Charleston County Tax

In the heart of South Carolina lies Charleston County, a vibrant and historic region known for its rich culture, picturesque landscapes, and thriving communities. As residents and property owners in this enchanting county, understanding the intricacies of Charleston County Tax is essential for financial planning and ensuring compliance with local regulations. This comprehensive guide aims to demystify the tax system, providing an in-depth analysis of tax rates, assessment processes, and strategies to optimize your tax obligations.

Understanding Charleston County’s Tax Landscape

Charleston County, with its diverse geography and vibrant economy, employs a nuanced tax system that reflects its unique characteristics. The county’s tax structure is designed to support essential services, infrastructure development, and community initiatives, while also catering to the diverse needs of its residents.

Tax Rates and Assessment Methodology

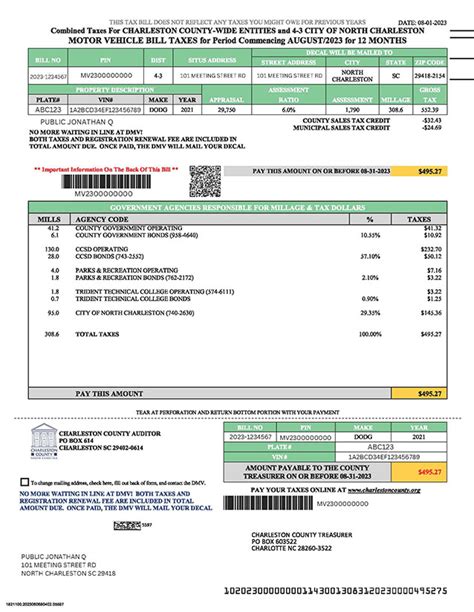

The cornerstone of Charleston County’s tax system is its millage rate, which serves as the basis for property tax calculations. The millage rate is a decimal representation of the tax rate per 1,000 of assessed property value. For instance, a millage rate of 0.1000 implies a tax of 100 for every $1,000 of assessed value. This rate is applied to the assessed value of your property, which is determined through a meticulous assessment process.

Charleston County employs a reassessment cycle, typically occurring every five years, to ensure that property values remain up-to-date. During this process, assessors evaluate factors such as recent sales data, market trends, and physical changes to properties. The assessed value is then used to calculate the tax liability, which is a critical component of your overall financial planning.

| Assessment Cycle | Millage Rate |

|---|---|

| 2023-2027 | 0.0800 |

| 2018-2022 | 0.0800 |

| 2013-2017 | 0.0825 |

Taxable Entities and Exemptions

Charleston County taxes a wide range of property types, including real estate (both residential and commercial), personal property (such as vehicles and boats), and business assets. However, certain entities and individuals may be eligible for tax exemptions or reduced rates. For instance, homeowners aged 65 or older with limited income may qualify for the Homestead Exemption, which reduces the taxable value of their primary residence.

Furthermore, charitable organizations, religious institutions, and government entities often benefit from tax-exempt status, ensuring that their properties are not subject to the standard tax rates. Understanding these exemptions and their eligibility criteria is crucial for property owners and businesses operating within Charleston County.

Navigating the Assessment and Payment Process

The assessment and payment of Charleston County taxes involves a series of well-defined steps, each playing a crucial role in the overall tax lifecycle.

Assessment Process Timeline

The assessment process in Charleston County is a meticulous endeavor, typically spanning several months. Here’s a simplified breakdown of the key stages:

- Data Collection: Assessors gather information about properties, including recent sales, building permits, and other relevant data.

- Preliminary Assessment: Based on the collected data, a preliminary assessed value is determined for each property.

- Public Review and Appeal: Property owners are notified of their preliminary assessments and given an opportunity to review and appeal if they believe the assessed value is inaccurate.

- Final Assessment: After considering any appeals and making necessary adjustments, assessors finalize the assessed values.

- Notice of Tax Liability: Property owners receive a tax bill, detailing their assessed value, applicable tax rates, and the total tax due.

Payment Options and Deadlines

Charleston County offers a range of payment options to cater to the diverse needs of its taxpayers. Property owners can choose from the following methods:

- Online Payment: A convenient and secure option, allowing taxpayers to pay their taxes through the county's official website using a credit or debit card.

- Mail-In Payment: For those who prefer traditional methods, a check or money order can be mailed to the Charleston County Treasurer's Office.

- In-Person Payment: Taxpayers can visit the Treasurer's Office during business hours to make payments in person.

- Automatic Payment Plans: Property owners can enroll in automatic payment plans, where tax payments are deducted directly from their bank accounts on specific dates.

It's crucial to note that payment deadlines are strictly enforced, and late payments may incur penalties and interest. Generally, taxes are due in two installments, with the first installment typically due in January and the second in July. However, the exact dates may vary, so it's essential to stay informed and plan your payments accordingly.

Strategies for Optimizing Your Tax Obligations

Understanding the tax landscape and assessment process is the first step towards effective tax management. However, there are several strategies and considerations that can help optimize your tax obligations and ensure you’re not overpaying.

Reviewing Your Assessment

When you receive your preliminary assessment, it’s essential to review it carefully. Discrepancies or inaccuracies in the assessed value can lead to overpayment. Factors such as recent renovations, property damage, or changes in the local real estate market can impact your property’s value. By staying informed and actively participating in the assessment process, you can ensure that your assessed value is accurate and fair.

Exploring Tax Relief Programs

Charleston County offers a range of tax relief programs designed to assist certain individuals and entities. These programs can provide significant savings on tax obligations, making them a crucial consideration for eligible taxpayers. Here are some notable programs:

- Homestead Exemption: As mentioned earlier, this exemption reduces the taxable value of a primary residence for homeowners aged 65 or older with limited income. It can provide substantial savings, especially for those on fixed incomes.

- Veterans Exemption: Qualified veterans and their surviving spouses may be eligible for a reduction in their taxable property value, offering a financial benefit for those who have served our country.

- Agricultural Assessment: Properties used for agricultural purposes may qualify for a lower tax assessment rate, encouraging agricultural activities and supporting local farming communities.

Appealing Your Assessment

If you believe your property’s assessed value is inaccurate, you have the right to appeal the assessment. This process involves gathering evidence, such as recent sales data or appraisals, to support your claim. It’s essential to understand the appeal process and gather the necessary documentation to present a strong case. Successful appeals can lead to a reduction in your tax liability, making it a worthwhile endeavor for taxpayers who feel their assessment is unfair.

Future Implications and Tax Planning

As Charleston County continues to evolve and thrive, its tax landscape is likely to experience changes and adaptations. Staying informed about potential changes in tax rates, assessment methodologies, and eligibility criteria for tax relief programs is crucial for effective tax planning.

Additionally, considering the long-term implications of tax obligations is essential for financial stability. Property owners and businesses should factor in tax expenses when making investment decisions, planning for retirement, or budgeting for future projects. By incorporating tax obligations into their financial strategies, taxpayers can ensure they are prepared for any changes in the tax landscape.

How can I estimate my tax liability before receiving my official tax bill?

+

To estimate your tax liability, you can use the millage rate for your specific area and multiply it by the assessed value of your property. This calculation provides a rough estimate of your tax obligation. However, it’s important to note that this estimate may not account for any exemptions or special assessments that could impact your final tax bill.

What happens if I miss the tax payment deadline?

+

Missing a tax payment deadline can result in penalties and interest charges. It’s crucial to stay informed about the payment deadlines and make timely payments to avoid additional financial burdens. If you’re facing financial difficulties, it’s advisable to contact the Charleston County Treasurer’s Office to discuss potential payment arrangements.

Can I pay my taxes in installments, and if so, what are the terms?

+

Yes, Charleston County offers the option to pay your taxes in installments. Typically, the first installment is due in January, and the second in July. However, the specific terms and deadlines may vary, so it’s essential to check with the Treasurer’s Office or refer to the official tax documents for accurate information.