Sales Tax California Sacramento

Sales tax is a crucial aspect of doing business in any state, and California is no exception. With its diverse economy and unique tax regulations, understanding the sales tax landscape is essential for businesses, especially in a major metropolitan area like Sacramento. In this comprehensive guide, we will delve into the specifics of sales tax in California, with a focus on the city of Sacramento, to provide you with an expert-level understanding of this critical topic.

The California Sales Tax System: An Overview

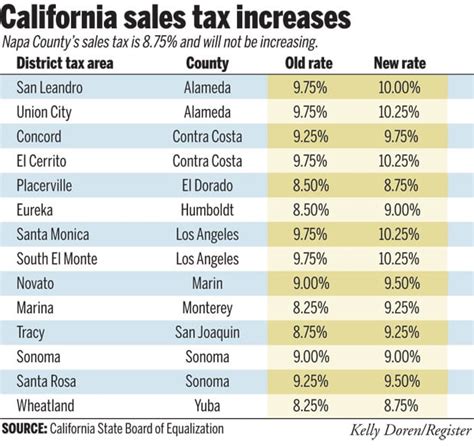

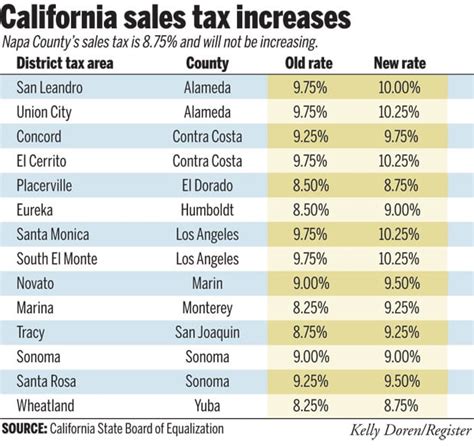

California’s sales tax system is a complex yet well-defined framework that businesses must navigate to comply with state and local regulations. The state’s sales tax rate is set at a base rate of 7.25%, which is applicable to most retail transactions. However, this is just the beginning, as California’s tax structure includes various additional layers that can significantly impact the final tax liability.

City and County Add-Ons

Sacramento, being the capital city and a major economic hub, has its own set of sales tax add-ons. The city of Sacramento imposes an additional 0.75% sales tax, bringing the total to 8% for most transactions within the city limits. This city tax is used to fund local infrastructure and community development projects.

Furthermore, Sacramento County, in which the city is located, adds another 0.25% to the sales tax rate. This county tax is aimed at supporting county-wide initiatives and services. Thus, for a business operating in Sacramento County, the total sales tax rate becomes 8.25%, a figure that is important for accurate pricing and tax compliance.

Special Districts and Taxes

California is known for its diverse special districts, each with its own tax considerations. In Sacramento, there are various special districts that may apply additional taxes to certain transactions. For instance, the Sacramento-Yolo Port District imposes a 0.10% sales tax on certain goods and services, while the Sacramento Transportation Authority may add another 0.5% to the tax rate for specific transportation-related purchases.

These special district taxes are often tied to specific projects or infrastructure developments, and they can vary significantly based on the type of business and the location within the city. It's crucial for businesses to understand these nuances to ensure accurate tax reporting and compliance.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| California State | 7.25% |

| Sacramento City | 0.75% |

| Sacramento County | 0.25% |

| Special Districts (e.g., Port District) | 0.10% - 0.5% |

| Total Sales Tax in Sacramento | 8.25% - 8.85% |

Compliance and Reporting: Navigating the Process

Ensuring compliance with California’s sales tax regulations is a critical task for any business operating in the state. The California Department of Tax and Fee Administration (CDTFA) is the governing body responsible for overseeing sales and use tax collection and administration.

Registering for a Sales Tax Permit

Businesses are required to obtain a Seller’s Permit from the CDTFA before engaging in taxable sales activities. This permit allows businesses to collect and remit sales tax on behalf of the state and local jurisdictions. The process typically involves an online application, where businesses provide details about their operations, expected sales volume, and tax liability.

Once registered, businesses are assigned a unique permit number and are expected to comply with regular reporting and payment deadlines. The CDTFA provides resources and guidance to help businesses understand their obligations and navigate the registration process smoothly.

Collecting and Remitting Sales Tax

Businesses are responsible for collecting sales tax at the point of sale, which includes the state base rate, any applicable city and county add-ons, and any special district taxes. The collected tax must be remitted to the CDTFA on a regular basis, typically quarterly or monthly, depending on the business’s sales volume and tax liability.

Accurate record-keeping is essential for compliance. Businesses must maintain detailed records of sales transactions, including the tax amount collected, to ensure accurate reporting. The CDTFA provides tools and resources to help businesses manage their sales tax obligations, including online filing and payment options.

Sales Tax for Online Businesses

With the rise of e-commerce, online businesses operating in California face unique sales tax challenges. The state has implemented various measures to ensure that online sellers comply with sales tax regulations, including the requirement to collect and remit sales tax on transactions made with California residents.

Economic Nexus and Sales Tax

California’s economic nexus laws require out-of-state sellers to register for a sales tax permit and collect sales tax if they meet certain sales thresholds within the state. For example, if an online business makes over $100,000 in sales or completes more than 200 transactions with California customers in a year, it must register for a sales tax permit and start collecting tax.

This law ensures that online businesses contribute to the state's revenue stream and level the playing field for local brick-and-mortar stores. Failure to comply with economic nexus laws can result in penalties and interest charges.

Marketplace Facilitator Rules

California has also implemented marketplace facilitator rules, which hold online marketplaces responsible for collecting and remitting sales tax on behalf of their third-party sellers. This means that platforms like Amazon, eBay, and Etsy are required to collect and remit sales tax for transactions made through their platforms, providing a more straightforward process for tax compliance.

Sales Tax Exemptions and Considerations

While sales tax is a standard part of doing business in California, there are certain transactions and scenarios where sales tax may be exempted or reduced.

Sales Tax Exemptions

California offers various sales tax exemptions for specific transactions and goods. For example, sales tax is not applicable to certain types of food, prescription medications, and select services. Additionally, charitable organizations and non-profits may be eligible for sales tax exemptions, depending on the nature of their activities.

It's crucial for businesses to stay informed about these exemptions to ensure they are not overcharging their customers or incurring unnecessary tax liabilities. The CDTFA provides detailed guidelines and resources to help businesses understand the exemptions and apply them correctly.

Resale and Purchase for Resale

Businesses that purchase goods for resale, such as retailers and wholesalers, are not required to pay sales tax on their purchases. Instead, they collect sales tax from their customers at the point of sale. This is known as the resale exemption and is a critical consideration for businesses engaged in wholesale or retail trade.

The Impact of Sales Tax on Business Operations

Sales tax is a significant factor in the financial planning and strategic decision-making of any business operating in California. It affects pricing strategies, cash flow management, and overall profitability.

Pricing and Competitive Advantage

In a competitive market, businesses must carefully consider their pricing strategies to remain attractive to customers while maintaining profitability. Sales tax is a substantial component of the final price, and businesses must factor it into their pricing models. This is especially true in Sacramento, where the total sales tax rate can reach up to 8.85% in certain areas.

Businesses may choose to absorb the sales tax into their product prices or offer tax-inclusive pricing to simplify the purchasing process for customers. Either way, understanding the sales tax landscape is crucial for setting competitive prices and ensuring a positive customer experience.

Cash Flow Management and Tax Payments

Sales tax payments represent a significant outflow of cash for businesses, especially those with high sales volumes. Accurate cash flow management is essential to ensure that businesses have sufficient funds to remit sales tax on time. Late payments can result in penalties and interest charges, impacting the business’s financial health.

Businesses should plan their cash flow to accommodate regular sales tax payments and consider the timing of these payments relative to their income streams. Proper cash flow management ensures that businesses can meet their tax obligations without disrupting their operations.

Future Trends and Developments

The landscape of sales tax in California is continually evolving, influenced by changing economic conditions, legislative decisions, and technological advancements. Staying informed about these developments is crucial for businesses to adapt their strategies and ensure ongoing compliance.

Potential Rate Changes

While the current sales tax rates in Sacramento and California are well-defined, they are not set in stone. Economic conditions, political decisions, and budget requirements can lead to changes in the sales tax rates. Businesses should stay updated on any proposed or impending rate changes to adjust their pricing and tax compliance strategies accordingly.

Technological Innovations

The rise of e-commerce and digital platforms has led to significant advancements in sales tax technology. Online businesses now have access to sophisticated tools and software that can automate sales tax calculations, reporting, and remittance. These technologies can streamline the tax compliance process, reduce errors, and save businesses time and resources.

Tax Policy Reform

California’s tax policies are subject to ongoing review and potential reform. Recent years have seen discussions around simplifying the tax system, streamlining tax collection processes, and addressing issues like sales tax evasion. Businesses should stay engaged with these policy discussions to understand how potential reforms may impact their operations and tax obligations.

How often do businesses need to remit sales tax in California?

+

The frequency of sales tax remittance in California depends on the business’s sales volume and tax liability. Businesses with a high sales volume (over $500,000 annually) are typically required to remit sales tax monthly. Those with lower sales may be eligible for quarterly remittance. However, businesses can also choose to remit sales tax more frequently to maintain a healthy cash flow and stay on top of their tax obligations.

Are there any sales tax holidays in California?

+

Yes, California does have sales tax holidays, typically held during certain periods to encourage shopping and stimulate the economy. During these holidays, specific categories of goods, such as clothing or school supplies, may be exempt from sales tax for a limited time. Businesses should stay informed about these holidays to accurately inform their customers and adjust their pricing strategies accordingly.

What happens if a business fails to collect or remit sales tax in California?

+

Failure to collect or remit sales tax in California can result in significant penalties and interest charges. The California Department of Tax and Fee Administration (CDTFA) has strict guidelines and enforcement mechanisms in place to ensure compliance. Businesses that repeatedly fail to comply may face more severe consequences, including revocation of their Seller’s Permit.

How can businesses stay updated on sales tax changes and regulations in California?

+

Businesses can stay informed about sales tax changes and regulations in California by regularly visiting the CDTFA website, subscribing to their newsletters, and following industry news and updates. Additionally, consulting with tax professionals or using reliable sales tax software can help businesses stay compliant and adapt to any changes in the sales tax landscape.