Santa Clara Tax

In the heart of Silicon Valley, nestled amidst the bustling tech hubs, lies the city of Santa Clara, California. With its vibrant community and thriving businesses, Santa Clara is a city that boasts not only innovation but also a unique tax landscape that influences its economic growth and development. Understanding the intricacies of Santa Clara's tax system is crucial for both residents and businesses operating within its boundaries. This article aims to provide an in-depth analysis of the Santa Clara tax system, exploring its various components, implications, and future prospects.

Unraveling the Santa Clara Tax System

The tax system in Santa Clara is a complex interplay of local, state, and federal regulations, tailored to meet the specific needs and characteristics of the city. It is a vital component of the city’s infrastructure, contributing significantly to its financial stability and the provision of essential services to its residents.

Local Taxes: A Comprehensive Overview

Santa Clara imposes a range of local taxes to fund its operations and development projects. These taxes include:

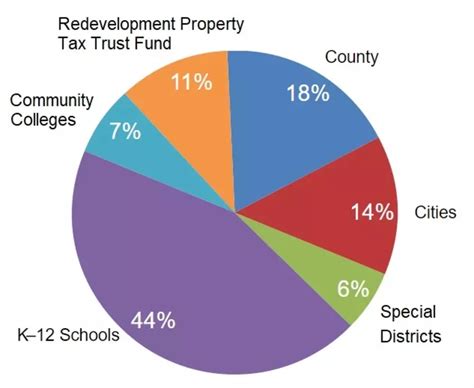

- Property Tax: One of the primary sources of revenue for the city, property tax is assessed based on the value of real estate within Santa Clara. The tax rate is determined by a combination of the assessed value and the city’s budget needs. For instance, in the fiscal year 2023-2024, the property tax rate in Santa Clara was set at 1.075 per 100 of assessed value.

- Sales and Use Tax: This tax applies to the sale of tangible goods and certain services within the city limits. The tax rate in Santa Clara is composed of both state and local components, with the state rate currently at 7.25% and the city’s rate varying depending on the use of the goods or services. For example, the city imposes a 1% tax on the sale of prepared food and beverages, while other sales are taxed at 0.75%.

- Hotel Occupancy Tax: With a thriving tourism industry, Santa Clara levies a tax on hotel and motel stays. The tax rate is typically 14% of the room rate, with the revenue generated supporting tourism-related initiatives and infrastructure development.

- Business License Tax: All businesses operating within Santa Clara are required to obtain a business license and pay a tax based on their gross receipts. The tax rate varies depending on the nature of the business and its revenue, with rates ranging from 0.35% to 0.6% of gross receipts.

| Tax Category | Tax Rate |

|---|---|

| Property Tax | $1.075 per $100 assessed value |

| Sales and Use Tax (City Portion) | 0.75% - 1% |

| Hotel Occupancy Tax | 14% |

| Business License Tax | 0.35% - 0.6% of gross receipts |

State and Federal Taxes: A Broader Perspective

Beyond the local taxes, Santa Clara’s residents and businesses are also subject to a range of state and federal taxes. These include:

- Income Tax: Both individuals and businesses in Santa Clara pay state income tax, with rates varying based on income brackets. For the 2023 tax year, the state income tax rates range from 1% to 12.3%.

- Corporate Tax: Corporations operating within Santa Clara are subject to the California Franchise Tax, which is calculated based on their net income. The tax rate for corporations varies, with a minimum tax of 800 and a standard rate of 8.84%.</li> <li>Employment Taxes: Employers in Santa Clara are responsible for paying various employment taxes, including state unemployment insurance taxes and workers' compensation insurance. These taxes ensure the financial security of employees and contribute to the state's social safety net.</li> <li>Excise Taxes: Santa Clara, like many other cities, imposes excise taxes on specific goods and services. For instance, there is a cigarette tax of 2.87 per pack, and a fuel tax is applied to gasoline and diesel sales.

Analyzing the Impact of Santa Clara’s Tax System

The tax system in Santa Clara has a profound impact on the city’s economy, businesses, and residents. It shapes the financial landscape, influencing investment, business growth, and the overall standard of living.

Economic Growth and Development

Santa Clara’s tax system plays a pivotal role in driving economic growth and development. The revenue generated from taxes is invested back into the community, funding critical infrastructure projects, public services, and initiatives that enhance the city’s competitiveness and attractiveness to businesses and residents alike.

For instance, the city's investment in transportation infrastructure, funded in part by tax revenue, has led to the development of an efficient public transit system, making Santa Clara an attractive location for businesses seeking a well-connected hub. Similarly, the allocation of tax funds towards education has resulted in high-quality schools, further enhancing the city's appeal to families.

Business Environment and Incentives

The tax structure in Santa Clara is designed to foster a business-friendly environment. While the city imposes various taxes, it also offers incentives and support to attract and retain businesses. For example, the city provides tax exemptions and abatements for certain types of businesses, particularly those focused on research and development or those that create significant job opportunities.

Additionally, the city has established partnerships with local businesses to streamline the tax payment process, making it more convenient and efficient. This not only reduces administrative burdens for businesses but also strengthens their financial stability, allowing them to focus on growth and innovation.

Resident Welfare and Services

Tax revenue is a critical component in the provision of essential services to Santa Clara’s residents. The city’s tax system ensures that residents have access to a wide range of services, including:

- Public Safety: Tax funds support the city’s police and fire departments, ensuring the safety and security of the community.

- Healthcare: The city invests tax revenue in healthcare initiatives, providing access to quality healthcare services for all residents.

- Recreational Facilities: Tax funds contribute to the development and maintenance of parks, recreational centers, and cultural venues, enhancing the quality of life for residents.

- Social Services: The city’s tax system also supports social welfare programs, providing assistance to vulnerable populations and ensuring a safety net for those in need.

Future Prospects and Implications

As Santa Clara continues to evolve and adapt to changing economic and social landscapes, its tax system will play a pivotal role in shaping its future. The city’s ability to navigate economic shifts, technological advancements, and demographic changes will heavily rely on the flexibility and adaptability of its tax policies.

Economic Resilience and Recovery

In the face of economic downturns or unforeseen challenges, such as the COVID-19 pandemic, Santa Clara’s tax system will be crucial in facilitating economic recovery. The city may need to adapt its tax policies to provide relief to businesses and residents, ensuring financial stability and promoting economic resilience.

Technological Integration

With the rapid advancement of technology, the tax system in Santa Clara will need to embrace digital solutions to enhance efficiency and transparency. This could involve the adoption of digital tax payment systems, online tax filing platforms, and the integration of blockchain technology for secure and traceable transactions.

Sustainable Development

As sustainability becomes an increasingly critical aspect of urban development, Santa Clara’s tax system may need to incorporate incentives and penalties to promote eco-friendly practices. This could include tax breaks for businesses adopting sustainable technologies or penalties for excessive carbon emissions, driving the city towards a more environmentally conscious future.

Demographic Shifts

Santa Clara’s changing demographics, with an increasing population and diverse cultural makeup, will impact the city’s tax system. The city will need to ensure that its tax policies are equitable and inclusive, catering to the needs of a diverse community. This may involve reevaluating tax structures to ensure that the tax burden is fairly distributed and that essential services are accessible to all residents.

Conclusion

Santa Clara’s tax system is a complex yet vital component of the city’s infrastructure, shaping its economic growth, business environment, and resident welfare. By understanding the intricacies of this system, residents and businesses can navigate the financial landscape more effectively, contributing to the city’s continued success and development.

As Santa Clara continues to evolve, its tax system will need to adapt and innovate, ensuring that the city remains fiscally responsible, economically resilient, and socially inclusive. The future of Santa Clara is intertwined with the evolution of its tax policies, and by staying informed and engaged, the community can actively participate in shaping this future.

What are the key benefits of Santa Clara’s tax system for businesses?

+Santa Clara’s tax system offers several benefits to businesses, including tax incentives for research and development, job creation, and investments in certain industries. Additionally, the city’s commitment to a streamlined tax payment process reduces administrative burdens for businesses, allowing them to focus on growth and innovation.

How does Santa Clara’s tax system support resident welfare?

+The tax revenue generated in Santa Clara is invested back into the community, funding essential services such as public safety, healthcare, recreational facilities, and social welfare programs. This ensures that residents have access to a high quality of life and necessary support systems.

What measures does Santa Clara take to ensure tax fairness and equity?

+Santa Clara aims to maintain a fair and equitable tax system by regularly reviewing and adjusting tax policies to ensure that the tax burden is distributed fairly among residents and businesses. The city also offers tax relief programs for low-income residents and provides resources to help residents understand and manage their tax obligations.