Alcohol Tax

Alcohol, a substance with a long and complex history, has been a part of human civilization for millennia. Its consumption and production have evolved over time, and so have the regulations and taxes surrounding it. In modern times, alcohol taxes play a significant role in government revenue and policy, impacting not only the industry but also consumer behavior and public health.

This in-depth article aims to explore the intricate world of alcohol taxation, delving into its historical context, current practices, and future implications. By examining real-world examples and industry data, we will gain a comprehensive understanding of this multifaceted topic.

The Historical Context of Alcohol Taxation

The taxation of alcohol is not a modern invention; its roots can be traced back to ancient civilizations. The ancient Egyptians, for instance, imposed taxes on beer production, while the Greeks and Romans levied duties on wine. These early taxes served multiple purposes, from generating revenue for rulers to controlling access to alcoholic beverages.

Fast forward to the medieval period, and we see the emergence of more organized systems of alcohol taxation. In Europe, for example, the English Crown introduced excise taxes on alcohol in the 16th century to fund military campaigns. Similarly, the French monarchy imposed taxes on wine and spirits, a practice that continued into the modern era.

The 18th century witnessed a significant shift in alcohol taxation with the advent of the American Revolution. The British government's attempt to impose taxes on alcohol and other goods sparked protests and eventually led to the famous Boston Tea Party, a pivotal event in the American struggle for independence.

Alcohol Taxation in the Modern Era

Today, alcohol taxation is a widespread practice across the globe. Governments utilize these taxes as a means to generate revenue, regulate consumption, and influence public health outcomes. The methods and rates of taxation vary significantly between countries and regions, often reflecting cultural attitudes towards alcohol, economic priorities, and public health goals.

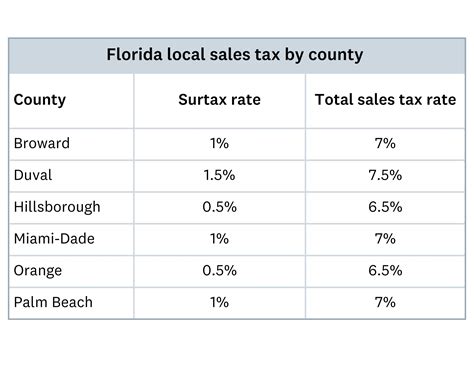

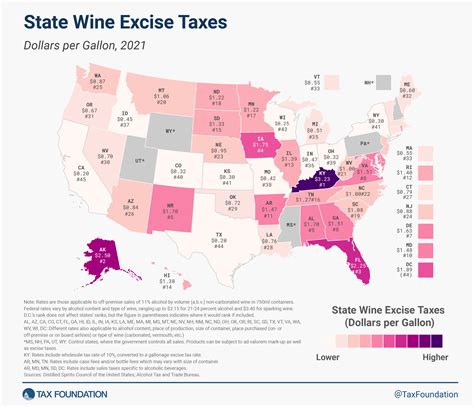

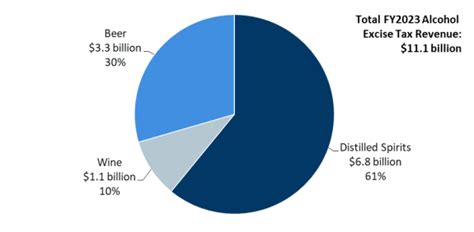

For instance, in the United States, alcohol taxes are levied at both the federal and state levels. The federal government imposes excise taxes on beer, wine, and spirits based on volume, while states often have their own additional taxes and licensing fees. These taxes can significantly impact the final price of alcoholic beverages, with rates varying widely from state to state.

In Europe, the European Union has implemented a harmonized system for taxing alcohol, ensuring a level playing field for producers and distributors across member states. However, individual countries retain the right to set their own tax rates, leading to variations in alcohol prices and consumption patterns.

| Country | Alcohol Tax Rate (Per Liter) |

|---|---|

| France | €8.20 for spirits, €2.35 for wine, €0.80 for beer |

| United Kingdom | £3.09 for spirits, £2.86 for wine, £0.28 for beer |

| Germany | €1.30 for spirits, €0.26 for wine, €0.08 for beer |

The Impact of Alcohol Taxation on the Industry

Alcohol taxes have a profound influence on the alcohol industry, affecting production, distribution, and consumer behavior. Higher taxes can lead to increased production costs, which may be passed on to consumers in the form of higher prices. This, in turn, can impact sales and market share, especially for premium or luxury brands.

Let's consider the case of the craft beer industry in the United States. This sector has witnessed explosive growth over the past decade, with a proliferation of small, independent breweries offering unique, high-quality beers. However, the increasing federal and state taxes on beer have posed a significant challenge to these small businesses, as they struggle to maintain profitability in the face of rising production costs.

Similarly, in the wine industry, tax rates can significantly impact the viability of small wineries, especially those producing high-quality, premium wines. Higher taxes can push up the price of these wines, making them less competitive in the market and potentially leading to a decline in sales.

Adapting to Tax Changes: Industry Strategies

In response to changing tax environments, the alcohol industry has developed various strategies to mitigate the impact of taxation. One common approach is to diversify product offerings, introducing lower-priced options to cater to price-sensitive consumers. This strategy has been particularly effective in the beer and spirits sectors, where companies have launched budget-friendly variants to maintain market share.

Another strategy involves optimizing production processes to reduce costs and maintain profitability. This may include investing in more efficient equipment, adopting sustainable practices to reduce waste, or negotiating better deals with suppliers. By streamlining operations, companies can offset some of the tax burden and maintain competitive pricing.

Additionally, many alcohol producers have turned to marketing and branding as a means to differentiate their products and command premium prices. By building strong brand identities and focusing on quality and uniqueness, they can create a perception of value that justifies higher prices, even in the face of increasing taxes.

Alcohol Taxation and Consumer Behavior

The impact of alcohol taxes extends beyond the industry, influencing consumer behavior and choices. Higher taxes can lead to reduced consumption, particularly among price-sensitive consumers. This effect is often seen in lower-income populations, where alcohol is a discretionary expense and higher prices can lead to decreased purchasing power.

However, the relationship between alcohol taxes and consumption is not always linear. In some cases, higher taxes can lead to increased illicit production and consumption, as consumers turn to cheaper, often unregulated, alternatives. This phenomenon is particularly evident in the spirits industry, where illicit production and trade can flourish in response to high tax rates.

The Role of Tax Policy in Public Health

Alcohol taxation is not just about revenue generation; it also plays a crucial role in public health policy. Governments often use tax policies as a tool to reduce alcohol-related harm, such as alcohol-attributable diseases and injuries. By increasing taxes on alcohol, policymakers aim to discourage excessive consumption and promote healthier behaviors.

Research has shown that higher alcohol taxes are associated with reduced alcohol consumption and related harms. For instance, a study conducted in the United States found that a 10% increase in alcohol prices led to a 5-7% reduction in alcohol-related motor vehicle fatalities. Similarly, a review of European countries found that higher alcohol taxes were associated with lower rates of alcohol-related liver disease.

However, the effectiveness of alcohol taxation as a public health tool is not without controversy. Critics argue that higher taxes can lead to unintended consequences, such as increased illicit trade and the consumption of unsafe, unregulated alcohol. Additionally, there are concerns about the regressive nature of alcohol taxes, as they can disproportionately impact lower-income individuals who are already vulnerable to alcohol-related harms.

The Future of Alcohol Taxation: Trends and Implications

As we look to the future, several trends and developments are shaping the landscape of alcohol taxation. One notable trend is the increasing focus on sustainability and environmental concerns within the industry. This is leading to a shift towards more environmentally friendly production practices and a growing demand for sustainable packaging.

In response, governments are considering new forms of taxation, such as environmental taxes, to incentivize sustainable practices. These taxes could be levied on producers based on the environmental impact of their production processes, encouraging them to adopt more sustainable methods and reduce their carbon footprint.

The Rise of Digital Technologies

The rapid advancement of digital technologies is also transforming the alcohol industry and its taxation. Online sales and distribution channels are becoming increasingly popular, offering consumers greater convenience and choice. However, this presents new challenges for tax authorities, who must ensure that alcohol sold online is properly taxed.

To address this, governments are developing new tax systems and regulations to keep pace with the digital revolution. This includes the implementation of digital tax stamps, which can be used to track and trace alcohol products, ensuring that they are properly taxed at every stage of the supply chain.

Additionally, the use of blockchain technology is being explored as a means to enhance transparency and traceability in the alcohol industry. By providing an immutable record of transactions, blockchain can help prevent tax evasion and ensure that all alcohol products are properly taxed.

Conclusion

Alcohol taxation is a complex and multifaceted issue, with far-reaching implications for the alcohol industry, consumer behavior, and public health. Throughout history, governments have utilized alcohol taxes as a tool to generate revenue, regulate consumption, and influence public health outcomes. While these taxes have evolved over time, their impact remains significant.

As we navigate the future, it is essential to consider the potential benefits and challenges of alcohol taxation. By striking a balance between revenue generation, consumer protection, and public health goals, governments can ensure that alcohol taxes serve their intended purposes while minimizing negative impacts. The ongoing dialogue and research in this field will undoubtedly shape the future of alcohol taxation, ensuring its effectiveness and relevance in a rapidly changing world.

What are the main types of alcohol taxes?

+The main types of alcohol taxes include excise taxes, which are based on the volume or alcohol content of the beverage, and sales taxes, which are levied as a percentage of the retail price. Additionally, some jurisdictions impose special taxes on certain types of alcoholic beverages, such as luxury taxes on premium spirits or taxes on specific types of beer or wine.

How do alcohol taxes impact the alcohol industry’s profitability?

+Alcohol taxes can significantly impact the profitability of the alcohol industry, especially for small or niche producers. Higher taxes can increase production costs, which may be passed on to consumers, leading to reduced sales and market share. However, some producers may absorb the tax burden to maintain competitive pricing, impacting their margins.

What are the potential benefits of alcohol taxation for public health?

+Alcohol taxation can have several public health benefits. Higher taxes can discourage excessive consumption, leading to reduced alcohol-related harms such as liver disease, motor vehicle accidents, and social issues. Additionally, taxes can generate revenue that can be allocated to public health initiatives and alcohol prevention programs.

Are there any alternatives to alcohol taxation for regulating consumption and generating revenue?

+While alcohol taxation is a common and effective tool, alternatives do exist. These include restricting alcohol advertising and marketing, implementing minimum pricing policies, and investing in education and prevention programs. However, taxation remains a significant and widely used method due to its proven effectiveness and revenue-generating potential.