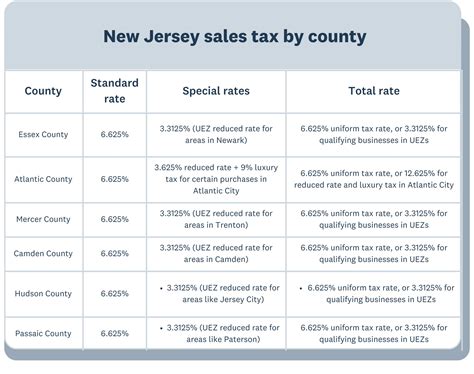

Sales taxes are another area where undocumented immigrants contribute. When they purchase goods and services, they pay sales taxes just like any other consumer. These taxes fund various public services and infrastructure projects. In some states, such as California, the impact is significant. A report by the California Legislative Analyst’s Office estimates that undocumented immigrants contribute over $3 billion annually to the state’s General Fund through sales and other taxes.

Property Taxes and Rent

Undocumented immigrants who own property or rent housing also contribute to the tax system. Property taxes are a major source of revenue for local governments, and undocumented homeowners pay their fair share. Even renters contribute indirectly through their monthly rent payments, as landlords often factor property taxes into rental prices.

| Tax Type | Estimated Annual Contribution |

|---|---|

| Income Taxes | $11.7 billion (ITEP, 2019) |

| Sales and Consumption Taxes | $13.9 billion (ITEP, 2019) |

| Property Taxes | Varies by location, but significant contributions are made. |

The Impact on Social Security and Medicare

Undocumented immigrants’ tax contributions extend beyond income and sales taxes. They also contribute to social safety net programs like Social Security and Medicare, albeit indirectly.

Social Security

Undocumented workers who use ITINs to file their taxes contribute to the Social Security trust fund. While they may not be eligible for benefits themselves, their payroll tax contributions help support the program. According to the Social Security Administration, these contributions can total hundreds of millions of dollars annually.

A 2018 study by the National Bureau of Economic Research (NBER) estimated that undocumented immigrants paid around $15 billion in payroll taxes between 1990 and 2010, benefiting Social Security and Medicare trust funds.

Medicare and Medicaid

While undocumented immigrants are generally ineligible for Medicare and Medicaid, their tax contributions still support these programs. A portion of the taxes they pay goes towards funding these vital healthcare programs for eligible Americans.

| Social Safety Net Program | Undocumented Immigrant Contribution |

|---|---|

| Social Security | Payroll tax contributions, estimated at $15 billion (1990-2010) |

| Medicare | Tax contributions supporting the program |

| Medicaid | Indirect support through tax contributions |

Addressing Misconceptions and the Impact on Communities

Despite the substantial tax contributions of undocumented immigrants, misconceptions and stereotypes persist. It is crucial to address these misconceptions to foster a more accurate understanding of the issue.

Dispelling Myths

- Myth: Undocumented immigrants are a burden on the tax system.

Reality: As we’ve seen, undocumented immigrants contribute billions of dollars annually to various tax systems. They pay income, sales, and property taxes, supporting local and federal governments.

- Myth: They don’t pay taxes because they use fake Social Security Numbers.

Reality: While some may use false identification, many undocumented immigrants use ITINs to file their taxes legitimately. The IRS has strict guidelines for ITIN usage, ensuring tax compliance.

- Myth: Undocumented immigrants benefit from tax-funded programs without contributing.

Reality: While they may not directly benefit from some programs, their tax contributions support a range of public services and infrastructure. They contribute to the overall well-being of the communities they live in.

Community Benefits and Economic Impact

The tax contributions of undocumented immigrants have a positive impact on their communities. Their tax dollars fund local schools, roads, public safety, and other essential services. In many cases, these contributions are crucial for the economic vitality of the regions where they reside.

For example, a study by the Center for American Progress (CAP) found that in California, undocumented immigrants' tax contributions support vital services, including education, healthcare, and public safety. The state's economy benefits significantly from these contributions, especially in industries like agriculture and construction.

Conclusion: A Complex Relationship

The relationship between undocumented immigrants and the tax system is multifaceted and complex. While they face challenges and limitations, their contributions are undeniable and significant. Understanding this reality is crucial for informed discussions and policy-making regarding immigration and tax reform.

As we've explored, undocumented immigrants' tax payments extend beyond income taxes, impacting sales, property, and even social safety net programs. Their contributions are a vital part of the economic fabric of the United States, and their role should be recognized and respected.

Further research and analysis are needed to fully understand the economic and social impacts of undocumented immigrants' tax contributions. As the conversation around immigration continues, it is essential to base decisions on facts and accurate information.

How do undocumented immigrants file taxes without a Social Security Number?

+Undocumented immigrants who work in the U.S. can obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. This allows them to file their tax returns and pay the necessary taxes.

Do undocumented immigrants receive tax refunds?

+Undocumented immigrants who pay taxes are eligible for tax refunds, just like any other taxpayer. However, their eligibility for certain tax credits and deductions may be limited due to their immigration status.

What happens to the tax contributions of undocumented immigrants if they are deported?

+If an undocumented immigrant is deported, their tax contributions remain in the system and continue to support various programs and services. Their tax payments are not refundable, and they do not receive any benefits from these contributions.