Sales Tax For Cars In Nj

Sales tax is an important consideration when purchasing a car, as it can significantly impact the overall cost of your vehicle. In the state of New Jersey, understanding the sales tax regulations and how they apply to car purchases is crucial for both buyers and sellers. This comprehensive guide aims to provide an in-depth analysis of sales tax for cars in New Jersey, covering everything from tax rates and exemptions to the impact on car sales and the economy.

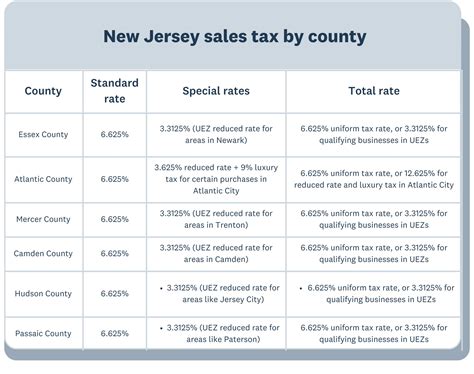

The New Jersey Sales Tax System

New Jersey operates a complex sales tax system, with rates and regulations that vary depending on the type of goods and services being purchased. The state sales tax rate for most goods is 6.625%, which includes the base state rate of 6.625% and an additional 0.5% allocated to the New Jersey Sales Tax Urban Enterprise Zone (UEZ) Program. This program provides tax incentives for businesses located in designated urban enterprise zones to encourage economic growth.

Vehicle Sales Tax Rate

For the sale of motor vehicles, the sales tax rate in New Jersey is slightly different. The state imposes a sales tax of 7% on the purchase of new and used cars, SUVs, trucks, motorcycles, and other motor vehicles. This rate is applicable statewide, ensuring a uniform tax structure for vehicle purchases.

The 7% sales tax is calculated based on the purchase price of the vehicle, including any additional costs such as dealer preparation fees, delivery charges, and optional equipment. However, it's important to note that certain fees and charges, such as registration fees and title transfer fees, are not subject to sales tax.

| Sales Tax Category | Rate |

|---|---|

| General Goods | 6.625% (6.625% base + 0.5% UEZ) |

| Motor Vehicles | 7% |

Sales Tax Exemptions for Vehicles in New Jersey

While the majority of vehicle purchases are subject to the 7% sales tax, there are certain exemptions and special cases where sales tax may not apply. These exemptions are designed to support specific groups or situations, providing financial relief and encouraging particular behaviors.

Disabled Individuals and Veterans

New Jersey offers a sales tax exemption for the purchase of motor vehicles by certain disabled individuals and veterans. This exemption applies to individuals who meet specific criteria, such as having a permanent disability or being a veteran with a service-connected disability.

To qualify for this exemption, individuals must provide documentation, such as a certificate of eligibility or a veteran's disability statement, to the dealer at the time of purchase. The dealer will then process the transaction without charging sales tax on the vehicle.

Trade-Ins and Leases

When trading in an old vehicle as part of a new car purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This means that if the trade-in value is equal to or greater than the purchase price, no sales tax is applied to the transaction.

Similarly, for leased vehicles, sales tax is calculated based on the monthly lease payments rather than the full purchase price. This can result in a significant tax savings for individuals who prefer leasing over buying.

Other Exemptions

New Jersey also provides sales tax exemptions for specific types of vehicles, including:

- Emergency Vehicles: Sales tax is waived for the purchase of vehicles used exclusively for emergency services, such as police cars, fire trucks, and ambulances.

- Farm Vehicles: Certain vehicles used primarily for agricultural purposes, such as tractors and farming equipment, are exempt from sales tax.

- Government Vehicles: Sales tax is not applied to the purchase of vehicles by state and local governments, including municipalities and public agencies.

Impact of Sales Tax on Car Sales and the Economy

The sales tax on car purchases in New Jersey has a significant impact on both the automotive industry and the state’s economy. It influences consumer behavior, dealer strategies, and the overall market dynamics.

Consumer Perspective

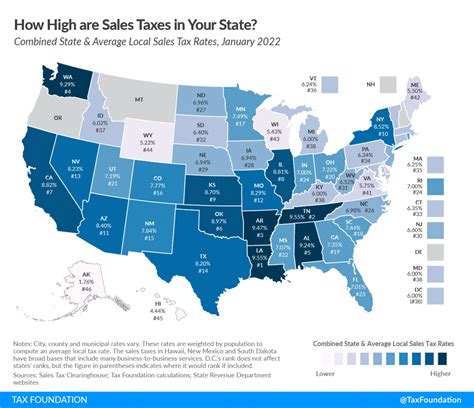

For car buyers, the 7% sales tax adds a substantial cost to their vehicle purchase. This tax can significantly impact their budget and purchasing decisions. To mitigate the tax burden, consumers often seek strategies such as negotiating a lower purchase price, exploring financing options with tax considerations, or considering vehicles with lower sales tax rates in neighboring states.

Additionally, the availability of sales tax exemptions for specific groups, such as disabled individuals and veterans, can provide much-needed financial relief and encourage car ownership among these populations.

Dealer Strategies

Car dealerships in New Jersey play a crucial role in navigating the sales tax landscape. They must stay informed about the latest tax regulations and exemptions to provide accurate information to their customers. Dealers often incorporate sales tax into their pricing strategies, offering competitive deals that include tax savings or providing financing options that spread out the tax payment.

Dealers may also leverage the UEZ program to their advantage, as it provides an opportunity to attract customers from outside the zone by offering tax-free shopping. This can boost sales and create a competitive edge for businesses located in these designated areas.

Economic Impact

The sales tax on car purchases contributes significantly to New Jersey’s revenue stream. The state collects billions of dollars in sales tax annually, with a substantial portion coming from vehicle sales. This revenue is essential for funding various public services, infrastructure projects, and social programs.

Moreover, the sales tax system, including the UEZ program, plays a vital role in promoting economic development and creating jobs. By offering tax incentives to businesses in designated zones, the state encourages investment and entrepreneurship, ultimately benefiting the local communities and the overall economy.

Future Implications and Considerations

As the automotive industry and tax regulations continue to evolve, several factors may influence the sales tax landscape in New Jersey.

Electric Vehicle (EV) Incentives

With the growing popularity of electric vehicles, New Jersey may consider implementing specific sales tax incentives or exemptions for EV purchases. These incentives could promote the adoption of sustainable transportation and align with the state’s environmental goals.

Online Sales and Remote Transactions

The rise of e-commerce and remote transactions poses a challenge for tax collection. New Jersey, like many states, is exploring ways to tax online sales effectively. This includes collaborating with online platforms and implementing laws to ensure that sales tax is collected and remitted accurately for vehicle purchases made online.

Tax Rate Adjustments

While the current sales tax rates in New Jersey are relatively stable, future economic conditions or budgetary needs may lead to rate adjustments. The state may consider increasing or decreasing tax rates to address fiscal challenges or stimulate the economy.

How often are sales tax rates updated in New Jersey?

+Sales tax rates in New Jersey are typically updated annually to account for inflation and economic changes. The state’s Division of Taxation announces any rate changes, and these updates often take effect at the beginning of the fiscal year.

Are there any tax breaks or incentives for hybrid or electric vehicles in New Jersey?

+Currently, New Jersey offers a sales tax exemption for the purchase of plug-in electric vehicles (PEVs) with a battery capacity of at least 5 kilowatt-hours. This exemption is part of the state’s efforts to promote clean energy and reduce carbon emissions.

Can I apply for a sales tax refund if I move out of state with my vehicle?

+Yes, if you relocate to another state and register your vehicle there, you may be eligible for a sales tax refund in New Jersey. The refund amount will depend on the time you spent in the state and the vehicle’s purchase price. It’s essential to follow the state’s procedures for applying for a refund.