Ct Income Tax

Connecticut's income tax system is a critical component of the state's financial landscape, impacting both individuals and businesses. Understanding the nuances of this tax system is essential for anyone navigating the financial waters of the Constitution State. This comprehensive guide aims to shed light on the intricacies of Connecticut's income tax, providing a detailed analysis of its structure, rates, and implications.

Understanding Connecticut’s Income Tax Structure

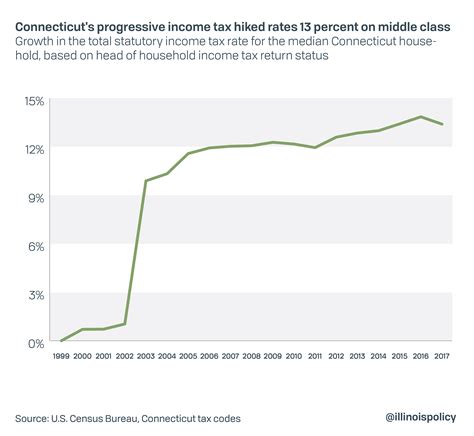

Connecticut’s income tax operates on a progressive scale, meaning tax rates increase as taxable income rises. This system is designed to ensure that those with higher incomes contribute a larger share of their earnings to the state’s revenue. The state’s tax year aligns with the federal government, running from January 1st to December 31st. Taxpayers are categorized into various brackets based on their filing status and taxable income.

Taxable Income Brackets and Rates

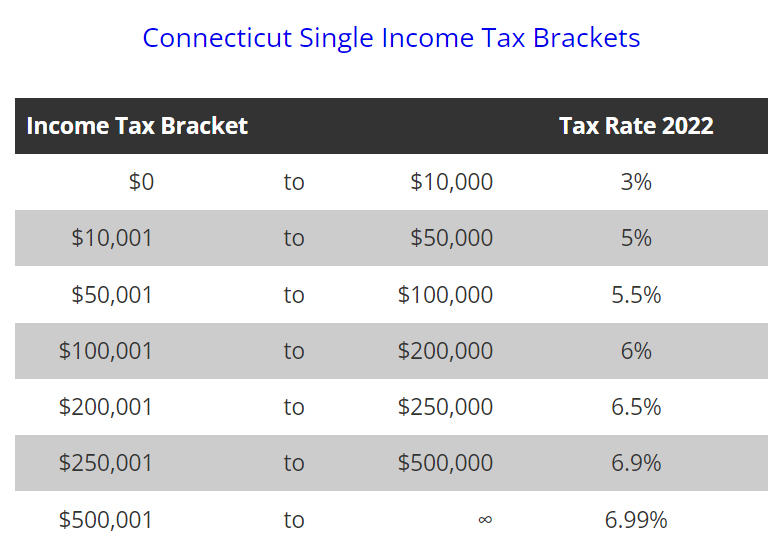

The taxable income brackets in Connecticut are as follows:

| Filing Status | Taxable Income Bracket | Tax Rate |

|---|---|---|

| Single | Up to 10,000</td> <td>3.05%</td> </tr> <tr> <td>Single</td> <td>10,001 - 50,000</td> <td>5.00%</td> </tr> <tr> <td>Single</td> <td>50,001 - 100,000</td> <td>5.50%</td> </tr> <tr> <td>Single</td> <td>100,001 - 200,000</td> <td>6.50%</td> </tr> <tr> <td>Single</td> <td>200,001 and above | 6.99% |

| Joint Filers | Up to 20,000</td> <td>3.05%</td> </tr> <tr> <td>Joint Filers</td> <td>20,001 - 100,000</td> <td>5.00%</td> </tr> <tr> <td>Joint Filers</td> <td>100,001 - 200,000</td> <td>5.50%</td> </tr> <tr> <td>Joint Filers</td> <td>200,001 - 400,000</td> <td>6.50%</td> </tr> <tr> <td>Joint Filers</td> <td>400,001 and above | 6.99% |

| Head of Household | Up to 15,000</td> <td>3.05%</td> </tr> <tr> <td>Head of Household</td> <td>15,001 - 75,000</td> <td>5.00%</td> </tr> <tr> <td>Head of Household</td> <td>75,001 - 150,000</td> <td>5.50%</td> </tr> <tr> <td>Head of Household</td> <td>150,001 - 300,000</td> <td>6.50%</td> </tr> <tr> <td>Head of Household</td> <td>300,001 and above | 6.99% |

These rates are subject to change, and it's advisable to consult the latest tax tables and guidelines issued by the Connecticut Department of Revenue Services (CT DRS) for the most accurate and up-to-date information.

Taxable Income and Deductions

Connecticut’s income tax applies to various sources of income, including wages, salaries, bonuses, commissions, and business income. Additionally, interest, dividends, capital gains, and pension or retirement income are also taxable. However, the state offers a number of deductions and credits that can reduce the tax burden for eligible taxpayers.

Deductions and Credits

Connecticut allows taxpayers to claim a standard deduction or itemize their deductions. The standard deduction amount varies based on filing status. For instance, single filers can claim a standard deduction of 3,500, while joint filers can deduct 7,000. Itemized deductions include medical expenses, charitable contributions, and state and local taxes. Taxpayers can choose the method that provides the most substantial tax savings.

Moreover, the state offers several tax credits, such as the Earned Income Tax Credit (EITC), which benefits low- to moderate-income workers. Other credits include the Property Tax Credit, which provides relief to homeowners, and the Child and Dependent Care Credit, which assists families with childcare expenses.

Income Tax for Businesses in Connecticut

Connecticut’s tax landscape extends to businesses operating within its borders. The state imposes a corporate income tax on businesses, including C corporations, S corporations, and limited liability companies (LLCs) treated as corporations for tax purposes.

Corporate Income Tax Rates

The corporate income tax in Connecticut is a flat rate of 7.5%, applicable to all taxable income. This rate is consistent for all corporations, regardless of size or industry. The state also offers a variety of incentives and tax credits to encourage business growth and investment, such as the Jobs Creation Tax Credit and the Urban and Industrial Site Reinvestment Tax Credit.

Pass-Through Entities and Self-Employment

For pass-through entities like partnerships, LLCs, and sole proprietorships, Connecticut treats the business income as personal income, subject to the individual income tax rates outlined earlier. This means that business profits are taxed at the owner’s individual tax rate, ensuring a seamless integration of business and personal finances.

Self-employed individuals, including freelancers and contractors, are responsible for paying both the employer and employee portions of payroll taxes, such as Social Security and Medicare. These taxes, known as self-employment taxes, can significantly impact the overall tax liability for these workers.

Compliance and Filing Requirements

Connecticut has strict compliance requirements for income tax filers. All taxpayers must accurately report their income and deductions on the appropriate tax forms. The state offers both paper and electronic filing options, with the latter being more efficient and often resulting in faster refunds.

Tax Forms and Due Dates

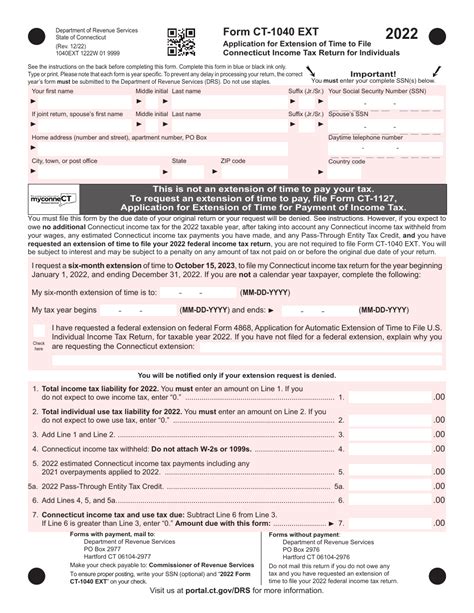

The most commonly used tax forms in Connecticut include Form CT-1040 for individual income tax returns and Form CT-1120 for corporate income tax returns. The filing deadlines align with the federal tax deadlines, typically falling on April 15th of the year following the tax year. However, taxpayers can request an extension, which provides additional time to file but not to pay any taxes owed.

Payment Options and Penalties

Taxpayers have various payment options, including direct bank account withdrawal, credit or debit card, check, or money order. It’s crucial to ensure timely payments to avoid penalties and interest. Late payments can incur a penalty of up to 5% of the unpaid tax, and interest accrues daily on the unpaid balance.

Tax Planning and Strategies

Effective tax planning is essential for individuals and businesses to minimize their tax liabilities and maximize their financial outcomes. Here are some strategies to consider:

Maximizing Deductions and Credits

Understanding the various deductions and credits available can significantly impact your tax liability. Ensure you’re taking advantage of all eligible deductions, such as the standard deduction or itemized deductions for medical expenses and charitable contributions. Additionally, explore tax credits like the EITC or the Property Tax Credit, which can provide substantial savings.

Business Tax Strategies

For businesses, consider strategies like cost segregation, which accelerates the depreciation of certain assets, reducing tax liabilities in the short term. Additionally, utilizing tax-efficient business structures, such as S corporations or LLCs, can provide tax benefits like pass-through taxation and reduced self-employment taxes.

Investment and Retirement Planning

Connecticut offers tax advantages for certain investment vehicles, such as 529 plans for education savings and Roth IRAs for retirement savings. These tax-advantaged accounts can provide significant long-term benefits, allowing your investments to grow tax-free or tax-deferred.

The Future of Connecticut’s Income Tax

As with any tax system, Connecticut’s income tax is subject to potential changes and reforms. Recent discussions have centered around proposals to simplify the tax code, reduce rates, and provide additional tax relief for residents. These proposed reforms aim to enhance the state’s competitiveness, attract businesses, and provide financial relief to taxpayers.

Additionally, the ongoing shift towards remote work and the rise of the gig economy present unique challenges and opportunities for Connecticut's tax system. The state will need to adapt its tax policies to accommodate these changes while ensuring fair and efficient taxation.

Conclusion

Connecticut’s income tax system is a critical component of the state’s financial framework, impacting both individuals and businesses. Understanding the tax rates, deductions, and compliance requirements is essential for effective financial planning. By leveraging tax-saving strategies and staying informed about potential reforms, taxpayers can navigate Connecticut’s tax landscape with confidence.

What is the tax rate for Connecticut’s highest income bracket?

+

The tax rate for Connecticut’s highest income bracket, applicable to taxable income over 200,000 for single filers and 400,000 for joint filers, is 6.99%.

Are there any special tax considerations for remote workers in Connecticut?

+

Connecticut’s tax laws apply to all individuals working within the state, regardless of their residence. This means that remote workers, even those living outside Connecticut, are subject to Connecticut income tax if they earn income from Connecticut-based employers or perform services in the state.

What is the penalty for late income tax payments in Connecticut?

+

Late income tax payments in Connecticut can incur a penalty of up to 5% of the unpaid tax, in addition to daily interest on the unpaid balance. It’s crucial to ensure timely payments to avoid these penalties.