Philadelphia Tax Rate

Understanding the Philadelphia tax landscape is crucial for both residents and businesses operating within the city. The tax structure in Philadelphia consists of various components, including local, state, and federal taxes, each with its own rates and regulations. In this comprehensive guide, we will delve into the intricacies of the Philadelphia tax rate, providing an in-depth analysis of the different taxes, their impact, and their implications for individuals and businesses.

Income Tax: The Backbone of Philadelphia’s Revenue

Philadelphia’s income tax is a significant contributor to the city’s revenue, and it applies to both residents and non-residents earning income within the city limits. The current income tax rate for the city is set at 3.8417%, which is one of the highest rates among major cities in the United States. This tax is levied on wages, salaries, commissions, and other forms of earned income.

The income tax is progressive, meaning that higher income brackets face higher tax rates. For instance, income above $35,000 is subject to an additional 0.4417% surtax, while income exceeding $75,000 is taxed at an even higher rate of 0.6417%. This progressive structure aims to ensure that those with higher earnings contribute a greater share to the city's finances.

In addition to the city's income tax, residents of Philadelphia are also subject to Pennsylvania's state income tax. The state tax rate varies based on income, with a 3.07% rate for the first $34,000 of taxable income and a 3.7% rate for income above that threshold. This state tax further contributes to the overall tax burden on Philadelphia residents.

Impact on Residents

The combined income tax rates in Philadelphia can significantly impact individuals’ take-home pay. For example, a resident earning 50,000</strong> annually would pay approximately <strong>2,215 in city and state income taxes, leaving them with a disposable income of around $47,785. This tax burden can influence individuals’ financial planning, savings, and overall standard of living.

To provide some context, let's compare Philadelphia's income tax rates with those of neighboring cities. New York City, for instance, has a slightly lower income tax rate of 3.876% for residents earning up to $52,000, while residents of Washington, D.C., face a 6.75% tax rate on income up to $50,000. These comparisons highlight the varying tax landscapes across different cities.

| City | Income Tax Rate | Income Threshold |

|---|---|---|

| Philadelphia | 3.8417% | No specific threshold |

| New York City | 3.876% | Up to $52,000 |

| Washington, D.C. | 6.75% | Up to $50,000 |

Tax Strategies for Residents

Given the relatively high income tax rate in Philadelphia, residents may explore various tax-saving strategies. One common approach is to maximize pre-tax deductions through contributions to retirement accounts like 401(k)s or IRAs. These deductions reduce taxable income, resulting in lower tax liabilities. Additionally, residents may consider tax-efficient investments or utilize tax credits and deductions offered by the city or state to reduce their overall tax burden.

Business Taxes: A Complex Web

Philadelphia’s tax structure for businesses is more intricate, encompassing various taxes that can impact different types of entities differently. One notable tax is the Business Income and Receipts Tax (BIRT), which is levied on businesses operating within the city. The BIRT rate is set at 6.25% for most businesses, but certain industries, such as banks and utilities, face a higher rate of 7.89%.

In addition to BIRT, businesses in Philadelphia are subject to a Net Profits Tax (NPT), which applies to businesses with a physical presence in the city. The NPT rate is 1.45% for corporations and 3.05% for pass-through entities like partnerships and S corporations. This tax is calculated based on the business's net profits, further contributing to the overall tax burden.

Real-World Examples

Let’s consider a hypothetical scenario to illustrate the impact of these business taxes. Imagine a small business in Philadelphia with annual receipts of 1,000,000</strong> and net profits of <strong>200,000. This business would owe 62,500</strong> in BIRT and an additional <strong>2,900 in NPT, resulting in a total tax liability of $65,400. These taxes can significantly affect a business’s profitability and cash flow, necessitating careful financial planning.

| Business Tax | Rate | Taxable Amount | Tax Liability |

|---|---|---|---|

| Business Income and Receipts Tax (BIRT) | 6.25% | $1,000,000 | $62,500 |

| Net Profits Tax (NPT) | 3.05% | $200,000 | $2,900 |

Tax Incentives for Businesses

To attract and support businesses, Philadelphia offers various tax incentives and programs. For instance, the Keystone Opportunity Improvement Zones (KOIZ) program provides eligible businesses with a 10-year tax abatement on BIRT. This incentive can significantly reduce the tax burden for businesses operating in designated zones, making Philadelphia more competitive in attracting new businesses.

Additionally, Philadelphia offers tax credits for job creation, investment, and community development. These incentives aim to encourage economic growth, job opportunities, and investment in the city. Businesses can explore these incentives to reduce their tax liabilities and contribute to the local economy.

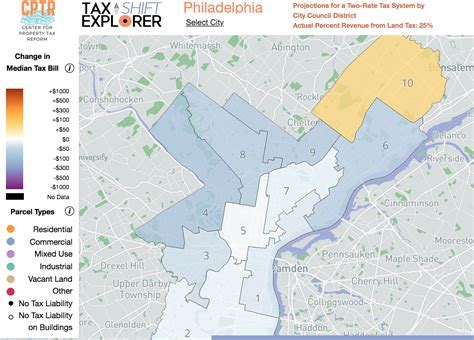

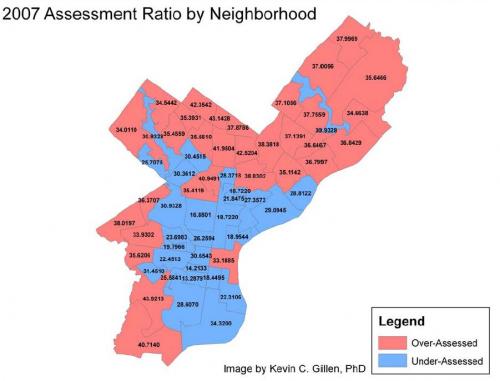

Real Estate Taxes: A Burden on Property Owners

Philadelphia’s real estate tax rate is another crucial component of the city’s tax landscape. The real estate tax, also known as the Property Tax, is levied on the assessed value of real property within the city. The current tax rate is 1.478%, which is applied to the assessed value of the property. This tax is a significant expense for homeowners and commercial property owners alike.

Assessed Value and Tax Calculation

The assessed value of a property is determined by the Philadelphia Office of Property Assessment. This value is typically lower than the market value, with residential properties assessed at 50% of their market value and commercial properties at 100% of their market value. The tax liability is calculated by multiplying the assessed value by the tax rate.

For example, consider a residential property with a market value of $200,000. The assessed value would be $100,000, and the annual real estate tax would be $1,478. This tax is typically paid in two installments, with the first due by March 31st and the second by September 30th.

| Property Type | Assessment Ratio | Example Market Value | Assessed Value | Annual Real Estate Tax |

|---|---|---|---|---|

| Residential | 50% | $200,000 | $100,000 | $1,478 |

| Commercial | 100% | $500,000 | $500,000 | $7,390 |

Property Tax Relief Programs

Philadelphia recognizes the financial burden of real estate taxes and offers several relief programs to assist homeowners. One notable program is the Homeowners’ Relief Program, which provides a tax credit to eligible homeowners based on their income and property value. This credit can reduce the tax liability, providing much-needed relief for low- and moderate-income homeowners.

Additionally, the city offers the Senior Citizen Tax Relief Program, which provides a tax exemption for qualifying senior citizens. This program aims to support older residents by reducing their tax burden and promoting aging in place.

Sales and Use Taxes: Impact on Consumers and Businesses

Philadelphia, like many other cities, imposes sales and use taxes on various goods and services. The sales tax rate in Philadelphia is 8%, which is comprised of a 6% state sales tax and a 2% local sales tax. This tax applies to most retail transactions, including clothing, electronics, and other consumer goods.

The sales tax can significantly impact consumers' purchasing power and businesses' pricing strategies. For instance, a $100 item would incur a $8 sales tax, resulting in a total cost of $108. This tax is often a consideration for consumers when making purchasing decisions.

Use Tax and E-Commerce

In addition to sales tax, Philadelphia imposes a Use Tax on certain purchases made outside the city but used within its limits. This tax is designed to prevent tax evasion and ensure that all purchases are taxed fairly. The Use Tax rate is the same as the sales tax rate, and it applies to items purchased online, by mail, or from out-of-state vendors.

With the rise of e-commerce, the Use Tax has become increasingly important. Online retailers are required to collect and remit this tax on behalf of consumers, ensuring that the city receives its fair share of tax revenue from online sales.

Sales Tax Exemptions

Philadelphia, like many jurisdictions, provides sales tax exemptions for certain goods and services. For example, most food items for home consumption are exempt from sales tax. This exemption benefits consumers by reducing the overall cost of groceries and other essential items. Additionally, certain services, such as medical services and educational courses, are often exempt from sales tax.

Businesses should be aware of these exemptions when pricing their products and services to ensure compliance with tax regulations and provide accurate information to their customers.

Impact on the Philadelphia Economy

The tax landscape in Philadelphia has a significant impact on the city’s economy. The various taxes contribute to the city’s revenue, which is used to fund essential services, infrastructure projects, and public programs. These funds support schools, public safety, transportation, and other vital aspects of city life.

While taxes can be a burden on individuals and businesses, they also play a crucial role in sustaining the city's infrastructure and services. The income generated through taxes allows Philadelphia to invest in economic development, job creation, and community initiatives, ultimately benefiting its residents and businesses.

Furthermore, the tax structure can influence business decisions and investment choices. High tax rates may deter certain businesses from establishing operations in the city, while tax incentives and relief programs can attract and retain businesses, contributing to the local economy and job market.

Future Outlook and Potential Changes

The tax landscape in Philadelphia is subject to change, and proposed tax reforms or adjustments can significantly impact residents and businesses. For instance, discussions around tax rate adjustments, tax relief programs, or the introduction of new taxes can shape the financial landscape for years to come.

Keeping an eye on tax policy developments is crucial for both residents and businesses. Any changes in tax rates or structures can influence financial planning, investment decisions, and overall financial well-being. Staying informed about proposed tax reforms and their potential implications is essential for navigating the evolving tax landscape.

How often do Philadelphia tax rates change?

+Tax rates in Philadelphia can change periodically, often as a result of budget considerations, economic factors, or policy decisions. While some tax rates may remain stable for extended periods, others, like income tax rates, can be subject to more frequent adjustments. It’s important for residents and businesses to stay informed about any proposed changes to tax rates.

Are there any tax breaks or incentives for homeowners in Philadelphia?

+Yes, Philadelphia offers various tax relief programs for homeowners. The Homeowners’ Relief Program provides a tax credit based on income and property value, offering financial assistance to eligible homeowners. Additionally, the Senior Citizen Tax Relief Program provides a tax exemption for qualifying senior citizens.

What are the tax implications for remote workers in Philadelphia?

+Remote workers who earn income from within Philadelphia are subject to the city’s income tax, regardless of their residence. This means that even if a remote worker resides outside the city, their Philadelphia-sourced income is taxable at the city’s rate. It’s important for remote workers to understand their tax obligations and consider tax planning strategies.