Pa State Income Tax Rate

Welcome to our comprehensive guide on the Pennsylvania state income tax rate. As one of the key considerations for individuals and businesses operating in the Keystone State, understanding the tax landscape is crucial for effective financial planning. In this article, we delve into the specifics of Pennsylvania's income tax system, offering a detailed analysis of the rates, brackets, and other essential aspects. Whether you're a resident, a business owner, or simply curious about the state's fiscal policies, this guide aims to provide you with the information you need to navigate the Pennsylvania tax landscape with confidence.

Pennsylvania’s Income Tax Structure: An Overview

The Commonwealth of Pennsylvania, like many other U.S. states, imposes an income tax on its residents and businesses. This tax revenue is a significant source of funding for various state programs and initiatives, including education, healthcare, and infrastructure development. Understanding the income tax structure is essential for individuals and entities to comply with their tax obligations and make informed financial decisions.

Pennsylvania's income tax system operates on a progressive rate structure, meaning that the tax rate increases as taxable income rises. This design aims to ensure that higher-income earners contribute a larger proportion of their income to state revenues, promoting fairness and equity in the tax system. Let's explore the key aspects of Pennsylvania's income tax rate in more detail.

Taxable Income and Brackets

The Pennsylvania Department of Revenue defines taxable income as the total income earned by individuals or entities within the state, subject to certain deductions and adjustments. This income can come from various sources, including wages, salaries, commissions, bonuses, business profits, interest, dividends, and capital gains.

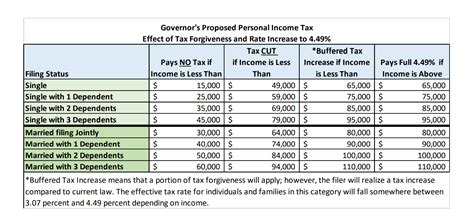

Pennsylvania's income tax system utilizes tax brackets, which categorize taxable income into different ranges and apply specific tax rates accordingly. As of 2023, the state has three tax brackets with corresponding rates:

| Tax Bracket | Tax Rate |

|---|---|

| First $37,150 | 3.07% |

| $37,151 to $87,000 | 3.75% |

| Over $87,000 | 3.87% |

These brackets and rates are subject to periodic adjustments to account for inflation and other economic factors. It's essential to refer to the most recent tax guidelines issued by the Pennsylvania Department of Revenue for the most accurate and up-to-date information.

Personal Income Tax Credits and Deductions

Pennsylvania offers various tax credits and deductions to alleviate the tax burden on individuals and families. These incentives aim to promote specific social or economic goals and provide financial relief to certain groups. Here are some notable tax credits and deductions available in Pennsylvania:

- Property Tax/Rent Rebate Program: Eligible Pennsylvania residents can receive a rebate on the property taxes they paid or on their rent expenses. This program aims to provide financial assistance to low- and moderate-income individuals and seniors.

- Low-Income Senior Tax Credit: Seniors with limited income may qualify for this credit, which provides a reduction in their income tax liability. The credit amount is determined based on income and property tax paid.

- Child and Dependent Care Credit: Taxpayers who incur expenses for child or dependent care while working or attending school may be eligible for this credit. The credit can offset a portion of these care expenses, providing financial relief to working families.

- Educational Tax Credits: Pennsylvania offers two types of educational tax credits: the Educational Improvement Tax Credit (EITC) and the Opportunity Scholarship Tax Credit (OSTC). These credits provide funding for private school tuition and other educational expenses, benefiting both students and educational institutions.

Business Income Tax

In addition to personal income tax, Pennsylvania imposes a Corporate Net Income Tax (CNIT) on businesses operating within the state. This tax is separate from the income tax paid by individuals and is calculated based on the net income of the business entity.

As of 2023, the Corporate Net Income Tax rate in Pennsylvania is 4.99%, which applies to all businesses, regardless of their size or industry. However, certain business entities, such as S-corporations and sole proprietorships, may be subject to the personal income tax rates mentioned earlier.

Compliance and Filing Requirements

Understanding the tax rates and brackets is just the first step in navigating Pennsylvania’s income tax system. It’s equally important to comply with the state’s tax filing requirements and deadlines to avoid penalties and ensure a smooth tax process.

Filing Deadlines

For most taxpayers, the deadline to file Pennsylvania income tax returns is aligned with the federal tax filing deadline, which is typically April 15th of each year. However, it’s crucial to note that this deadline may be subject to change due to various factors, such as federal tax law changes or special circumstances.

It's advisable to consult the official tax calendar published by the Pennsylvania Department of Revenue for the most accurate and up-to-date information on filing deadlines. Additionally, taxpayers should be aware of the specific deadlines for estimated tax payments, which may be required for individuals with substantial income or businesses with significant tax liabilities.

Online Filing and Payment Options

Pennsylvania offers convenient online filing and payment options through its official website. Taxpayers can utilize the e-file system to submit their tax returns electronically, ensuring a faster and more efficient process. The state also provides an online payment portal, allowing taxpayers to make secure payments using various methods, including credit cards, debit cards, and electronic funds transfers.

Online filing and payment not only streamline the tax process but also reduce the risk of errors and delays associated with traditional paper filing methods. Taxpayers can track the status of their returns and payments online, providing added transparency and convenience.

Future Implications and Considerations

As with any tax system, Pennsylvania’s income tax rates and policies are subject to change over time. Economic conditions, political factors, and legislative decisions can influence the state’s fiscal policies, leading to potential adjustments in tax rates, brackets, and other aspects of the tax landscape.

Staying informed about any proposed or enacted changes is crucial for individuals and businesses to adapt their financial planning strategies accordingly. Regularly reviewing official tax guidelines, following updates from the Pennsylvania Department of Revenue, and consulting with tax professionals can help taxpayers navigate the evolving tax environment effectively.

Tax Planning and Strategies

Understanding the income tax rates and brackets in Pennsylvania provides a solid foundation for effective tax planning. Taxpayers can optimize their financial strategies by taking advantage of available tax credits, deductions, and incentives. For instance, individuals can maximize their standard deductions or explore the eligibility criteria for specific tax credits to reduce their taxable income.

Businesses, on the other hand, can consider various tax-efficient structures and strategies to minimize their tax liabilities. This may involve exploring different business entity types, implementing cost-saving measures, or utilizing tax-advantaged investment options. Consulting with tax advisors or accountants who specialize in Pennsylvania tax law can provide valuable insights and guidance tailored to individual circumstances.

Economic Impact and Development

The income tax system in Pennsylvania plays a significant role in shaping the state’s economic landscape. The tax revenue generated from personal and corporate income taxes funds critical state programs and initiatives, contributing to the overall economic development and well-being of the Commonwealth.

As the state's fiscal policies evolve, policymakers must strike a balance between generating sufficient tax revenue and promoting economic growth and competitiveness. This delicate equilibrium ensures that Pennsylvania remains an attractive destination for businesses and residents while also providing the necessary resources to support public services and infrastructure.

Comparative Analysis with Other States

Comparing Pennsylvania’s income tax rates with those of other states provides valuable context and insights into the state’s tax competitiveness. While a detailed analysis is beyond the scope of this article, it’s worth noting that Pennsylvania’s income tax rates are generally competitive with those of neighboring states and other regions across the country.

However, it's essential to consider the overall tax landscape, including property taxes, sales taxes, and other levies, when assessing the tax environment in Pennsylvania. A comprehensive analysis of the state's tax system can help individuals and businesses make informed decisions about their financial strategies and long-term planning.

Conclusion

Pennsylvania’s income tax system, with its progressive rate structure and various tax brackets, plays a vital role in funding the state’s essential services and programs. Understanding the tax rates, compliance requirements, and available tax incentives is crucial for individuals and businesses operating within the Commonwealth.

By staying informed about the latest tax guidelines, exploring tax-efficient strategies, and leveraging available tax credits and deductions, taxpayers can optimize their financial positions and contribute to the economic vitality of Pennsylvania. As the state continues to evolve its fiscal policies, staying abreast of changes and adapting financial planning strategies will remain essential for individuals and businesses alike.

FAQ

What is the difference between personal income tax and corporate income tax in Pennsylvania?

+Personal income tax is levied on the taxable income of individuals and is calculated based on their income level and filing status. In contrast, corporate income tax, or Corporate Net Income Tax (CNIT), is imposed on the net income of business entities, regardless of their size or industry.

Are there any tax credits available for Pennsylvania residents?

+Yes, Pennsylvania offers various tax credits, including the Property Tax/Rent Rebate Program, the Low-Income Senior Tax Credit, and the Child and Dependent Care Credit. Additionally, the state provides educational tax credits, such as the Educational Improvement Tax Credit (EITC) and the Opportunity Scholarship Tax Credit (OSTC), to support private education.

How often do Pennsylvania’s income tax rates change?

+Pennsylvania’s income tax rates are subject to periodic adjustments to account for inflation and other economic factors. While there is no set schedule for these changes, taxpayers should stay informed about any proposed or enacted modifications by referring to official tax guidelines and updates from the Pennsylvania Department of Revenue.

Can I file my Pennsylvania income tax return online?

+Yes, Pennsylvania offers an online filing system through its official website. Taxpayers can utilize the e-file system to submit their tax returns electronically, providing a faster and more efficient process. Online filing also allows for secure online payments using various methods, including credit cards and electronic funds transfers.

What are the tax brackets for Pennsylvania’s income tax as of 2023?

+As of 2023, Pennsylvania’s income tax brackets are as follows: the first 37,150 is taxed at 3.07%, income between 37,151 and 87,000 is taxed at 3.75%, and income over 87,000 is taxed at 3.87%.