Monroe County Tax

Monroe County, situated in the state of Michigan, presents a unique landscape when it comes to taxation. With a diverse range of communities and a vibrant economy, understanding the tax system in this county is essential for residents, businesses, and anyone considering relocation. This article aims to delve into the intricacies of Monroe County tax, offering an in-depth analysis of its structure, rates, and implications.

Unraveling the Monroe County Tax System

The tax system in Monroe County is a comprehensive framework designed to support the county’s operations and development. It encompasses various types of taxes, each playing a crucial role in funding essential services and initiatives.

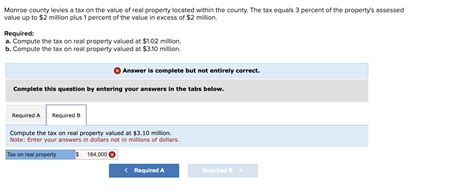

Property Taxes: A Pillar of County Funding

Property taxes are a cornerstone of Monroe County’s revenue generation. These taxes are levied on both residential and commercial properties, with rates varying based on factors such as property value, location, and usage.

| Property Type | Tax Rate |

|---|---|

| Residential Properties | 1.5% of Assessed Value |

| Commercial Properties | 1.8% of Assessed Value |

The assessed value of a property is determined by the county's tax assessor, who considers factors like market value, improvements, and location. Property owners can expect to receive a tax bill annually, which includes the calculated tax amount and due date.

It's worth noting that Monroe County offers tax incentives for certain property types, such as agricultural lands and historic properties. These incentives aim to promote specific industries and preserve the county's cultural heritage.

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are another vital component of Monroe County’s tax structure. These taxes are imposed on the sale of goods and services within the county, with the responsibility often falling on businesses to collect and remit the taxes.

The sales tax rate in Monroe County is currently set at 6%, which includes both the state and local sales tax. This rate applies to most tangible personal property and certain services. However, certain items, such as groceries and prescription drugs, are exempt from sales tax to alleviate the burden on essential consumer goods.

Use taxes, on the other hand, are applicable when goods are purchased from out-of-state vendors and brought into Monroe County for use. This ensures that all goods, regardless of their point of sale, contribute to the county's revenue stream.

Businesses operating in Monroe County must register for a sales and use tax permit and remit taxes on a monthly or quarterly basis. Failure to comply with these obligations can result in penalties and interest charges.

Income Taxes: Individual and Corporate Contributions

Monroe County, like many other counties in Michigan, does not impose a local income tax. However, residents and businesses are still subject to state income taxes, which are used to fund various state-level programs and services.

The state of Michigan has a flat tax rate of 4.25% for individual income taxes. This means that regardless of income level, all individuals pay the same rate on their taxable income. For corporations, the tax rate is slightly higher at 6%.

It's important for individuals and businesses to understand their tax obligations at the state level, as failure to comply can result in significant penalties. Additionally, staying informed about any changes to tax laws and regulations is crucial for accurate tax planning and compliance.

Other Taxes and Fees

In addition to the aforementioned taxes, Monroe County also collects various other taxes and fees to support specific initiatives and services.

- Vehicle Registration Fees: Vehicle owners in Monroe County are required to pay registration fees annually. These fees vary based on the type and weight of the vehicle.

- Hotel and Lodging Taxes: A 5% tax is imposed on the rental of hotel rooms and other lodging facilities within the county. This tax contributes to tourism development and promotion.

- Excise Taxes: Monroe County levies excise taxes on certain goods and activities, such as gasoline, tobacco products, and outdoor advertising. These taxes are used to fund specific infrastructure projects and environmental initiatives.

Tax Relief and Assistance Programs

Monroe County recognizes the financial challenges that taxes can pose, especially for low-income households and seniors. As such, the county offers a range of tax relief and assistance programs to alleviate the burden.

Property Tax Exemptions and Credits

Property owners in Monroe County may be eligible for various tax exemptions and credits, which can significantly reduce their tax liability. Some of these include:

- Homestead Exemption: Residents who own and occupy their primary residence in Monroe County can apply for a homestead exemption. This exemption reduces the taxable value of their property, resulting in lower property taxes.

- Senior Citizen Exemption: Monroe County offers a property tax exemption to senior citizens aged 65 and above. This exemption is based on income and can provide significant relief for older homeowners.

- Veteran's Exemption: Veterans who meet certain criteria, such as having a service-connected disability, may be eligible for a property tax exemption. This is a way for the county to show appreciation for their service.

Tax Assistance Programs

For individuals and businesses facing financial difficulties, Monroe County provides access to tax assistance programs and resources. These programs aim to help taxpayers navigate the tax system and ensure compliance while minimizing penalties.

One such program is the Monroe County Taxpayer Assistance Office, which offers free tax preparation services for eligible low-income individuals and families. This office provides guidance on tax forms, deductions, and credits, ensuring that taxpayers receive the maximum benefit available to them.

Additionally, the county partners with local community organizations to provide tax clinics and workshops, offering education and support to taxpayers throughout the year.

Future Implications and Tax Planning

As Monroe County continues to grow and evolve, the tax system will likely undergo changes to adapt to the changing needs of the community. Staying informed about these changes is crucial for both individuals and businesses.

For homeowners, keeping track of property tax assessments and taking advantage of available exemptions can significantly impact their financial planning. Regularly reviewing tax rates and staying updated on any proposed changes can help them make informed decisions about their properties.

Businesses, on the other hand, should stay informed about sales tax rates and regulations. With the rise of e-commerce, understanding the nuances of sales tax collection and remittance, especially for out-of-state sales, is essential. Additionally, businesses should explore tax incentives and credits that can reduce their tax burden and support their growth.

Furthermore, with the ever-changing landscape of tax laws, seeking professional advice from tax experts and accountants can provide valuable insights and ensure compliance with the latest regulations.

Conclusion

The tax system in Monroe County is a complex yet crucial component of the county’s financial health. Understanding this system, from property taxes to sales taxes and various other levies, empowers residents and businesses to make informed decisions and contribute effectively to the community’s growth and development.

By staying informed, taking advantage of available tax relief programs, and seeking professional guidance when needed, individuals and businesses can navigate the tax landscape with confidence and ensure their financial well-being.

How often are property taxes assessed in Monroe County?

+Property taxes in Monroe County are assessed annually. The county’s tax assessor evaluates properties based on various factors, and property owners receive a tax bill reflecting the assessed value and applicable tax rate.

Are there any upcoming changes to sales tax rates in Monroe County?

+As of my knowledge cutoff in January 2023, there were no announced changes to the sales tax rates in Monroe County. However, it’s always a good practice to stay updated with local news and official announcements to ensure you have the latest information.

What support is available for businesses struggling with tax compliance?

+Monroe County offers various resources and support for businesses facing tax compliance challenges. This includes access to tax professionals, workshops, and online resources. Additionally, the county provides tax incentives and credits to support business growth and development.