City Of Phoenix Sales Tax

Welcome to the comprehensive guide on the sales tax landscape in the vibrant city of Phoenix, Arizona. This journal-style article will delve into the intricacies of the Phoenix sales tax, offering an expert-level analysis and a deep dive into its structure, rates, and implications. With a unique blend of professional insights and real-world examples, we aim to provide a clear understanding of this critical aspect of doing business in Phoenix.

Understanding the Phoenix Sales Tax Structure

The sales tax in Phoenix, like many other cities in the United States, is a combination of state, county, and municipal taxes. This layered structure can sometimes be complex, but understanding it is crucial for businesses and consumers alike. Let’s break it down step by step.

State Sales Tax

Arizona, the state where Phoenix is located, imposes a 5.6% state sales tax rate. This tax is applied to most retail sales, including goods and some services. The state sales tax is a fundamental component of Arizona’s revenue stream and is used to fund various state-level services and initiatives.

County Sales Tax

Maricopa County, where Phoenix is the county seat, adds an additional 0.7% sales tax. This county-level tax is a common feature in many states, and its revenue often supports specific county-wide projects and infrastructure development.

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Arizona | 5.6% |

| Maricopa County | 0.7% |

Municipal Sales Tax: The Phoenix Advantage

Phoenix, as the largest city in Arizona, has its own sales tax rate. This 2.3% municipal tax is a key revenue source for the city, contributing to its economic growth and development. The funds generated from this tax support a range of city services, from public safety to community programs.

Combined Sales Tax Rates in Phoenix

When you add up the state, county, and municipal sales taxes, the total sales tax rate in Phoenix comes to 8.6%. This rate is applied to most transactions within the city limits, making it an important consideration for businesses operating in Phoenix.

Sales Tax Exemptions: Navigating the Complexity

While the sales tax structure in Phoenix is relatively straightforward, there are certain exemptions and special cases to be aware of. For instance, certain types of food, prescription drugs, and medical devices are often exempt from sales tax. Additionally, some items like clothing and footwear below a certain price point may also be tax-free.

It's crucial for businesses to stay updated on these exemptions to ensure compliance and avoid any potential legal issues. Misinterpreting or overlooking these exemptions can lead to costly mistakes.

Sales Tax Compliance: A Strategic Imperative

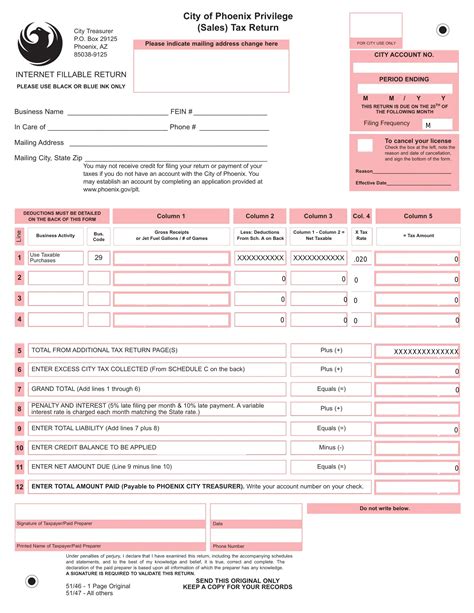

Maintaining sales tax compliance is not just a legal obligation but also a strategic necessity for businesses in Phoenix. Accurate sales tax calculation and reporting ensure a business’s credibility and help maintain a positive relationship with the local community and authorities.

Businesses should invest in robust sales tax management systems and stay informed about any changes in tax rates or regulations. This proactive approach not only mitigates the risk of non-compliance but also ensures a smooth and efficient tax process.

The Impact of Sales Tax on Phoenix’s Economy

Sales tax is a significant contributor to Phoenix’s economic vitality. It provides a steady stream of revenue for the city, enabling it to invest in infrastructure, education, and other vital services. The tax also plays a role in shaping the city’s business landscape, influencing the cost of doing business and consumer spending patterns.

Economic Growth and Development

The sales tax revenue is a key enabler of Phoenix’s economic growth. It funds infrastructure projects that enhance the city’s appeal, making it more attractive for businesses and residents alike. From road improvements to public transportation initiatives, the sales tax plays a vital role in shaping Phoenix’s future.

Community Investment and Social Programs

A portion of the sales tax revenue is dedicated to community development and social programs. This includes funding for education, healthcare, and social services, ensuring that Phoenix’s residents have access to the support they need. These investments contribute to the overall well-being and quality of life in the city.

Comparative Analysis: Phoenix’s Sales Tax in Perspective

When compared to other major cities, Phoenix’s sales tax rate is relatively competitive. This is a strategic advantage for businesses, as it can influence consumer behavior and make Phoenix an attractive location for retail and commerce.

| City | Total Sales Tax Rate |

|---|---|

| Phoenix, AZ | 8.6% |

| Los Angeles, CA | 9.5% |

| Chicago, IL | 10.25% |

| New York, NY | 8.875% |

Sales Tax and Consumer Behavior

The sales tax rate can influence consumer spending habits. In Phoenix, the relatively lower tax rate may encourage consumers to make more purchases, which can benefit local businesses. However, it’s important for businesses to strike a balance, offering competitive pricing while still ensuring profitability.

Future Implications and Potential Changes

While the current sales tax structure in Phoenix is well-established, it’s important to consider potential future changes. As the city continues to grow and evolve, so too might its tax landscape.

Potential Rate Adjustments

The sales tax rate in Phoenix, like in any city, is subject to change. This could be driven by various factors, including economic conditions, political decisions, or the need to fund specific projects. Businesses and consumers should stay informed about any proposed changes to be prepared for potential shifts in their tax obligations.

Emerging Trends in Taxation

With the rise of e-commerce and online sales, the traditional sales tax model is evolving. Cities like Phoenix may need to adapt their tax structures to accommodate these changes. This could include exploring new ways to tax online sales or implementing innovative tax collection methods.

Strategic Planning for Businesses

For businesses operating in Phoenix, staying abreast of these potential changes is crucial. Proactive planning can help businesses navigate any future tax landscape shifts. This might involve reviewing pricing strategies, exploring new sales channels, or investing in more efficient tax management systems.

What are the consequences of non-compliance with sales tax regulations in Phoenix?

+Non-compliance with sales tax regulations can result in significant penalties and legal consequences for businesses. These may include fines, interest charges, and even criminal prosecution in severe cases. It's crucial for businesses to understand and adhere to sales tax laws to avoid these pitfalls.

How often are sales tax rates reviewed and adjusted in Phoenix?

+Sales tax rates in Phoenix, like in many cities, are reviewed periodically, often annually or biennially. These reviews consider economic factors, revenue needs, and other relevant considerations. While rate adjustments are not frequent, businesses should stay updated to be prepared for any changes.

Are there any tax incentives or breaks available for businesses in Phoenix?

+Yes, Phoenix, like many cities, offers various tax incentives and breaks to attract and support businesses. These can include tax credits, abatements, or grants. Businesses should research and explore these opportunities to potentially reduce their tax obligations and boost their bottom line.

In conclusion, understanding and effectively managing sales tax is a critical aspect of doing business in Phoenix. With its unique sales tax structure and competitive rates, Phoenix presents both opportunities and challenges for businesses. By staying informed and proactive, businesses can navigate the city’s tax landscape successfully and contribute to Phoenix’s vibrant economy.