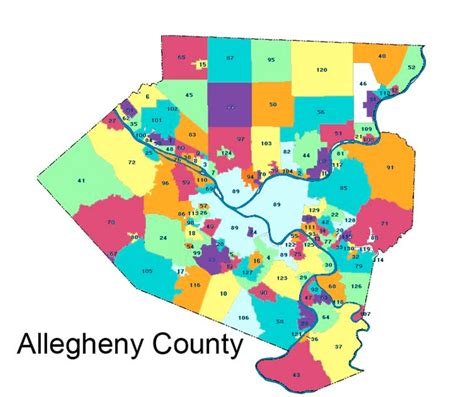

Allegheny County Property Taxes

Allegheny County, located in the state of Pennsylvania, has a robust system for assessing and collecting property taxes. Property taxes are a significant source of revenue for local governments, and Allegheny County's approach to this crucial aspect of municipal finance is both comprehensive and unique. This article will delve into the intricacies of Allegheny County property taxes, exploring the assessment process, tax rates, payment methods, and exemptions, as well as the implications for homeowners and the broader community.

Understanding Allegheny County’s Property Tax System

Property taxes in Allegheny County are determined through a meticulous assessment process. The County’s Department of Real Estate administers the property assessment function, which involves evaluating the market value of each property within the county. This value, known as the Fair Market Value (FMV), is a critical determinant in calculating the property tax liability for homeowners.

The FMV is established through a combination of methods, including market analysis, income capitalization, and cost approaches. Assessors consider recent sales of comparable properties, rental income, and the replacement cost of the property to arrive at a fair and accurate FMV. This value is then subject to a Common Level Ratio (CLR), which is a statewide measure of the relationship between assessed values and actual market values.

Once the FMV is determined and adjusted by the CLR, it is multiplied by the millage rate to arrive at the property tax liability. The millage rate, set annually by the Allegheny County Council, is the tax rate per thousand dollars of assessed value. This rate can vary across different taxing districts within the county, reflecting the specific needs and budgets of each municipality.

Assessment Appeal Process

Homeowners who believe their property assessment is inaccurate have the right to appeal. The Allegheny County Board of Property Assessment, Appeals and Review (BPAAR) handles these appeals. The process involves submitting an appeal application, often accompanied by evidence such as recent sales of comparable properties or professional appraisals. The BPAAR reviews these appeals and may schedule a hearing to gather additional information. Homeowners who disagree with the BPAAR’s decision can further appeal to the Pennsylvania Commonwealth Court.

| Assessment Appeal Timelines | Key Dates |

|---|---|

| Appeal Deadline | Typically 45 days from the mailing date of the assessment notice |

| Hearing Schedule | Hearings are usually held within 60-90 days of the appeal filing |

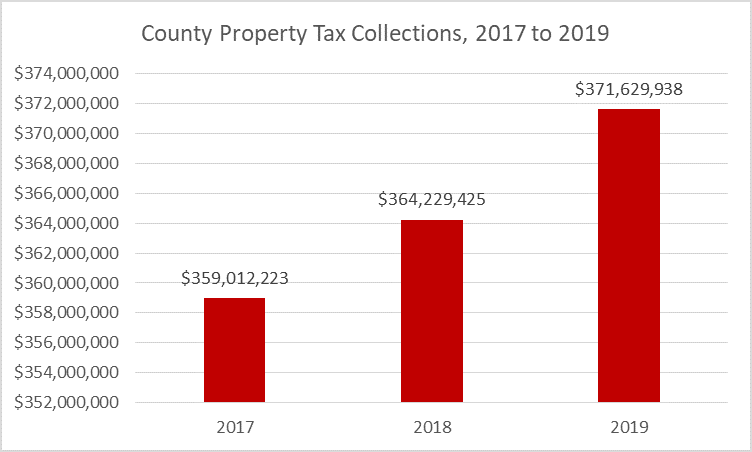

Tax Rates and Collections

Allegheny County’s property tax rates are established at the municipal level, with each taxing district setting its own millage rate. These rates can vary significantly, reflecting the unique financial needs and obligations of each municipality. The County of Allegheny itself sets a separate millage rate, which is applied uniformly across the county. In addition to the county rate, homeowners may also be subject to rates set by their school district, municipality, and any other special taxing districts in which their property is located.

The millage rates are typically expressed in mills, with one mill representing $1 of tax for every $1,000 of assessed value. For example, a property with an assessed value of $100,000 and a millage rate of 10 mills would have a property tax liability of $1,000. It's important to note that these rates can change annually, so homeowners should stay informed about any potential changes in their taxing district's millage rate.

Property tax payments in Allegheny County are typically due in two installments. The first installment is due in March, and the second installment is due in September. Homeowners have the option to pay their taxes online through the county's website, by mail, or in person at the County Treasurer's Office. Late payments are subject to interest and penalties, which can accrue rapidly, so timely payment is essential.

Tax Exemptions and Relief Programs

Allegheny County offers several tax exemptions and relief programs to assist certain homeowners. These programs are designed to alleviate the tax burden for eligible individuals, such as seniors, veterans, and homeowners with low incomes. Some of the key exemptions and relief programs include:

- Homestead Exemption: This exemption provides a reduction in property taxes for owner-occupied homes. To qualify, homeowners must meet specific income requirements and reside in the property as their primary residence.

- Senior Citizens Tax Relief: Eligible seniors can receive a rebate on their property taxes. The rebate amount is based on the individual's income and property tax liability.

- Veterans Exemption: Certain veterans and their surviving spouses may be eligible for a partial or total exemption from property taxes.

- Low-Income Tax Relief: Homeowners with limited incomes may qualify for reduced property taxes or other forms of assistance.

It's important for homeowners to research and understand the specific requirements and application processes for these programs to determine their eligibility and take advantage of any available relief.

Impact on Homeowners and the Community

Property taxes in Allegheny County have a significant impact on both individual homeowners and the broader community. For homeowners, property taxes are a substantial annual expense that can influence their financial planning and decision-making. The tax liability can affect a homeowner’s ability to afford their property and may even impact their decision to buy or sell a home.

From a community perspective, property taxes are a crucial source of revenue for local governments. These funds are used to support essential services such as education, public safety, infrastructure maintenance, and social programs. The property tax system ensures that the cost of these services is shared equitably among property owners within the county.

Furthermore, the property tax system in Allegheny County influences the real estate market. High property taxes can potentially deter homebuyers, while low taxes can attract them. As a result, property tax rates can impact the desirability and value of properties within the county.

The Future of Property Taxes in Allegheny County

Looking ahead, the future of property taxes in Allegheny County is likely to be shaped by several factors. One key consideration is the ongoing efforts to modernize and streamline the property assessment process. Technological advancements and data analytics are expected to play a significant role in enhancing the accuracy and efficiency of assessments, potentially reducing the likelihood of appeals and disputes.

Additionally, the county's commitment to transparency and accountability in tax administration is likely to continue. This includes providing homeowners with clear and accessible information about their tax obligations, as well as ensuring that the tax system remains fair and equitable. Initiatives such as online tax payment portals and digital platforms for accessing assessment data are expected to enhance convenience and accessibility for taxpayers.

Lastly, the economic landscape and demographic trends within Allegheny County will undoubtedly influence future property tax policies. As the county continues to evolve, with shifts in population, employment patterns, and economic growth, the tax system will need to adapt to meet the changing needs and priorities of the community. This may involve reevaluating tax rates, exemptions, and relief programs to ensure they remain effective and responsive to the diverse needs of homeowners and the broader community.

What is the average property tax rate in Allegheny County?

+

The average property tax rate in Allegheny County varies depending on the taxing district. As of the latest available data, the overall average millage rate across the county is approximately 8.5 mills. However, it’s important to note that individual municipalities within the county may have significantly higher or lower rates, so it’s essential to check the specific rate for your property’s taxing district.

How often are property assessments conducted in Allegheny County?

+

Property assessments in Allegheny County are conducted on a rolling basis. The county aims to reassess all properties every three years. However, certain factors, such as significant improvements or additions to a property, may trigger an interim assessment. Homeowners are notified of any changes to their property’s assessed value, and they have the right to appeal if they believe the new assessment is inaccurate.

Are there any online tools to estimate my property taxes in Allegheny County?

+

Yes, the Allegheny County website provides an online tax calculator that allows homeowners to estimate their property taxes based on their assessed value and the current millage rate. This tool can be a useful resource for budgeting and financial planning. However, it’s important to note that the actual tax liability may vary based on any exemptions or additional taxes levied by special taxing districts.

Can I pay my property taxes online in Allegheny County?

+

Yes, Allegheny County offers an online payment portal for property taxes. Homeowners can access this portal through the county’s website and make payments using a credit card, debit card, or electronic check. This convenient option allows taxpayers to pay their taxes from the comfort of their homes and provides a secure and efficient method for tax payments.