What Is Colorado Sales Tax

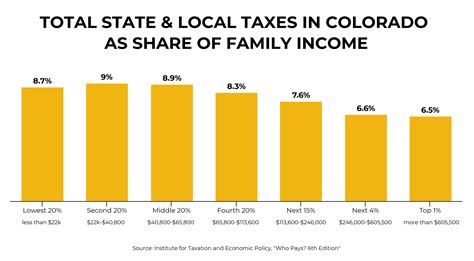

Welcome to the world of Colorado's sales tax system, a fascinating and intricate web of regulations and rates that impact every purchase made within the state. As a resident or a business owner in Colorado, understanding this system is crucial for staying compliant and ensuring a smooth financial journey. In this comprehensive guide, we'll delve into the specifics of Colorado sales tax, from its historical development to the latest rates and regulations, offering you a clear and actionable roadmap.

The Historical Evolution of Colorado Sales Tax

The journey of sales tax in Colorado began in 1935 when the state first imposed a 2% sales tax rate. This marked a significant step towards generating revenue and funding essential state services. Over the decades, the sales tax rate has undergone several adjustments, each reflecting the economic climate and the state’s financial needs.

One of the most notable milestones in Colorado sales tax history was the Taxpayer's Bill of Rights (TABOR) amendment to the state constitution in 1992. TABOR imposed strict limits on tax increases, requiring voter approval for any rate changes above a certain threshold. This amendment had a profound impact on the state's fiscal policy and continues to shape the sales tax landscape today.

Current Sales Tax Rates in Colorado

As of my last update in January 2023, Colorado operates with a state-wide sales and use tax rate of 2.9%. However, this is just the beginning of the story, as Colorado is unique in its local tax structure.

In addition to the state-wide rate, Colorado allows for local governments to impose their own sales and use taxes. This means that the total sales tax rate can vary significantly depending on the location of the purchase. For instance, in the city of Denver, the total sales tax rate is 8.312%, which includes the state rate, a 3.812% city rate, and a 1.6% rate for specific transportation projects.

| Location | Total Sales Tax Rate | State Rate | Local Rate |

|---|---|---|---|

| Denver | 8.312% | 2.9% | 5.412% |

| Boulder | 7.68% | 2.9% | 4.78% |

| Colorado Springs | 7.15% | 2.9% | 4.25% |

| Fort Collins | 7.58% | 2.9% | 4.68% |

These local rates can be further broken down into specific taxes for various purposes, such as transportation, public safety, or cultural facilities. This complexity ensures that sales tax revenue is directed towards the specific needs of each community.

Sales Tax Exemptions and Special Considerations

Colorado’s sales tax system also includes a range of exemptions and special considerations. Certain goods and services are exempt from sales tax, such as most groceries, prescription drugs, and over-the-counter medications. Additionally, certain groups, like Native American tribes and qualifying nonprofits, may be eligible for sales tax exemptions or refunds.

It's important to note that while many states offer a sales tax holiday for back-to-school shopping or other specific periods, Colorado does not currently have any such provisions. However, the state does allow for tax refunds on certain items, such as sales tax paid on purchases made by out-of-state residents.

Registration and Compliance for Businesses

For businesses operating in Colorado, understanding and complying with sales tax regulations is a critical aspect of their financial operations. The Colorado Department of Revenue provides resources and guidelines to help businesses navigate the sales tax landscape, including registration processes and tax collection and remittance procedures.

Businesses are required to register for a sales tax license with the state and may also need to register with local governments depending on their location and the nature of their operations. Regular reporting and payment of sales tax are essential to maintain compliance and avoid penalties.

The Impact of E-Commerce on Colorado Sales Tax

The rise of e-commerce has presented unique challenges and opportunities for sales tax collection in Colorado. With the advent of remote sellers and online marketplaces, the state has had to adapt its regulations to ensure that sales tax is collected on these transactions.

In 2017, Colorado implemented the Marketplace Fairness Act, which requires remote sellers and online marketplaces to collect and remit sales tax on behalf of the state. This legislation has had a significant impact on the sales tax landscape, ensuring that e-commerce businesses contribute to the state's revenue stream.

Looking Ahead: Future Trends and Developments

As we move forward, several trends and developments are likely to shape the future of Colorado’s sales tax system. The continued growth of e-commerce and the evolving nature of the digital economy will present ongoing challenges and opportunities for tax collection.

Additionally, the state's fiscal needs and economic priorities may drive further adjustments to the sales tax rate or structure. Keeping an eye on these developments is crucial for both consumers and businesses to ensure they remain informed and compliant with the latest regulations.

Conclusion

Colorado’s sales tax system is a dynamic and ever-evolving entity, shaped by historical context, local needs, and the evolving digital economy. By understanding the intricacies of this system, residents and businesses can navigate their financial obligations with confidence and contribute to the vibrant economic landscape of the state.

How often are sales tax rates updated in Colorado?

+Sales tax rates in Colorado can be adjusted annually, typically in response to the state’s fiscal needs and economic climate. However, local governments may adjust their rates more frequently to address specific community needs.

Are there any plans to simplify Colorado’s sales tax structure?

+While there have been discussions about simplifying the sales tax structure, particularly regarding the various local rates, no significant changes have been implemented to date. The current system reflects the state’s commitment to local control and community-specific needs.

How does Colorado handle sales tax for online purchases?

+Colorado has implemented laws requiring remote sellers and online marketplaces to collect and remit sales tax on behalf of the state. This ensures that online purchases contribute to the state’s revenue stream just like in-person transactions.