How Long Do You Save Tax Returns

Understanding the appropriate retention period for tax returns is crucial for individuals and businesses alike. Tax returns, with their intricate details and financial implications, require careful consideration regarding their storage and eventual disposal. In this comprehensive guide, we delve into the factors influencing the retention of tax returns, explore industry practices, and provide expert insights to ensure you maintain a compliant and organized approach to your financial records.

The Significance of Tax Return Retention

Tax returns are more than just documents; they are a snapshot of your financial history and compliance with tax regulations. Properly managing these records is essential for several reasons:

- Compliance and Audits: Tax authorities may request documentation to verify the accuracy of your returns. Having organized records can streamline the audit process and protect you from potential penalties.

- Financial Planning: Tax returns offer valuable insights into your financial trends, allowing for better planning and decision-making.

- Legal Protection: In certain legal disputes, tax records can serve as evidence, offering crucial support for your case.

Legal and Regulatory Guidelines

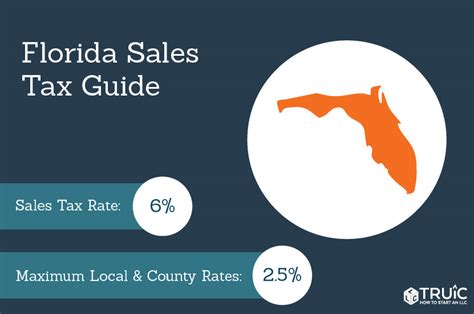

The duration for which tax returns should be retained varies based on geographical location and the nature of the entity filing the return. Let’s explore the key guidelines:

United States

In the US, the Internal Revenue Service (IRS) recommends that individuals and businesses retain their tax returns and supporting documents for a minimum of three years after the date of filing or due date, whichever is later. This guideline is based on the statute of limitations for tax assessments.

However, in cases of substantial errors, fraud, or a failure to file, the IRS can assess taxes from up to six years ago. Additionally, if you file a claim for a tax credit from the Earned Income Tax Credit (EITC), you should keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.

For businesses, the retention period can vary depending on the type of business and the nature of the transactions. For instance, records related to employment taxes should be kept for four years after the date the tax becomes due or is paid, whichever is later.

United Kingdom

In the UK, Her Majesty’s Revenue and Customs (HMRC) advises individuals and businesses to keep their tax records for at least five tax years after the end of the tax year they relate to. This period can be extended if an investigation or inquiry is underway.

For self-assessment taxpayers, records should be retained for at least 12 years after the end of the tax year to which they relate, or five years from the date the tax was paid, whichever is later. This includes records related to Capital Gains Tax, Income Tax, and National Insurance contributions.

Canada

In Canada, the Canada Revenue Agency (CRA) requires individuals and businesses to retain tax records for a minimum of six years after the end of the last tax year to which they relate. This period may be extended if an audit or review is initiated.

For specific tax situations, such as charitable donations or carrying forward capital losses, records may need to be kept for longer periods.

Australia

The Australian Taxation Office (ATO) recommends that individuals and businesses retain their tax records for a minimum of five years after the date the records were created or the date the transactions were completed, whichever is later. This includes records related to income tax, GST, and fringe benefits tax.

In cases of tax evasion or fraud, the ATO can investigate records from up to twelve years ago.

Industry Practices and Recommendations

While legal guidelines provide a baseline, industry experts often recommend extending the retention period to mitigate potential risks and ensure comprehensive record-keeping. Here are some additional considerations:

- Electronic Storage: With the increasing popularity of digital records, it's important to note that electronic tax returns and supporting documents should be retained securely. Ensure your storage system is reliable and accessible.

- Audit Trail: Maintaining a clear audit trail is crucial. Keep records that show the process of calculating your tax liability, including any adjustments or amendments.

- Long-Term Planning: For complex financial strategies or investments, consider retaining tax records for a longer period to facilitate long-term planning and analysis.

Best Practices for Tax Return Storage

To ensure efficient management of your tax records, consider the following best practices:

- Organize Digitally: Scan and digitize your tax returns and supporting documents. This makes retrieval and analysis easier, especially when using tax software or cloud-based storage.

- Use a Secure Cloud: Opt for a reputable cloud storage service with robust security measures to protect your sensitive financial data.

- Back Up Regularly: Implement a regular backup schedule to prevent data loss. Consider using multiple backup methods for added security.

- Label and Index: Create a comprehensive indexing system for your tax records, making it easier to locate specific documents when needed.

Future-Proofing Your Tax Records

As technology advances, so do the methods for storing and retrieving tax records. Consider adopting innovative solutions like blockchain-based record-keeping, which offers enhanced security and transparency.

Additionally, stay informed about evolving tax laws and regulations. Regularly review and update your tax strategies and record-keeping practices to align with any changes in the legal landscape.

Conclusion

The retention of tax returns is a critical aspect of financial management, offering protection, compliance, and valuable insights. By understanding the legal guidelines, industry practices, and best storage practices, you can ensure a well-organized and compliant approach to your tax records. Remember, while the recommended retention periods provide a foundation, adapting your strategy to your unique financial circumstances is key to future-proofing your financial health.

What happens if I don’t keep my tax records for the recommended period?

+Failing to retain tax records for the recommended period can lead to significant consequences. Tax authorities may impose penalties, fines, or even criminal charges for non-compliance. Additionally, it can hinder your ability to resolve tax disputes or support your financial position in legal matters.

Can I destroy my tax records after the recommended retention period?

+While you are no longer legally required to retain your tax records after the recommended period, it is generally advisable to keep them for a longer duration. This provides a safety net in case of unexpected audits or legal issues that may arise years later. It’s also worth considering the sentimental value of financial records, especially for significant life events or business milestones.

Are there any exceptions to the recommended retention periods?

+Yes, there are certain exceptions and special circumstances that may require extended retention periods. For instance, if you have significant assets or complex financial structures, it is often recommended to retain records for longer. Additionally, if you are involved in a legal dispute or under audit, the retention period may be extended until the matter is resolved.