Ohio Tax Brackets 2025

Ohio's tax system is an integral part of the state's fiscal framework, and understanding the tax brackets is crucial for individuals and businesses alike. The state's income tax structure, which is based on brackets, can significantly impact financial planning and investment strategies. As we look ahead to 2025, it's essential to delve into the specifics of Ohio's tax brackets to anticipate potential financial implications and make informed decisions.

Ohio Tax Brackets for 2025: A Comprehensive Overview

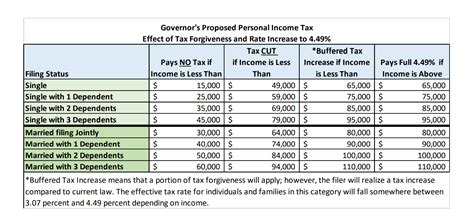

Ohio's tax system operates on a progressive basis, meaning that the state's tax rate increases as taxable income rises. This system ensures that individuals and entities with higher incomes contribute a larger share of their earnings to the state's revenue. The following table provides an overview of the tax brackets for Ohio's income tax rates for tax year 2025, applicable to the 2026 filing season.

| Tax Rate | Taxable Income Range |

|---|---|

| 0.4792% | $0 - $5,500 |

| 1.5075% | $5,501 - $10,500 |

| 2.375% | $10,501 - $21,000 |

| 3.333% | $21,001 - $42,000 |

| 4.047% | $42,001 - $84,000 |

| 4.791% | $84,001 - $100,000 |

| 5.333% | $100,001 and above |

It's important to note that these tax rates are applied to Ohio taxable income, which is calculated after deductions and exemptions. The state offers various deductions and credits to reduce the taxable income, such as the standard deduction, itemized deductions, and personal exemptions. Additionally, Ohio has a School District Income Tax, which is imposed by local school districts and can vary depending on the location.

Understanding the Impact of Ohio's Tax Brackets

The progressive nature of Ohio's tax brackets means that taxpayers with higher incomes will face higher effective tax rates. For instance, an individual with a taxable income of $150,000 would fall into the highest tax bracket of 5.333%. This means that a significant portion of their income would be subject to the highest tax rate. On the other hand, someone with a taxable income of $30,000 would be taxed at lower rates, with the majority of their income falling within the lower tax brackets.

This progressive system ensures that individuals with higher incomes contribute proportionally more to the state's revenue, which can have significant implications for financial planning and investment strategies. Taxpayers may need to consider strategies such as maximizing deductions and credits, investing in tax-advantaged accounts, or even adjusting their income to stay within lower tax brackets.

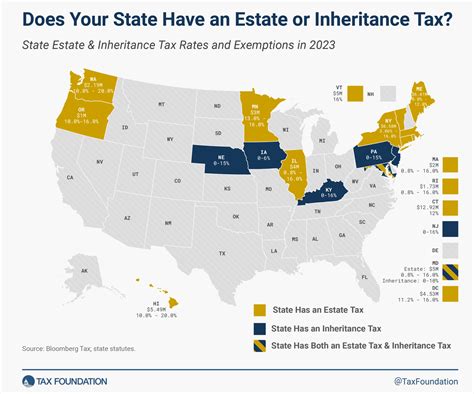

Comparison with Other States

Ohio's tax system stands out when compared to other states. While some states, like Florida and Texas, have no income tax, Ohio relies on its progressive income tax structure to generate revenue. This can make Ohio a less attractive option for high-income earners who may face higher tax liabilities compared to no-income-tax states.

However, Ohio's tax system also offers advantages. For instance, the state's tax rates are generally lower than those in states like California or New York, which can be more appealing to individuals and businesses. Additionally, Ohio's tax system provides stability and predictability, as tax rates are relatively consistent and have not undergone significant changes in recent years.

Future Implications and Tax Planning Strategies

Looking ahead to 2025 and beyond, it's essential to consider potential changes to Ohio's tax system. While tax rates have remained relatively stable in recent years, there is always the possibility of legislative changes that could impact tax brackets and rates. Taxpayers should stay informed about any proposed changes and consider the potential impact on their financial planning.

For long-term financial planning, individuals and businesses may want to consider strategies that optimize their tax situation. This could include investing in Ohio's tax-advantaged programs, such as the state's New Markets Tax Credit program, which encourages investment in economically distressed areas. Additionally, staying informed about potential tax incentives and credits can help taxpayers reduce their overall tax burden.

In conclusion, Ohio's tax brackets for 2025 provide a clear picture of the state's progressive tax system. Understanding these brackets and their implications is crucial for effective financial planning. By staying informed and implementing strategic tax planning, individuals and businesses can navigate Ohio's tax landscape and make the most of their financial opportunities.

How often are Ohio’s tax brackets updated?

+Ohio’s tax brackets are typically updated annually to adjust for inflation and changing economic conditions. The updates are usually made based on recommendations from the Ohio Department of Taxation and approved by the state legislature.

Are there any tax credits or deductions available in Ohio?

+Yes, Ohio offers various tax credits and deductions to reduce taxable income. These include the standard deduction, itemized deductions for expenses like medical costs and property taxes, and credits for things like dependent care, child and dependent care expenses, and research and development activities.

How does Ohio’s tax system compare to federal tax brackets?

+Ohio’s tax system operates separately from the federal tax system, and the state’s tax brackets are not directly linked to federal tax brackets. However, changes in federal tax policies can indirectly impact Ohio’s tax system, as they may influence the state’s economy and revenue generation.