State Tax Alabama

Understanding the state tax system in Alabama is crucial for both individuals and businesses operating within its borders. Alabama's tax structure is unique and can impact financial planning, investment decisions, and overall economic growth in the state. This comprehensive guide aims to provide an in-depth analysis of Alabama's state tax, covering its various aspects, rates, and implications.

Overview of Alabama’s State Tax Structure

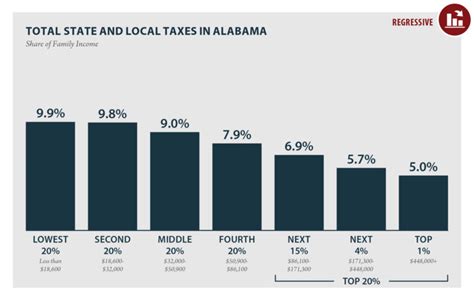

Alabama’s state tax system consists of a range of taxes, each designed to contribute to the state’s revenue. The primary taxes include income tax, sales and use tax, property tax, and various other taxes and fees. Let’s delve into each of these categories to gain a comprehensive understanding.

Income Tax in Alabama

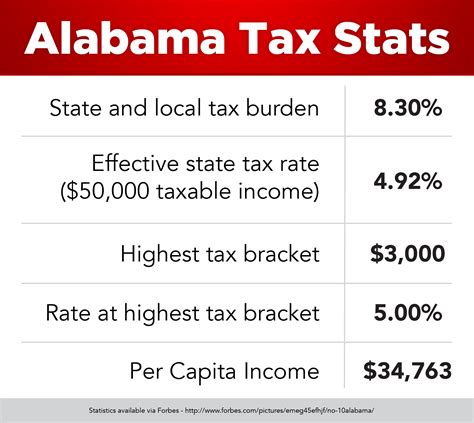

Alabama levies an income tax on both individuals and corporations. The state’s income tax system is progressive, meaning that higher income brackets are taxed at a higher rate. The income tax rates in Alabama range from 2% to 5% for individuals, with six different tax brackets based on taxable income. For corporations, the income tax rate is a flat 6.5%.

| Tax Bracket (Individual) | Tax Rate |

|---|---|

| First $5,000 | 2% |

| $5,001 - $10,000 | 3% |

| $10,001 - $25,000 | 4% |

| $25,001 - $30,000 | 5% |

| Over $30,000 | 5% |

It's important to note that Alabama offers several tax credits and deductions, such as the Earned Income Tax Credit and the Alabama Property Tax Credit, which can reduce the overall tax liability for eligible individuals and businesses.

Sales and Use Tax

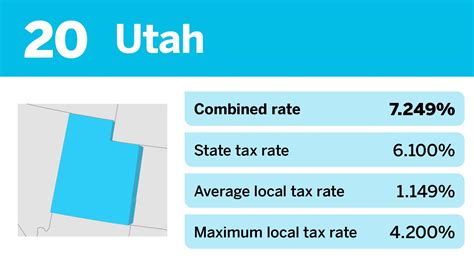

Alabama imposes a sales and use tax on the sale of tangible personal property and certain services. The state’s base sales tax rate is 4%, but local governments can add their own sales taxes, resulting in a combined rate that varies across the state. The average combined rate is around 9%, but some counties have rates as high as 11%.

Certain items are exempt from sales tax in Alabama, including prescription drugs, most groceries, and select manufacturing machinery. Additionally, Alabama offers a variety of sales tax holidays throughout the year, providing tax-free shopping opportunities for specific items such as back-to-school supplies and energy-efficient appliances.

Property Tax

Property taxes in Alabama are primarily levied by local governments, including counties, municipalities, and school districts. The state does not impose a uniform property tax rate, and rates can vary significantly across different jurisdictions. The average effective property tax rate in Alabama is approximately 0.44% of a property’s assessed value.

Alabama utilizes a "40% assessment ratio" for residential and commercial properties, meaning that the assessed value for property tax purposes is equal to 40% of the property's fair market value. This assessment ratio is applied uniformly across the state.

Other Taxes and Fees

Alabama also collects various other taxes and fees to support specific programs and services. These include:

- Fuel taxes: Alabama imposes taxes on gasoline and diesel fuel, with rates varying based on the type of fuel and its intended use.

- Motor vehicle taxes: Vehicle registration fees and title transfer fees are charged based on the value of the vehicle.

- Severance taxes: Taxes are levied on the extraction of natural resources, such as oil, gas, and minerals.

- Excise taxes: These taxes are imposed on specific activities or goods, such as telecommunications services and alcohol.

Tax Incentives and Credits in Alabama

Alabama offers a range of tax incentives and credits to attract businesses and promote economic development. These incentives can significantly reduce a company’s tax liability and are often tailored to specific industries or initiatives.

Business Tax Incentives

Alabama provides tax incentives for businesses in various sectors, including manufacturing, technology, and renewable energy. Some of the key incentives include:

- Jobs Tax Credit: Businesses that create new jobs and meet certain criteria can qualify for a tax credit of up to $3,500 per new job.

- Capital Investment Tax Credit: Companies investing in new facilities or equipment can receive a tax credit based on the value of their investment.

- Research and Development Tax Credit: Businesses engaged in qualified research activities can claim a tax credit equal to a percentage of their research expenses.

Individual Tax Credits

Alabama offers several tax credits to individuals, primarily focused on reducing the tax burden for low- and middle-income residents. These credits include:

- Earned Income Tax Credit: A refundable tax credit for low- to moderate-income working individuals and families, designed to offset the burden of social security taxes and provide an incentive to work.

- Child and Dependent Care Credit: A credit for childcare expenses, helping working parents offset the cost of childcare.

- Alabama Property Tax Credit: Eligible homeowners can receive a credit to offset a portion of their property taxes.

Compliance and Reporting Requirements

Alabama’s Department of Revenue imposes strict compliance and reporting requirements for both individuals and businesses. Accurate and timely filing of tax returns is crucial to avoid penalties and interest charges.

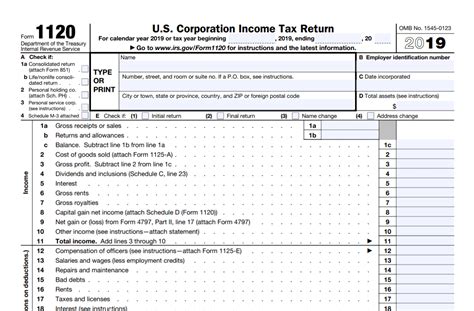

Income Tax Filing

Individuals and corporations in Alabama must file their income tax returns annually. The deadline for filing income tax returns is typically April 15th for individuals and March 15th for corporations. However, taxpayers can request an extension to file their returns, which extends the deadline to October 15th for individuals and September 15th for corporations.

Sales and Use Tax Filing

Businesses that collect sales tax in Alabama must register with the Department of Revenue and file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume. The due dates for sales tax returns are typically the 20th of the month following the tax period.

Property Tax Assessment and Appeal

Property owners in Alabama receive a notice of assessment from their local tax assessor’s office. If a property owner disagrees with the assessed value, they have the right to appeal the assessment. The appeal process involves a review by a local board of equalization and, if necessary, a hearing before the Alabama Tax Tribunal.

Economic Impact and Future Outlook

Alabama’s state tax structure plays a significant role in shaping the state’s economy. The state’s tax policies can influence investment decisions, business growth, and overall economic development. Let’s explore some of the key economic implications and future prospects.

Impact on Business Climate

Alabama’s competitive tax rates, particularly in the corporate income tax category, make it an attractive destination for businesses. The state’s tax incentives and credits further enhance its appeal, encouraging companies to invest and create jobs. As a result, Alabama has seen significant growth in various sectors, including automotive manufacturing, aerospace, and technology.

Revenue Generation and Budget

State taxes are a critical source of revenue for Alabama’s budget. The state’s tax structure ensures a balanced approach to revenue generation, with a focus on income, sales, and property taxes. This revenue is essential for funding various public services, including education, healthcare, infrastructure development, and social programs.

Future Tax Policy Considerations

As Alabama’s economy continues to evolve, the state’s tax policies will likely undergo periodic reviews and adjustments. Some key considerations for future tax policy include:

- Modernizing the tax system to adapt to changing economic conditions and technological advancements.

- Addressing tax disparities and ensuring fairness across different income levels and industries.

- Exploring opportunities to simplify the tax code and reduce administrative burdens on taxpayers.

- Continuing to offer competitive tax incentives to attract businesses and promote economic growth.

FAQ

What is the current sales tax rate in Alabama for online purchases?

+

The sales tax rate for online purchases in Alabama is the same as the sales tax rate in the county where the item is shipped. This rate can vary depending on the county, as local governments have the authority to add their own sales taxes.

Are there any tax incentives for renewable energy projects in Alabama?

+

Yes, Alabama offers tax incentives for renewable energy projects. The state provides a sales and use tax exemption for the purchase of renewable energy equipment and a corporate income tax credit for investments in qualifying renewable energy facilities.

How often do property tax assessments occur in Alabama?

+

Property tax assessments in Alabama occur every four years. However, if a property undergoes significant improvements or changes in ownership, a reassessment may be conducted sooner.