What Countries Tax Unrealized Gains

The concept of taxing unrealized gains is a complex and evolving aspect of international tax policies. While many countries rely on traditional methods of taxation, such as capital gains taxes on realized profits, a growing number of nations are exploring innovative ways to enhance their tax revenues by targeting unrealized capital gains.

In this comprehensive guide, we will delve into the countries that have implemented or are considering policies to tax unrealized capital gains. We will explore the various approaches, their potential impact on investors and economies, and the underlying motivations driving these tax reforms.

Understanding Unrealized Capital Gains

Before diving into the countries that tax unrealized gains, it’s essential to grasp the concept itself. Unrealized capital gains, also known as paper gains, refer to the increase in the value of an asset that an investor holds but has not yet sold. In simpler terms, it’s the potential profit an investor could make if they were to sell the asset at its current market value.

For instance, if an investor purchases a stock for $100 and its value appreciates to $150, the investor has an unrealized capital gain of $50. This gain remains unrealized until the investor decides to sell the stock, at which point it becomes a realized capital gain subject to taxation.

The Rise of Unrealized Gains Taxation

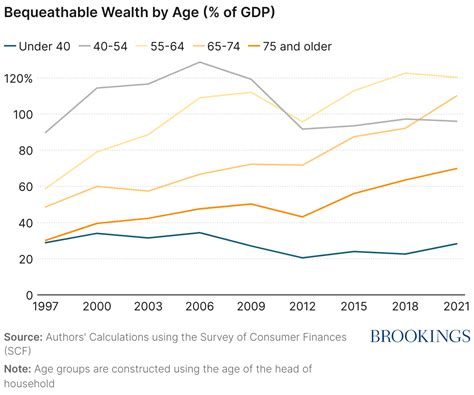

The idea of taxing unrealized capital gains has gained traction in recent years due to several factors. Governments are increasingly seeking innovative ways to enhance their tax bases, particularly in the face of rising public debt and changing economic landscapes. Taxing unrealized gains offers a potential solution to address revenue shortfalls and promote fairness in the tax system.

Key Drivers of Unrealized Gains Taxation

- Revenue Generation: Taxing unrealized gains can provide a significant source of revenue for governments. By capturing profits as they accrue, rather than waiting for assets to be sold, governments can potentially collect taxes on a wider range of gains.

- Fairness and Equity: Advocates argue that taxing unrealized gains promotes a more equitable tax system. It ensures that investors pay taxes on their profits regardless of when they choose to sell their assets, addressing concerns about tax avoidance through timing strategies.

- Addressing Market Inefficiencies: Some economists believe that taxing unrealized gains can help mitigate market inefficiencies. By discouraging excessive speculation and encouraging long-term investment, it may promote more stable and sustainable financial markets.

Countries Leading the Way

Several countries have taken the initiative to implement or propose policies targeting unrealized capital gains. Here’s an overview of some of the notable jurisdictions:

1. United States

The United States has been at the forefront of discussions surrounding unrealized gains taxation. While the country currently taxes capital gains on realized profits, there have been proposals to introduce a mark-to-market system for certain assets. This system would require taxpayers to report and pay taxes on the annual increase in the value of their assets, effectively taxing unrealized gains.

The Build Back Better Plan, proposed by the Biden administration, included a provision to tax certain unrealized gains for individuals with incomes exceeding $1 million. However, this proposal faced significant opposition and was not enacted.

2. United Kingdom

The UK has implemented a unique approach to taxing unrealized gains through its Annual Tax on Enveloped Dwellings (ATED). This tax applies to non-natural persons, such as companies or trusts, who own residential properties worth more than a certain threshold. The ATED is based on the value of the property, with higher rates for more valuable properties.

While not a direct tax on unrealized capital gains, the ATED aims to discourage the use of companies and trusts to hold residential property, which can lead to tax avoidance. It effectively encourages the realization of gains and promotes transparency in property ownership.

3. France

France has a well-established system for taxing unrealized capital gains on certain assets. The solidarity tax on wealth (ISF), now replaced by the impôt sur la fortune immobilière (IFI), was a wealth tax that applied to individuals with net assets exceeding a certain threshold. The ISF included unrealized gains on financial assets as part of the taxable base.

Although the ISF has been reformed, France continues to tax unrealized gains on certain assets, primarily focused on real estate. This approach aims to ensure that individuals with significant wealth contribute to the country's tax revenue.

4. Canada

Canada has a progressive tax system that includes provisions for taxing unrealized gains. The capital gains inclusion rate is a mechanism that allows the government to tax a portion of capital gains at the regular income tax rate. This inclusion rate effectively captures some of the unrealized gains, providing a source of revenue for the Canadian government.

Additionally, Canada imposes a deemed disposition rule for certain assets, such as foreign property, which triggers a tax liability on unrealized gains when specific conditions are met. This rule aims to prevent tax avoidance and ensure that gains are properly reported and taxed.

5. Australia

Australia has a comprehensive tax system that includes provisions for taxing unrealized capital gains. The capital gains tax (CGT) applies to both realized and unrealized gains on assets held for more than 12 months. The CGT discount, which provides a 50% discount on the capital gain for individuals, further incentivizes long-term investment.

Australia's approach to taxing unrealized gains is considered relatively straightforward and transparent, as taxpayers must report and pay tax on gains as they accrue.

Global Trends and Potential Impact

The trend towards taxing unrealized gains is part of a broader movement towards more progressive and comprehensive tax systems. As countries strive to adapt to changing economic landscapes and address revenue challenges, the taxation of unrealized gains presents an attractive option.

However, implementing such policies comes with its own set of considerations and potential challenges. Critics argue that taxing unrealized gains could discourage investment, particularly in volatile markets, and lead to increased complexity in tax administration. On the other hand, proponents highlight the potential benefits of promoting long-term investment, enhancing tax fairness, and generating additional revenue for crucial public services.

Potential Impact on Investors

- Increased Tax Burden: Investors may face a higher tax liability if unrealized gains are taxed. This could impact investment strategies and potentially discourage short-term trading in favor of long-term investment.

- Complexity and Compliance: Taxing unrealized gains may introduce additional complexity into tax systems, requiring investors to navigate new reporting requirements and calculations.

- Market Efficiency: Some argue that taxing unrealized gains could lead to more efficient markets, as investors may be less inclined to engage in excessive speculation.

Future Implications

As the global economic landscape continues to evolve, the taxation of unrealized gains is likely to remain a topic of discussion and debate among policymakers and economists. Countries will carefully consider the potential benefits and drawbacks before implementing such policies.

In the meantime, investors and businesses should stay informed about the tax landscapes in their jurisdictions and adapt their strategies accordingly. Understanding the potential implications of unrealized gains taxation can help individuals and companies make informed decisions about their investments and tax planning.

Conclusion

The concept of taxing unrealized capital gains is an intriguing and complex aspect of international tax policies. While several countries have ventured into this territory, the approach and scope of such policies vary significantly. As the world navigates economic challenges and seeks innovative solutions, the taxation of unrealized gains will undoubtedly continue to be a subject of interest and debate.

Stay tuned for further developments and insights into this evolving area of tax policy, as governments strive to strike a balance between revenue generation, fairness, and market stability.

Are there any countries that have successfully implemented a tax on unrealized gains, and what have been the results?

+Yes, France’s former wealth tax, the ISF, provides an example of a country that taxed unrealized gains on financial assets. However, the results were mixed, with some critics arguing that it led to capital flight and discouraged investment. The reform of the ISF into the IFI aimed to address these concerns.

How might taxing unrealized gains impact investment strategies and portfolio management?

+Taxing unrealized gains could encourage investors to adopt more long-term investment strategies and reduce short-term trading. This shift may lead to more stable markets and potentially impact the timing and frequency of asset sales.

What are the potential challenges and concerns associated with taxing unrealized gains?

+Critics argue that taxing unrealized gains could increase tax complexity, discourage investment, and lead to administrative challenges. Additionally, there are concerns about the potential impact on market liquidity and investor behavior.