How To File Taxes Without W2

Tax season can be a daunting time, especially if you're missing key documents like your W2 form. However, filing your taxes without a W2 is not an impossible task. In this comprehensive guide, we will walk you through the steps and provide insights to help you navigate this process successfully.

Understanding the W2 Form and Its Role

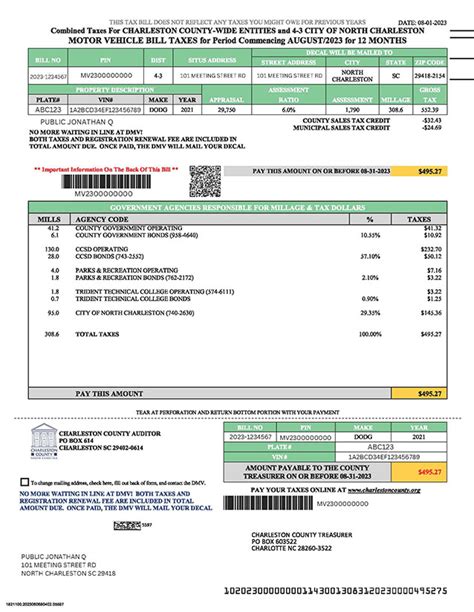

The W2 form, or Wage and Tax Statement, is a crucial document issued by your employer. It summarizes your earnings and the taxes withheld from your paycheck throughout the year. Typically, it includes your total wages, federal and state taxes withheld, Social Security and Medicare contributions, and any additional compensation or deductions.

When it comes to filing your taxes, the W2 is essential as it provides an accurate record of your taxable income. Without it, you may face challenges in accurately reporting your earnings and could potentially miss out on tax refunds or deductions you're entitled to.

Step 1: Gather Alternative Documentation

If you’re missing your W2, the first step is to gather any alternative documentation that can help you recreate your income and tax information. Here are some documents that can be useful:

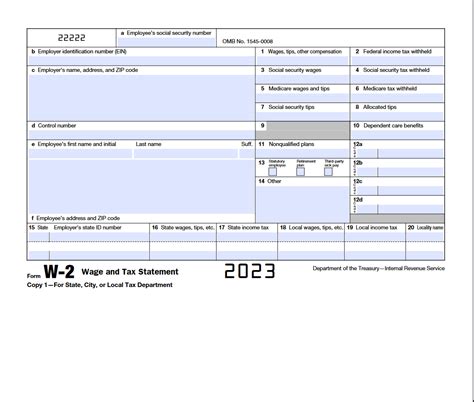

- Pay Stubs: Collect all your pay stubs from the previous year. These should include details like your gross pay, any deductions, and the taxes withheld.

- Bank Statements: Review your bank statements to identify any direct deposits from your employer. This can help verify your earnings and tax withholdings.

- 1099 Forms: If you received any 1099 forms for independent contractor work or other income sources, gather these as well. They provide similar information to a W2 but for non-employee compensation.

- Records of Deductions: Compile any records of expenses or deductions you incurred during the year. This could include receipts for business expenses, healthcare costs, charitable donations, or other eligible deductions.

By gathering these alternative documents, you can start to piece together a clear picture of your financial situation and ensure you have the necessary information for filing your taxes.

Step 2: Estimate Your Taxable Income

With the documentation you’ve gathered, it’s time to estimate your taxable income. This step is crucial as it forms the basis of your tax return.

- Total Earnings: Add up all your income sources, including wages from pay stubs, direct deposits, and any additional compensation from 1099 forms. This will give you your total earnings for the year.

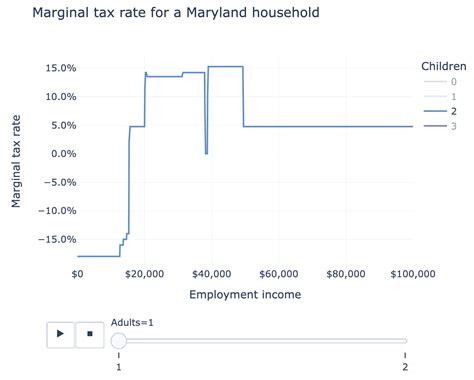

- Calculate Deductions: Next, tally up any eligible deductions you have. This could include business expenses, medical costs, education expenses, or other deductions you're entitled to. Subtract these from your total earnings to arrive at your taxable income.

- Tax Withholdings: Use your pay stubs or bank statements to estimate the total amount of taxes withheld from your paychecks. This information will be crucial for completing your tax return.

By estimating your taxable income and tax withholdings, you can get a clear understanding of your tax situation and ensure you're prepared to file your taxes accurately.

Step 3: Choose the Right Tax Form

Depending on your income and circumstances, you’ll need to choose the appropriate tax form to file. The most common forms are the 1040 and 1040A, but there are others as well.

- Form 1040: This is the standard tax form used by most taxpayers. It's comprehensive and allows for various deductions and credits. If your financial situation is complex or you have significant investments, this form is likely your best choice.

- Form 1040A: This simplified tax form is designed for taxpayers with straightforward financial situations. It has fewer lines and is easier to complete than the 1040. However, it may not accommodate all types of income or deductions.

- Other Forms: Depending on your circumstances, you may need additional forms. For instance, if you're self-employed, you'll need to file Schedule C. If you have rental income, you'll use Schedule E. Be sure to consult tax resources or seek professional advice to determine the right forms for your situation.

Choosing the right tax form is essential to ensure you can accurately report your income and claim all the deductions and credits you're entitled to.

Step 4: File Your Taxes

Now it’s time to file your taxes using the information you’ve gathered and the appropriate tax form. Here’s a step-by-step guide:

- Prepare Your Return: Using the tax form you've chosen, fill out all the relevant sections with your income, deductions, and credits. Be sure to double-check your calculations and ensure accuracy.

- Claim Deductions and Credits: Take advantage of any deductions or credits you're eligible for. This could include the standard deduction, personal exemptions, or specific credits like the Child Tax Credit or Earned Income Credit.

- Calculate Your Tax Liability: Based on your taxable income and the deductions/credits claimed, calculate your total tax liability. This is the amount of tax you owe or the refund you're entitled to.

- Sign and Submit: Sign your tax return and submit it to the IRS. You can do this electronically through IRS-approved software or by mailing your completed return. Ensure you keep a copy for your records.

By following these steps and staying organized, you can successfully file your taxes without a W2. Remember, if you have any doubts or complex financial situations, it's always a good idea to consult a tax professional for guidance.

Tips and Considerations

Here are some additional tips to keep in mind when filing your taxes without a W2:

- Keep Records: Maintain good records of your income, expenses, and deductions. This will make it easier to file your taxes accurately and support any claims you make.

- Seek Professional Help: If you're unsure about any aspect of your tax return or have a complex financial situation, consider seeking the advice of a tax professional. They can provide tailored guidance and ensure you're taking advantage of all the deductions and credits you're entitled to.

- Stay Informed: Keep up-to-date with the latest tax laws and regulations. This will help you understand any changes that may impact your tax return and ensure you're compliant with all requirements.

Filing your taxes without a W2 is a manageable process, but it requires careful attention to detail and accurate record-keeping. By following the steps outlined above and staying informed, you can successfully navigate this process and ensure a smooth tax filing experience.

Frequently Asked Questions

What happens if I can’t find my W2 form?

+If you can’t locate your W2 form, contact your employer and request a replacement. They are required to provide you with a new copy. In the meantime, gather alternative documentation like pay stubs and bank statements to estimate your income and tax withholdings.

Can I still claim deductions without a W2?

+Yes, you can still claim deductions without a W2. However, you’ll need to provide supporting documentation to substantiate your claims. This could include receipts, records of expenses, or other relevant evidence.

What if my tax situation is complex and I don’t feel confident filing on my own?

+If your tax situation is complex or you’re unsure about certain aspects of your return, consider seeking the assistance of a tax professional. They can guide you through the process, ensure accuracy, and help you maximize your deductions and credits.

Are there any penalties for filing without a W2?

+There are no specific penalties for filing without a W2. However, it’s important to ensure the accuracy of your tax return and provide supporting documentation for all income and deductions claimed. Inaccurate or incomplete returns may result in penalties and interest charges.