Sales Tax In Spokane Washington

Sales tax is an essential component of the revenue system in the United States, with each state, county, and city having its own set of regulations and rates. In the city of Spokane, Washington, sales tax plays a crucial role in funding public services and infrastructure development. This article aims to provide an in-depth analysis of sales tax in Spokane, exploring its rates, exemptions, collection processes, and impact on local businesses and residents.

Understanding Sales Tax in Spokane, Washington

Sales tax in Spokane operates under the state’s comprehensive sales and use tax laws, which are administered by the Washington State Department of Revenue. The city of Spokane, being the largest city in the state’s Inland Northwest region, has a unique tax structure that contributes significantly to its economic landscape.

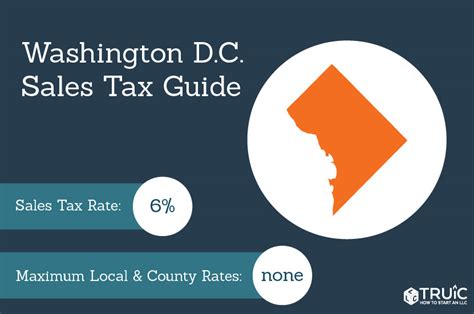

Spokane's sales tax system is a combination of state, county, and city taxes, with each level of government imposing its own rate. As of [current date], the total sales tax rate in Spokane is [current rate]%, which includes:

- State Sales Tax: [state tax rate]%

- County Sales Tax: [county tax rate]%

- City Sales Tax: [city tax rate]%

This multi-level tax structure ensures that a portion of the sales tax revenue is allocated to the state, county, and city, allowing for efficient distribution of funds to various public services and infrastructure projects.

Sales Tax Exemptions in Spokane

While most retail sales are subject to sales tax in Spokane, there are specific exemptions and exceptions outlined in the state’s tax laws. Some of the notable sales tax exemptions in Spokane include:

- Grocery items: Essential food products, including non-prepared foods, are exempt from sales tax, providing a much-needed relief for households on a tight budget.

- Prescription medications: Sales tax does not apply to pharmaceutical drugs, ensuring that healthcare expenses are more affordable for residents.

- Certain services: Many professional services, such as legal, accounting, and consulting, are exempt from sales tax, as they are considered intangible products.

- Resale items: Businesses that purchase goods for resale, such as wholesalers and retailers, are not required to pay sales tax on their purchases.

These exemptions are in place to encourage economic growth, support essential industries, and reduce the tax burden on specific sectors and individuals.

Sales Tax Collection and Administration

In Spokane, the responsibility of collecting and administering sales tax falls on the shoulders of businesses operating within the city limits. These businesses are required to register with the Washington State Department of Revenue and obtain a sales tax permit. Once registered, businesses must:

- Collect sales tax from customers at the point of sale, ensuring that the correct rate is applied to each taxable transaction.

- Remit the collected sales tax to the Department of Revenue on a regular basis, typically on a monthly or quarterly basis, depending on the business's tax liability.

- Maintain accurate records of sales transactions, including taxable and exempt sales, to facilitate proper tax reporting.

The Department of Revenue provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations and ensuring compliance. Non-compliance with sales tax regulations can result in penalties, fines, and legal consequences.

Online Sales and Sales Tax

With the rise of e-commerce, online sales have become a significant part of the retail landscape in Spokane. To address the collection of sales tax on online transactions, the state of Washington has implemented various measures, including:

- Requiring online retailers to register for a sales tax permit and collect sales tax from customers based on the delivery address.

- Establishing a threshold for remote sellers, which, if exceeded, requires them to collect and remit sales tax on their online sales.

- Collaborating with major online marketplaces to ensure that sales tax is accurately collected and remitted on transactions facilitated through their platforms.

These measures aim to ensure a level playing field for local businesses and prevent online retailers from gaining an unfair advantage by not collecting sales tax.

Impact on Local Businesses and Residents

Sales tax in Spokane has a direct impact on both local businesses and residents. For businesses, sales tax can influence pricing strategies, profit margins, and overall competitiveness in the market. Here’s how sales tax affects different aspects of the business landscape:

Retail Businesses

Retail stores in Spokane must carefully consider the impact of sales tax on their pricing. While a higher sales tax rate can increase the overall cost of goods for customers, it also provides an opportunity for retailers to promote their competitive pricing and attract price-conscious shoppers.

Retailers may also choose to absorb a portion of the sales tax to maintain their pricing strategy, especially if they are competing with online retailers or businesses from neighboring areas with lower sales tax rates.

E-commerce and Online Businesses

Online businesses in Spokane, particularly those with a significant online presence, are required to collect and remit sales tax on their transactions. While this adds an administrative burden, it ensures that online retailers contribute to the local tax base and compete fairly with brick-and-mortar stores.

To stay competitive, online businesses may need to adjust their pricing strategies to account for sales tax, offer free shipping to offset the tax burden, or provide other incentives to encourage online purchases.

Residential Impact

Sales tax in Spokane affects residents by influencing the cost of goods and services they purchase. While a higher sales tax rate can increase the cost of living, it also supports essential public services and infrastructure projects that benefit the community.

The sales tax revenue collected in Spokane is utilized for various purposes, including:

- Funding public education and improving school facilities.

- Supporting public safety initiatives, such as police and fire departments.

- Maintaining and improving roads, bridges, and other transportation infrastructure.

- Investing in cultural and recreational facilities, enhancing the quality of life for residents.

Therefore, while sales tax may add to the cost of goods, it ultimately contributes to the overall well-being and development of the city.

Future Implications and Potential Changes

As the economic landscape continues to evolve, sales tax regulations in Spokane may undergo changes to adapt to new challenges and opportunities. Here are some potential future implications and considerations:

Online Sales and Remote Sellers

With the rapid growth of e-commerce, the state of Washington may need to further refine its regulations regarding online sales and remote sellers. This could involve adjusting thresholds for sales tax collection, enhancing enforcement measures, and collaborating with online platforms to ensure compliance.

Sales Tax Simplification

Simplifying the sales tax system in Spokane could be beneficial for both businesses and consumers. This may involve consolidating tax rates, streamlining registration and reporting processes, and providing clearer guidelines to reduce confusion and administrative burdens.

Tax Exemptions and Revenues

The state and local governments may review existing sales tax exemptions to ensure they align with current economic priorities and social needs. While exemptions provide relief to specific sectors and individuals, they also reduce the tax base, impacting the overall revenue collection.

Regional Cooperation

Spokane’s sales tax system could be influenced by regional cooperation and coordination with neighboring counties and cities. Collaborative efforts could lead to more consistent tax rates and regulations, making it easier for businesses to operate across multiple jurisdictions.

Economic Development and Growth

As Spokane continues to grow and attract new businesses, the sales tax system will play a vital role in supporting economic development initiatives. The city may explore ways to utilize sales tax revenue to incentivize business growth, create jobs, and enhance the local economy.

FAQ

What is the current sales tax rate in Spokane, Washington?

+

As of [current date], the total sales tax rate in Spokane is [current rate]%, which includes the state, county, and city sales tax rates.

Are there any sales tax exemptions in Spokane?

+

Yes, Spokane has several sales tax exemptions, including grocery items, prescription medications, certain services, and resale items. These exemptions are in place to support essential industries and reduce the tax burden on specific sectors.

Who is responsible for collecting and remitting sales tax in Spokane?

+

Businesses operating within the city limits of Spokane are responsible for collecting and remitting sales tax. They must register with the Washington State Department of Revenue, obtain a sales tax permit, and follow the guidelines for tax collection and reporting.

How does sales tax affect pricing strategies for local businesses in Spokane?

+

Sales tax can influence pricing strategies by increasing the overall cost of goods for customers. Retailers may choose to absorb a portion of the tax to maintain competitive pricing or promote their prices as an advantage over neighboring areas with lower tax rates.

What are the potential future changes to sales tax regulations in Spokane?

+

Future changes may include refining regulations for online sales and remote sellers, simplifying the sales tax system, reviewing tax exemptions, and promoting regional cooperation to create a more consistent tax environment. These changes aim to adapt to the evolving economic landscape and support the city’s growth.