Tax Abatement

Tax abatement is a strategic financial tool utilized by governments and municipalities to stimulate economic growth, encourage investment, and foster community development. This practice involves temporarily reducing or eliminating specific taxes for eligible businesses and individuals, creating an attractive incentive for economic expansion. The aim is to attract new businesses, retain existing ones, and promote job creation, ultimately enhancing the local economy.

Understanding Tax Abatement Programs

Tax abatement programs are meticulously designed to target specific industries, geographical areas, or developmental projects. These programs are a vital component of a region’s economic development strategy, offering a competitive advantage to attract investors and businesses. By offering tax breaks, governments can facilitate the growth of new industries, support existing businesses during challenging times, and promote the redevelopment of underutilized properties.

One of the key advantages of tax abatement is its ability to encourage businesses to invest in areas that may otherwise be overlooked. For instance, a city might offer tax abatements to encourage the development of a new industrial park, thereby creating jobs and revitalizing a neglected part of the city. Similarly, tax breaks can be a powerful tool to attract high-tech industries, which often bring significant economic benefits and future growth potential.

Types of Tax Abatement

Tax abatement takes various forms, each tailored to meet specific economic development goals. Some common types include:

- Property Tax Abatement: This is one of the most prevalent forms, where a portion or the entire property tax is reduced or eliminated for a set period. This is particularly effective in encouraging real estate development and attracting new businesses.

- Income Tax Abatement: Certain jurisdictions offer reductions in income taxes to attract high-earning professionals or specific industries. This strategy can stimulate economic growth by bringing in skilled workers and fostering a competitive business environment.

- Sales Tax Abatement: Governments might waive or reduce sales taxes for a specified period to encourage consumer spending and support local businesses. This strategy is often employed during economic downturns to boost retail activity.

- Customized Tax Abatement: In certain cases, governments collaborate with businesses to design customized tax abatement packages that meet the unique needs of the business and the community.

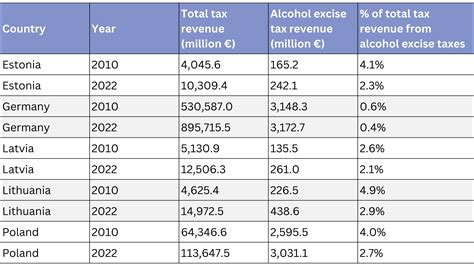

| Tax Abatement Type | Description |

|---|---|

| Property Tax Abatement | Reduces or eliminates property taxes for a specified period, often used to encourage real estate development. |

| Income Tax Abatement | Reduces income taxes to attract high-earning professionals or specific industries, fostering economic growth. |

| Sales Tax Abatement | Waives or reduces sales taxes temporarily to stimulate consumer spending and support local businesses. |

| Customized Tax Abatement | Tailored tax packages designed collaboratively between governments and businesses to meet unique needs. |

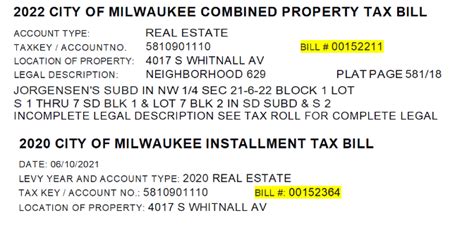

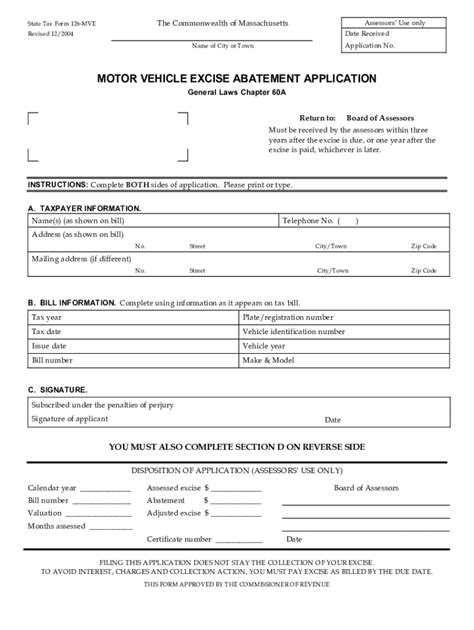

Eligibility and Application Process

Eligibility criteria for tax abatement programs vary widely depending on the jurisdiction and the specific program. Generally, these programs target businesses or projects that align with the region’s economic development goals. For instance, a city might offer tax breaks to encourage the establishment of green energy companies or businesses that focus on innovation and research.

The application process often involves a detailed assessment of the proposed project or business, including its economic impact, job creation potential, and alignment with the community's development objectives. This process ensures that the tax abatement benefits are awarded to those who will bring the most significant economic advantages to the region.

Benefits and Considerations

Tax abatement programs offer a range of benefits, including:

- Economic Growth: These programs can stimulate economic activity, leading to increased employment opportunities and business growth.

- Community Development: They can facilitate the redevelopment of underutilized areas, improving the overall quality of life in the community.

- Competitive Advantage: Regions with tax abatement programs can attract businesses that might otherwise choose more traditional investment destinations.

However, it's important to consider the potential downsides. Tax abatements can result in a loss of revenue for the government, which might impact other essential services. Additionally, if not carefully managed, these programs could lead to an overreliance on a few large businesses, potentially leaving the community vulnerable to economic shocks.

Case Studies: Successful Tax Abatement Strategies

Let’s explore some real-world examples of how tax abatement programs have been successfully implemented:

City of Philadelphia: The Keystone Opportunity Improvement Zones (KOIZ)

The City of Philadelphia implemented the KOIZ program to stimulate economic growth in designated distressed areas. The program offers a 10-year tax abatement on eligible real and personal property for businesses that invest in these zones. This strategy has successfully attracted businesses, leading to significant job creation and economic development in these previously neglected areas.

State of Ohio: Job Creation Tax Credits

Ohio offers a range of tax credits to businesses that create or retain jobs in the state. The program provides tax credits for a set number of years based on the number of jobs created or retained. This incentive has been instrumental in attracting businesses, particularly in the manufacturing sector, and has contributed to the state’s economic growth.

Singapore: Tax Incentives for R&D Activities

Singapore provides tax incentives for businesses engaged in research and development (R&D) activities. The country offers a partial exemption from corporate income tax for income derived from qualifying R&D activities. This strategy has encouraged businesses to invest in R&D, contributing to Singapore’s reputation as a hub for innovation and technology.

Future Outlook and Innovations

As the economic landscape continues to evolve, tax abatement strategies are likely to play an increasingly important role in shaping regional development. Governments and municipalities will need to adapt their programs to meet the changing needs of businesses and communities.

One potential innovation is the use of tax abatement as a tool to promote sustainability and environmental initiatives. Governments could offer tax breaks to businesses that adopt sustainable practices or invest in green technologies, encouraging a transition towards a more sustainable economy.

Additionally, the integration of tax abatement with other economic development tools, such as targeted infrastructure investments and workforce training programs, could enhance the effectiveness of these initiatives. By combining tax incentives with other supportive measures, governments can create a more holistic approach to economic development.

How do tax abatement programs benefit local communities?

+Tax abatement programs can bring numerous benefits to local communities. They stimulate economic growth, leading to increased job opportunities and business development. These programs often target neglected or underdeveloped areas, revitalizing these regions and improving the overall quality of life for residents. Additionally, by attracting new businesses, tax abatements can enhance the local tax base, providing additional funding for essential community services.

What are the potential drawbacks of tax abatement programs?

+While tax abatement programs can be highly effective, they also come with potential drawbacks. One major concern is the loss of tax revenue for the government, which could impact funding for essential services. Additionally, if not properly managed, these programs might lead to an overreliance on a few large businesses, making the community vulnerable to economic downturns. There is also a risk that businesses might leave the region once the tax abatement period ends, resulting in a loss of jobs and economic activity.

How can governments ensure the success of tax abatement programs?

+To ensure the success of tax abatement programs, governments should carefully design and implement them. This includes setting clear objectives, targeting specific industries or projects that align with the community’s development goals, and conducting thorough assessments of proposed businesses or projects. Regular monitoring and evaluation of the program’s impact is also crucial. Governments should work closely with businesses to understand their needs and challenges, and adapt the program accordingly to ensure it remains effective and beneficial to all stakeholders.