Virginia Personal Property Tax

The Virginia Personal Property Tax is an annual levy imposed on tangible personal property, including vehicles, boats, and various types of business equipment, owned by individuals and businesses within the state. This tax is an essential component of Virginia's revenue stream, contributing to the funding of local governments and essential public services. The administration and assessment of this tax vary across jurisdictions, reflecting the diverse needs and characteristics of different regions within the state.

Understanding the Virginia Personal Property Tax

The Personal Property Tax in Virginia is a crucial aspect of the state’s fiscal system, serving as a significant revenue source for local governments. This tax, levied annually, applies to a wide range of personal property, from vehicles and boats to machinery and furniture. Its assessment and collection processes are intricate, involving a combination of state regulations and local ordinances.

For vehicles, the tax is typically based on the vehicle's age, make, model, and retail value. Older vehicles tend to have lower assessments, while newer, more expensive models may be subject to higher tax rates. This system ensures that the tax burden is distributed fairly among vehicle owners, taking into account both the value and age of the vehicle.

In the case of business equipment, the tax is often assessed based on the original cost of the equipment, its current market value, or a combination of both. This approach ensures that businesses with more valuable assets contribute a proportionate share to the local tax base. It also encourages businesses to maintain accurate records of their equipment, as these records are often used for tax assessment purposes.

Boats and other watercraft are also subject to the Personal Property Tax. The tax for these assets is typically calculated based on factors such as the boat's length, type, and value. This ensures that boat owners contribute to the local tax revenue, which in turn supports the maintenance of marinas, harbors, and other water-related infrastructure.

The Assessment Process

The assessment of the Personal Property Tax in Virginia is a detailed process that involves several key steps. Firstly, property owners are required to declare their personal property to the local commissioner of the revenue by a certain deadline each year. This declaration process ensures that all taxable property is accounted for and assessed accurately.

Once the declaration is received, the commissioner's office assesses the value of the property based on established guidelines. For vehicles, this often involves consulting vehicle valuation guides, while for business equipment, it may involve physical inspections or reviews of purchase records. The assessed value is then used to calculate the tax liability for each property owner.

It's worth noting that the assessment process can vary slightly between different localities in Virginia. Some jurisdictions may use a fixed assessment rate, while others may employ a more flexible approach, adjusting rates based on the property's value and the local tax needs.

| Property Type | Assessment Basis |

|---|---|

| Vehicles | Vehicle age, make, model, and retail value |

| Business Equipment | Original cost, current market value, or a combination of both |

| Boats and Watercraft | Boat length, type, and value |

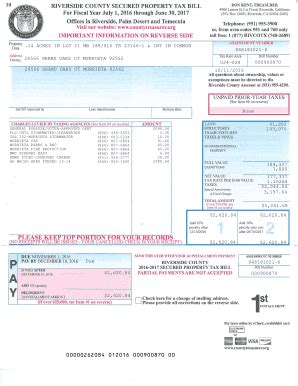

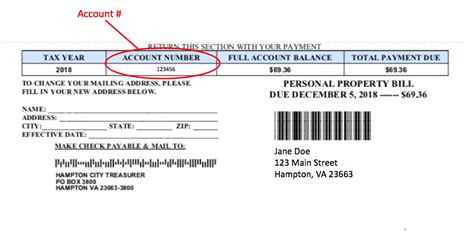

Payment and Due Dates

The payment of the Virginia Personal Property Tax is an annual obligation for property owners. The tax is typically due by a specific date, which can vary depending on the locality. It’s important for property owners to be aware of these due dates to ensure timely payment and avoid penalties.

The payment process is usually straightforward. Property owners can pay their taxes online, by mail, or in person at their local commissioner's office. Online payment is often the most convenient option, as it allows for quick and secure transactions. Mail-in payments require the completion of a tax form and a check or money order, which should be sent to the address specified by the commissioner's office.

In-person payments are an option for those who prefer a more personal approach. Property owners can visit their local commissioner's office, where they can make payments using cash, check, or, in some cases, credit cards. It's important to note that certain localities may charge a fee for credit card payments.

For those who need assistance or have questions about their tax bill, the commissioner's office is a valuable resource. Staff members are available to provide guidance on payment options, due dates, and any other tax-related queries. They can also assist with issues such as tax exemptions or disputes.

Exemptions and Discounts

Virginia offers several exemptions and discounts for the Personal Property Tax, which can provide significant savings for eligible property owners. These exemptions and discounts are designed to alleviate the tax burden for certain groups and situations.

One common exemption is for disabled veterans. Qualifying veterans may be eligible for a full or partial exemption from the Personal Property Tax on their vehicles. This exemption recognizes the service and sacrifices made by these veterans and provides them with some financial relief.

Another exemption is available for low-income seniors. Seniors who meet certain income criteria may be eligible for a reduced tax rate or even a complete exemption. This exemption helps ensure that older adults on fixed incomes are not unduly burdened by property taxes.

In addition to exemptions, Virginia also offers a discount for early payment of the Personal Property Tax. Property owners who pay their taxes by a specified early payment deadline can receive a discount on their total tax amount. This incentive encourages timely payment and helps local governments with their cash flow.

| Exemption/Discount | Eligibility |

|---|---|

| Disabled Veteran Exemption | Qualifying veterans with service-related disabilities |

| Low-Income Senior Exemption | Seniors meeting certain income criteria |

| Early Payment Discount | Property owners paying by the early payment deadline |

Challenges and Controversies

While the Virginia Personal Property Tax serves as a vital revenue stream for local governments, it is not without its challenges and controversies. These issues often stem from the complexity of assessing and collecting taxes on a diverse range of personal property.

Valuation Challenges

One of the primary challenges with the Personal Property Tax is the accurate valuation of assets. Vehicles, for instance, can depreciate at different rates depending on their make, model, and usage. This makes it difficult to establish a fair and consistent valuation method that takes into account the unique characteristics of each vehicle.

Similarly, the valuation of business equipment can be complex. Equipment may depreciate differently based on its usage, industry, and technological advancements. Finding a valuation method that considers these factors while also being fair and consistent can be a significant challenge for tax assessors.

Tax Avoidance and Non-Compliance

Another challenge faced by Virginia’s tax authorities is tax avoidance and non-compliance. Some property owners may deliberately or inadvertently fail to declare their personal property, leading to an underestimation of the tax base. This can result in a significant loss of revenue for local governments.

To combat this, tax authorities employ various strategies, including random audits, cross-referencing data from different sources, and encouraging property owners to report their assets accurately. These measures help ensure a more accurate tax base and reduce the instances of tax avoidance.

Equity Concerns

The Personal Property Tax has also been the subject of equity concerns. Some critics argue that the tax places an unfair burden on certain groups, such as low-income individuals or small businesses, who may struggle to afford the tax on their personal property.

Addressing these equity concerns often involves a careful balancing act. On one hand, local governments need sufficient revenue to fund essential services. On the other hand, they must ensure that the tax burden is distributed fairly and does not disproportionately affect certain segments of the population.

| Challenge | Impact |

|---|---|

| Valuation Challenges | Difficult to establish fair and consistent valuation methods for diverse assets |

| Tax Avoidance and Non-Compliance | Leads to underestimation of tax base and revenue loss for local governments |

| Equity Concerns | May disproportionately affect low-income individuals and small businesses |

Future Outlook and Potential Reforms

As Virginia continues to evolve and adapt to changing economic and social landscapes, the Personal Property Tax is likely to undergo further reforms to ensure its effectiveness and fairness. These reforms could address some of the challenges discussed earlier and better align the tax system with the state’s evolving needs.

Simplification of Valuation Methods

One potential reform could involve simplifying the valuation methods for personal property. This could mean adopting a more standardized approach to valuing assets, especially for vehicles and business equipment. Such a reform could lead to a more consistent and fair tax system, making it easier for property owners to understand and comply with their tax obligations.

Enhanced Tax Compliance Measures

To address the issue of tax avoidance and non-compliance, Virginia could implement more robust tax compliance measures. This could include increasing the frequency and scope of audits, utilizing advanced data analytics to identify potential tax evasion, and enhancing taxpayer education and outreach programs. By taking a proactive approach to tax compliance, the state can ensure a more accurate tax base and fair distribution of the tax burden.

Equitable Tax Burden

Reforms could also focus on ensuring a more equitable distribution of the tax burden. This could involve exploring alternative tax structures, such as progressive tax rates or tax credits, that take into account the ability to pay. By making the tax system more responsive to the financial situations of individuals and businesses, Virginia can promote social and economic fairness.

Integration of Technology

In today’s digital age, integrating technology into the tax system can greatly enhance efficiency and accuracy. Virginia could explore the use of digital platforms for tax declaration, payment, and record-keeping. This would not only streamline the process for taxpayers but also reduce administrative costs for local governments. Additionally, digital systems can provide real-time data, aiding in more effective tax planning and policy decisions.

| Reform | Potential Impact |

|---|---|

| Simplified Valuation Methods | More consistent and fair tax system |

| Enhanced Tax Compliance Measures | Accurate tax base and fair distribution of tax burden |

| Equitable Tax Burden | Promotes social and economic fairness |

| Integration of Technology | Enhanced efficiency, accuracy, and real-time data for tax planning |

Conclusion

The Virginia Personal Property Tax is a critical component of the state’s fiscal system, contributing significantly to local governments’ revenue. While it faces challenges related to valuation, tax avoidance, and equity, the tax system remains an essential tool for funding public services and infrastructure. Ongoing reforms and adaptations are crucial to ensure the tax system remains fair, effective, and responsive to the changing needs of Virginia’s diverse population.

What is the Virginia Personal Property Tax and how does it work?

+The Virginia Personal Property Tax is an annual tax levied on tangible personal property, including vehicles, boats, and business equipment. The tax is assessed based on the property’s value and is used to fund local governments and public services.

When is the Personal Property Tax due, and what are the payment options?

+The tax is typically due by a specific date, which can vary by locality. Property owners can pay online, by mail, or in person at their local commissioner’s office. Online payment is often the most convenient option.

Are there any exemptions or discounts for the Personal Property Tax?

+Yes, Virginia offers exemptions for disabled veterans and low-income seniors. There is also a discount for early payment of the tax. These measures aim to alleviate the tax burden for certain groups.

What challenges does the Personal Property Tax face, and how are they being addressed?

+Challenges include accurate valuation of assets, tax avoidance, and equity concerns. To address these, Virginia is considering reforms such as simplified valuation methods, enhanced tax compliance measures, and ensuring a more equitable tax burden.

How might the Personal Property Tax change in the future to meet Virginia’s evolving needs?

+Future reforms could involve simplifying valuation methods, enhancing tax compliance, ensuring a more equitable tax burden, and integrating technology for improved efficiency and accuracy. These changes aim to create a more effective and fair tax system.